• Positive vibes. Concerns about the upcoming French election settled down. Equities rose, as did bond yields, with EUR also a little higher.

• RBA today. No change from the RBA anticipated. It is likely to reiterate that it isn’t ruling anything in or out. The first RBA cut isn’t priced until mid-2025.

• Global data. Yesterday’s China data batch was mixed. Tonight, US retail sales are released. A modest rebound is US consumer spending is predicted.

A bit more of a positive tone in markets at the start of the new week. Concerns in Europe about the upcoming French parliamentary elections settled down, at least for the time being. This helped European equities rise overnight (EuroStoxx50 +0.9%) after falling back last week, with the spread between French and German 10yr yields (a proxy for inter-regional risks) also narrowing slightly and the EUR nudging up (now ~$1.0730). The uptick in EUR and GBP (now ~$1.2705) exerted a modest amount of downward pressure on the USD, though net FX moves haven’t been overly large. USD/SGD is hovering near ~1.3520, NZD has drifted lower (now ~$0.6130), and the AUD is treading water (now ~$0.6615). Yesterday’s mixed China activity data batch which showed stronger retail sales growth, consolidation in industrial production, and lukewarm fixed asset investment didn’t have a lasting market impact.

Elsewhere, the positive run in US equities continued with the S&P500 (+0.7%) hitting another record. The S&P500 is now nearly 15% higher year-to-date, with only one negative monthly performance occurring since last-November. US bond yields also rose, though the ~6bp lift has only undone a small amount of the recent downtrend. At ~4.28% the benchmark US 10yr rate is still ~40bps below its late-April high. Interest rate markets continue to toy with the idea of 1 or 2 rate cuts by the US Fed by year-end. This is no different to Fed policymakers. Overnight, Philadelphia Fed President Harker (who isn’t a voting member in 2024) indicated he was in the group forecasting only one move this year. But as the Fed is data dependent he could see “two cuts, or none” as being “quite possible if the data break one way or another”. There are several Fed members speaking tonight with Barkin (12am AEST), Logan (3am AEST), Kugler (3am AEST), Musalem (3:20am AEST) and Goolsbee (4am AEST) discussing the outlook. Attention will be on how much policy recalibration they are anticipating over the period ahead and when things might kick off.

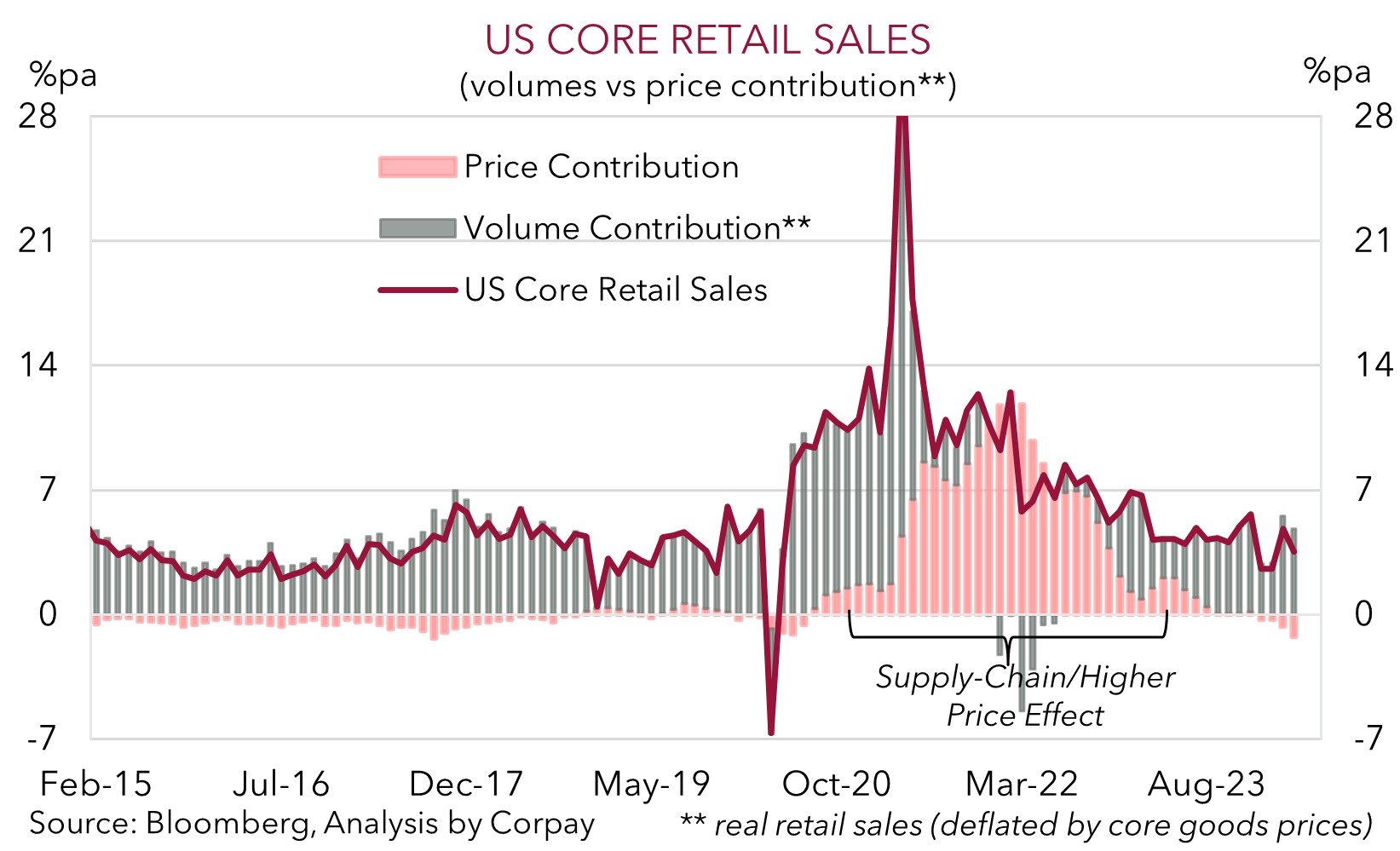

Tonight, in addition to the US Fed speakers, the latest US retail sales data is due (10:30pm AEST). After a soft few month’s analysts are expecting a bit of a recovery in May, although this looks like it could reflect retailers offering discounts to entice customers given various consumer fundamentals are deteriorating. In our view, a tepid rebound in US retail sales would support thinking that after a surprisingly strong start to 2024 the US economy is losing steam as tighter monetary/credit conditions bite. This in turn may see markets look to again fully discount a second Fed rate cut by the end-2024, which if realised could drag on the USD.

AUD Corner

The AUD has had a subdued start to the week with the currency little changed from where it was this time yesterday (now ~$0.6615) as the more upbeat market tone was counteracted by sluggish China activity data (see above). On the crosses, the AUD has been mixed. The uptick in the EUR has pulled down AUD/EUR a little (now ~0.6163). It was a similar story for AUD/GBP (now ~0.5205). By contrast, AUD/NZD is drifting up towards its 200-day moving average (~1.0802), and AUD/JPY (now ~104.30) is hovering within 0.6% of its late-April cyclical peak.

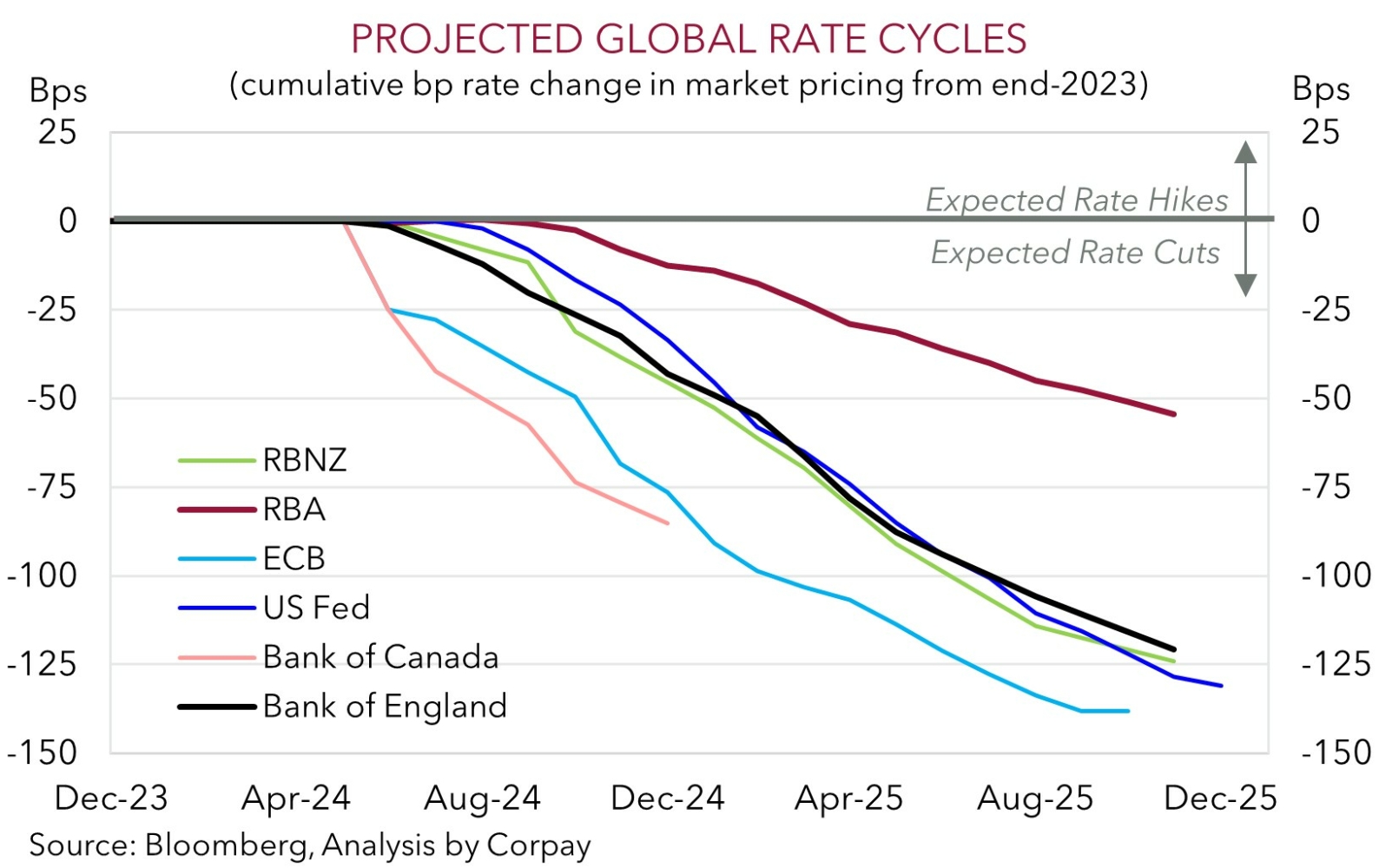

Locally, the RBA decision (2:30pm AEST) and Governor Bullock’s press conference (3:30pm AEST) are in focus today. This isn’t a forecasting round for the RBA, so we aren’t expecting much of a change in its rhetoric. While Australian GDP growth has slowed, the level of activity is still quite high, and revisions in the national accounts also indicate household consumption has held up better than previously thought. This, the resilience in the labour market, and stickiness across domestic services/core inflation should, in our view, see the RBA keep rates on hold and reiterate that it is “not ruling anything in or out” when it comes to future policy moves. This would reinforce our long-held view that it might be some time before the RBA eases policy. Interest rate markets agree with the first RBA rate cut not priced in until April 2025. And as our chart shows, there is a wide gulf between the anticipated outlook for the RBA and many of the other central banks. We believe the policy and macro divergence between Australia and others should be AUD supportive over the medium-term.

This could also come through on some of the AUD crosses over the next few days. Another weak NZ GDP print (Thurs AEST) may hold down the NZD and help AUD/NZD continue to recoup lost ground. Similarly, if the Bank of England further opens the door to the start of its policy easing cycle and/or French election nerves return AUD/GBP might push above its 50-day moving average (~0.5219). While in the US, a subpar rebound in US retail sales (10:30pm AEST) could revive expectations for a second Fed rate cut by year-end, exerting a bit of downward pressure on the USD.