• Partial reversal. US equities consolidated, bond yields eased, & base metal prices rose. After a negative run AUD & NZD a bit firmer.

• US inflation. Headline & core CPI a touch higher than predicted. Key underlying trends still point to a series of US Fed rate cuts over the next year.

• Event radar. China holds a fiscal policy briefing tomorrow. US PPI tonight. Next week AU jobs, US retail sales, ECB meeting, & China GDP are due.

A modest reversal of fortunes across markets overnight despite the latest US CPI inflation reading coming in a touch higher than predicted. US equities consolidated with the S&P500 (-0.2%) drifting back from record highs. Elsewhere, bond yields lost altitude with the US 2yr rate falling ~6bps (now ~3.96%) and the 10yr rate treading water (now ~4.06%), though this comes after its recent sharp upswing. Across commodities oil prices rose (WTI crude ~3%) and industrial metals ticked up (copper +0.9%, iron ore +0.2%). Chinese Finance Ministers hold a briefing on Saturday about fiscal policy, and expectations more concrete measures could be outlined looks to be giving cyclical China-linked assets support. In FX, the USD has on net drifted marginally lower. EUR (now ~$1.0935) and GBP (now ~$1.3060) have held steady, and USD/JPY followed the dip in US yields (now ~148.55). By contrast, NZD (now ~$0.6092) and AUD (now ~$0.6740) have recouped a little lost ground.

In terms of the US data, annual headline CPI slowed slightly less than anticipated (2.4%pa from 2.5%pa), while core inflation nudged up (3.3%pa from 3.2%pa). A closer look under the hood finds both good and bad news. On the positive side, the drop off in rents (a key driver behind the higher US inflation over the past year) may finally be making faster progress. Added to that some of the upside surprise in September was due to apparel prices and airfares which are likely to unwind. On the negative side, there is still lingering stickiness across a few services categories that might take more labour market slack to extinguish. Post the data the Fed’s Williams noted there will be volatility month-to-month but the underlying progress should continue and this supports the case for the policy stance to shift to ‘neutral’. However, the Fed’s Bostic countered this by stating the choppiness means he is open to the Fed pausing in November.

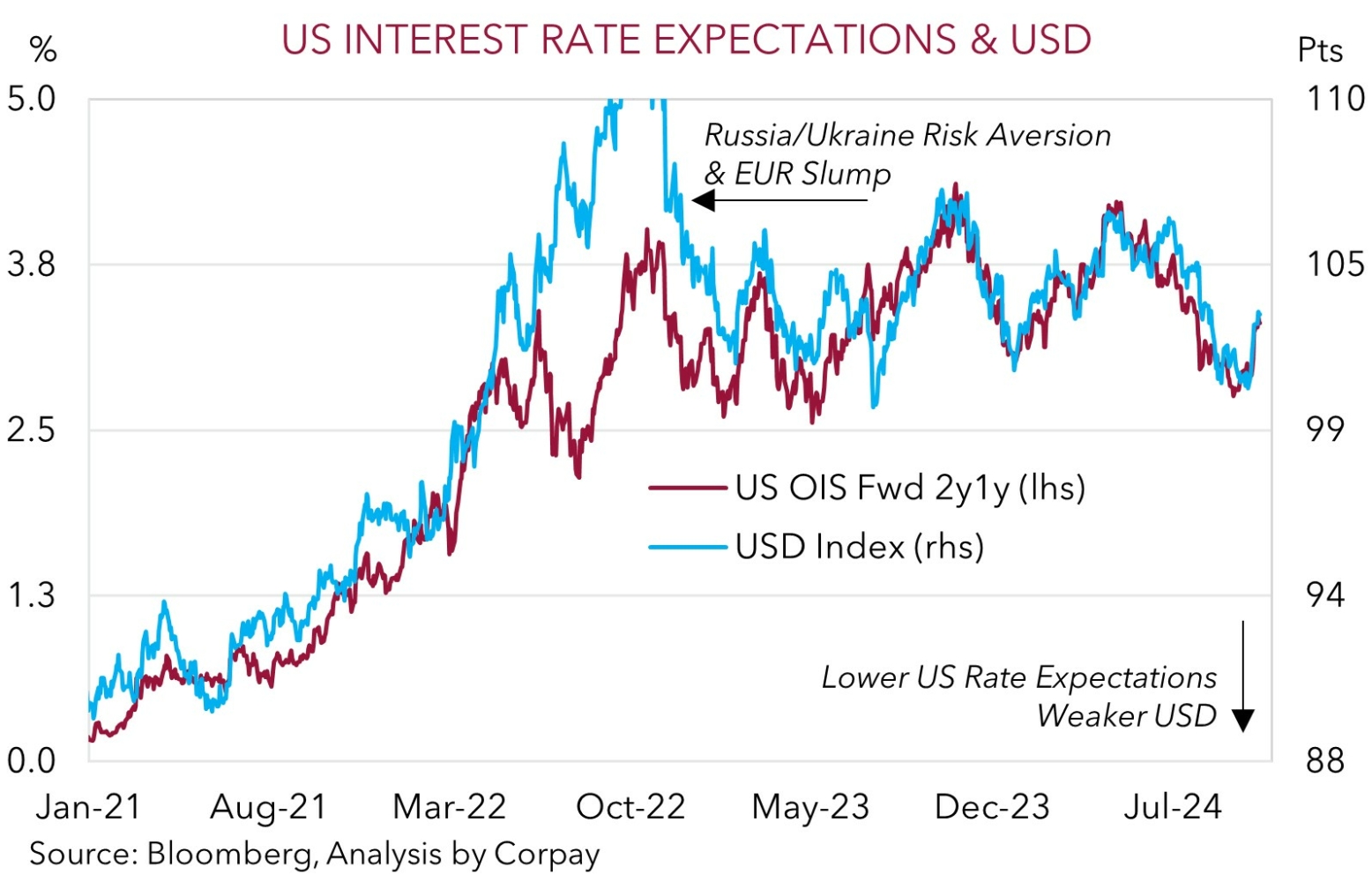

On balance, we think the US labour market and broader inflation trends should see the US Fed deliver a steady stream of 25bp cuts over coming meetings as it continues to recalibrate the level of interest rates down towards ‘neutral’ (i.e. ~2.75-3%). Given US interest rate expectations are now broadly inline with the US Fed’s ‘dot plot’ forecasts, barring significant surprises in the US data and/or a sharp deterioration in risk sentiment, we believe further USD upside may be limited. US Producer Price Inflation is due tonight (11:30pm AEDT) and there are several Fed members also speaking.

AUD Corner

On the back of the uptick in energy and base metal prices, and modest pull-back in US bond yields, the AUD has recouped a little lost ground over the past 24hrs. At ~$0.6740 the AUD is hovering just above its 50-day moving average, with the backdrop also generating support on most crosses. AUD has appreciated by ~0.4% versus the EUR and GBP, ~0.6% against the CAD, and ~0.2% relative to CNH. Elsewhere, AUD/NZD continues to hover north of ~1.1050 with AUD/JPY holding above ~100.

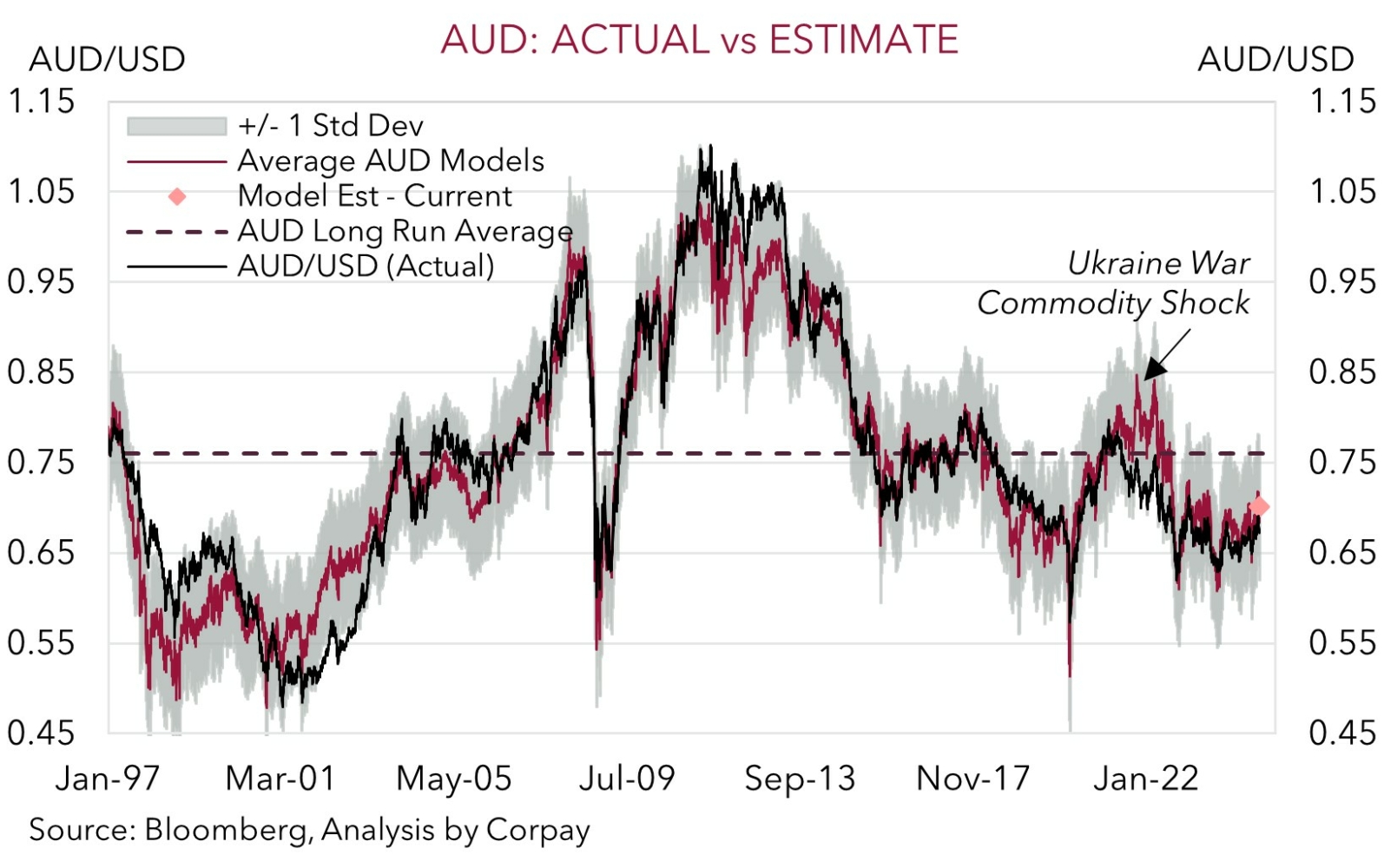

In our opinion, after falling back rather sharply over early-October the AUD may be carving out a bottom. The AUD is now ~2.9% below its recent peak and key forces that have driven its move lower such as the upward repricing in US bond yields may have run their course. As mentioned above, US interest rate expectations are now on par with the US Fed’s ‘dot plot’ projections. This in turn means that without a string of further upside US data surprises and/or a sharp deterioration in risk sentiment a ceiling on the USD could be in place.

At the same time, efforts to revive China’s growth momentum are coming through. We expect this to gain traction over coming months which would be a tailwind for industrial metals and cyclical currencies like the AUD. Chinese Finance Ministers are due to hold a briefing about fiscal policy on Saturday. Domestically, we also continue to believe that the mix of fiscal/income support that is flowing to households, sticky services inflation, lower interest rate starting point, and resilient labour market should see the RBA lag its peers in terms of when it starts and how far it goes during the global easing cycle. Another solid Australian jobs report is anticipated next Thursday. The shift in bond yield spreads in Australia’s favour should be AUD supportive, in our opinion, particularly against currencies like the EUR, CAD, GBP, NZD, and USD (albeit to a lesser extent) where their respective central banks have already begun to lower rates. All up, we think the broader set of fundamentals suggest the AUD is currently undervalued. Indeed, the average across our suite of ‘fair value’ models indicates that the AUD should now be tracking closer to ~$0.6950 rather than ~$0.6750.