• Diverging trends. Business surveys show that manufacturing is slowing, but services are still strong. This suggests policy still isn’t tight enough.

• BoJ surprise? This Friday’s BoJ meeting is the first for new Governor Ueda. Tweaks can’t be ruled out. A ‘surprise’ would ripple through FX markets.

• AUD sluggish. Weaker global manufacturing momentum weighed on metals prices and the AUD. AU CPI inflation released on Wednesday.

Risk sentiment improved on Friday. European and US equities posted some modest gains (S&P500 +0.1%, Eurostoxx50 +0.5%) and bond yields rebounded. The US 2-year bond yield rose ~8bps to 4.18%, and the 10-year ticked up to 3.57%. As a result, despite the day-to-day swings, on net, US yields lifted for the second straight week. In FX, the USD Index remained range bound, though commodity currencies underperformed with the AUD slipping back under ~$0.67 as metal prices bucked the trend and lost ground (copper dipped another 1% and iron ore futures declined ~2.8%).

The varying performance across markets and in FX reflected the diverging trends economic signals coming through in the global business surveys. Data released on Friday for Japan, the Eurozone, the UK, and the US showed that while the larger and more labour-intensive services sectors continue to have positive momentum, the manufacturing side, which is more plugged into commodity-demand and production, remains under pressure. In our view, the resilience of the services sectors is a double-edged sword. While it shows activity is still holding up, it may also suggest that policy settings still aren’t ‘restrictive’ enough to slow growth to the rates needed to meaningfully push up unemployment and bring inflation down to target.

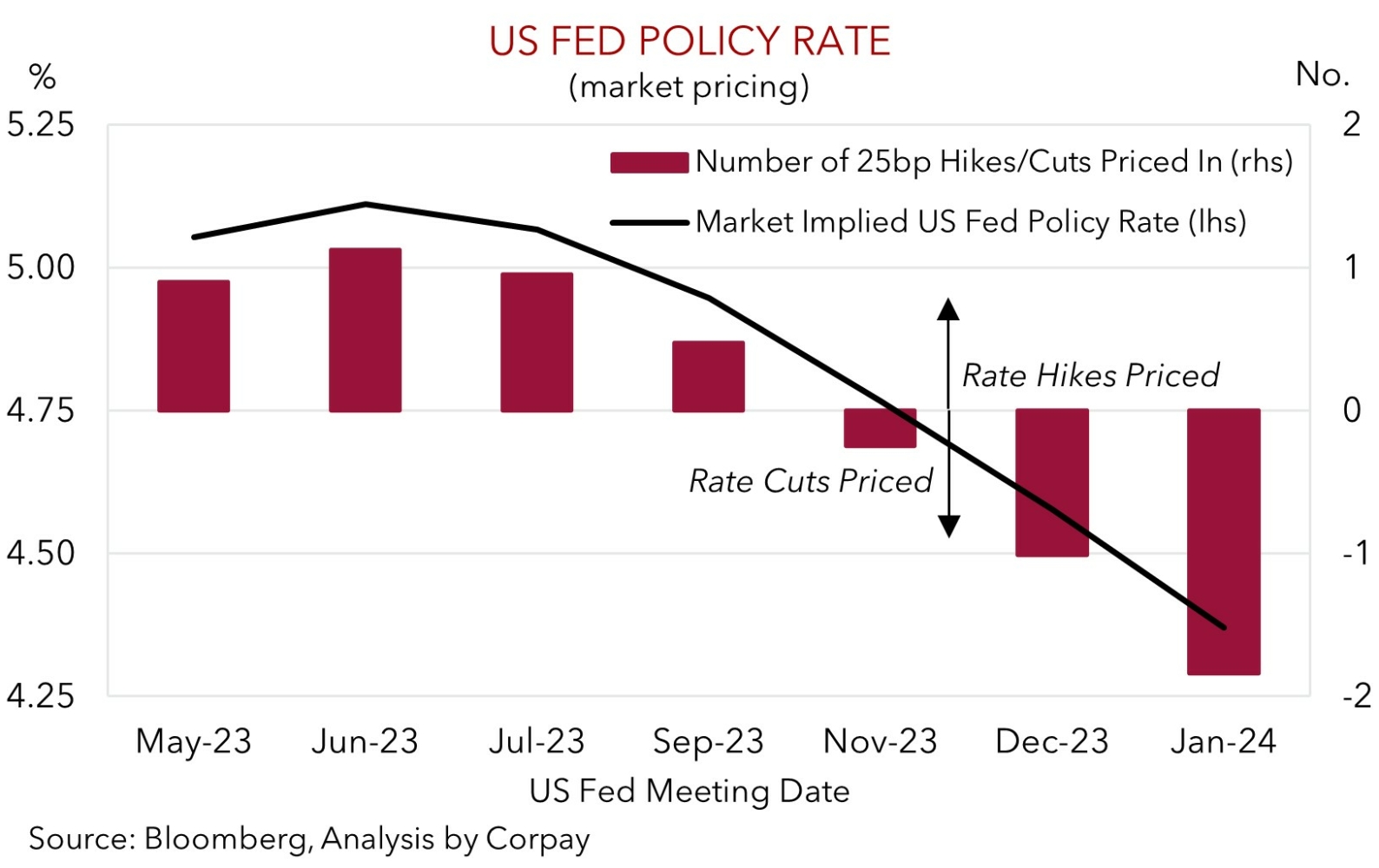

Later this week there are a few US data releases that we believe should strengthen the case for another rate hike by the US Fed in early-May and push back on the markets projections looking for rate cuts over H2 2023 (see chart below). US Q1 GDP (Thursday), the Employment Cost Index, and the PCE deflator (these are the Fed’s preferred wages and inflation gauges) (both Friday) are in focus. Consumer spending, particularly on services, is expected to have underpinned another solid quarter of US growth, and the tight labour market is predicted to keep the ECI and core PCE deflator elevated. We think a positive run of US data and a paring back of longer-dated US Fed rate cut pricing could be USD positive.

Friday’s Bank of Japan meeting, the first for new Governor Ueda, is also a potential source of market volatility. Inflation and wage pressures in Japan are building, and we think it is inevitable the BoJ starts to wind back its very loose policy settings. On balance, we think large changes are more likely towards mid-year, however, tweaks this week can’t be ruled out. A ‘surprise’ shift on Friday would be JPY supportive, and this would cascade through broader FX markets given the resultant moves in USD/JPY and on the JPY crosses.

Global event radar: AU CPI (Weds), US GDP (Thurs), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), Fed Chair Powell Speaks (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May).

AUD corner

The AUD fell back on Friday, ending the week back below ~$0.67, with the AUD also underperforming against the EUR, JPY, and GBP. As outlined above, while the global PMIs indicate that growth across ‘services’ remains positive, the manufacturing side of the story, which is more correlated to industrial activity, commodity demand, and the AUD, has weakened. And we expect this part of the global engine to continue to relatively underperform as higher interest rates and tighter credit conditions dampen demand for ‘goods’ at a time inventory levels in major economies like the US are already high. This supports our general thinking that the AUD could continue to face an uphill battle over the next few months as the global economy slows and more ‘aftershocks’ from the fast global tightening cycle generate more bouts of volatility.

This week, as discussed above, we think the major US economic data (Q1 GDP on Thursday, Employment Cost Index on Friday), should be positive. In our view, this may bolster expectations for another rate hike by the US Fed in early-May and could see rate cut pricing for later this year unwind. If realised, we believe this should boost the USD (and weigh on the AUD).

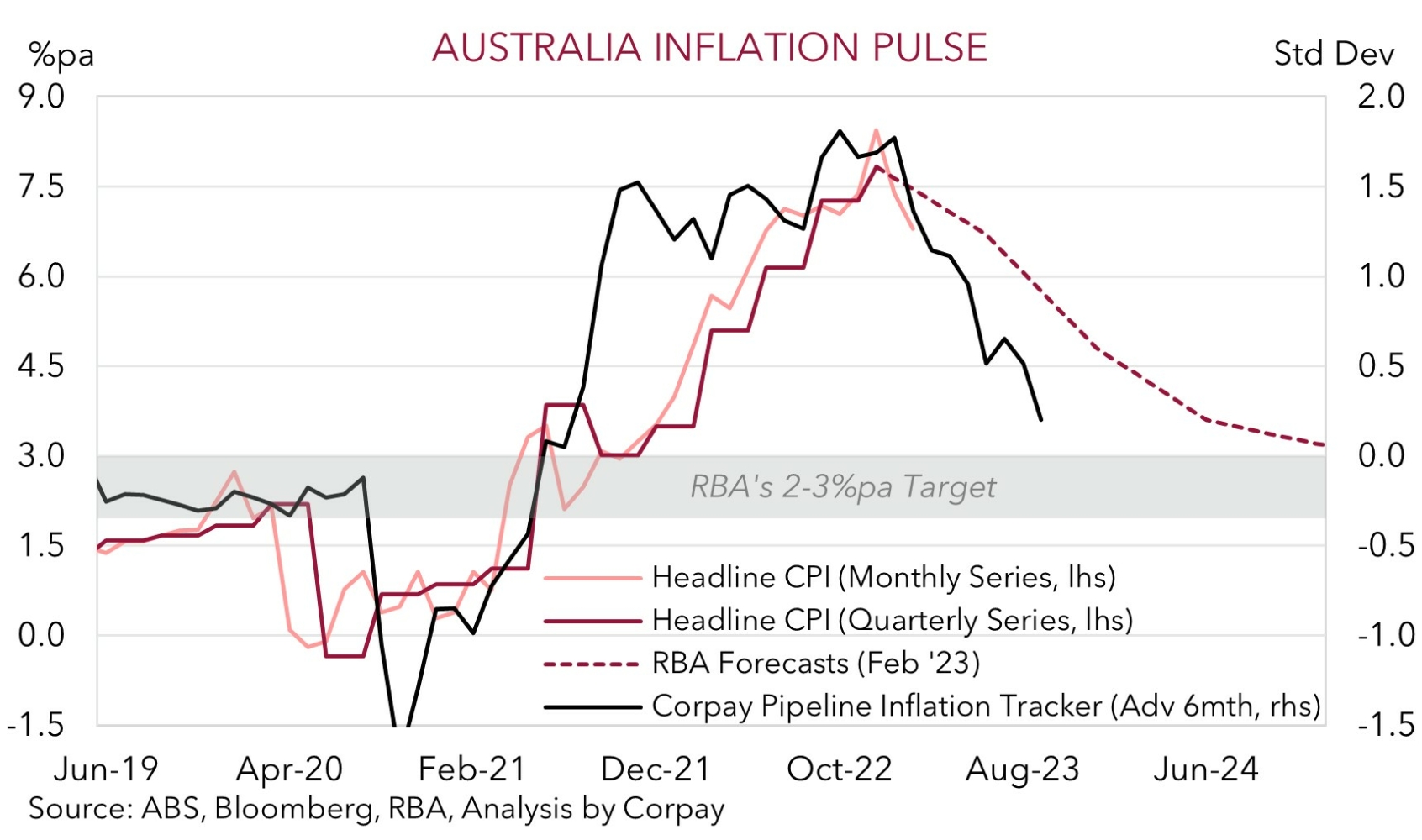

Locally, Q1 CPI inflation (released Wednesday) is the focal point. The data is the last major release ahead of the 2 May RBA meeting. The Q1 report is expected to show inflation is past its peak. Markets are looking for headline inflation to dip from 7.8%pa to 6.9%pa, and for core inflation (which is what the RBA is focused on) to ease from 6.9%pa to 6.7%pa. These types of outcomes would be a touch below what the RBA had penciled in in its February forecasts, and in our opinion, should support the case for another pause in May, keeping the AUD on the backfoot. As shown below, our pipeline tracker is pointing to a pullback in inflation over the next few quarters, and when combined with the large amount of tightening that has yet to have its full impact, we think the RBA doesn’t need to do any more.

AUD event radar: AU CPI (Weds), US GDP (Thurs), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), RBA Gov. Lowe Speaks (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), AU Wages (17th May), AU Jobs Report (18th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6595, 0.6662 / 0.6742, 0.6798

SGD corner

USD/SGD consolidated over the back half of last week, tracking in a tight range centered on ~$1.3340. As we have run through above, this week the US economic data is in focus with Q1 GDP (Thursday), the Employment Cost Index (Friday), and PCE deflator (Friday) released. Based on our reading of various leading indicators, we think the major US data should be relatively positive, particularly the wages and inflation gauges. If realised, we expect the USD (and USD/SGD) to be supported by a lift in near-term US Fed rate hike expectations and a reduction in rate cut pricing that has been baked in for later this year. More broadly, we remain of the view that USD/SGD can edge up towards the top of its ~$1.3150-1.3450 range over the period ahead, as a slowing global economy and further policy tightening by the major central banks like the US Fed and ECB generates some renewed market volatility.

SGD event radar: Singapore CPI (Mon), US GDP (Thurs), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), Singapore CPI (23rd May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3373, 1.3400