• US Fed. A ‘dovish’ pivot by the Fed. Comments & updated forecasts point to the next step being policy easing, with several cuts projected in 2024.

• Market repricing. US bond yields tumbled as markets adjusted their thinking. This weighed on the USD & propelled the AUD & risk markets higher.

• AU jobs. After a strong Oct., there are risks to the Nov. data. This may exert short-term pressure on the AUD, but it shouldn’t change the bigger USD driven trend.

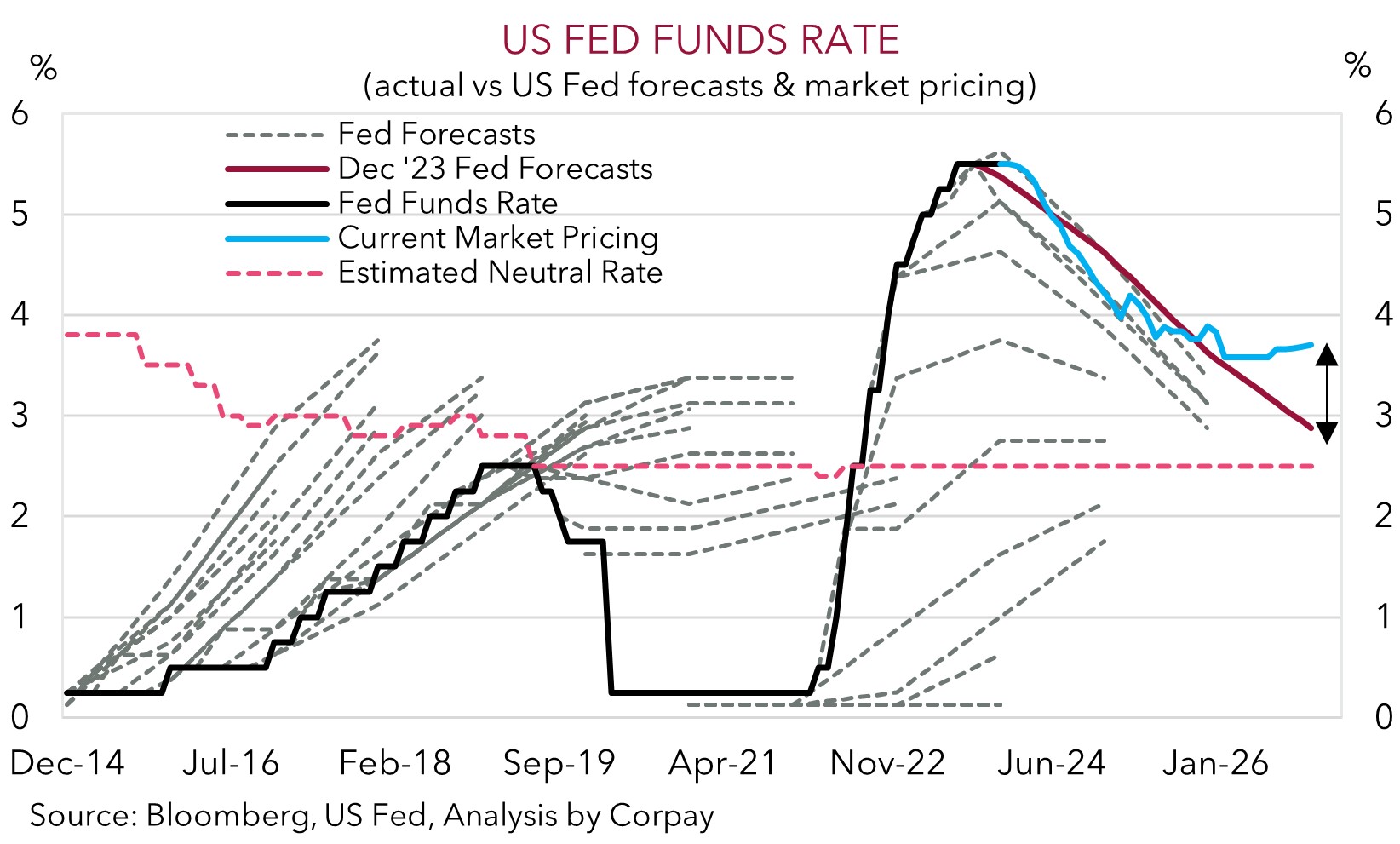

All eyes were on the US Fed meeting and press conference this morning and the ‘dovish’ tilt we were flagging came through. As anticipated, the FOMC kept policy unchanged for the third straight time with the funds rate target kept at 5.25-5.50%. However, some notable adjustments to its guidance, tone, and forecasts showed the next move is probably policy easing. According to the FOMC, rather than looking at how things are unfolding to determine the extent of “additional” tightening, they will now be monitoring developments to see if “any” more steps are needed. Compounding this strong signal the hiking phase is over, updated forecasts show that US core inflation is predicted to slow towards target faster than previously thought, while the interest rate ‘dot plot’ was also revised lower. The Fed policy rate is now projected to be at 4.6% at end-2024 (prev. 5.1%) and 3.6% in 2025 (prev. 3.9%). Indeed, while Fed Chair Powell reiterated they are still prepared to tighten further, if appropriate, he stressed the committee is “proceeding carefully” and for the first time this cycle indicated the timing of rate cuts was “discussed”.

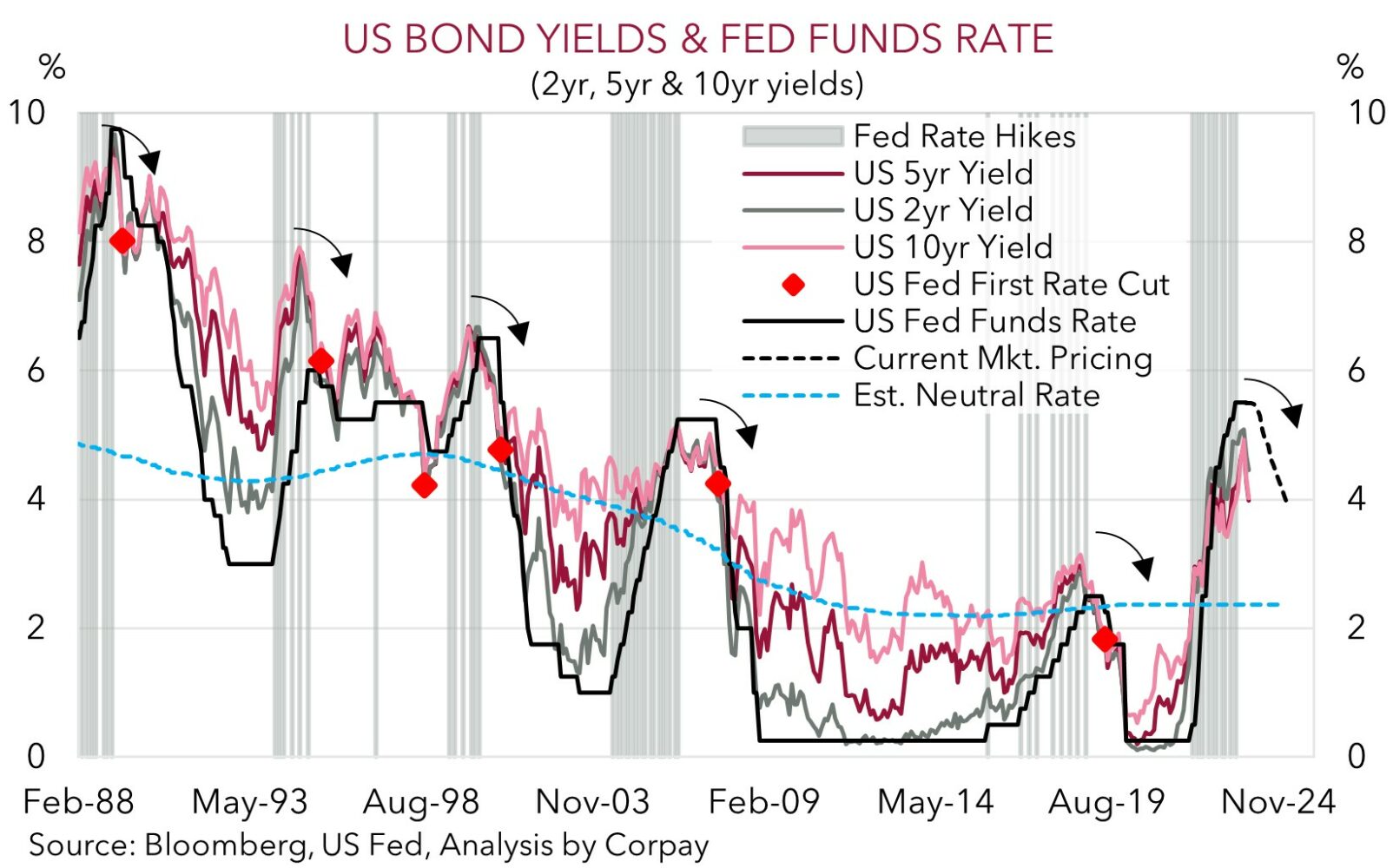

There was a sizeable repricing in US interest rate expectations on the back of the Fed’s pivot. US bond yields slumped with the 2yr rate falling ~30bps to 4.43%, its lowest since early-June, while the 10yr fell ~18bps (now 4.03%, close to 100bps below its October peak). Interest rate markets are now factoring in a bit over 5 Fed rate cuts in 2024. Although this is a slightly more aggressive than the Fed’s thinking, as our chart shows, markets are more ‘hawkish’ further out and are assuming rates bottom at higher levels. The drop in US yields propelled equities higher (S&P500 +1.4%, the index is at its highest since January 2022) and weighed on the USD. EUR spiked up towards ~$1.09 before giving back some ground and USD/JPY is down near ~143. USD/SGD (now ~1.3341) has unwound its December gains, and the mix of a weaker USD and positive risk sentiment has seen the AUD shoot up towards its December highs (now ~$0.6653).

Central banks will remain in the spotlight tonight with the Bank of England (11pm AEDT) and ECB (12:15am AEDT) handing down their decisions. No policy changes are expected, but in contrast to the US Fed, we believe there is a risk the ECB pushes back on the aggressive rate cuts bets being factored in. If realised, this may give the EUR some more support. At the same time, we think US retail sales (12:30am AEDT) could underwhelm. In our opinion, a softening US retail pulse (the engine room of the US economy) would reinforce the Fed’s ‘dovish’ turn, exerting additional pressure on US bond yields and the USD. The unfolding trends are in line with our views looking for the USD to gradually weaken over coming quarters (see Market Musings: USD losing its shine).

AUD corner

The AUD has been jolted higher by the Fed’s ‘dovish’ pivot and downward adjustment in US interest rate expectations, which in turn weighed on the USD and boosted risk appetite (see above). At ~$0.6653 the AUD is back near the top of its multi-month range. The backdrop has also pushed the AUD higher on most crosses. Ahead of tonight’s ECB decision (12:15am AEDT) where we think the EUR may garner support from a possible push back by officials on the aggressive market rate cut pricing, AUD/EUR has jumped to ~0.6125. Similarly, AUD/GBP has risen by ~1% (now ~0.5275) with weaker than expected UK GDP bolstering bets the Bank of England could send out a more cautious tone at tonight’s meeting (11pm AEDT). AUD/NZD has also rebounded towards 1.08 after the Q3 NZ GDP report came in weaker than expected. The NZ economy contracted by 0.3% (the third fall in the past four quarters), supporting calls for the RBNZ’s next step to be to cut rates.

After its positive run, we think the AUD might face some intra-day headwinds in the form of the November jobs report (11:30am AEDT). This is the last notable local data release of the year. Australian employment has been more volatile than usual recently. Following a strong October, which was boosted by a few temporary factors, employment is predicted to slow in November (mkt +11,500) with unemployment edging a touch higher (mkt 3.8%). That said, while a negative employment surprise could generate a knee-jerk dip in the AUD, particularly on the crosses, we don’t think it should change the positive medium-term trend that is forming. Indeed, as discussed above, we believe the USD should remain on the backfoot as the Fed’s change of tune continues to wash through markets, and with risks tilted to tonight’s US retail sales data undershooting consensus forecasts. Added to that, tomorrow’s China activity data batch should show momentum is picking up, a positive sign for commodity demand and growth linked currencies like the AUD.

Markets don’t move in straight lines, and there will continue to be bumps along the way. But based on our fundamental outlook which assumes growth in China improves; the USD trends lower as US bond yields continue to fall as activity weakens and the next Fed easing cycle comes closer into view; and short-dated interest differentials narrow in Australia’s favour due to the likelihood the RBA lags its peers because of the stickiness in domestic services inflation, the support to aggregate demand from the population surge, and/or the income support stemming from incoming tax cuts, we continue to forecast the AUD to rise to ~$0.68 by Q1 and then onto ~$0.70-0.71 by this time next year.

AUD levels to watch (support / resistance): 0.6550, 0.6600 / 0.6680, 0.6710