• Positive vibes. US equities posted another gain with the seasonal rally in full swing. Backdrop supported the AUD which touched its highest level since July.

• USD softer. USD lost ground with the lift in USD/JPY on the back of a ‘dovish’ BoJ an exception. JPY underperformed with AUD/JPY up ~1.6% over the past 24hrs.

• US inflation. PCE deflator (Fed’s preferred inflation gauge) due at the end of the week. A deceleration could reinforce rate cut pricing, weighing on the USD.

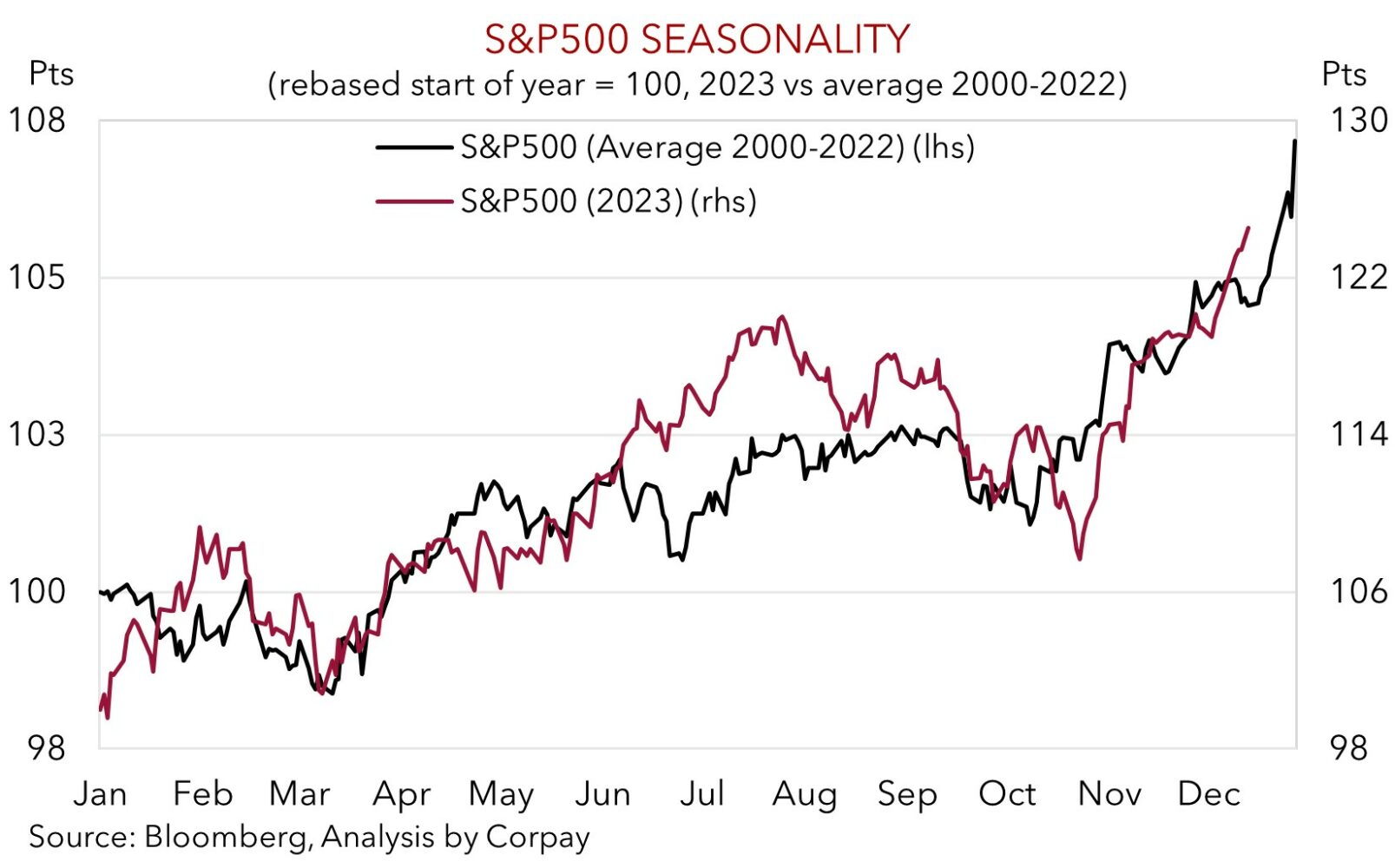

The positive run across risk assets continued overnight. US equities posted another gain with the S&P500 (+0.6%) within striking distance of its record high as the seasonal ‘Santa Rally’ unfolds. As our chart illustrates, US equities typically power ahead late in the year with renewed bouts of volatility normally occurring in Q1. Some positive US data (housing starts jumped nearly 15% in November) supported the ‘soft landing’ narrative. At the same time, rhetoric from Fed officials was mixed. After a few members (Williams, Goolsbee, Mester) tried to push back on Fed rate cut enthusiasm over recent days, Richmond President Barkin was more pragmatic. In Barkin’s view, he will be looking for “consistency” in the inflation data, and that if you assume “inflation comes down nicely” policymakers would respond “appropriately”.

We think this type of forward-looking risk management approach to the Fed’s decisions will gain prominence in 2024. As noted, with US inflation slowing, unless nominal settings are recalibrated, the Fed’s policy stance (which is measured by the gap between real interest rates and the equilibrium ‘neutral’ rate) would become more ‘restrictive’. This is something we doubt the Fed wants to happen (see Market Musings: US Fed pivot has further to run).

US yields consolidated with the 10yr rate tracking near 3.93%. Markets continue to discount a ~70% chance the Fed begins its easing cycle in March. Although we judge this may be too soon, the direction of travel looks right. Based on our analysis of past cycles and the Fed’s ‘policy rules’ we believe a steady re-adjustment from mid-2024 looks likely. By contrast, bond yields across Europe and Japan fell back, with UK, German and Japanese 10yr rates down 4-6bps. Even though the Bank of Japan had watered down expectations, some participants still look to have been surprised by the lack of a change at yesterday’s meeting. The BoJ maintained its accommodative stance with Governor Ueda retaining his cautious views. That said, underlying comments that while the “threshold” for an adjustment hadn’t been reached the price stability target was gradually turning “more certain” does, in our mind, suggest the door to a shift is slightly more ajar. Based on the state of play we expect incremental BoJ policy adjustments to come through over January-April.

In FX, the USD generally lost ground with the lift in USD/JPY (now ~143.94) on the back of the ‘dovish’ BoJ an exception. EUR edged up to the top of the range occupied since August (now ~1.0976) and GBP rose (now ~1.2721). USD/SGD (now ~1.3290) slipped towards the bottom of its multi-month range, and the AUD (now $0.6759) extended its upswing. The US PCE deflator (the Fed’s preferred inflation gauge) is due at the end of the week (Sat AEDT). On a 6-month annualised rate core PCE may hit the Fed’s 2%pa target for the first time in years. If realised, this could see markets add to their Fed rate cut bets, exerting pressure on the USD.

AUD corner

The positive risk backdrop, with US equities, energy prices, and industrial metals like copper moving higher, has underpinned the AUD (see above). At ~$0.6759 the AUD is near its highest level since late-July, with the cumulative rally from its October low approaching 8%. On the crosses, the AUD extended its positive run against GBP (now ~0.5314) and EUR (now ~0.6159) with improved sentiment, a sturdier Australian economy, and shift in interest rate spreads supportive. AUD/JPY (+1.6%, now ~97.29) also snapped back after the BoJ maintained its accommodative stance yesterday (see above). While AUD/JPY may remain supported over the near-term, we continue to think that given its high starting point, over the medium-term there is more downside than upside potential for the pair.

Locally, the minutes of the December RBA meeting were released, and in our opinion (as per last month) they again read slightly more ‘hawkish’ than the post meeting statement. While no change in policy was made, the case for another hike was considered. Notably, inline with the recently signed Statement on the Conduct of Monetary Policy, which agreed that the RBA Board would target the middle of the 2-3% inflation target, the minutes mentioned CPI is only projected to be at the “top” of the band by end-2025 and not the mid-point. The underlying tone supports our assumption that while the RBA may not hike rates again, it shouldn’t be completely discounted, and that the stickiness in domestic inflation, assistance to demand from the surging population, and the support stemming from the incoming tax cuts is likely to see the RBA lag is counterparts when the next global easing cycle unfolds. But unlike on the way up where the RBA’s measured approach created headwinds for the AUD, this time, we believe it should generate tailwinds.

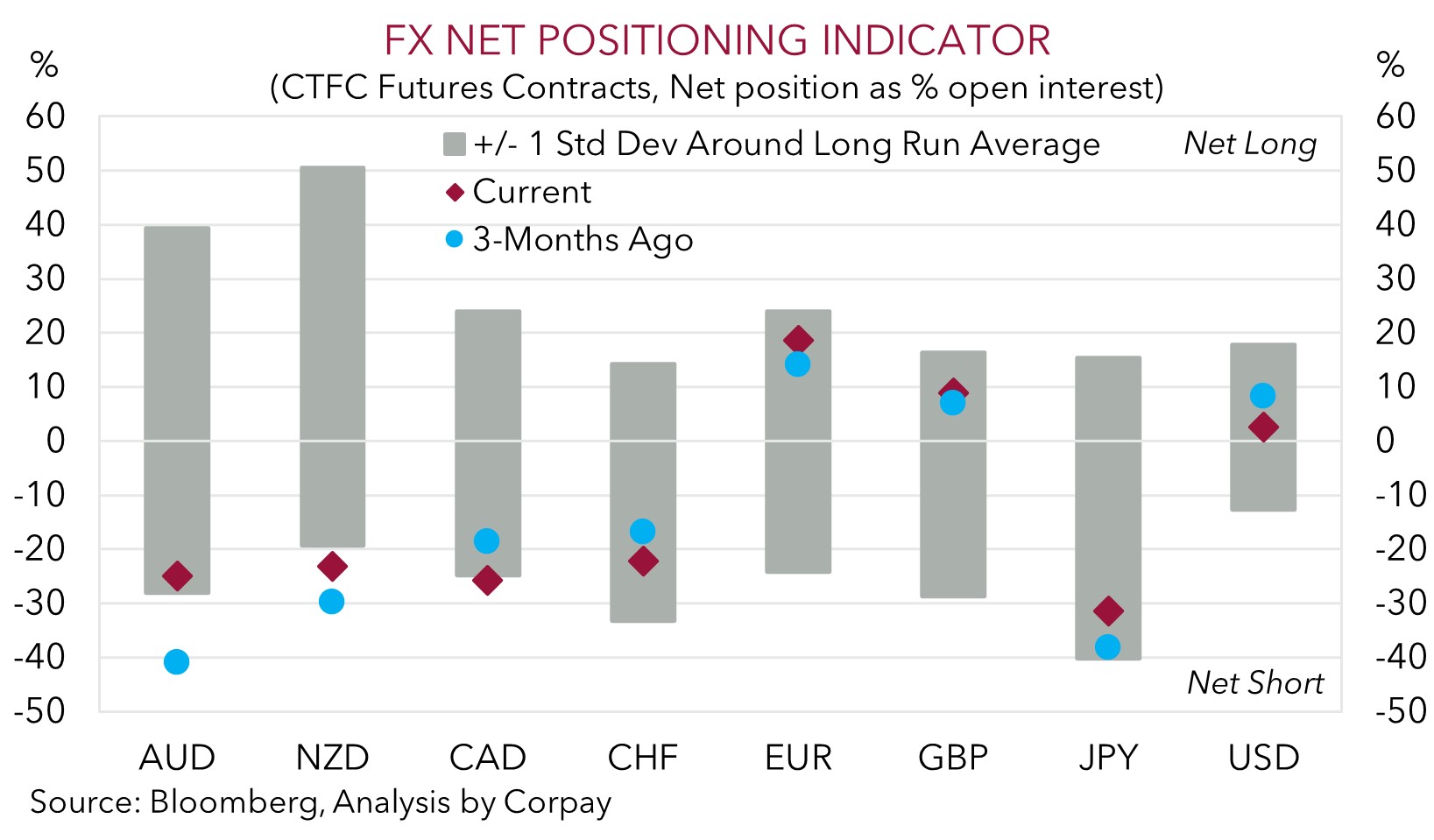

There will be bumps along the way as bouts of volatility come through. However, beyond any short-term intermittent swings, we continue to think that a reacceleration in China’s economy; more USD weakness on the back of lower US bond yields as the next Fed easing cycle comes closer into view; and a shift in shorter-dated yield spreads in Australia’s favour should see the AUD rise to ~$0.68 by Q1 and then onto ~$0.70-0.71 by Q3. Added to that, as our chart shows, while bearish AUD sentiment has been pared back from extreme levels, net short positioning (as measured by CFTC futures) is still quite large. A further unwind of the markets bearish AUD positioning points to more AUD upside over the period ahead, in our view.

AUD levels to watch (support / resistance): 0.6650, 0.6690 / 0.6780, 0.6820