• Holiday vibes. Quiet start to the week. US equities & bond yields a little higher. AUD continues to track near the top-end of its multi-month range.

• Fed rhetoric. More Fed members tried to push back on rate cut pricing. PCE deflator (the Fed’s preferred inflation gauge) due at the end of this week.

• Macro events. RBA minutes are due & the BoJ hands down its decision. No change expected, but there is a chance the BoJ lays the platform for future moves.

It has been a quiet start to the final week before Christmas across markets. In contrast to the pull-back in Europe (EuroStoxx50 -0.6%), US equities ticked up. The S&P500 (+0.6%) recorded its 7th increase in 8 trading days to be at its highest level since early-2022. A few announced M&A deals boosted sentiment, offsetting the lift in bond yields as members of the US Fed continued to try and curb the markets enthusiasm about future rate cuts. The US 10yr yield rose ~3bps to 3.94% with the 2yr rate nudging up slightly (now 4.46%). In FX, the USD Index is a touch firmer, though this reflects a bit of a lift in USD/JPY (now ~142.91) ahead of today’s BoJ decision, and a drift lower in GBP (now ~1.2645). EUR (now $1.0917) consolidated with a softer German IFO survey shrugged off. USD/SGD is treading water (now ~1.3329), with the AUD hovering around ~$0.67.

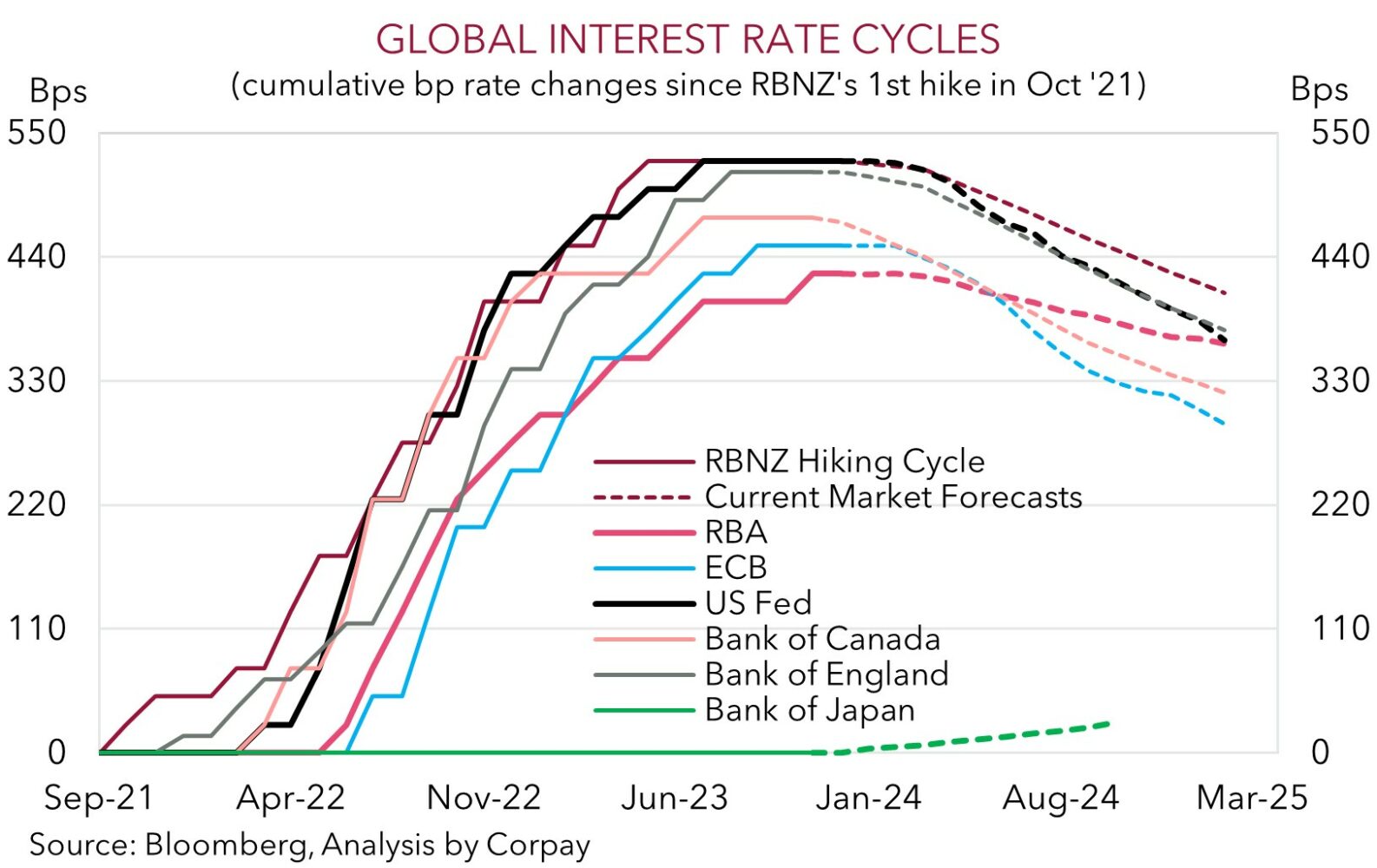

Following NY Fed President Williams comments at the end of last week pushing back on rate reductions as soon as March, members Goolsbee and Mester hit the wires overnight. According to Mester markets had gotten “a little bit ahead” of themselves with the next phase of the cycle focused on how long rates need to stay at ‘restrictive’ levels, not when they could be lowered. And in Goolsbee’s view although progress has been made, he would “still caution” that the inflation fight isn’t over. As noted yesterday, we tend to agree. We think that while the direction is right, and that markets may not be factoring in enough in terms of the amount of easing the Fed could deliver over coming years, a move by March (which is still ~70% priced in) looks too soon. Based on our analysis of past cycles and the Fed’s ‘policy rules’ we believe a recalibration from mid-2024 is more likely (see Market Musings: US Fed pivot has further to run).

The data, especially US inflation and labour market trends, will drive the Fed’s decisions. The US PCE deflator (the Fed’s preferred inflation gauge) is due at the end of this week (Sat AEDT). The core PCE deflator is expected to show the US’ inflation pulse has cooled further, with the 6-month annualised rate potentially hitting the Fed’s 2%pa target for the first time in several years. If realised, we believe this could reinforce the markets ‘dovish’ Fed expectations, exerting pressure on the USD.

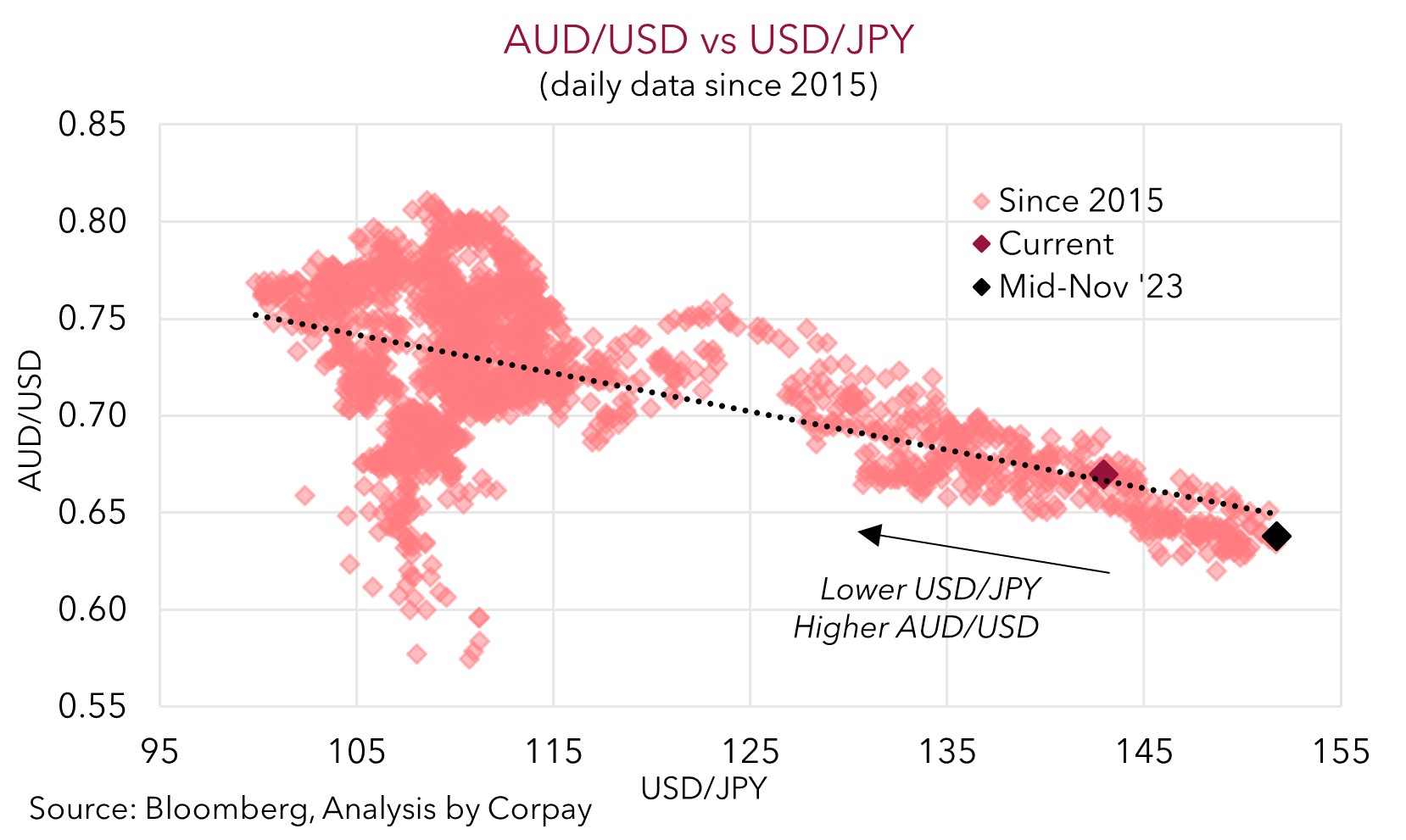

Ahead of that, attention will be on today’s BoJ announcement (no set time). No change is expected, but there is a chance the BoJ lays the platform for future moves. It looks to be a matter of when, not if, adjustments are made. We see ‘asymmetric’ market risks around today’s decision. Keeping things steady may weigh a little on the JPY, but a ‘hawkish’ BoJ step should be a relatively larger JPY positive which would also drag on the USD (USD/JPY is the 2nd most traded pair).

AUD corner

The AUD has consolidated near ~$0.67, around the top of its multi-month range, at the start of the new week. The positive market tone, as illustrated by the uptick in US equities and firmer energy prices, has counteracted the modest rise in bond yields (see above). On the crosses, the AUD extended its positive run against GBP. At ~0.53 AUD/GBP is nearing ~6-month highs. And while it eased back slightly over the past 24hrs AUD/EUR remains around levels last traded in June.

Locally, the minutes of the December RBA meeting are due today (11:30am AEDT). We see a risk that as per last month the minutes read a little more ‘hawkish’ relative to the post meeting statement. Comments that another 25bp rate hike was discussed as an option at the December meeting could support thoughts the RBA may remain on a different trajectory than its central bank counterparts over the next year. While the RBA may not hike rates again, we think that the stickiness in domestic services inflation, assistance to aggregate demand from the surging population, and the support stemming from the incoming tax cuts could see the RBA lag is peers when the next global easing cycle unfolds.

Also in today’s Asian session, the BoJ policy decision will be announced (no set time). As discussed above, although we don’t see the BoJ making any changes to its stance today, based on Japan’s inflation pulse and solid domestic economic conditions we believe adjustments should come through over the January-April 2024 period. While no change by the BoJ today could exert a bit of pressure on the JPY (pushing AUD/JPY higher), in our opinion, a larger (positive) JPY reaction would occur if the BoJ delivers a ‘hawkish’ surprise as it did a year ago when it tweaked its yield curve control settings. Although this type of result would weigh on AUD/JPY, the flow through impacts on USD/JPY would likely be AUD/USD supportive (see our scatter plot below).

Markets don’t move in straight lines and there will be bumps along the way. But beyond the intermittent short-term swings we continue to think that a reacceleration in China’s economy; more USD weakness on the back of lower US bond yields as the next Fed easing cycle comes closer into view; and a shift in Australia-US shorter-dated yield spreads should see the AUD rise to ~$0.68 by Q1 and then onto ~$0.70-0.71 by Q3.

AUD levels to watch (support / resistance): 0.6610, 0.6660 / 0.6740, 0.6780