• Mixed markets. Equities consolidated, long end yields dipped. USD clawed back ground against EUR & GBP. AUD hovering near the top of its range.

• Fed push back. NY Fed Pres. Williams tried to curb the rate cut enthusiasm. But the die has been cast. Markets looking to price in the easing cycle.

• Event radar. Locally, the minutes of the RBA meeting are due. Offshore, the US PCE deflator is released & the Bank of Japan meets.

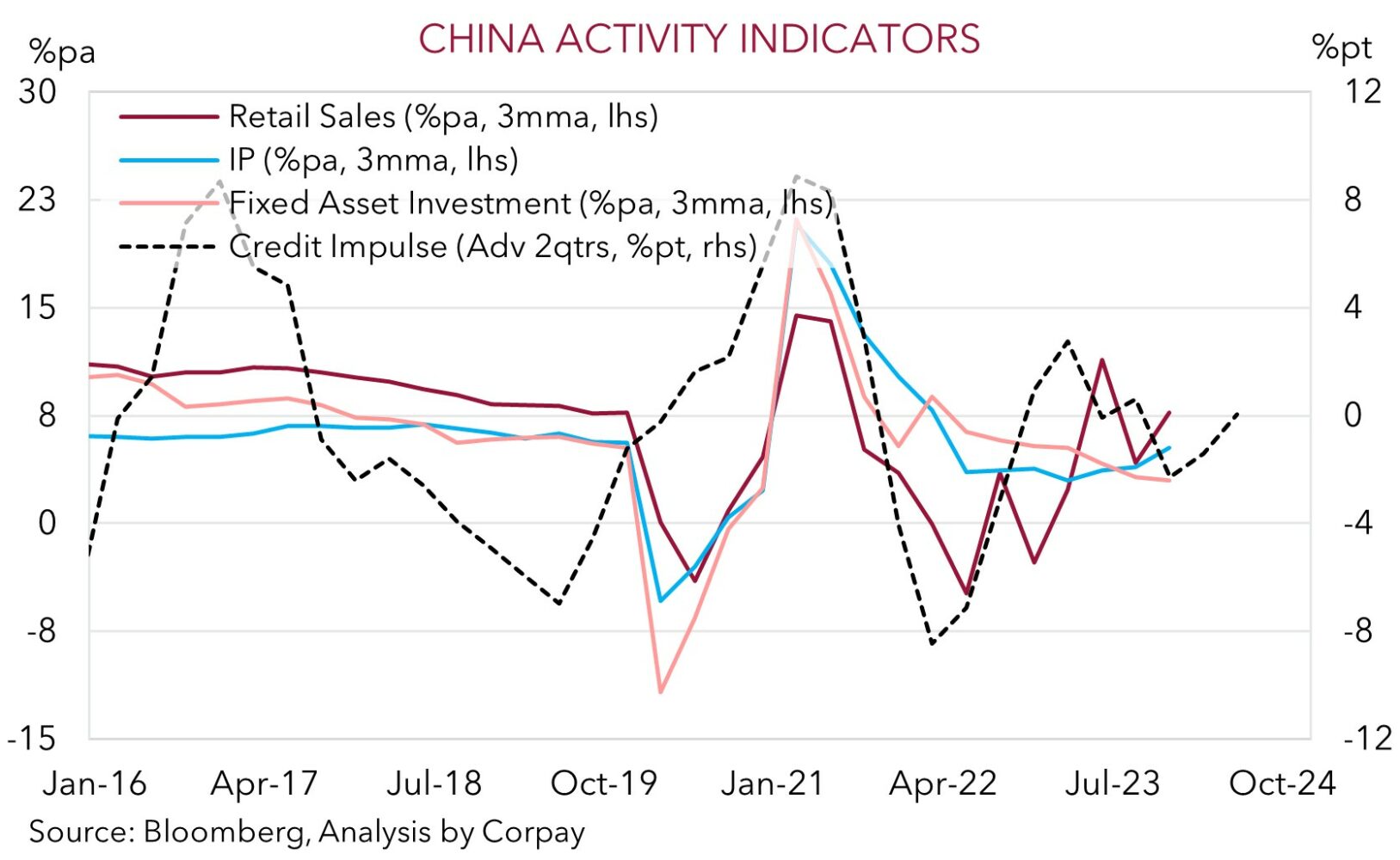

It was a mixed end to last week for markets. Macro-wise China’s November activity data was generally better than anticipated. Helped by stimulus support and favourable base-effects as past COVID disruptions washed through, industrial production (now 6.6%pa) and retail sales quickened (now 10.1%pa). That said, other areas such as property investment remain under pressure. Across Europe and the US the business PMIs diverged. The Eurozone PMIs underwhelmed with manufacturing and services mired in ‘contractionary’ territory. In the UK and US manufacturing weakened, however the more economically influential services side strengthened.

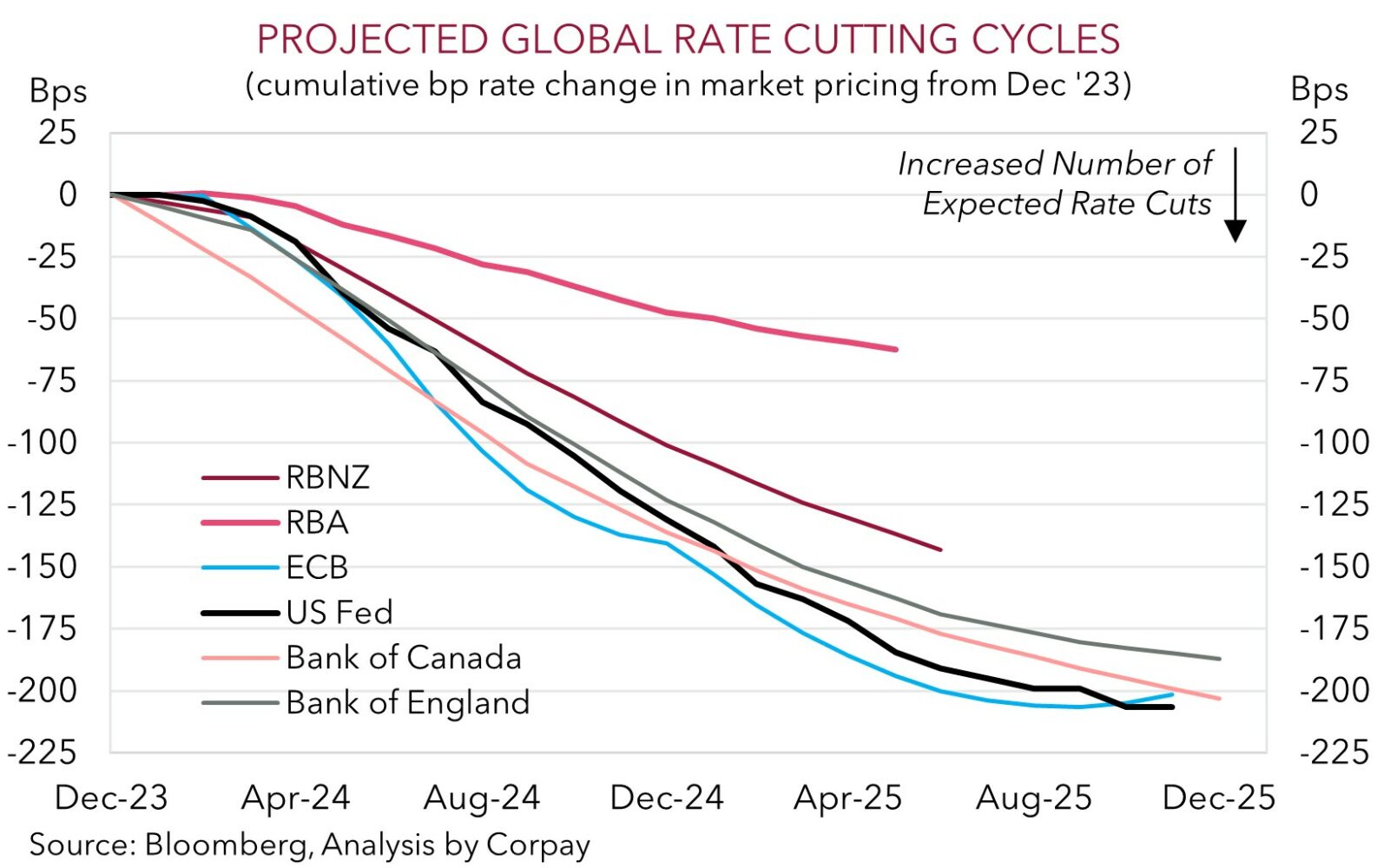

Central bank comments were also in focus. After a week where there was a significant repricing in the outlook on the back of the Fed’s ‘dovish pivot’ some US policymakers attempted to curb the markets enthusiasm. NY Fed President Williams indicated that although the topic of rate cuts did come up, it was an extension of officials’ discussing their 2024 forecasts rather than signaling a reversal was imminent. Indeed, Williams pushed back explicitly on markets factoring in close to a full rate cut by March. We tend to agree and think that while the direction of travel is right, and that markets may not be penciling in enough in terms of the amount of cuts the Fed could deliver over coming years, a move by March looks too soon. Based on our analysis of past cycles and the Fed’s ‘policy rules’ we believe a recalibration from mid-2024 is more likely (see Market Musings: US Fed pivot has further to run).

In terms of markets equities and oil prices consolidated. In bonds German and UK 10yr yields fell (-10bps), though the US equivalent was down just 3bps (now 3.91%). A modest paring back of Fed easing bets saw the US 2yr yield rise 2bps. But at 4.44% the US 2yr is still ~28bps lower relative to a week ago and ~82bps from its cyclical peak. In FX, these shifts helped the USD Index clawed back some ground, however it was concentrated against the EUR (-0.9% to ~1.0895) and GBP (-0.7% to ~1.2681). USD/JPY ticked up (+0.2%) and the AUD is hovering around ~$0.67.

Globally, things are starting to wind down for the holiday’s but there are a few focal points to flag. The US PCE deflator (the Fed’s preferred inflation measure) is due (Sat AEDT), and the Bank of Japan meets (Tues AEDT). The core PCE deflator is expected to show a further slowing in the US’ inflation pulse, with the 6-month annualised rate potentially hitting the Fed’s 2%pa target for the first time in several years. If realised, we believe this should reinforce the US Fed’s ‘dovish’ outlook, exerting pressure on the USD. For the BoJ, we think there are asymmetric risks. No change is expected this week, but there is a chance the BoJ lays the foundations for future moves. A ‘hawkish’ tone from the BoJ could be a positive jolt for the JPY and another drag on the USD (USD/JPY is the 2nd most traded pair).

AUD corner

The AUD held its ground against the firmer USD at the end of last week. At ~$0.67 the AUD remains near the top end of its multi-month range. The AUD also outperformed on the crosses. Soft PMIs out of the Eurozone/UK, and the drop in bond yields weighed on EUR and GBP (see above). At the same time signs China’s economy is picking up, and less policy easing assumed by the RBA over 2024 has supported the AUD. At ~0.6151 is nearing its ~6-month highs, while AUD/GBP (now ~0.5278) is at the upper end of the range it has occupied over recent months.

Locally, there isn’t a great deal on the economic calendar over the rest of the year. The minutes of the December RBA meeting are due on Tuesday, but beyond that its not until 9 January when November retail sales are reported that a key piece of economic information is released. In terms of the RBA minutes, we see a risk that as per last month the minutes read a bit more ‘hawkish’ compared to the post meeting statement. Comments that another 25bp rate hike was discussed as an option at the December meeting could support thoughts the RBA is on a different path compared to its peers. This divergence, and the shift in short-dated yield differentials can, in our opinion, continue to be AUD supportive over the period ahead. In addition, as discussed above, we believe the US PCE deflator (Sat AEDT) could show inflation pressures are receding, which in turn may exert more pressure on the USD. As could a ‘hawkish’ turn by the BoJ (Tues AEDT). While we don’t see the BoJ making any major changes to its policy stance this week, given the economic state of play in Japan, it looks to be a matter of when, not if substantial adjustments are made. Indications a change could be forthcoming would be a positive for the JPY, and while this would drag on AUD/JPY, the flow through impacts on USD/JPY are likely to be a positive for the AUD/USD.

There will be volatile periods along the way, but based on our outlook which assumes growth in China improves; the USD trends lower as US bond yields fall as activity weakens and the next Fed easing cycle comes closer into view; and the RBA lags its peers because of the stickiness in domestic services inflation, the assistance to aggregate demand from the population surge, and the income support stemming from incoming tax cuts, we continue to forecast the AUD to rise to ~$0.68 by Q1 and then onto ~$0.70-0.71 by Q3.

AUD levels to watch (support / resistance): 0.6610, 0.6680 / 0.6730, 0.6780

SGD corner

The drop in the USD on the back of the ‘dovish’ turn by the US Fed at last week’s policy meeting and downtrend in US bond yields has pushed USD/SGD to the bottom-end of its multi-month range (now ~1.3299). On the crosses, EUR/SGD has been volatile with the positive jolt stemming from the US interest rate repricing offset by the weak Eurozone growth pulse. At ~1.4494 EUR/SGD is on net just ~0.3% higher compared to this time last week, however the pair had traded north of 1.46 earlier in the week. Elsewhere, SGD/JPY has come under renewed downward pressure (now 106.84, ~4.7% under its November highs), with the decline in global bond yields a positive for the JPY.

As mentioned, we believe the USD may stay heavy this week if the US PCE deflator confirms the inflation pulse is weakening. If realised, this could reinforce expectations that the Fed’s policy easing cycle is approaching, weighing on the USD (and USD/SGD). This may be compounded if the BoJ opens the door to policy normalisation steps at upcoming meetings. As discussed, we believe it is a matter of time before the BoJ makes these changes with its current accommodative stance untenable. USD/JPY is the 2nd most traded currency pair, hence any meaningful changes in the direction of the JPY tend to have a cascading impact across FX markets.

SGD levels to watch (support / resistance): 1.3220, 1.3250 / 1.3360, 1.3400