• Hot UK CPI. Higher than expected UK CPI boosted bond yields overnight. Markets are now factoring in a few more BoE rate hikes this year.

• NZ inflation slows. NZ CPI came in below expectations. NZD dipped and AUD/NZD moved higher as markets question the RBNZ rate outlook.

• AUD holding. AUD hovering just above $0.67. RBA review to be released today. US Fed speakers are also on the calendar over the next 24hrs.

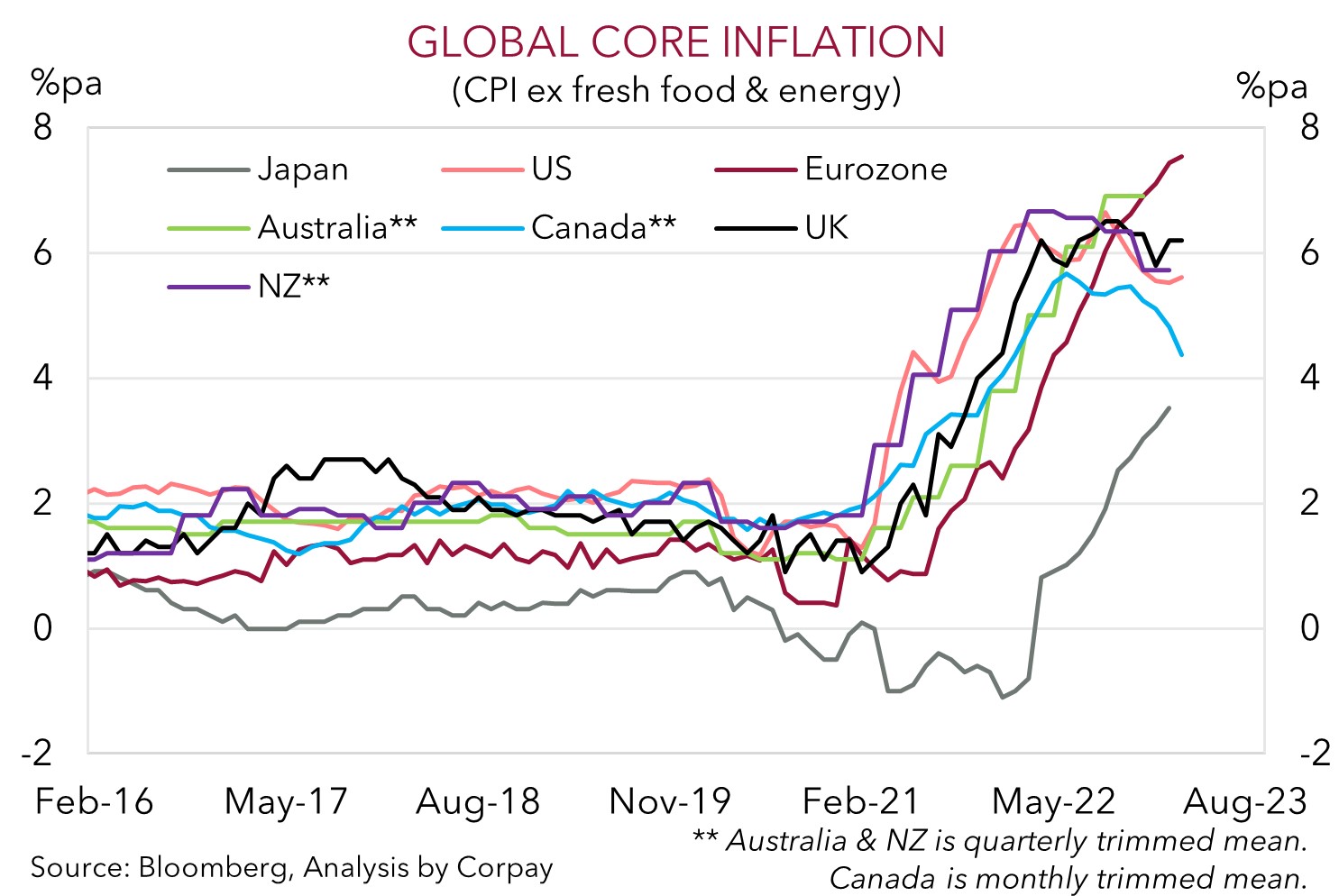

The rebound in global bond yields has continued, with Europe leading the way. Another hotter than expected UK CPI print, the only major economic data of note overnight, was the catalyst. Concerns inflation could prove to be more entrenched than assumed, which in turn forces central banks to tighten policy even further, may be starting to play on markets minds. The mechanical improvement in headline inflation from base-effects, as last year’s large price increases in things like oil roll out of calculations, are the easy wins which should continue over the next few months. However, that doesn’t tell the full story. As our chart shows, core inflation remains well above target. This inflation ‘persistence’ is what policymakers are focusing on, and to break the back of core/services inflation an extended period of ‘restrictive’ policy, below trend growth, and higher unemployment is typically needed.

UK headline inflation eased, but not as much as projected. Headline inflation in the UK was running at 10.1%pa in March, and more importantly, core inflation (which strips out food and energy) held steady at a very high 6.2%pa. The CPI follows on from the strong UK wages a few days ago. Together the data indicates that UK inflation is sticky and that the Bank of England has more work to do. BoE rate hike bets have been bolstered, with some chance of a larger 50bp move in May starting to be discounted. Markets are pricing in the BoE rate (currently 4.25%) to rise towards ~5% later this year. As a result, UK bond yields jumped up with the 2-year rising ~14bps to 3.79%, near the highest since early-March. Eurozone and US yields also moved up, but by smaller amounts. The US 2-year rose ~4bps to 4.24% (near a 1-month high).

Moves across other assets were more muted. US equities were flat, while energy prices lost some ground (WTI crude oil fell 2.1% to ~$79/brl, its lowest level since the surprise OPEC+ production cut announcement in early-April). In FX, the USD Index drifted a little higher, with some JPY weakness on the back of the lift in US yields and media reports the Bank of Japan is wary of tweaking or scrapping its yield curve control policy at next week’s meeting given the global banking wobbles, outweighing the tick up in GBP. AUD eased a touch to now be back around ~$0.6715 (~0.2% lower than this time yesterday).

A few US Fed voting members are due to speak over the next 24hrs. Given the still high US inflation and tight labour market conditions, we think the Fed officials could reiterate that some further tightening is still on the cards and that pricing of rate cuts later this year looks misplaced. In our view, a further paring back of the H2 2023 Fed rate cut predictions could give the USD some support.

Global event radar: Eurozone PMIs (Fri), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), Fed Chair Powell Speaks (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May).

AUD corner

The AUD has drifted back slightly over the past 24hrs, to be down near ~$0.6715. The rise in US and European bond yields, softer energy prices, and tick up in the USD (see above) have exerted a little pressure on the AUD. The AUD’s recent lackluster performance, despite relatively more ‘hawkish’ comments in the April RBA meeting minutes and stronger China GDP data, reinforces our thinking that near-term upside in AUD/USD should be limited. An environment of decelerating global industrial activity, likelihood of renewed volatility as ‘aftershocks’ from the fast global tightening cycle bubble to the surface, and risk that H2 2023 US Fed rate cut pricing unwinds remain AUD headwinds, in our opinion.

Today, Australian Treasurer Chalmers should be presenting the results of the RBA review, ahead of a response from Governor Lowe scheduled for 12pm AEST. Media reports indicate that the 51 recommendations are supported by the Treasurer. The most significant is a proposal to create two separate boards (one for monetary policy and another for governance). This will require legislative change. Other steps such as a shift to 6-week meeting intervals and regular post-meeting press conferences have also been mooted. The current 2-3% inflation target is unlikely to change. The board changes would put the RBA more inline with peers like the Bank of Canada and Bank of England. Headlines may generate some vol., but we doubt the review will generate a meaningful shift in near-term policy expectations and/or the AUD.

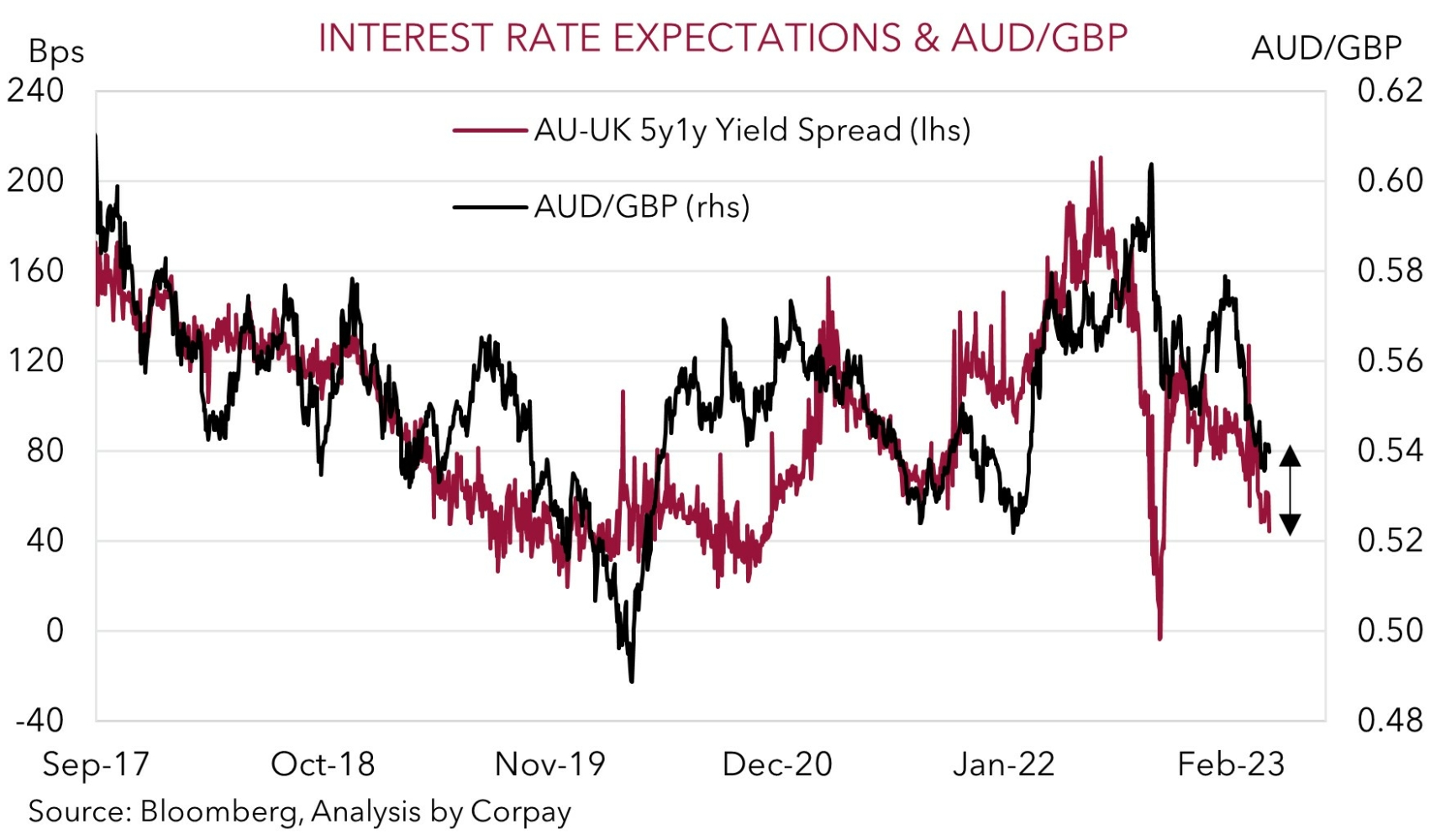

On the crosses, AUD/GBP slipped below ~0.54, with the stronger UK CPI boosting UK interest rate expectations. While there is some renewed debate about whether the RBA could rate rates again in May, the inflation pulse in the UK points to more aggressive action still needing to be taken by the BoE. We think the diverging policy expectations and increasingly negative AU-UK interest rate differentials could see AUD/GBP unwind its recent rebound.

AUD/NZD has continued its move higher, with this morning’s weaker than expected Q1 NZ CPI giving the cross another shot in the arm. AUD/NZD is back above ~1.0860, ~2.6% above the early-April low. NZ headline inflation slowed from 7.2%pa to 6.7%pa. The market was looking for inflation to moderate to 6.9%pa, while the RBNZ had penciled in a lift to 7.3%pa. Across the components, non-tradeables inflation (i.e. domestic inflation) ticked up less than the RBNZ was forecasting, while tradeables inflation (which is driven by global forces) decelerated more sharply. In our view, the data is likely to raise doubts that the aggressive RBNZ will need to raise rates again this cycle. Policy is already in ‘restrictive’ territory and the growth pulse is weakening. We think the diverging broader macro trends (i.e. growth, labour market and commodity prices) should see AUD/NZD push higher over the medium-term (see Market Musings: Cross-Check: AUD/NZD – RBNZ Shock & Orr).

AUD event radar: Eurozone PMIs (Fri), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), AU Wages (17th May), AU Jobs Report (18th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6620, 0.6662 / 0.6743, 0.6800

SGD corner

USD/SGD has drifted a little higher so far this week. At ~$1.3345, USD/SGD is ~1% above last week’s low point. In addition to the ‘dovish’ tilt by the MAS, the rebound in US and European bond yields, given the easing in banking sector concerns and signs inflation could be more persistent than anticipated (see above) has supported USD/SGD. Other major Asian currencies have also weaken over the past few days.

We continue to think that the USD can recover some more lost ground over the period ahead, with USD/SGD potentially edgingup towards the top of its recent ~$1.3150-1.3450 range. US Fed speakers are in focus over the next 24hrs. As discussed, we think that given the high/sticky US core inflation and still tight labour market the Fed officials could reiterate that some further tightening looks likely and that pricing of rate cuts later this year looks out of place. In our opinion, a reduction of H2 2023 Fed rate cut predictions could give the USD (and USD/SGD) some further support.

SGD event radar: Eurozone PMIs (Fri), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3369, 1.3400