• Bond yield plunge. Extreme moves in bonds with US yields falling sharply (2yr down another ~60bps) as the Fed rate outlook is radically repriced.

• Weaker USD. The adjustment has weighed on the USD. AUD is higher, though it is little changed on the crosses, illustrating how USD-centric it has been.

• US CPI. Markets may have moved too far when it comes to Fed expectations. US CPI released tonight, another strong result could generate more volatility.

The turmoil stemming from the US regional banking issues has continued despite efforts from authorities to try and contain contagion and macroeconomic risks. In our view, the steps announced yesterday morning by the US FDIC, Fed, and Treasury are some of the strongest that could have been reasonably expected. All deposits at Silicon Valley Bank are protected, while the Fed’s new lending program is designed to ensure all eligible institutions have enough liquidity to handle deposit outflows. Yet market swings have persisted, particularly in bank shares and the bond market. The major European equity indices fell 2-3%, thanks in part to their higher weighting to financials. In the US, the S&P500 had a choppy session, having been down ~1.4% early on, before being up over 1% in afternoon trade, only to end the day close to flat. Below the surface, however, there was large sectoral variation with financials falling, cyclical stocks linked to the economic outlook underperforming, and bond-sensitive sectors like technology outperforming.

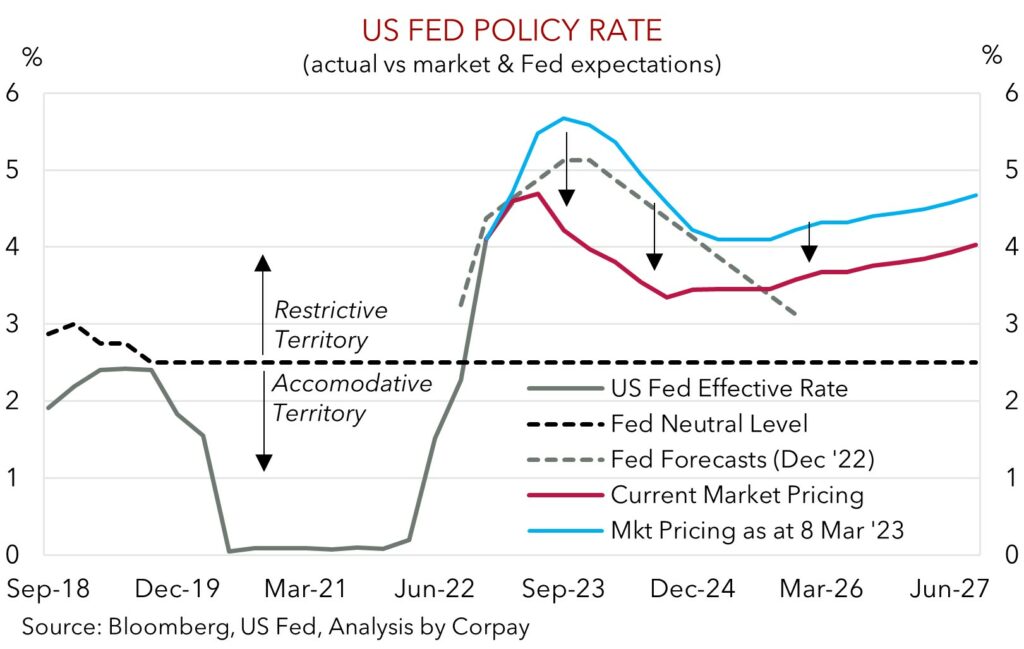

The bond market continues to experience extreme volatility, with expectations for the Fed hiking cycle changing dramatically over recent days. As our chart shows, last week the market was factoring in close to another 100bps of Fed hikes, but now it is essentially assuming no more increases with the next move expected to be a rate cut around mid-year. This turnaround has driven US (and global) bond yields lower, with the front-end of the curve leading the charge. US 2yr yields plunged another 60bps overnight, taking the move over the last 3 days to ~108bps. By my calculations that is the 2nd biggest 3-day fall since 1986.

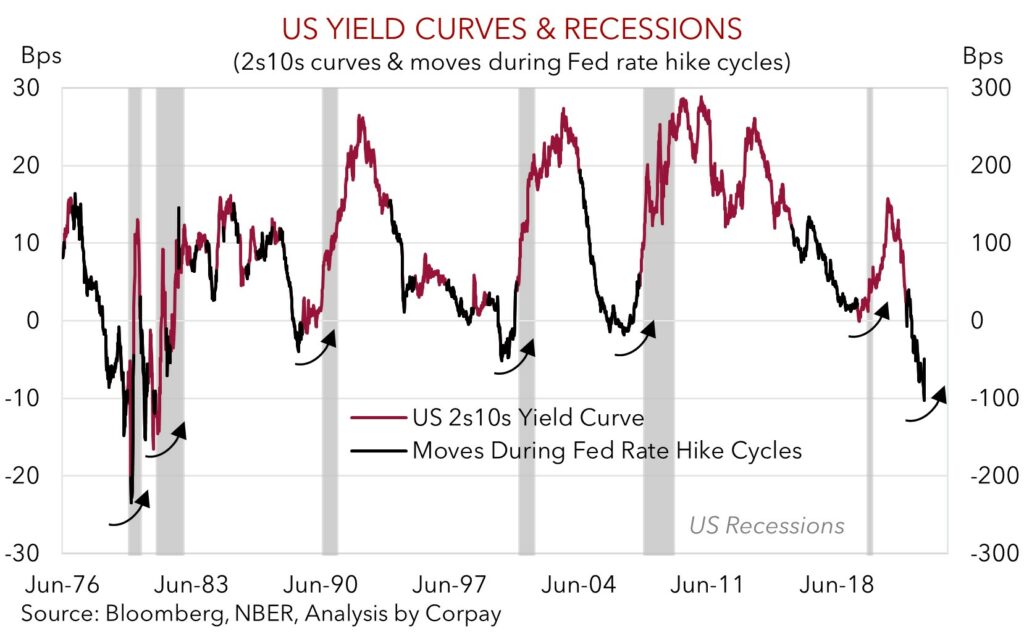

Notably, the relatively smaller change further out has seen the US yield curve steepen, with the 2s10s spread moving from -108bps last Wednesday to -42bps today. This is another indication that investors are fretting about a US downturn on the back of the Fed’s restrictive policy stance given the re-steepening of a deeply inverted yield curve has historically tended to be a good timing tool for an impending recession (see second chart below). In FX, the USD has lost more ground, with a positioning adjustment compounded by the relatively larger move in US rate expectations. EUR has popped back above 1.07, the rate sensitive USD/JPY is down near 133, while AUD has risen ~1.3% to be near $0.6670.

We expect market gyrations to continue near-term as the economic and financial market effects from the most abrupt tightening cycle in decades continue to play out. While we think the US Fed should tread carefully from here, the measures announced should help contain financial stability risks, thereby allowing the Fed to continue its battle against high inflation. Unlike the post GFC environment when inflation was low, the current inflation dynamics make it much harder for the Fed to shift course at the first sign of trouble. In our view, Fed rate expectations may have moved too far too fast, and another strong US CPI report (released tonight 11:30pm AEDT) could see pricing rebound, which should give the USD some renewed support, though it may also add to volatility across risk assets.

Global event radar: US CPI Inflation (Tonight), US Retail Sales (Weds), China Activity Data (Weds), ECB Meeting (Fri), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr).

AUD corner

AUD has risen by ~1.3% over the past 24hrs to be back up around $0.6670. This is where it was trading mid last week. The catalyst has been the substantial repricing in US interest rate expectations on the back of the issues impacting some regional banks and US recession fears. This adjustment has weighed on the USD, with AUD largely range bound against most of the other majors.

As outlined above, and in our previous research, we think volatility is likely to be higher than normal over coming months as the macro and market impacts from the most abrupt tightening cycles delivered by central banks in several decades continue to flow through (see Market Musings: Reality check, phase two). Broadly speaking, periods of heightened volatility and US/global economic downturns are environments that typically create headwinds for the pro-cyclical AUD. On the crosses, we think this backdrop continues to point to more downside in AUD/EUR, with a fall to ~0.60 our expectation (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations).

In addition to the market swings due to the unfolding US banking situation, the AUD will also have to contend with several economic releases/events over the rest of this week. AUD intra-day volatility looks set to remain elevated. Locally, consumer (10:30am AEDT) and business confidence (11:30am AEDT) is due today, with the important US CPI report released tonight (11:30pm AEDT). This will be followed by US retail sales (Weds), the China activity data (Weds), Australian labour force report (Thurs), and ECB policy meeting (Fri) later in the week. As discussed above, while we think the US Fed should become more cautious given market ructions, we still believe the bar to a ‘pause’ and a ‘pivot’ to an accommodative stance are quite high. Inflation is still to high, and another strong CPI print could refocus the markets attention on the fact the Fed has to keep at it. Based on recent moves we think this could revive the USD, yet it may also further dampen risk sentiment. These are both AUD headwinds.

AUD event radar: AU Business Survey (Today), US CPI Inflation (Tonight), US Retail Sales (Weds), China Activity Data (Weds), AU Jobs Data (Thurs), ECB Meeting (Fri), US FOMC Meeting (23rd Mar), AU Retail Sales (28th Mar), AU CPI Indicator (29th Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), RBA Meeting (4th Apr), RBNZ Meeting (5th Apr), RBA Governor Lowe Speaks (5th Apr).

AUD levels to watch (support / resistance): 0.6490, 0.6522 / 0.6740, 0.6800

SGD corner

The sharp falls in US bond yields and weaker USD due to the regional banking sector issues has seen USD/SGD ease back. At ~1.3465 USD/SGD is ~0.8% below last week’s high. All things considered; this isn’t that big of a move, with the pair still within striking distance of its 100-day moving average (1.3516). As outlined above, we think market volatility stemming from the economic and market fallout from the US banking situation and Fed tightening cycle can continue for a while yet, with upcoming US data releases potential triggers for even more market swings.

Market expectations for US interest rates have shifted substantially over the last week, with thoughts of another ~100bps worth of rate hikes replaced by expectations the next move could be a cut. We think the market may have swung too far, particularly given the US’ ongoing inflation problem. The February US CPI report is released tonight. Expectations are for core inflation to remain sticky at ~6%pa. This is still too high, in our view, for the Fed to back away from its policy tightening path, though it may become more cautious in its approach. In our opinion another strong US CPI report could give the USD some renewed strength. If realised, this can push USD/SGD back up towards its recent highs.

SGD event radar: US CPI Inflation (Tonight), US Retail Sales (Weds), China Activity Data (Weds), ECB Meeting (Fri), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar), China PMIs (31st Mar), MAS Review (by mid-Apr).

SGD levels to watch (support / resistance): 1.3320, 1.3377 / 1.3523, 1.3590