• Negative vibes. Growth concerns and renewed banking sector worries weighed on risk sentiment. Equities, bond yields, and commodities lower.

• AUD under pressure. The backdrop has supported the USD and JPY, and helped push AUD/USD down to within 1% of its 2023 low.

• CPI in focus. Australia Q1 CPI released today. Annual inflation predicted to slow. This is the last major local release ahead of the 2 May RBA meeting.

Risk sentiment soured overnight as growth concerns and renewed banking sector nerves weighed on investors’ minds. Banking stocks were dragged lower, firstly in Europe by some disappointing results, and then in the US after the embattled First Republic Bank’s larger than expected Q1 deposit outflows and announcement it is embarking on a cost-cutting drive and exploring a potential asset sale rekindled worries that the banking issues have further to run.

US equities underperformed with the S&P500 down 1.6%, the biggest one-day fall in a month. The risk off tone flowed through to bonds. European yields fell ~12-14bps across the curve, while the US 2-year yield slumped by ~15bps overnight. At 3.94% the US 2-year yield is nearly 25bps lower than where it was before ANZAC day. Markets continue to favour another 25bp rate hike by the US Fed next week, but the assigned probability has slipped to ~80%, with rate cut expectations for later this year increasing. The interest rate market is now factoring in ~2 rate cuts by the US Fed over H2 2023.

Elsewhere, energy prices remain on the backfoot. WTI crude oil dropped another ~2%. At ~US$77/brl, WTI has retraced the bulk of its early-April OPEC+ production cut driven spike. Industrial metals were also weaker. Copper declined for the 5th straight session and is now over 8% below its mid-April high, while iron ore has remained under pressure. At ~$106/tonne, iron ore is at its lowest level since late-2022. In FX, the negative risk environment supported the USD and the JPY. EUR unwound its recent lift to be back near ~1.0975 and GBP dipped down to ~1.24. Commodity currencies like the AUD, CAD and NZD underperformed, to differing degrees. The AUD (now ~$0.6627) is less than 1% from its 2023 low.

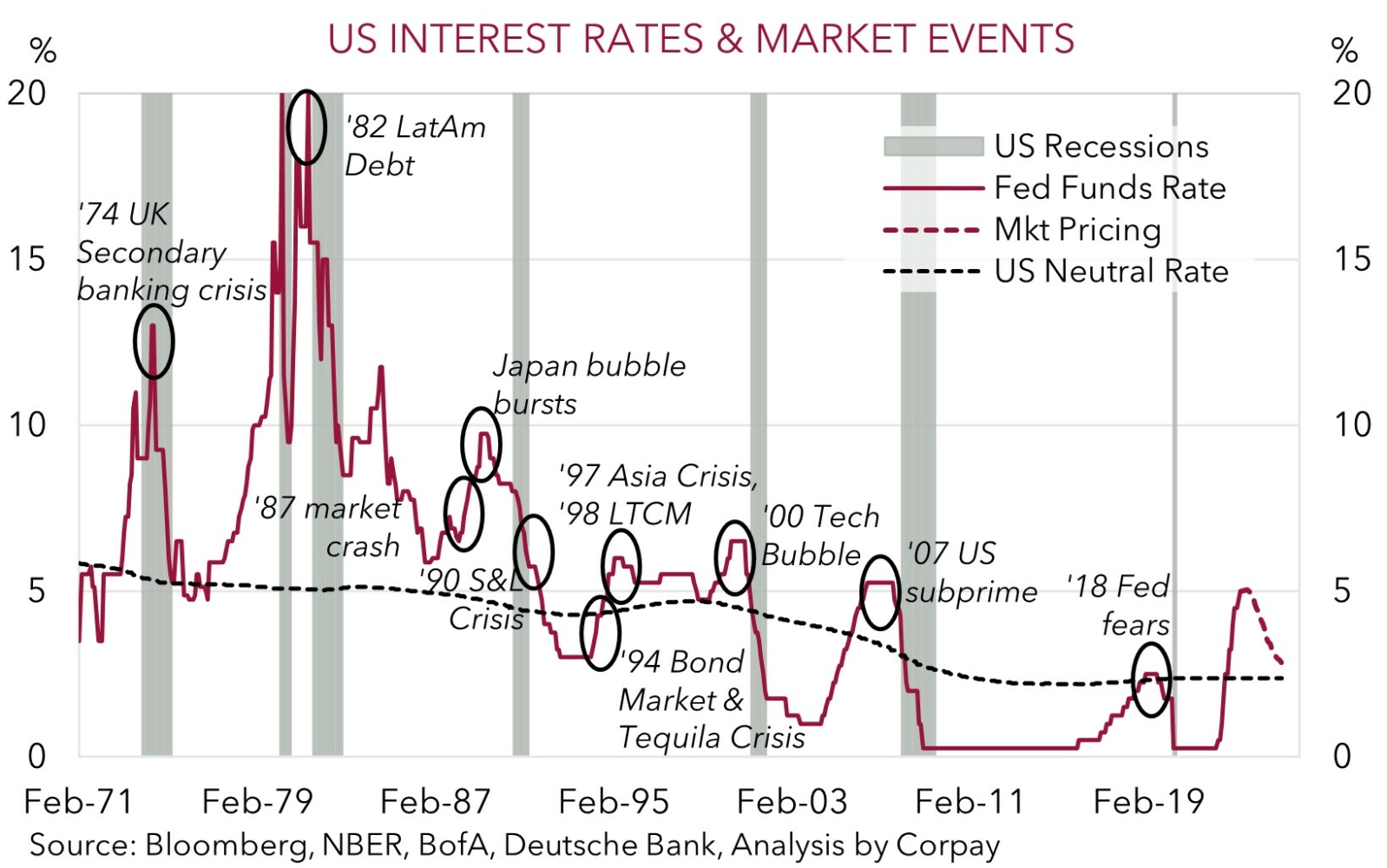

On the data front, US consumer confidence undershot expectations. Sentiment is at its lowest since last July, with tighter credit conditions starting to take their toll. Regional Fed manufacturing surveys from Dallas, Philadelphia, and Richmond also came in softer. Signs the US slowdown is starting to unfold are beginning to pile up. As tighter policy settings and credit conditions continue to bite, we expect the US economic downturn to gather pace over the next few months, and for volatility to continue. As our chart shows, US Fed tightening cycles typically expose market vulnerabilities. As outlined previously, this is a backdrop that normally supports currencies like the USD, EUR and JPY over global growth-linked ones such as the AUD and NZD (see Market Musings: Buckle up, volatility should continue).

Global event radar: AU CPI (Today), US GDP (Thurs), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), Fed Chair Powell Speaks (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May).

AUD corner

AUD remains under pressure. As outlined above, renewed banking sector worries, combined with ongoing economic growth concerns have dampened risk appetite. Equities, energy prices, industrial metals, and bond yields have declined. The resultant bounce in the USD has pushed the AUD to the bottom of its April range (now ~$0.6627, and ~1% from its 2023 lows), with the negative environment also seeing the AUD underperform on the major crosses.

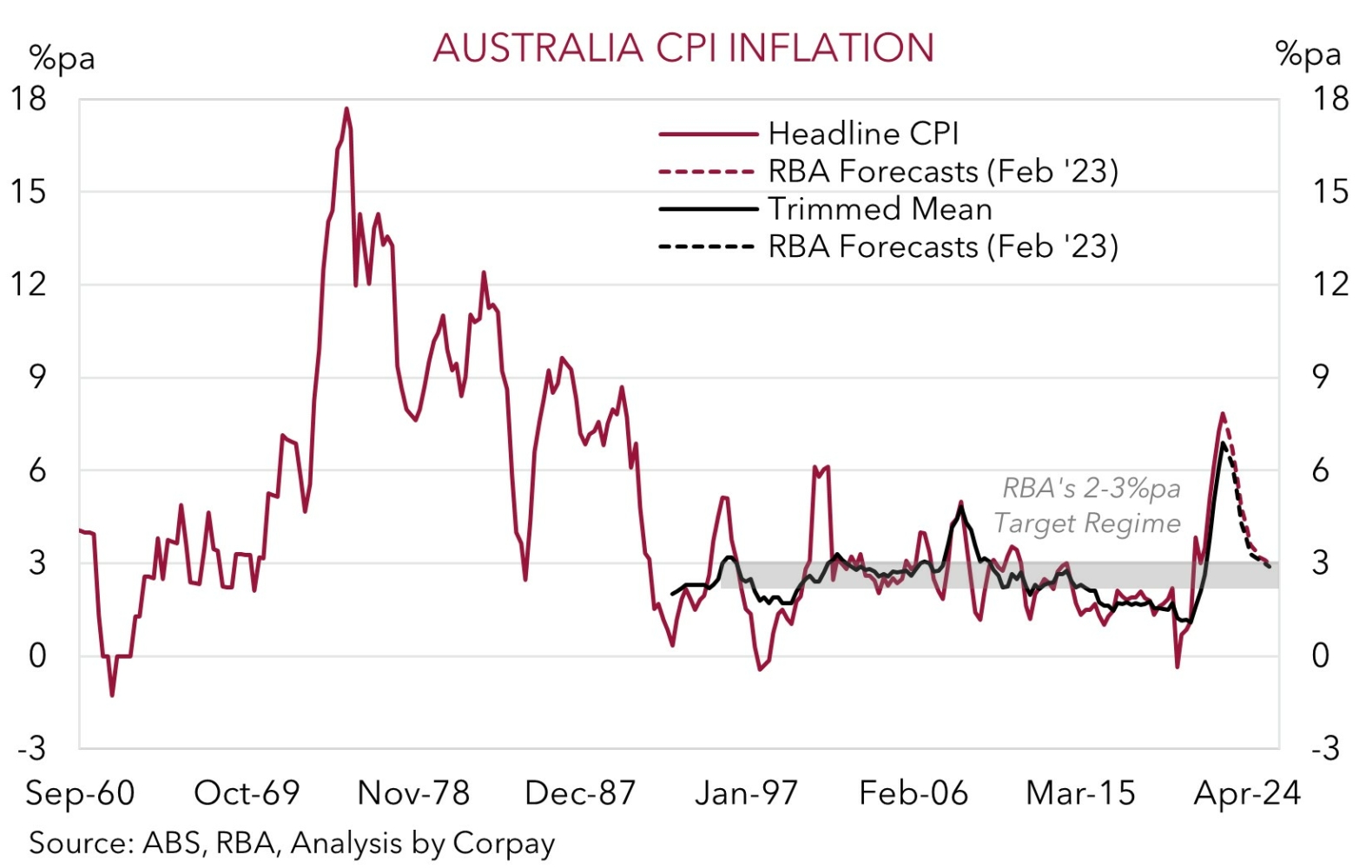

Locally, Q1 CPI inflation is a focal point today (11:30am AEST). The data is the last major release ahead of the 2 May RBA meeting. The Q1 report is expected to show inflation is past its peak. Markets are looking for headline inflation to decelerate from 7.8%pa to 6.9%pa, and for core inflation (which is what the RBA is focused on) to ease from 6.9%pa to 6.7%pa. These types of outcomes would be a touch below what the RBA had penciled in in its February forecasts, and in our opinion, should support the case for another pause in May, keeping the AUD on the backfoot. Indeed, given the global market and economic backdrop, and firmer USD, we doubt that even a small positive Q1 CPI surprise (which would bolster expectations for another RBA rate hike in May) would generate a sustainable turnaround in the AUD.

Broadly speaking, we continue to think that the AUD is facing an uphill battle over the next few months as the global economy slows and more ‘aftershocks’ from the fast global tightening cycle generates further bouts of market volatility. When combined with China’s increasing focus on consumption driven growth rather than commodity intensive infrastructure spending, and outlook for a relatively more aggressive ECB, we expect AUD/EUR to remain heavy (see Market Wire: China’s sector divergence & AUD/EUR). Similarly, while the BoJ appears unlikely to make any major policy changes this Friday, we think it is a matter of time. In our view, this eventual BoJ shift, coupled with Japan’s improving capital flow dynamics, and a global slowdown, favours a lower AUD/JPY (see Market Musings: Cross-Check: AUD/JPY – change is on the horizon).

AUD event radar: AU CPI (Today), US GDP (Thurs), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), RBA Gov. Lowe Speaks (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), AU Wages (17th May), AU Jobs Report (18th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6565, 0.6595 / 0.6741, 0.6797

SGD corner

USD/SGD has pushed up towards ~$1.3390, its highest level since 21 March as global growth and banking worries weighed on risk sentiment and boosted the USD (see above). We remain of the view that USD/SGD can edge up towards the top of its ~$1.3150-1.3450 range as a slowing global economy and further policy tightening by the major central banks like the US Fed and ECB generates renewed market volatility. This is normally a negative backdrop for cyclical currencies like Asian FX.

Over the next few days there are also a few major US economic releases that markets will be focusing in on such as Q1 GDP (Thursday), the Employment Cost Index (Friday), and PCE deflator (Friday). Based on our reading of various leading indicators, we think the upcoming US data could be relatively positive, particularly the wages and inflation gauges. If realised, we expect the USD (and USD/SGD) to be supported by a renewed lift in near-term US Fed rate hike expectations and a possible reduction in rate cut pricing that has been baked in for later this year.

SGD event radar: US GDP (Thurs), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), Singapore CPI (23rd May).

SGD levels to watch (support / resistance): 1.3200, 1.3290 / 1.3420, 1.3490