• FX consolidation. Quiet start to the week across FX. USD consolidated with AUD treading water. US CPI the major focal point this week (released Fri AEDT).

• Mixed markets. A tech sector rally boosted US equities. Oil prices fell on softer demand signals, & bond yields lost some ground.

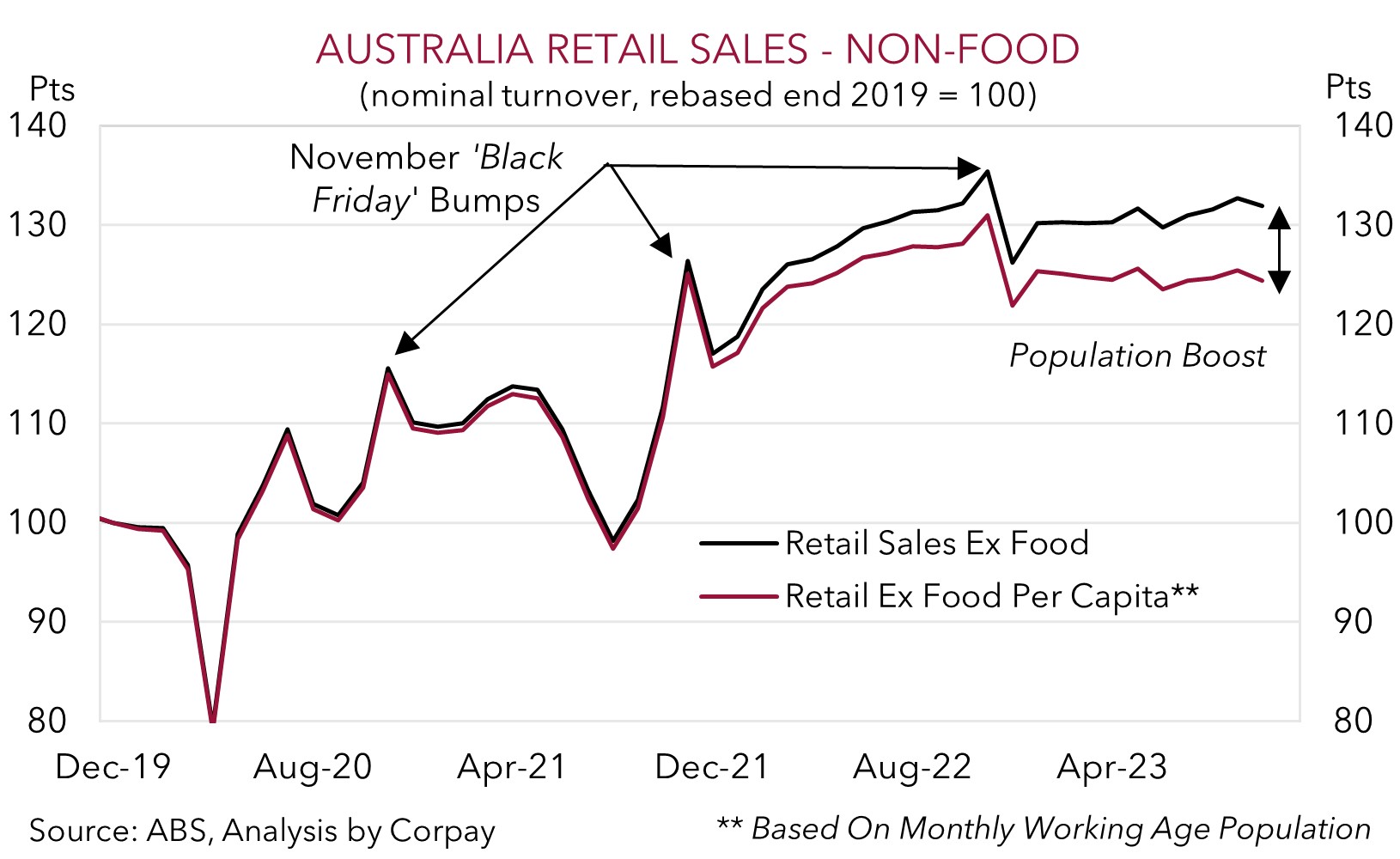

• AU data. November retail sales due today. Black Friday sales expected to have boosted spending. Tomorrow the monthly CPI indicator is released.

It has been a quiet start to the week for FX markets with the major currencies range bound over the past 24hrs. The USD index has held onto its early January gains with EUR hovering down near ~1.0950 (~1.7% below its late-December highs) and USD/JPY tracking just over 144 (~2.8% above its December multi-month low). USD/SGD is treading water around ~1.3280, NZD (now ~$0.6245) remains close to 2% from its recent peak, and the AUD has consolidated (now ~$0.6718).

The relative stability across FX has occurred despite some movement in other asset classes. The major European and US equity markets rose overnight with the latter outperforming. Led by a rally across the big tech sector the NASDAQ increased 2.2%, its best one-day result since mid-November. Elsewhere bond yields gave back a little ground with the benchmark US 10yr rate ~4bps lower (now 4.01%). The mix of lower oil prices (WTI crude fell ~3.8% after Saudia Arabia’s state producer Saudi Aramco lowered its official selling prices due to signs of weakening demand) and a decline in the NY Fed US inflation expectations gauges reinforced views the next move by central banks would be to ease policy. US inflation expectations fell indicating that consumers feel more confident price gains will lessen over the period ahead. This is notable as inflation expectations can impact actual inflation outcomes as they influence wages and pricing behaviour.

As outlined yesterday, US inflation (released Fri AEDT) is this week’s global macro focal point. Swings in gasoline prices and less favourable base-effects point to headline CPI picking up (mkt 3.2%pa). However, we think markets and policymakers should be more focused on core inflation which looks set to moderate (mkt 3.8%pa). If realised, this would be the slowest pace in US core CPI since early-2021, supporting the case for Fed easing over 2024, and in our view, exerting renewed pressure on the USD. While we think a Fed rate cut as soon as March looks too soon (markets are factoring a 62% chance this occurs), based on our analysis of past cycles and the Fed’s ‘policy rules’ we believe a steady stream of reductions from mid-2024 is likely (see Market Musings: US Fed pivot has further to run).

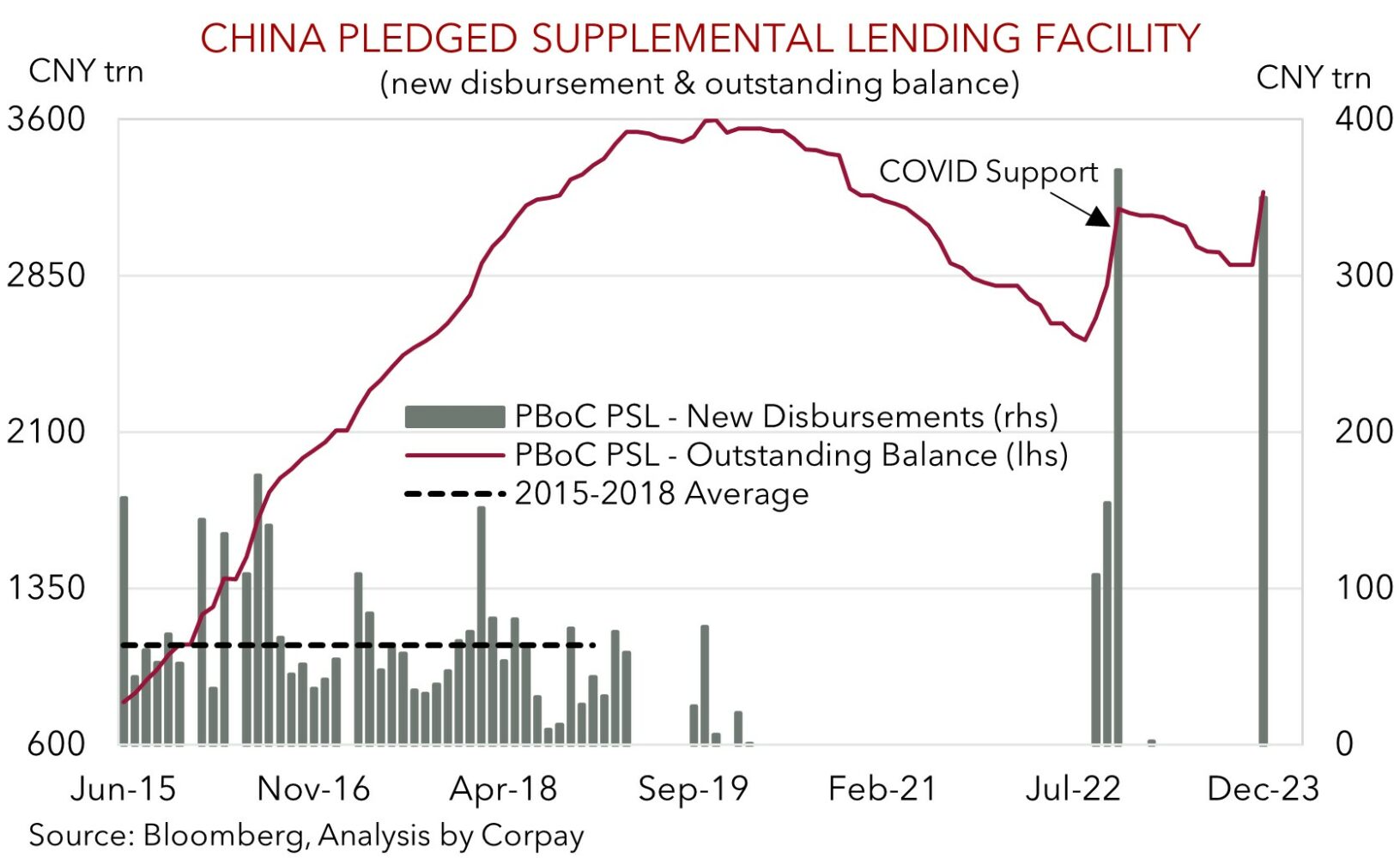

In addition to when and by how much the US Fed and other central banks could ease policy, developments in China should also have a major sway on markets in 2024. On this front there are signals authorities are looking to shore up the stumbling post COVID recovery. Data released last week showed that usage of the PBoC’s Pledged Supplemental Lending Facility shot up in December. The PSL provides low cost, long-term funding to China’s main policy banks which are lenders focused on implementing the government’s policies. The resumption of the PSL could mark an important shift towards supporting investment across the commodity intensive property sector, bolstering credit, and driving growth. In our view, a positive turn in China’s economy would be a tailwind for cyclical currencies like the AUD.

AUD corner

Despite the upswing in European and US equities, the AUD has tread water over the past 24hrs (now ~$0.6718) with the drop in oil prices (WTI crude -3.8%) an offsetting factor. On the crosses, the AUD has eased back slightly, falling by ~0.1-0.3% against the EUR, JPY, GBP, NZD, and CAD at the start of the new week. That said, at ~0.6133 AUD/EUR remains ~1% from its recent multi-month peak while AUD/CNH (now ~4.8123) is still ~1.8% above its 6-month average.

After the holiday break the domestic economic data starts to flow again today with November retail sales and building approvals due (11:30am AEDT). Tomorrow the November reading of the monthly CPI indicator and quarterly job vacancies are released. Despite the squeeze on indebted mortgage holders from higher interest rates, on the back of the increasingly popular Black Friday sales and a larger population retail sales are forecast to rise strongly in November (mkt +1.2%). We think a positive result may generate a bit of intra-day support for the AUD, particularly if the relatively large lift in US equities flows through to risk sentiment and Asian markets.

Beyond retail sales, tomorrow’s monthly CPI data will also be in focus. As November is the mid-month of the quarter the data will have better coverage of services prices. While annual headline inflation should slow (mkt 4.5%pa from 4.9%pa), signs services inflation remains ‘sticky’ given faster wage growth may continue to keep the RBA on edge, particularly given Australia’s lackluster productivity. While we don’t see the RBA hiking rates again, we continue to think that domestic inflation trends, especially around services, the support to aggregate demand from surging population growth, and future income support from the incoming Stage 3 tax cuts is likely to see the RBA lag is counterparts when the next global policy easing cycle unfolds. FX is a relative price, and this divergence could, in our view, see short-dated yield differentials shift further in favour of a higher AUD over the next few quarters. When coupled with our expectation activity in China should improve as policy stimulus actions gain traction, and outlook for lower US bond yields to weigh on the USD, we see the AUD rising to ~$0.70-0.71 by Q3.

AUD levels to watch (support / resistance): 0.6610, 0.6660 / 0.6730, 0.6780