• Ongoing concerns. Banking issues remain in the US, while various indicators like the copper price point to a sharp slowdown in global growth.

• AUD under pressure. Global backdrop compounded by softer Q1 Australian CPI. We expect the RBA to hold steady again at next week’s meeting.

• US data in focus. US Q1 GDP released tonight, while the Employment Cost Index and PCE deflator are due tomorrow.

Sentiment across markets continues to have a negative vibe. Banking sector concerns and growth worries remain front of mind. Outside of the US tech-focused NASDAQ, which was boosted by robust earnings from a couple of mega-caps (Alphabet and Microsoft), equities again edged lower. The US S&P500 dipped another 0.4%, with banks underperforming. First Republic Bank remains in the headlines with its share price down another 20% after reports it could face potential restrictions on borrowing from the US Fed added to investor nerves. US bond yields ticked up, rising by ~5-6bps across the curve. But this comes after some sharp falls over recent days. At 3.95% the US 2-year yield remains over 30bps below its mid-April highs.

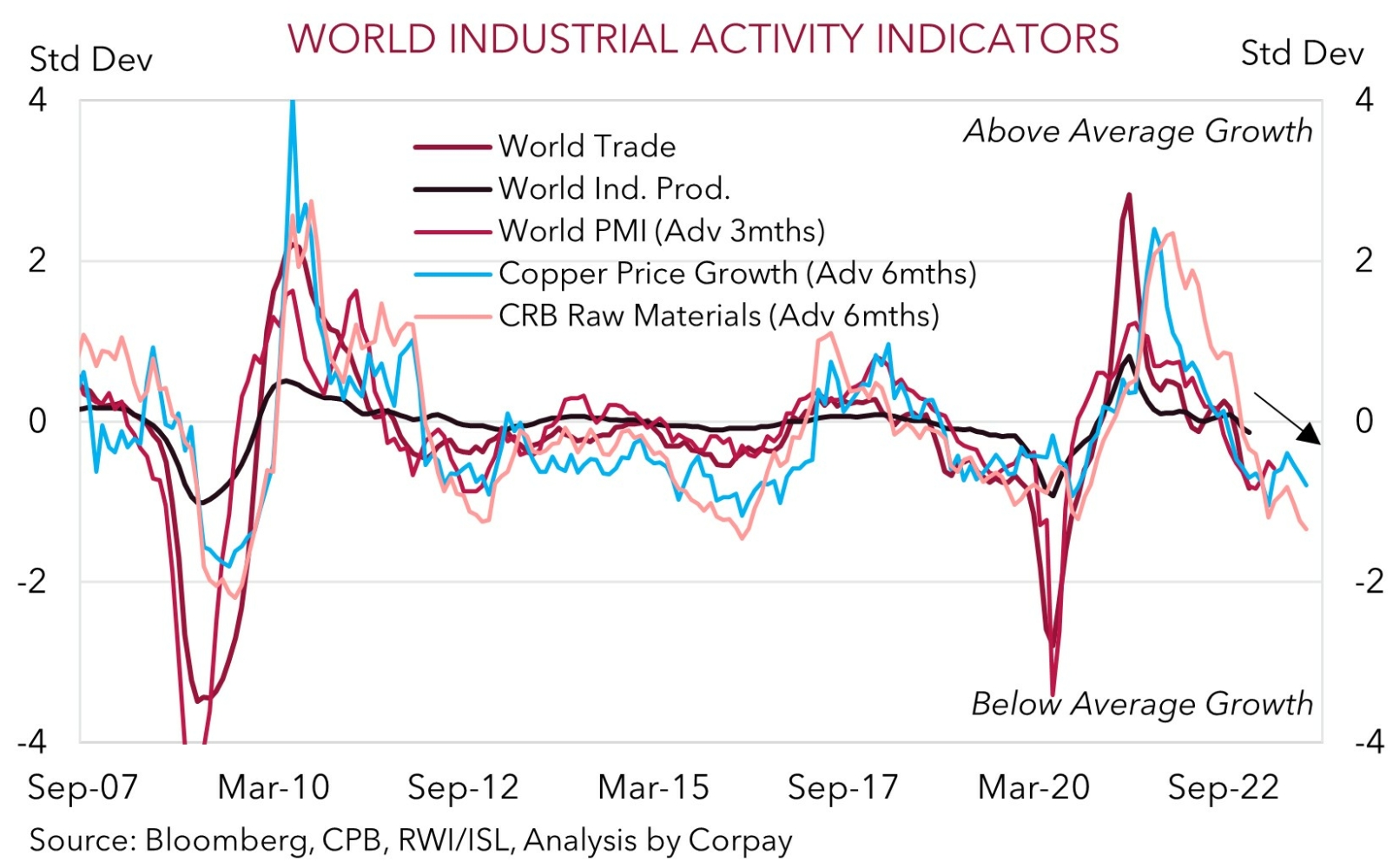

Elsewhere, in a negative sign for the global demand outlook, commodity prices remain under pressure. WTI crude oil declined another 3.6%. At ~US$74.30/brl, WTI has now more than unwound its early-April OPEC+ production cut spike. Base metals remain near recent lows. Copper is ~8% below its April highs. Given its wide-ranging applications copper price trends have historically proven to be a good guide to global momentum (and the AUD). As our chart below shows, “Dr Copper” is pointing to a further step down in activity over the next ~6-months, with higher interest rates and tighter credit conditions constraining spending, production, and trade across most major economies.

In FX, the USD Index eased back with EUR pushing up to ~1.1040, GBP ticking back over ~1.2460, and USD/JPY drifting a bit lower. US banking wobbles and news Germany’s economic ministry raised its 2023 growth projections looks to have given EUR a lift. The German economy is forecast to grow by a 0.4% this year, up from a contraction of 0.2% predicted 6-months ago. By contrast, commodity currencies like the AUD and NZD continue to underperform. As outlined previously, an environment of slowing global growth and market volatility normally supports currencies like the USD, EUR and JPY over cyclical ones such as the AUD and NZD (see Market Musings: Buckle up, volatility should continue).

The US economic data will be in focus tonight, with Q1 GDP the main release (10:30pm AEST). Stronger consumer spending at the turn of the year, particularly on services, is expected to have underpinned another solid quarter of US growth. If realised, we expect this to bolster expectations for another rate hike by the US Fed at next week’s meeting, which in turn should be USD supportive, in our view.

Global event radar: US GDP (Tonight), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), Fed Chair Powell Speaks (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May).

AUD corner

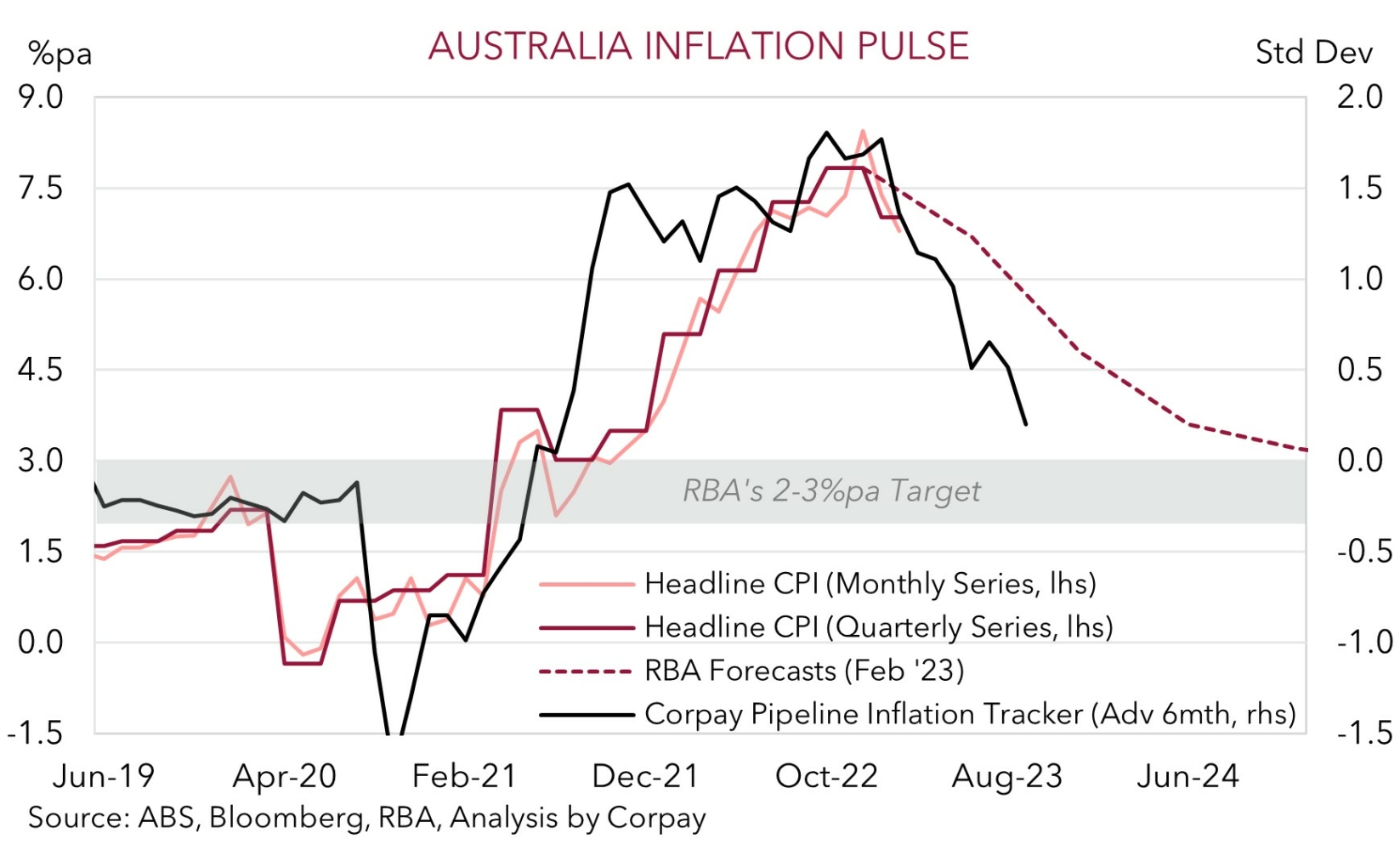

AUD remains on the backfoot with the shaky risk sentiment, global growth slowdown and lower commodity prices (see above) compounded by yesterday’s softer than anticipated Q1 Australian CPI. The data confirms that inflation in Australia ‘peaked’ at the end of 2022. Headline inflation stepped down from 7.8%pa to 7.0%pa, while trimmed mean (the RBA’s preferred core inflation gauge) also eased a bit more than anticipated, slowing from 6.9%pa to 6.6%pa (mkt and RBA ~6.7%pa).

Policy-wise, the Q1 inflation data supports our base case looking for the pragmatic RBA to remain on the sidelines once again at the 2 May meeting. We think the RBA will continue to talk tough and flag the risk of additional tightening. But the burden will continue to be on the data to force the RBA’s hand. And based on our outlook for growth and inflation we doubt further tightening will be needed, especially with the RBA trying to achieve a ‘soft landing’. As shown, our inflation pipeline tracker is pointing to a sizeable deceleration in annual inflation over the next few quarters, and there is also still a lot of ‘natural’ tightening that will flow through over 2023 as the large pool of cheap COVID-era fixed rate loans are refinanced at higher rates (see Market Wire: Inflation breathing space for the RBA).

In our view, diverging policy trends and global environment should keep the AUD under pressure. We believe the AUD’s 2023 low (~$0.6565) could be under threat near-term, particularly with the US Fed meeting (where we see another rate hike coming through and some push back on market pricing looking for cuts later this year) also up next week. Beyond that, the next major AUD support zone appears to be around ~$0.6475-0.65.

Broadly speaking, we continue to expect the AUD to face an uphill battle over the next few months as the global economy slows and more ‘aftershocks’ from the fast global tightening cycle generates volatility. More specifically, we think AUD/EUR (which has slipped below ~0.60 for the first time since Q4 2020) can fall further as macro trends continue to favour the EUR (see Market Wire: China’s sector divergence & AUD/EUR). And we also see AUD/JPY moving lower as various positive fundamentals boost the JPY (see Market Musings: Cross-Check: AUD/JPY – change is on the horizon).

AUD event radar: US GDP (Tonight), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), RBA Gov. Lowe Speaks (2nd May), AU Retail Sales (3rd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), AU Wages (17th May), AU Jobs Report (18th May), RBNZ Meeting (24th May).

AUD levels to watch (support / resistance): 0.6525, 0.6565 / 0.6708, 0.6740

SGD corner

USD/SGD has consolidated near ~$1.3360, with a slightly softer USD Index (largely due to a firmer EUR, see above) counteracting the negative risk backdrop. We continue to see USD/SGD ticking up towards the top of its ~$1.3150-1.3450 range, and for the SGD to underperform the EUR and JPY, as a slowing global economy and further policy tightening by the major central banks like the US Fed and ECB generates further market volatility. This is normally a negative environment for currencies leveraged to the global growth cycle like the SGD.

The US economic calendar heats up over the next two days. Q1 US GDP is released tonight, while the Employment Cost Index and PCE deflator are due on Friday. Based on our reading of various leading indicators, we think the US data could be relatively positive, particularly the wages and inflation measures. If realised, we expect the USD (and USD/SGD) to be supported by a lift in near-term US Fed rate hike expectations and a possible reduction in rate cut pricing that has been factored in by markets later this year.

SGD event radar: US GDP (Tonight), Bank of Japan Meeting (Fri), China PMI (Sun), RBA Meeting (2nd May), Eurozone CPI (2nd May), ECB Meeting (4th May), US Fed Meeting (4th May), US Jobs Report (5th May), US CPI (10th May), Bank of England Meeting (11th May), US Retail Sales (16th May), Singapore CPI (23rd May).

SGD levels to watch (support / resistance): 1.3200, 1.3290 / 1.3420, 1.3490