• European politics. Concerns about the French elections has exerted pressure on the EUR. This helped push AUD/EUR higher.

• US data. US PPI undershot forecasts. Inflation tide may be turning. US yields fell, but European issues supported the USD. AUD/USD drifted back.

• AU jobs. May jobs report better than expected. At 4% unemployment is still low. Conditions for an RBA interest rate cut still look some time away.

US economic and European political crosscurrents have pushed and pulled markets overnight. Data wise, following on from the lower than expected US CPI report US Producer Prices also undershot forecasts. Importantly, the bits and pieces from the CPI and PPI which flow into the US PCE deflator (the US Fed’s preferred inflation gauge) suggest the inflation tide is turning with an encouraging step down likely. The PCE deflator is due on 28 June. On top of that US weekly initial jobless claims (a measure of how many people are filing for unemployment benefits) rose to their highest level since August 2023, an indication the heat is coming out of the labour market which it also a positive for future inflation.

The run of data suggests the US Fed’s updated interest rate projections (i.e. the ‘dot plot’) looking for just 1 rate cut in 2024 might already be stale. We think the US Fed may deliver a bit more near-term interest rate relief than is assumed, especially as Chair Powell already flagged that many members had a hard time determining whether a 2 cut or 1 cut scenario in 2024 was more likely. Indeed, markets have shifted to now be discounting 2 rate cuts by December. This has weighed on US bond yields with the US 2yr rate shedding another ~6bps (now 4.70%) and the benchmark 10yr rate falling ~7bps (now 4.24%, a low since early-April). The bond adjustment and strength in tech stocks helped the US S&P500 hold up (+0.2%), in contrast to the negative performance across Europe (EuroStoxx50 -2%) as concerns about French politics continue to unnerve investors.

French Parliamentary elections will be held on 30 June and 7 July. An agreement by a group of left-leaning parties to form an alliance is said to be another blow to President Macron’s chances of emerging with a stronger standing. This, and worries about France’s fiscal position, has seen the spread between French and German bond yields (a proxy for inter-regional stress) widen. European political uncertainty also exerted downward pressure on the EUR (now ~$1.0740). Elsewhere, GBP eased (now ~$1.2760) while USD/JPY (now ~157) and USD/SGD (now ~1.3510) ticked up. The firmer USD on the back of the European issues has also seen the NZD (now ~$0.6170) and AUD (now ~$0.6635) give back ground.

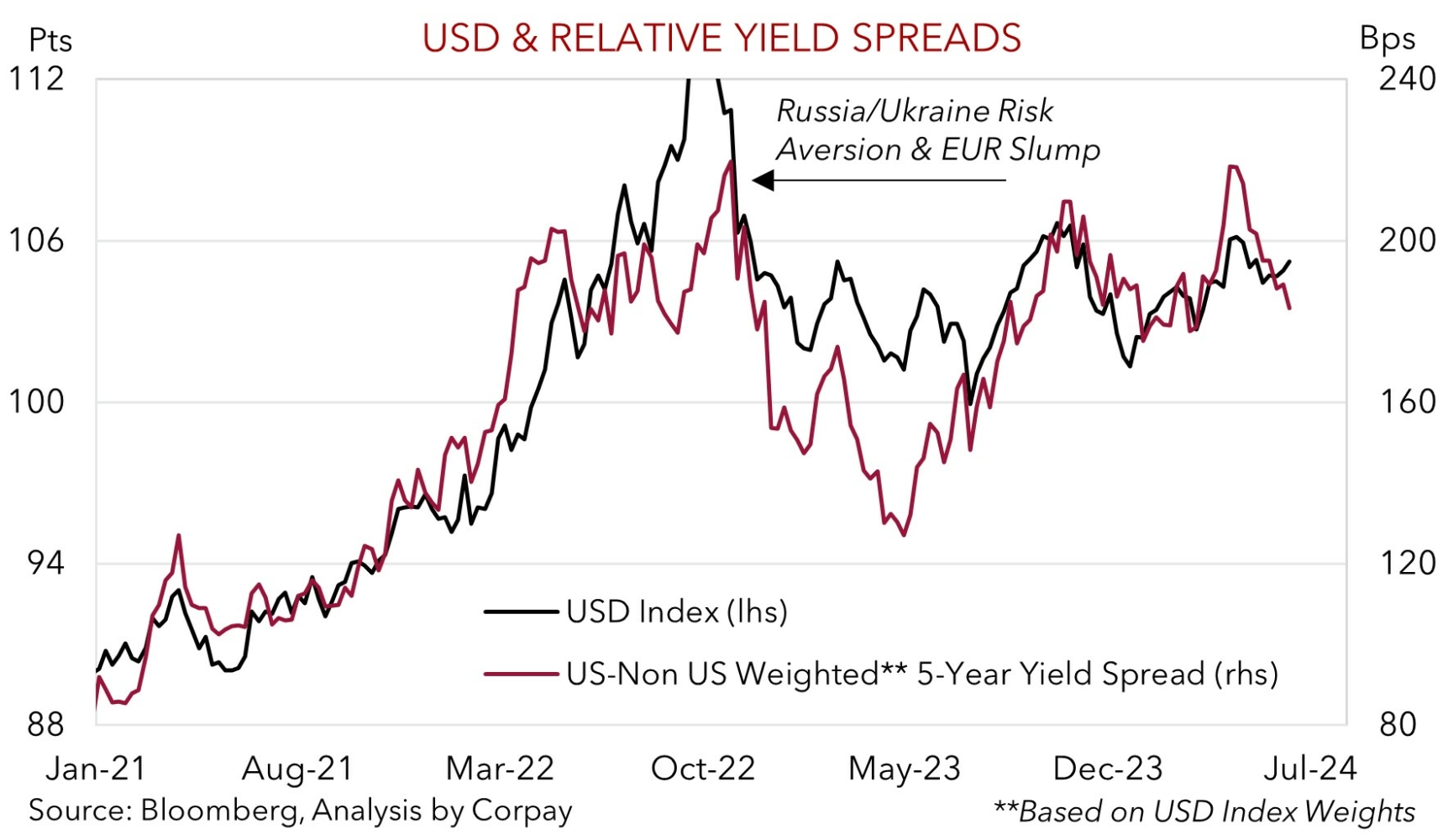

Nervousness about French politics can keep the EUR on the backfoot in the short-term, and this impulse may continue to counteract the drag on the USD stemming from the evolving US economic trends. As our chart shows, the USD looks to be tracking above levels implied by relative bond yield spreads. Hence, in our opinion, if/when European risks fade the EUR should recover and the USD could slip back. Indications from the Bank of Japan at today’s meeting (no set time) that it is paring back its bond purchases and/or might look to raise interest rates again is another possible driver for a softer USD.

AUD Corner

The uptick in the USD on the back of softer EUR and shaky risk sentiment due to European political concerns has seen the AUD drift a bit lower (see above). At ~$0.6635 the AUD is broadly inline with its ~1-month average. The AUD also shed ~0.2% against the JPY, GBP, NZD, and CAD over the past 24hrs. That said, the weaker EUR helped push AUD/EUR (now ~0.6175) to its highest point since early-January. European political issues aside, we continue to believe that the contrasting macro outlooks and relative long-term yield differentials between Australia and the Eurozone point to a slightly higher AUD/EUR.

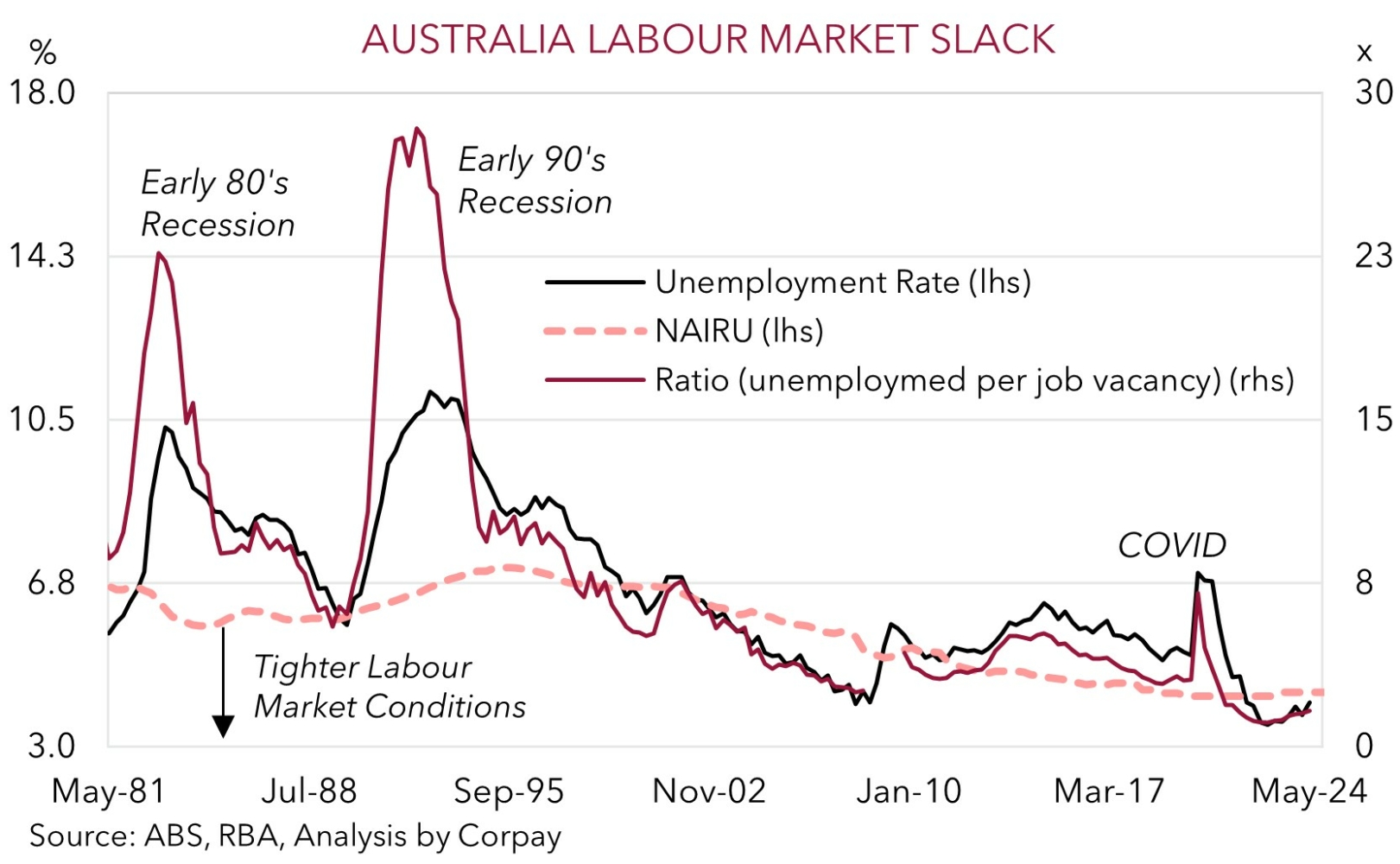

Locally, the May jobs report was released yesterday and on balance it was better than anticipated. ~39,700 jobs were added with full-time leading the way (+41,700). And despite greater labour supply solid jobs growth helped lower unemployment down to 4%. Under the hood, trend employment (which strips out monthly volatility) is still running at an above average 2.7%pa pace, with the employment to population ratio still very high. Although labour market conditions aren’t as tight as they were a year ago, they still are from a historical perspective with unemployment below estimates of ‘full-employment’. This is supportive for wages, and in turn core inflation.

Australian labour market trends reinforce our long-held assessment that it could be some time before the RBA looks to lower rates. Based on the stickiness in domestic inflation, incoming income support from the stage 3 tax cuts, resilience in the labour market, and signs of improvement in China’s economy a modest RBA rate cutting cycle looks to be a story for 2025. Interest rate markets agree with the first RBA rate cut not fully factored in until mid-2025. We think the RBA is likely to reiterate that it isn’t ruling anything in or out when it comes to future moves at next Tuesday’s meeting given the battle against inflation isn’t over and with revisions in the GDP report indicating household consumption has held up better than originally thought. Diverging economic and policy trends should, in our opinion, be supportive for the AUD against the EUR, GBP, NZD, and CAD, and less so against the USD, over the period ahead. Signs of improvement in the upcoming China activity data batch (released Monday), especially on the commodity intensive industrial side, may also give the AUD a hand.