• Market reversal. Late-2023 rally lost steam. Equities have given back ground over early-January, bond yields are higher, & the USD is firmer. AUD near ~$0.6725.

• US jobs. Payrolls rose more than predicted in December. But stepping back there are signs conditions are loosening. Policy easing cycles will be in focus in 2024.

• Event radar. Globally, the latest US CPI report is in focus (Fri AEDT). Locally, retail sales (Tues AEDT) & monthly inflation (Weds AEDT) are due.

The late-2023 risk rally has lost puff over early 2024. Equities have given back ground over the first week of January (S&P500 shed ~1.5%, although this followed a ~13.7% rise over November-December). Bond yields have partially rebounded with the US 10yr (now 4.05%) and 2yr (now 4.38%) rates ~26bps and ~15bps above their respective December lows. However, this only puts both where they were mid last month with the benchmark US 10yr yield still almost 1% under its October peak. In FX, the USD has bounced back after a torrid tail end of 2023. EUR/USD is around ~$1.0950 (~1.7% below its late-December highs), the rate sensitive USD/JPY has tracked the recovery in US yields (now ~144.63, +2.6% from where it ended 2023), and AUD has unwound a bit more than half of its December increase (now ~$0.6725).

In our opinion, the firmer USD at the start of 2024 reflects: (i) the EUR’s negative seasonality at this time of year (following its tendency to jump up in December) due to the regions holiday impacted trade/capital flows; (ii) the sluggish Eurozone growth pulse stemming from the ECB’s aggressive policy steps aimed at bringing down inflation; and (iii) the pick up in yields as a decent run of data has seen markets lower the probability of a March rate cut by the US Fed and trim back how much easing could unfold this year.

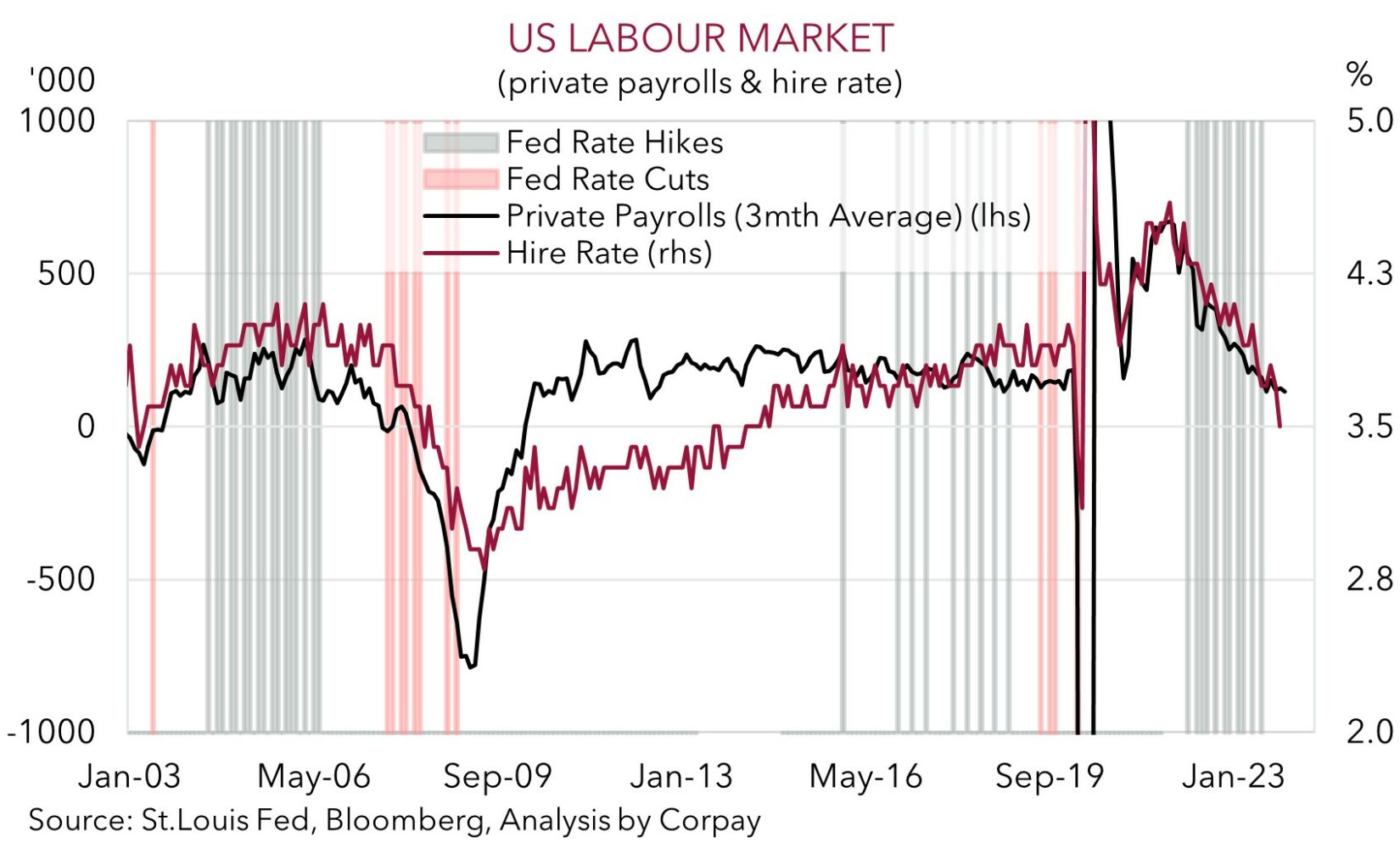

We agree and believe that while the direction is right and think markets may not be penciling in enough in terms of the amount of cuts the Fed could deliver over future years, a move by March (which is still assigned a ~67% chance) looks too soon. Based on our analysis of past cycles and the Fed’s ‘policy rules’ we feel a recalibration from mid-2024 is more likely (see Market Musings: US Fed pivot has further to run). Indeed, the latest US jobs report (released on Friday night) is consistent with an economic expansion continuing in Q4. Non-farm payrolls rose by more than predicted (216,000), the unemployment rate held steady at 3.7%, and average weekly earnings (a wages proxy) quickened to 4.1%pa. That said, if you step back there are signs conditions are loosening, and that this should continue. The payrolls monthly run-rate is slowing, temporary help workers are declining, and leading indicators such as the hiring rate and ISM employment intentions have weakened. There will be volatility along the way, but we anticipate this should drag on US yields and the USD over time.

This week’s global focus is US inflation (released Fri AEDT). Swings in gasoline prices, less favourable base-effects, and stickiness across services points to headline CPI accelerating (mkt 3.2%pa). However, we think markets may be more attuned to slower core inflation (mkt 3.8%pa). If realised, this would be the lowest since early-2021, supporting the case for Fed easing over 2024, and in our view, exerting renewed pressure on the USD.

AUD corner

After strong end to 2023, when the upswing in risk assets was in full swing, the AUD has given back some ground over early-January. The partial rebound in the USD, on the back of the negative EUR seasonality and move up in US bond yields (see above) has seen the AUD slip back to ~$0.6725 (~2.1% below its late-December multi-month peak). That said, in a reflection of how USD (rather than AUD) centric the moves have been, the AUD has held up on some of the key crosses. AUD/EUR (now ~0.6143) remains towards the upper-end of its ~6-month range and AUD/JPY has edged back above ~97. Elsewhere, while AUD/CNH, AUD/GBP, and AUD/NZD have softened, they all remain within 0.3-1.4% from where they closed 2023.

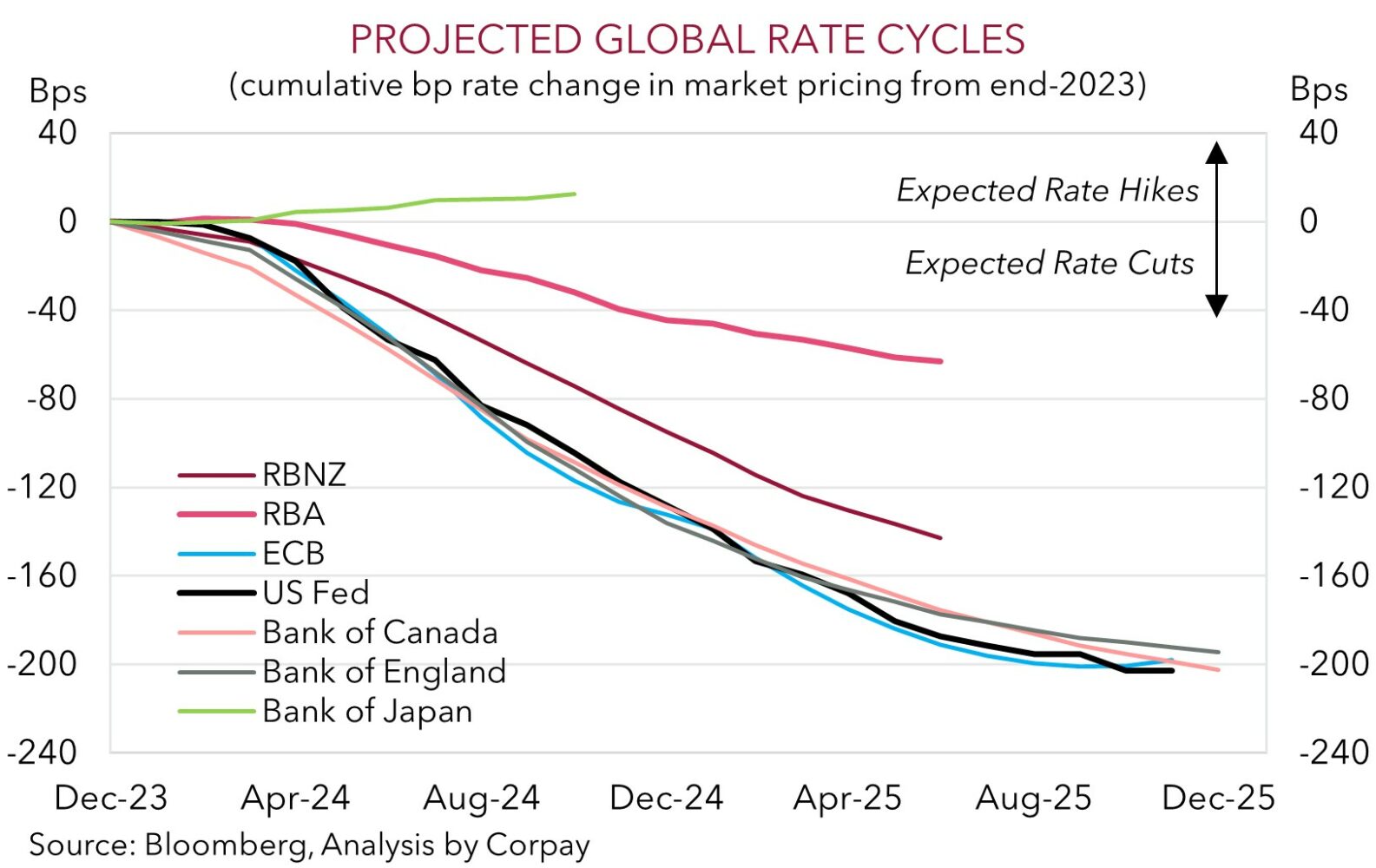

Locally, after the Christmas/New Year beak, the economic dataflow picks up. The November readings for retail sales (Tues), the monthly CPI (Weds), job vacancies (Weds), building approvals (Tues), trade (Thurs), and new home loans (Fri) are all due this week. Retail sales and monthly inflation are the pick of the bunch. We expect retail sales to bounce back strongly in November (mkt +1.2%), reflecting the increased popularity of the Black Friday sales and larger population. In terms of the CPI data, as November is the mid-month of the quarter, this release should have better coverage of services prices. While annual headline inflation should continue to slow (mkt 4.5%pa from 4.9%pa), signs that services price pressures remain ‘sticky’ thanks to ongoing tight labour market conditions/faster wages, are likely to keep the RBA on guard. Although we doubt the pragmatic RBA will hike rates again, we remain of the opinion that the stickiness in domestic services inflation, assistance to aggregate demand from the surging population, and support stemming from the incoming tax cuts could see the RBA lag is peers when the next global easing cycle unfolds (see chart below).

This, coupled with an anticipated deceleration in US core inflation (released Fri AEDT) could see short-dated yield differentials shift further in favour of the AUD. At ~47bps the Australia-US 2-year yield spread is around levels it was tracking in late-June. Back then the AUD was north of ~$0.68. Markets don’t move in straight lines and there will be intermittent periods of volatility along the way, but based on our outlook which assumes growth in China improves; the USD trends lower as US bond yields fall as activity weakens and the next Fed easing cycle comes closer into view; and the RBA is slower to turn course we continue to forecast the AUD to rise to ~$0.70-0.71 by Q3.

SGD corner

The retracement in the USD over the past week, on the back of the more positive USD seasonality and higher US bond yields, has seen USD/SGD tick back up towards ~1.33. That said, this is only where USD/SGD was trading in mid-December, with the pair still ~3.4% below its October peak. On the crosses, EUR/SGD has remained volatile with the jolt stemming from the upward US interest rate repricing offset by sluggish Eurozone growth/inflation momentum. At ~1.4556 EUR/SGD is just under its ~3-month average. Elsewhere, the softer JPY in early-January has seen SGD/JPY lift towards its 100-day moving average (~109.04).

As flagged, the global focus this week will be on US CPI. In our judgement, while headline US inflation may nudge up, core inflation should remain in a slowing trend. This should support the view that the next move by the US Fed should be to cut rates, which in turn may see the USD (and USD/SGD) ease lower. Over the next few months, we think the downward pressure on the USD should return with USD/SGD projected to fall towards ~1.30 as US bond yields resume their downtrend, growth in China improves as stimulus measures gain traction, and with stronger than anticipated Singapore GDP and inflation likely to see the MAS maintain its ‘hawkish’ bias for a while longer.