• Calm markets. Limited moves across markets. The USD gave back a little ground. US Fed speakers will be in focus later this week.

• China data. China GDP higher than predicted. Growth is being driven by consumer spending. Industrial production & investment underwhelmed. Diverging sector performance points to more AUD/EUR downside.

• AUD/NZD in focus. NZ CPI released tomorrow. Will the data meet the RBNZ’s lofty forecasts? We see AUD/NZD moving higher over the medium-term.

Markets paused for breath overnight, with movements across most assets well contained despite an array of data and US earnings results. US equities ended the data flat with no meaningful variation across sectors. US long-end bond yields ticked down slightly, but at 3.57% the 10-year is still near the top of its April range. And in FX, the USD’s revival hit a bit of a wall with the Index unwinding yesterday’s modest gains. As a result, EUR is back up near ~1.0980, GBP has nudged up towards ~1.2430, USD/JPY is hovering around ~134, and the AUD is tracking slightly below its 50-day moving average (~$0.6735).

Apart from UK inflation, the data calendar is limited over the next 24hrs. Later in the week, there are a few Fed voting members speaking and the global PMIs are released. Given the still high/sticky US inflation we continue to expect Fed members to reiterate that there is still more work to do and that pricing for rate cuts later this year is misplaced. Overnight non-voting Fed members Bostic and Bullard offered differing degrees of hawkishness. Bullard favours 3 more hikes while Bostic is looking for 1 more before pausing for some time. In our view, a further paring back of the H2 2023 Fed rate cut predictions could provide the USD with renewed support.

Macro wise, yesterday China’s data batch for March confirmed the economic rebound following the shift away from the COVID zero policy is unfolding. GDP growth was stronger than predicted, with China’s economy expanding by 2.2% over Q1. As a result, annual growth stepped up to 4.5%pa. A look across the underlying drivers shows that, as per other economies when COVID health/mobility restrictions were lifted, consumer spending is doing the heavy lifting as pent-up demand is unleashed. Retail sales rose 5.8%pa over Q1, while at the same time industrial production and fixed asset investment (the areas more important for the AUD) underwhelmed.

Elsewhere, UK labour market conditions remain tight. Employment was much stronger than anticipated in February, with wages growth picking up. Weekly earnings excluding bonuses are now running at 6.6%pa. The data reinforced expectations for another Bank of England rate hike on 11 May. This gave GBP a boost and prompted a larger lift in UK bond yields (UK 2-year yields increased ~8bps to 3.66%). UK inflation data for March is released today (4pm AEST). Barring a huge downside surprise, we assume the BoE will deliver further tightening in May and keep the door open to doing more. In our opinion, BoE rate hike pricing can continue to underpin GBP over the near term and limit AUD/GBP rebounds.

Global event radar: Eurozone PMIs (Fri), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), Fed Chair Powell Speaks (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May).

AUD corner

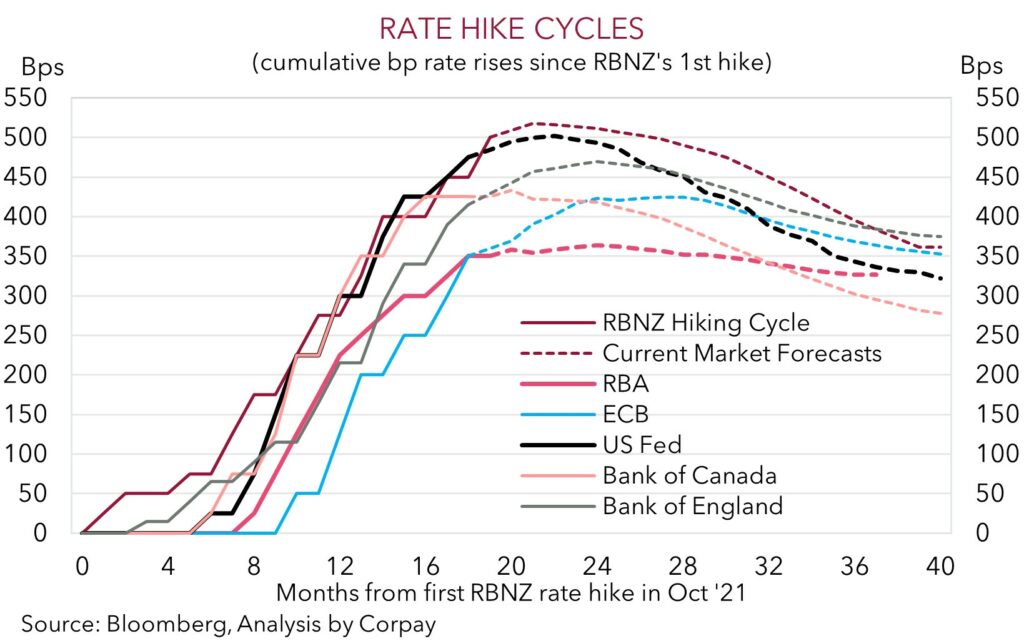

The AUD has risen a modest ~0.3% so far this week to be trading just below its 50-day moving average (~$0.6735). The AUD garnered some support over the past 24hrs from the minutes of the April RBA meeting and the better than expected China GDP. That said, we continue to believe that near-term upside in AUD/USD is likely to be limited given the backdrop of slowing global growth, risks of renewed market volatility as ‘aftershocks’ from the fast global tightening cycle continue to manifest, and with rate pricing looking for cuts by the US Fed later this year at risk of unwinding.

In terms of the RBA minutes, the Board actively debated the case to pause hiking in April or to deliver another 25bp rise. Given the RBA retains a ‘conditional’ data-dependent tightening bias this isn’t overly surprising to us, but it does indicate that the May meeting is “live” for another move. Next week’s Q1 CPI data and the RBA’s updated growth and inflation forecasts will make or break the case for another hike. At this stage we expect the RBA to stay on hold given signs inflation has turned, and the large amount of tightening in the system that hasn’t had its full impact.

In China, while GDP was higher than forecast (see above), we would note that the areas important for commodity demand and the AUD (i.e. fixed asset investment and industrial production) were sluggish. And we expect this side of China’s growth story to relatively underperform resurgent consumer spending over 2023. Notably, in periods when growth across China’s ‘tertiary’ sectors (i.e. services, consumption etc) outpaces ‘secondary’ sector growth (i.e. infrastructure, construction) we have found that the EUR normally outperforms the AUD given the Eurozone’s stronger ties to the services part of China’s economy. As a result, we see some more near-term downside in AUD/EUR (see Market Wire: China’s sector divergence & AUD/EUR).

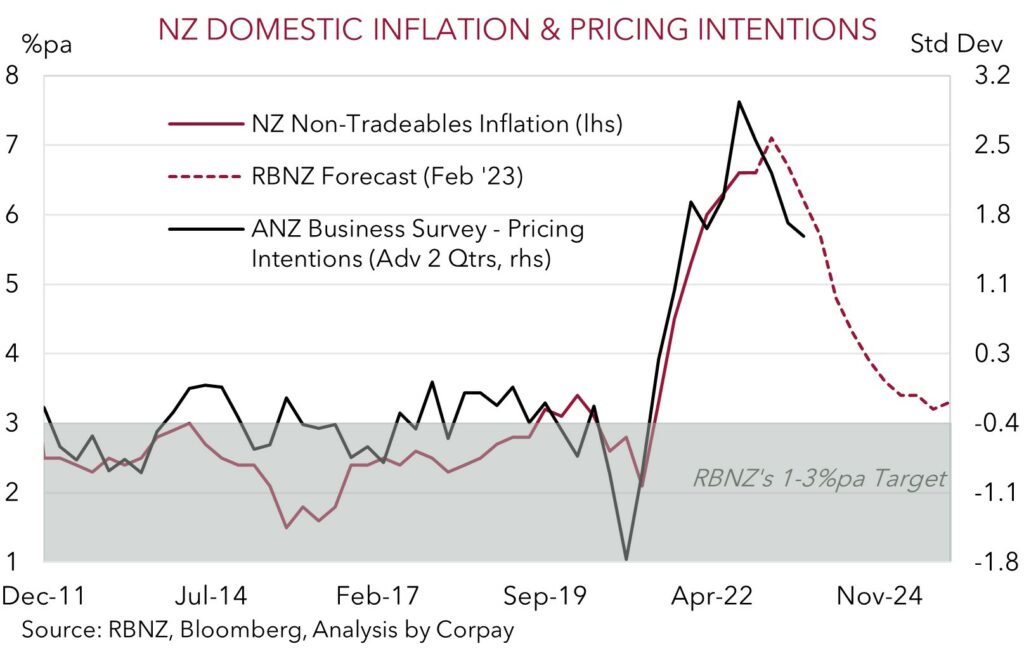

AUD/NZD has bounced back sharply following its post-RBNZ rate hike dip in early-April. At ~1.0835 AUD/NZD is ~2.3% above its recent low. Q1 NZ CPI is released tomorrow morning. Inflation pressures remain elevated in NZ, however, the RBNZ has penciled in a very high forecast for Q1 (RBNZ 7.3%pa). Given the pull-back in oil and the moderation in NZ business pricing intentions, we think inflation may undershoot the RBNZ’s lofty expectations. A result close to consensus projections (mkt 6.9%pa) could add to the belief the RBNZ is very close too, if not already at, an interest rate peak. If realised, we expect this to provide AUD/NZD further support. Over the medium-term we continue to see AUD/NZD moving higher (see Market Musings: Cross-Check: AUD/NZD – RBNZ Shock & Orr).

AUD event radar: NZ CPI (Thurs), Eurozone PMIs (Fri), AU CPI Inflation (26th Apr), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), AU Wages (17th May), AU Jobs Report (18th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6620, 0.6662 / 0.6744, 0.6800

SGD corner

USD/SGD has consolidated over the past 24hrs, with the pair hovering around ~$1.3330. As discussed above, the economic calendar is limited today, though there are a few voting Fed members speaking later this week, while the latest batch of global PMIs are released on Friday. We continue to think that the USD can recover some more lost ground over the period ahead, with USD/SGD potentially drifting up towards the top of its ~$1.3150-1.3450 range.

Given the still high US core/services inflation and tight labour market conditions, we believe the US Fed members speaking later this week could continue to push back on market pricing looking for rate cuts over H2 2023. In our judgement, a further upward repricing in longer-dated US interest rate expectations towards an on hold “higher for longer” Fed view may provide the USD with some support.

SGD event radar: Eurozone PMIs (Fri), US GDP (27th Apr), Bank of Japan Meeting (28th Apr), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May).

SGD levels to watch (support / resistance): 1.3200, 1.3245 / 1.3368, 1.3400