• European concerns. French political risks weighing on European assets. EUR near a ~1-month low. This, and a softer JPY, has supported the USD.

• AUD cross-currents. Backdrop has seen AUD drift back. But it isn’t all one-way. AUD/EUR near the upper end of its 2024 range.

• Event radar. RBA meets (Tues). Offshore, in addition to French politics, markets focused on the China data, US retail sales, Fed speakers, BoE meeting, & PMIs.

Nerves about the potential outcome of the upcoming French parliamentary elections (30 June & 7 July) continued to dampen sentiment in Europe at the end of last week. Regional equities declined on Friday with the EuroStoxx600 (-1%) recording its 5th fall in 6 sessions, while the spread between French and German 10yr yields (a gauge for inter-regional risks) moved to its widest level in several years, and EUR (not ~$1.0705) touched a 1-month low as a greater risk premium was factored into European assets.

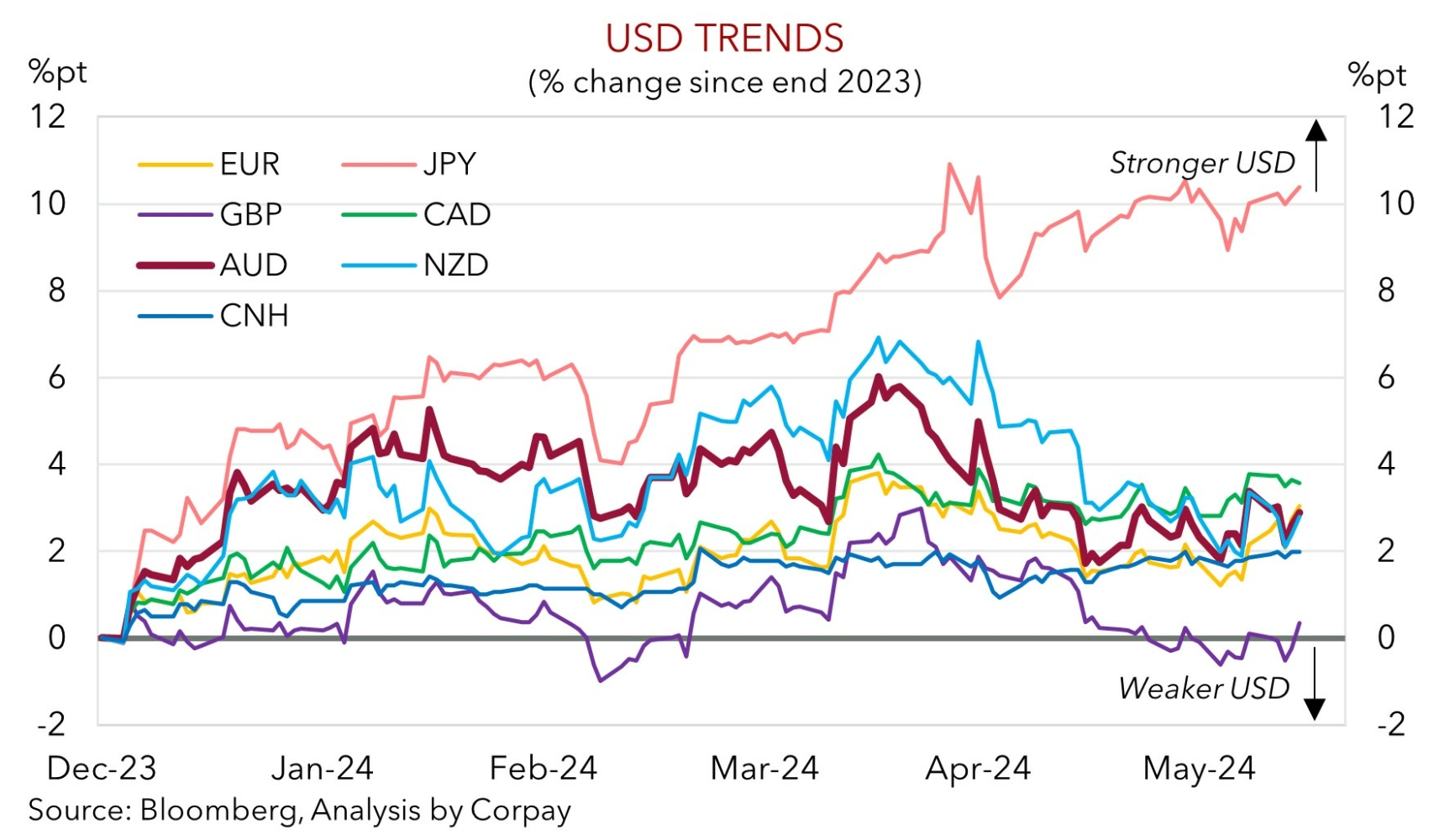

Elsewhere, USD/JPY hit its highest level since late- April before drifting back (now ~157.40) after the Bank of Japan underwhelmed participants by failing to announce an immediate reduction in its bond buying. Rather, the slow-moving BoJ stated this would be decided at its 31 July meeting, though Governor Ueda did flag it could be “substantial” and that depending on the data it was still possible for the BoJ to raise rates again next time out. The softer EUR, JPY, and GBP supported the USD Index with the issues in Europe and a weak US consumer confidence report also exerting more downward pressure on US bond yields. The US 10yr rate slipped back another ~2bps to be at 4.22%, a low since early-June. And while this helped the US equity market hold up, the shaky risk sentiment did drag on the NZD (now ~$0.6140) and AUD (now ~$0.6615) a little.

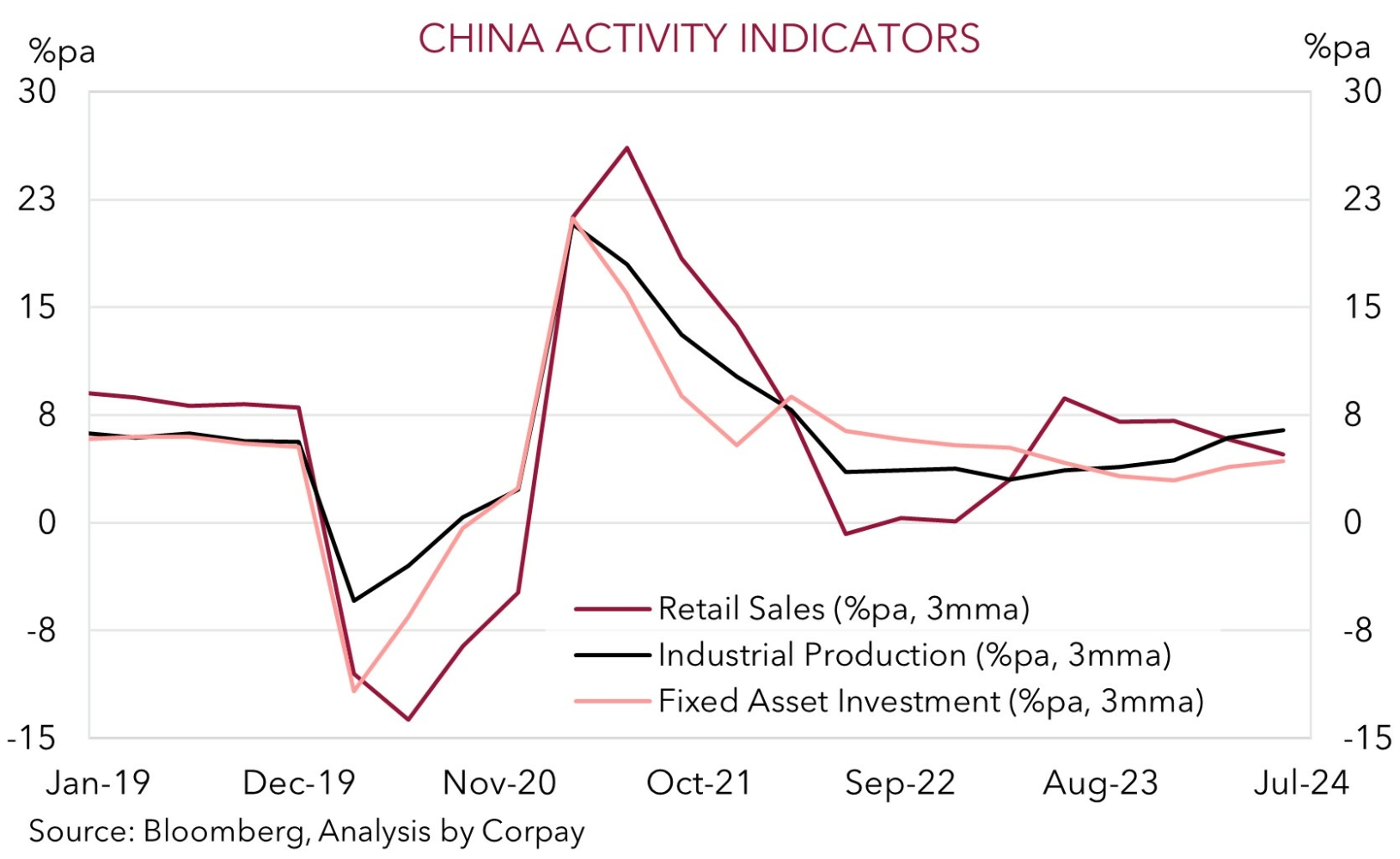

This week economic and political cross-currents are likely to continue to push and pull on markets. The uncertainty about the looming French elections looks set to keep the EUR on the back-foot, in our view, which in turn can continue to prop up the USD (note, the EUR is ~58% of the USD index). However, we believe the incoming global economic events could work in the other direction, and hence when European political risks fade the USD might quickly reverse course. In China the May activity data batch is due today (12pm AEST), in the US retail sales (Tues AEST) and US Fed speakers will be in focus, while in Europe the Bank of England decision (Thurs AEST) and business PMIs (Fri AEST) are on the radar. Signs momentum in China is improving and/or a relatively larger pick up in the Eurozone PMIs, coupled with a tepid rebound in US retail spending due to weakening fundamentals would indicate that the US’ economic outperformance is fading. This was one of the pillars, along with the very weak JPY (see chart below), underpinning the USD over recent months.

AUD Corner

European market jitters stemming from concerns about the upcoming French parliamentary elections has weighed on the EUR (see above). This in turn has supported the USD, with the backdrop also dragging on the AUD over the latter part of last week. At ~$0.6615 the AUD is tracking a bit under its ~1-month average. That said, the environment is holding up AUD/EUR which continues to trade near the upper bound of its 2024 range (now ~0.6180). The AUD was mixed on the other crosses with modest gains against GBP (now ~0.5215) and NZD (now ~1.0775) offset by some underperformance versus the CAD (now ~0.9085) and CNH (now ~4.81).

In addition to the global economic events mentioned (i.e. China data batch (12pm AEST), US retail sales (Tues AEST), several US Fed speakers, Bank of England decision (Thurs AEST), and global PMIs (Fri AEST)) the RBA also meets this week (Tuesday 2:30pm AEST). No change is widely anticipated, and we believe the resilience in the domestic labour market and stickiness in inflation should see the RBA reiterate that it is “not ruling anything in or out” when it comes to future policy moves. This would reinforce our long-held view that it might be some time before the RBA contemplates rate cuts. Interest rate markets agree with the first RBA rate reduction not factored in until mid-2025.

In our opinion, while a firm USD on the back of European issues points to a period of AUD/USD consolidation, macro and policy trends between Australia and others could be supportive for the AUD against currencies like the EUR and NZD over the near-term. On top of the diverging interest rate story, solid momentum in the China activity data batch, especially on the commodity intensive industrial side, might give the AUD a relative helping hand. On the other side of the ledger, we think the NZD could be held down by another weak NZ GDP print (Thurs AEST), and the EUR may continue to be depressed by French political uncertainty, at least until the first round of parliamentary elections (30 June). We also feel AUD/GBP may nudge up a bit if the Bank of England further opens the door to the start of its policy easing cycle. Signs the BoE is unconcerned about the recent modestly stronger UK wage and services inflation data might revive the markets rate cut bets.