• Central banks. ECB & BoE kept rates steady but tried to push back on policy easing expectations. This helped EUR & GBP with the USD still under pressure.

• Fed impacts. The US Fed’s dovish turn has continued to reverberate across markets. Bond yields fell again & risk sentiment remains positive.

• AU jobs. Employment exceeded forecasts & while unemployment ticked up it remains low. China data batch due today. This can impact the AUD.

Following yesterdays ‘dovish’ pivot by the US Fed and signals that rate cuts will probably be the next step, central banks remained in focus overnight. As expected, both the European Central Bank and Bank of England kept rates steady, however they sounded cautious on the outlook and attempted to push back on market assumptions that policy easing may be around the corner. In the UK, the BoE retained a ‘hawkish’ bias given lingering inflation concerns with 3 of 9 committee members voting for another hike. The ECB stressed it shouldn’t lower its guard and that it “did not discuss rate cuts at all” despite lowering its growth and inflation forecasts.

That said, the Fed’s messaging remained the focus for markets. On net, bond yields fell again. The US 10yr rate declined another ~11bps to 3.91%, its lowest since late-July, while the 2yr rate slipped ~5bps to 4.38% (a ~6-month low). Across Europe, despite the central bank messaging, bond yields also lost ground with markets prepared to call their bluff. UK yields are ~5-6bps lower across the curve, and German yields are down ~6-11bps. A string of rate cuts by the US Fed from May 2024 continues to be factored in, while April is predicted to be the jumping off point for the ECB with the BoE on hold until June. US equities added to their gains with the S&P500 edging up 0.2%. Solid US economic data supported the ‘soft landing’ narrative and helped underpin risk sentiment. US retail sales were better than expected, rising 0.3% in November with consumers taking advantage of the sales period, and weekly jobless claims remain at low levels.

In FX, the shifting sands and drop in US yields has exerted more pressure on the USD. The trends are in line with our view looking for the USD to gradually weaken over coming quarters (see Market Musings: USD losing its shine). The contrasting message from the ECB helped EUR push up towards ~$1.10, the top of its ~4-month range. Similarly, GBP appreciated to ~$1.2765, a high since August, while the yield sensitive USD/JPY is tracking sub 142 (a multi-month low). USD/SGD is still on the backfoot with the pair at levels last seen in July (now ~1.3280). NZD shrugged off the contraction in NZ GDP and is hovering above ~$0.62. AUD has pushed up to ~$0.67 with a solid Australian jobs report and firmer base metal (copper +2.4%) and energy (WTI crude +3.1%) prices supportive.

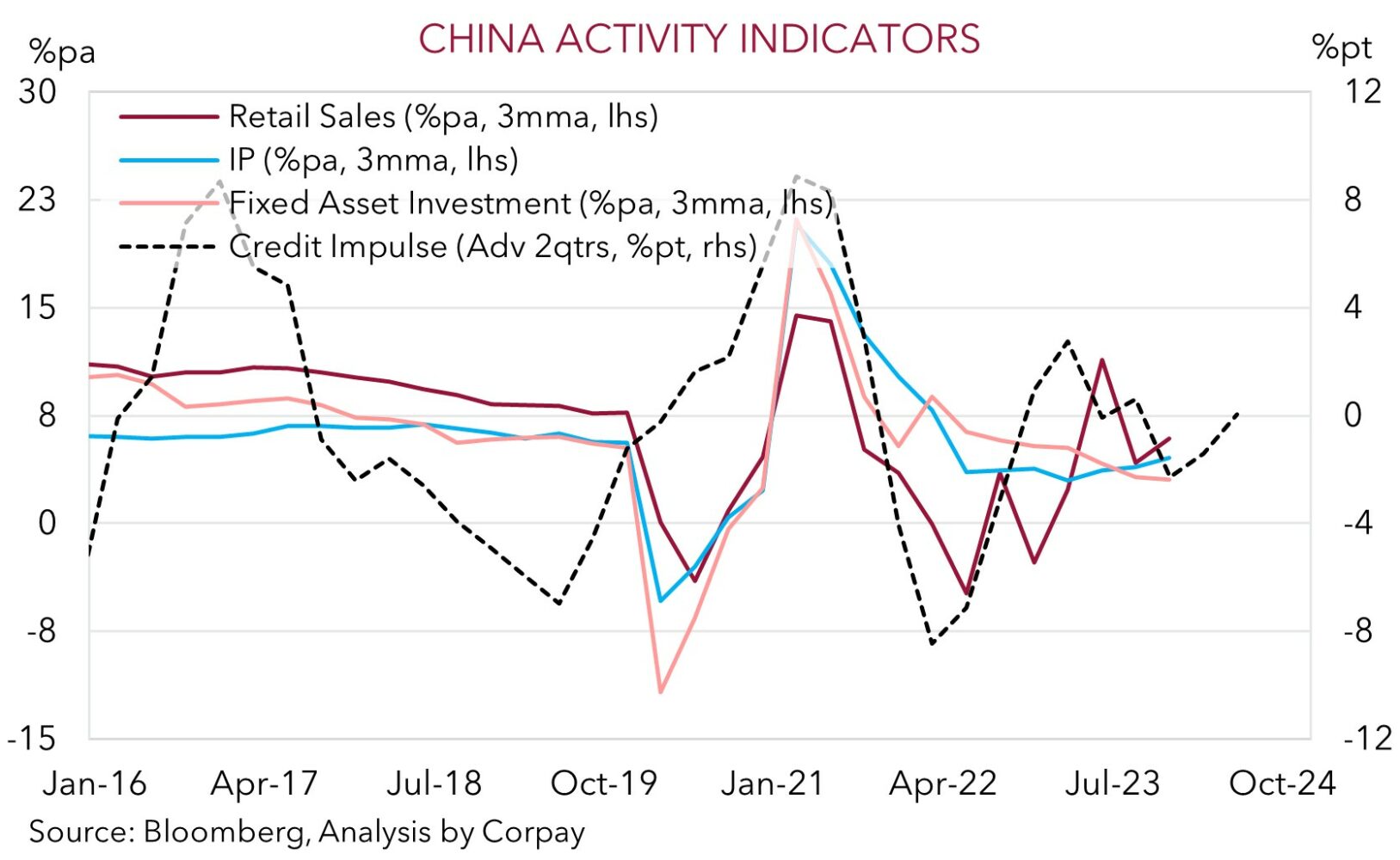

Today, attention will be on the China data (1pm AEDT) and Eurozone/US PMIs (8pm/1:45am AEDT). On the back of the uptick in China’s credit impulse and policy injections aimed at bolstering the recovery, growth in industrial production, retail sales, and fixed asset investment is forecast to accelerate. Some improvement in the Eurozone PMIs is also looked for. If realised, we think this should be a tailwind for cyclical currencies like Asian FX and the AUD, and drag on the USD.

AUD corner

The AUD has added to its post-US Fed inspired gains over the past 24hrs. The mix of a softer USD, positive risk sentiment/higher commodity prices, and a solid Australian jobs data has pushed the AUD up to ~$0.67, the top of the range it has occupied since late-July and ~6.8% above its late-October low. That said, it has been more of a mixed picture for the AUD on the crosses. The ‘hawkish’ rhetoric from the ECB and BoE has seen AUD/EUR and AUD/GBP slip back by ~0.5% (see above). AUD/JPY has also eased (-0.3% to ~95), while AUD/NZD is tracking just shy of its 200-day moving average (~1.08) after the latest contraction in NZ GDP reinforced expectations the RBNZ may relent and beginning cutting rates sooner than it thinks.

Locally, the November employment stats positively surprised. Employment rose by 61,500, well ahead of consensus forecasts (mkt 11,500). The bulk of the jobs were full-time (+57,000), and the potential payback from the October lift was nowhere to be seen. Labour supply also increased with the participation rate rising to a new record (now 67.2%). The latter helps square the circle as to why unemployment nudged up from 3.8% to 3.9%, but from a long-term perspective this is still very low. While there are signs the ‘excessive’ heat is coming out of the labour market such as the slowdown in hours worked, tick up in underemployment, and higher youth unemployment, we don’t believe it is not enough to say overall conditions are no longer ‘tight’.

Given the domestic labour market conditions, stickiness in services inflation, support to aggregate demand from the population surge, and future income support stemming from the incoming tax cuts, we remain of the opinion that the RBA should lags its peers when the next global easing cycle kicks off. These diverging policy trends should see short-dated interest rate differentials trend in a more AUD supportive direction over the medium-term. When combined with further USD weakness as US bond yields continue to fall as the Fed’s rate cutting phase comes closer into view, and an improvement in China’s economic fortunes, we see the AUD rising to ~$0.68 by Q1 and then onto ~$0.70-0.71 by Q3. The November China activity data batch is released today (1pm AEDT) and it is expected to show growth is improving.

AUD levels to watch (support / resistance): 0.6600, 0.6650 / 0.6730, 0.6770