• Market swings. Some intra-session vol. around the US CPI. But net market moves have been modest. USD softer, though lower oil prices held down the AUD.

• US inflation. Data matched predictions. Headline inflation slowed to 3.1%pa, while core steady at 4%pa. Firmer services shows the last leg could be difficult.

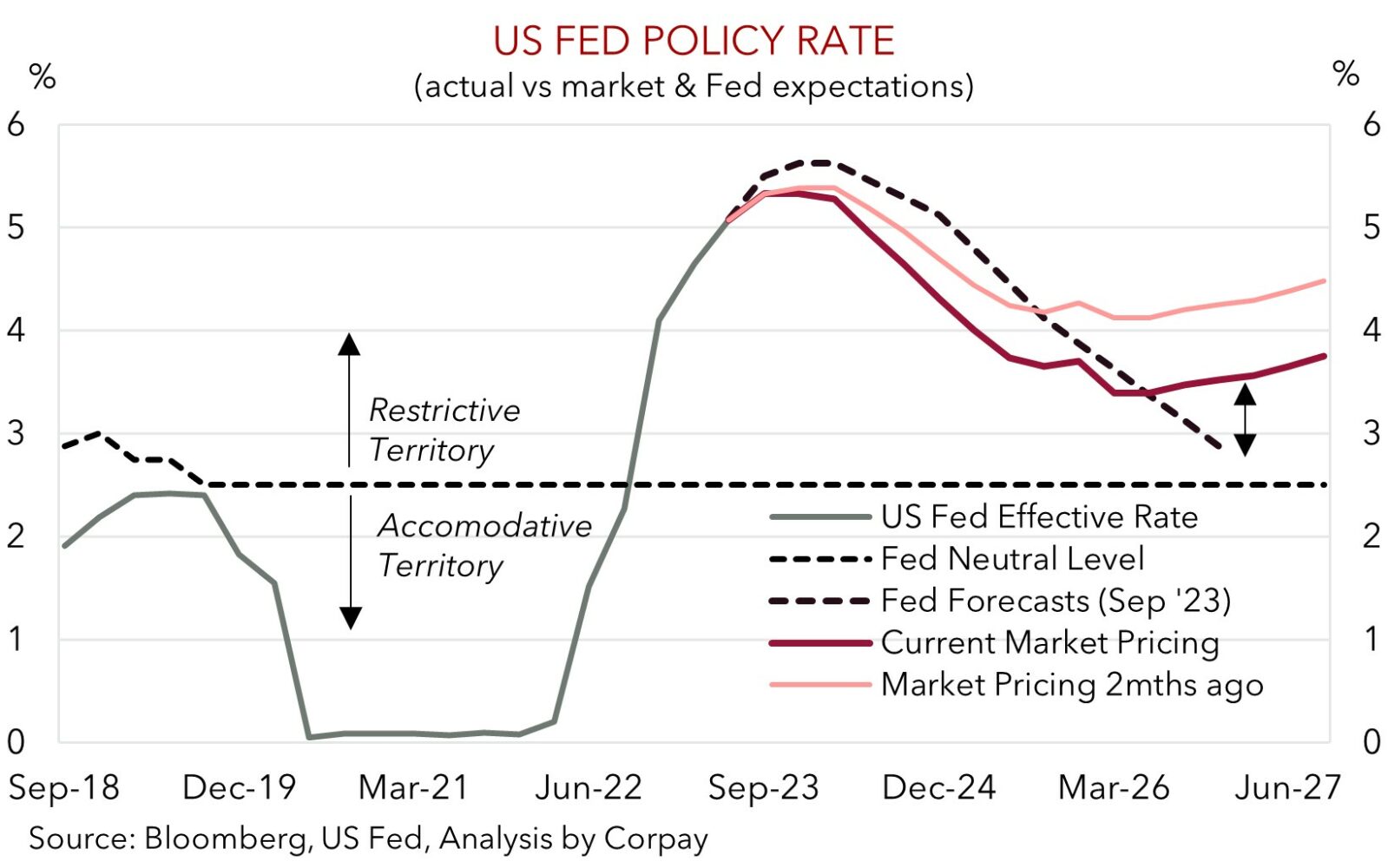

• US Fed. No policy change expected. While the Fed should reiterate it may do more if needed, we think the forecasts should show that the next move will be a rate cut.

There has been a bit of market volatility overnight around the release of the latest US CPI inflation figures, but the net moves have been modest with the outcomes largely matching expectations. In terms of the data, which is the last piece of macro information ahead of tomorrow’s US Fed decision (6am AEDT) and Chair Powell’s press conference (6:30am AEDT), annual headline inflation ticked down to 3.1%pa and core inflation (i.e. ex food and energy) held steady at 4%pa. And although the 6-month annualised run-rate in core CPI (a gauge of the disinflation trend) continued to moderate, the firmer services inflation pulse because of rents and still high wages again showed that the last leg of this race could be difficult. Central banks are under no illusion to this. Indeed, a few weeks back Fed Chair Powell stressed further inflation progress will “come in lumps and be bumpy”.

Markets wise after opening a touch lower the US S&P500 ended the day in positive territory (+0.4%) with the index now at its highest level since mid-January. Over the course of the day US bond yields were little different. The benchmark US 10yr yield slipped back slightly (-3bps to 4.20%), while the 2yr rate ticked up (+2bps to 4.73%) as participants slightly pared back US Fed rate cut bets. Markets are discounting the first Fed rate reduction in May, with another ~3 anticipated to follow over the rest of 2024. In FX, the USD’s knee-jerk intra-session strength post the US CPI release faded. On net, the USD index is lower compared to this time yesterday. EUR has edged back up towards ~$1.08, USD/JPY drifted marginally lower (now ~145.50), and GBP consolidated near ~$1.2570 as a larger than predicted slowdown in UK wages reinforced future BoE rate cut expectations. USD/SGD unwound yesterday’s lift to be back around ~1.3415. After clawing back some lost ground during the Asian and European sessions the AUD has slipped under its 200-day moving average (~$0.6575), with a pull-back in energy (WTI crude -3.5%) more than offsetting the softer USD.

As mentioned, attention now shifts to the US Fed decision and Chair Powell’s press conference. No change in policy is widely anticipated. As such, focus will be on the Fed’s updated economic and interest rate projections and guidance from Chair Powell. While we think Chair Powell should reiterate that, if needed, the door to further tightening is open, and that it is premature to speculate about rate cuts, we believe the Fed’s updated forecasts should solidify views the tightening phase has ended and that barring a shock an easing cycle should kick off in 2024 with the interest rate ‘dot plot’ likely to be revised lower. In our opinion, this type of ‘dovish’ tilt coupled with a softening retail spending pulse (Fri AEDT) and signs momentum in China is improving (Fri AEDT) could exert downward pressure on the USD.

AUD corner

On net the AUD is little changed from this time yesterday (now ~$0.6561), but this masks the bout of intra-day volatility that occurred in the lead up to and post the US inflation data (see above). The AUD traded in a ~1% range over the past 24hrs with gains ahead of the US CPI unwinding after the fact and with the AUD held down by the over 3% drop in oil prices. This backdrop has seen the AUD underperform on the crosses. AUD/JPY (-0.5%) has slipped towards its 100-day moving average (~95.34), with the AUD also depreciating by 0.2-0.4% against the GBP, NZD, and EUR.

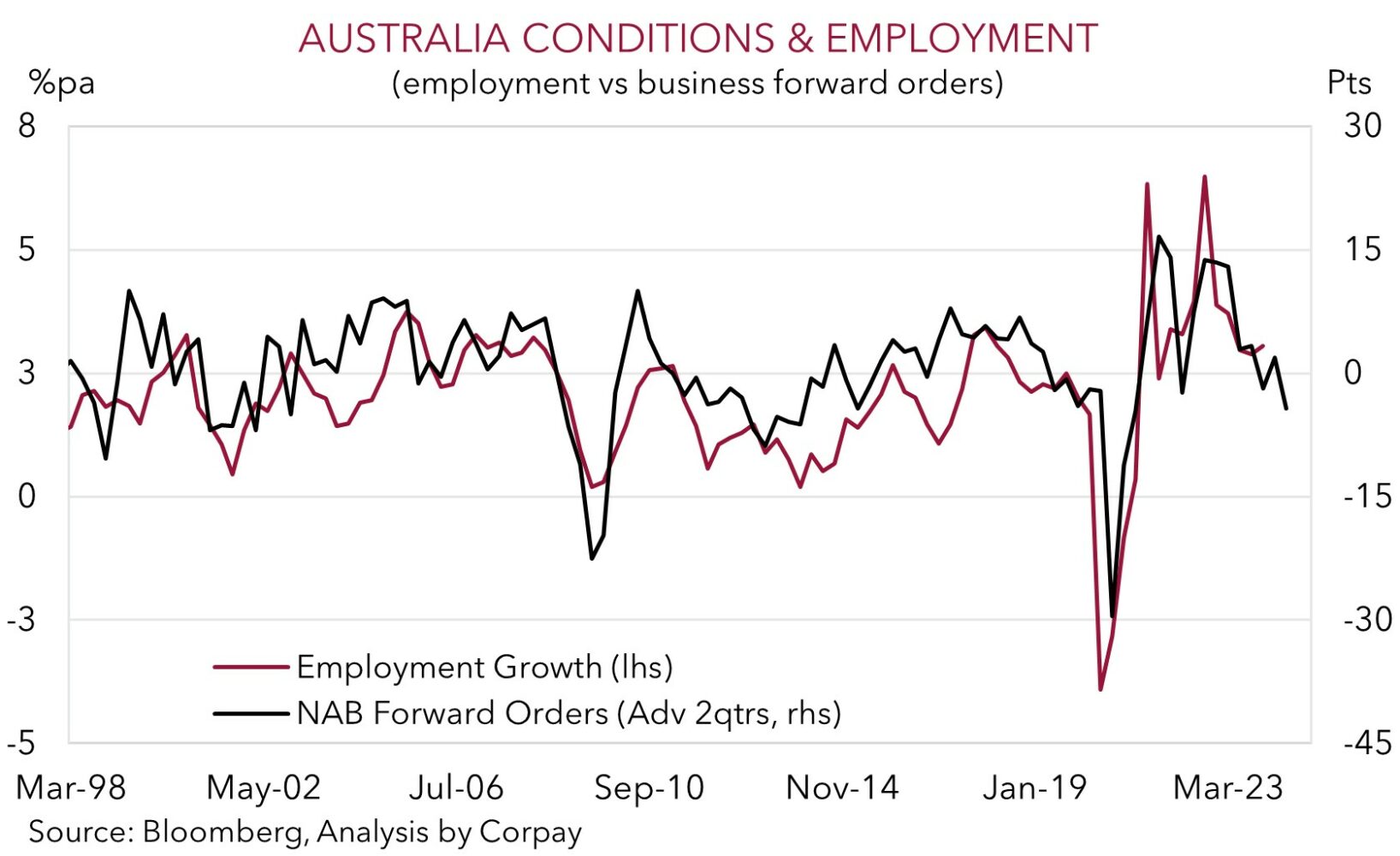

Locally, the latest readings on consumer sentiment and business conditions were released yesterday. While consumer confidence improved in December, it remains at quite gloomy levels. And on the business front, confidence fell and conditions lost ground. Although conditions remain above average, they are well off their mid-2022 peak with the decline in forward orders (a guide to future private demand) pointing to soft growth continuing over H1 2024. However, with capacity utilisation, input costs, and output prices still elevated, the pressure on the RBA to do more if inflation doesn’t improve remains, in our view. The next quarterly Australian CPI print (released 31 January), as well as trends in the labour market, will be pivotal for the RBA’s next steps. All up, we continue to believe that while the RBA may not hike rates again, the mix of Australia’s slower moving wage dynamics due to multi-year enterprise bargaining agreements, support to aggregate demand from the population surge, and incoming income tax cuts could see the RBA lag others when the next global easing cycle comes through (see Market Musings: Australia’s growth pulse: down but not out). Over the medium-term, we expect this to see short-dated interest rate differentials continue to narrow in an AUD supportive direction.

AUD volatility could pick up over the next few days with the US Fed meeting (Thurs 6am AEDT), Fed Chair’s press conference (Thurs 6:30am AEDT), the Australian labour force stats (Thurs 11:30am AEDT), the ECB decision (Fri 12:15am AEDT), US retail sales (Fri 12:30am AEDT), and the China data batch (Fri 1pm AEDT) on the schedule. Given the long list of events there should be some bumps over the rest of this week. Although we expect the US Fed to continue to talk tough and flag it is open to more tightening if required, its updated economic forecasts are more likely to support the case that the next move will probably be to lower interest rates. If realised, we think this type of underlying messaging, combined with signs momentum in China’s economy is improving, should be a positive for risk sentiment and cyclical currencies like the AUD.

AUD levels to watch (support / resistance): 0.6510, 0.6540 / 0.6620, 0.6680