• Growth jitters. A run of weaker than expected data and ‘hawkish’ rhetoric from central bankers has generated renewed growth worries.

• Shaky sentiment. Negative growth signals dampened risk appetite. US equities, bond yields, oil, and metals prices a bit lower overnight.

• AUD lifts. Despite the backdrop AUD lifted a little. We doubt the move can be sustained. Looking ahead, May tends to be a negative month for the AUD.

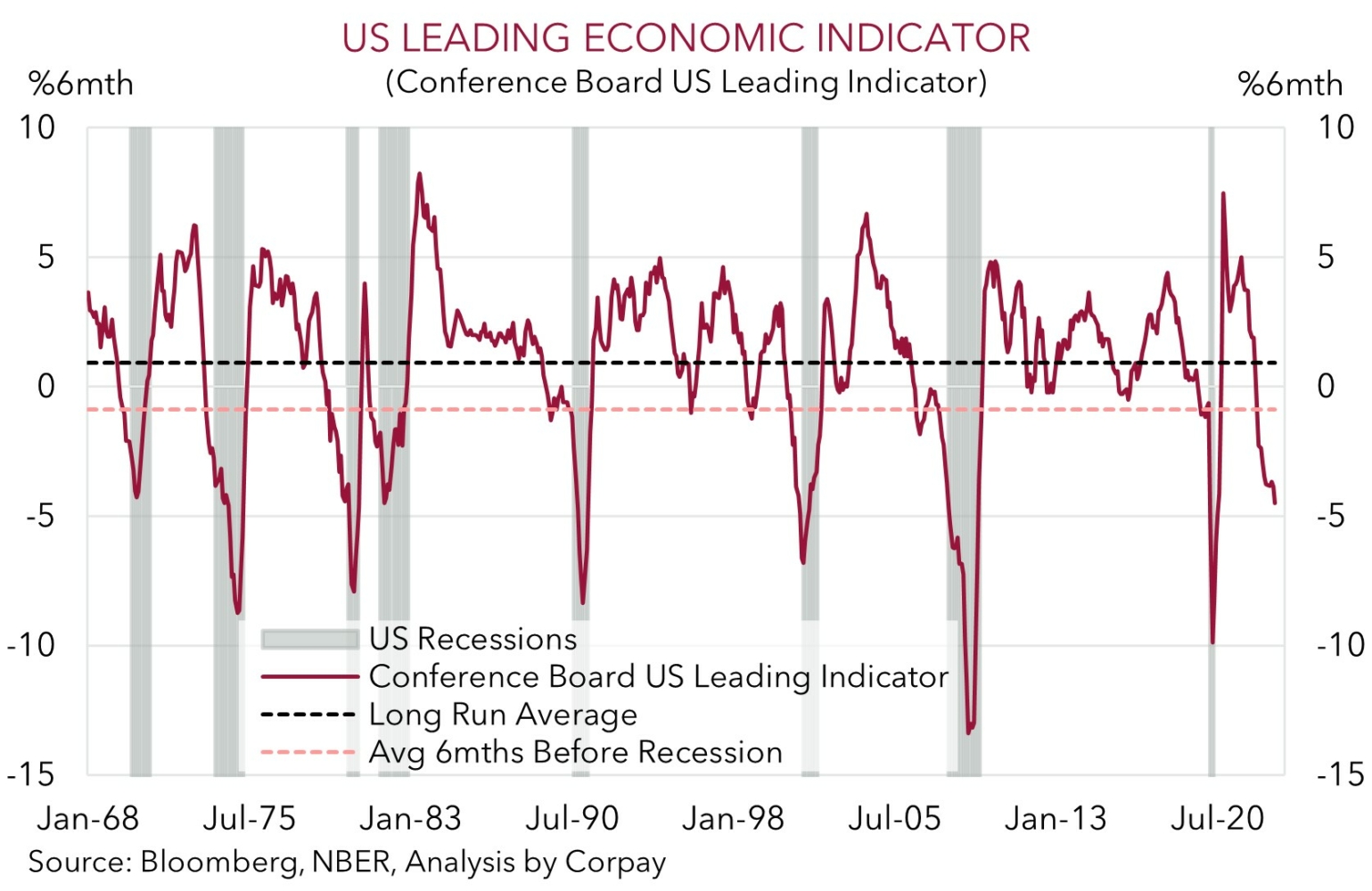

Growth concerns are back in focus following a string of weaker than anticipated data, cautious tone about the outlook in some corporate earnings results, and ‘hawkish’ rhetoric from central bank officials. In the US, the labour market is showing more signs of cracking. Weekly initial jobless claims (a measure of how many people are applying for unemployment benefits) came in a higher once again. At ~240,000 the 4-week average is near its highest since early 2022. The Philly Fed business outlook slumped to its lowest level since the initial COVID outbreak, US existing home sales fell in March, and the Conference Board Leading Index declined for the 12th straight month. The latter index captures the signal from 10 leading indicators, and as our chart shows it has a long track record of accurately picking up US downturns. Going back to 1968, each time the index has fallen by a similar amount over a 6-month period as it has recently a US recession has come about.

Despite slowing growth, central bankers continue to point to further policy tightening to win the battle against inflation. This in turn only adds to the economic risks. US Fed heavyweight policymaker Williams noted that while inflation is cooling it is still too high and that further tightening and an extended period of ‘restrictive’ settings are needed. Over in Europe, the minutes of the March ECB meeting, when rates were increased 50bps, indicated that further hikes were likely. Separately, ECB President Lagarde said “there’s still a little way to go on the [interest rate] path”, and another member, Klass Knot, bluntly stated that it’s too early to discuss a pause and more hikes were possible in May, June, and July.

Across markets the negative growth signals dampened risk appetite. US equities edged lower (S&P500 -0.6%), oil continued to fall back (WTI crude fell another 2.4% to ~US$77.40/brl), industrial metals slipped (copper dipped ~0.5%), and bond yields unwound some of their recent bounce. German yields declined ~6-7bps across the curve, and in the US, the 2-year yield dropped ~10bps to 4.14% as Fed rate cut bets for later this year and 2024 picked up. In contrast to moves in some other markets, FX was more contained. The USD Index remained range bound, with EUR hovering just below ~1.0980 and USD/JPY tracking above 134.20. AUD has nudged up slightly towards its 200-day moving average (~$0.6743).

Given the focus on growth, today’s batch of global PMIs for April will be watched closely. Data for Japan (10:30am AEST), the Eurozone (6pm AEST), the UK (6:30pm AEST) and the US (11:45pm AEST) will be released. We think more signs that policy tightening is slowing activity could further weigh on sentiment. In FX, this normally favours currencies like the USD, JPY, and EUR over cyclical ones like the AUD.

Global event radar: Eurozone PMIs (Today), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), Fed Chair Powell Speaks (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May).

AUD corner

The AUD ticked up overnight, rising by ~0.4% compared to this time yesterday to be back up near its 200-day moving average (~$0.6743). In our view, the moves in AUD/USD, and the AUD’s slightly stronger showing against other currencies like the EUR, GBP, and JPY appears inconsistent with the more negative risk sentiment running through markets stemming from renewed global growth worries (see above). We are doubtful that the AUD’s positive run, particularly on the mentioned crosses, can continue, particularly if the global PMI data released throughout today (Japan (10:30am AEST), Eurozone (6pm AEST), UK (6:30pm AEST) and US (11:45pm AEST)) show signs activity momentum is losing steam. That said, given the diverging broader economic trends we continue to see AUD/NZD pushing higher over the medium-term, with yesterday’s weaker than predicted NZ CPI data reinforcing our thinking (see Market Musings: Cross-Check: AUD/NZD – RBNZ Shock & Orr).

Bigger picture, we remain of the opinion that the environment of slowing global growth and likelihood of renewed market volatility as more ‘aftershocks’ from the fast global tightening cycle bubble to the surface should remain AUD headwinds over the next few months. We believe any short-term spikes in the AUD above ~$0.68-0.69 are unlikely to be sustained.

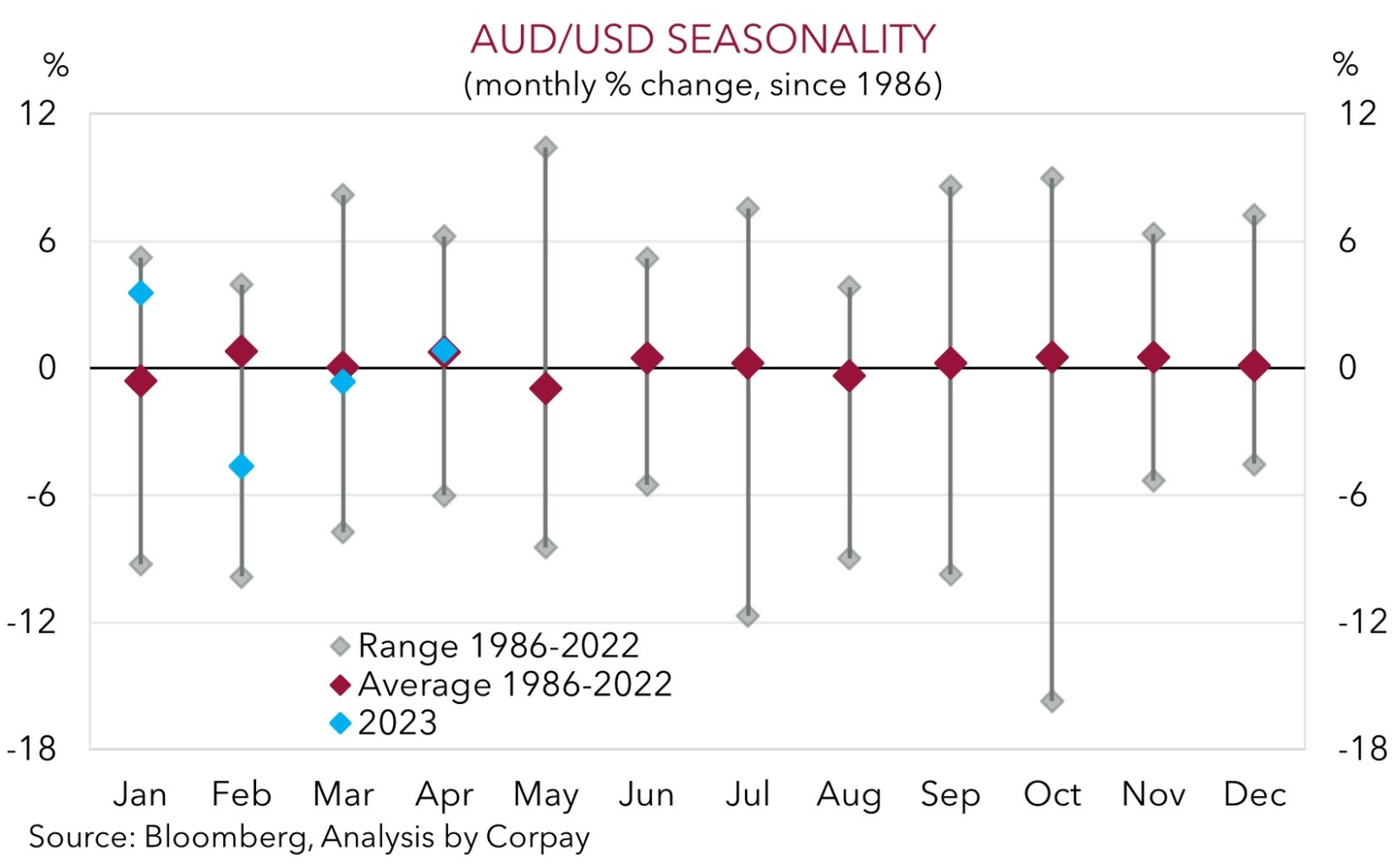

As the AUD radar below shows, there are several major domestic and global macro events on the calendar over the next few weeks which we think could spark renewed market volatility, and/or, on net, see the USD recover some lost ground. For example, while it will be a ‘live’ meeting, on balance, we judge the RBA is still more likely than not to keep rates on hold in early May. By contrast, we expect the US Fed to deliver another rate hike a few days later, and think the still high/sticky US inflation and tight labour market could see US policymakers push back on the pricing looking for cuts later this year. This mix could see relative interest rate differentials move in favour of a lower AUD/USD. Added to that, as our chart illustrates, the AUD’s lift so far this April has been inline with the historical norm, however, we would also point out that May tends to be a more negative month. Our analysis finds that the AUD has fallen in 22 of the past 37 May’s, with a ~1% decline the average move.

AUD event radar: Eurozone PMIs (Today), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), AU Wages (17th May), AU Jobs Report (18th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6620, 0.6662 / 0.6799, 0.6814

SGD corner

USD/SGD gave back a little ground overnight, but at ~$1.3323 USD/SGD is still ~0.9% above last week’s low point. As outlined above, global growth concerns have come back into focus following a run of weaker data, and still ‘hawkish’ rhetoric from central bankers focused on bringing down too high inflation. The attention today will be on the array of global PMIs for April, with data for Japan, the Eurozone, the UK, and the US scheduled to be released.

Given the market jitters, we believe weaker than expected PMI data, which would indicate that growth momentum has slowed further on the back of tighter credit conditions, could further dampen risk sentiment. This is usually not a positive backdrop for Asian FX (and the SGD) given the region is leveraged to global growth. Looking ahead, we continue to think that USD/SGD can edge up towards the top of its ~$1.3150-1.3450 range, as a slowing global economy and further policy tightening by the major central banks like the US Fed and ECB over early-May potentially generates further market volatility.

SGD event radar: Eurozone PMIs (Today), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3371, 1.3400