• Data vs the Fed. Softer US inflation overpowered a ‘higher for longer’ Fed message. US yields fell, equities rose, & the USD weakened.

• Stale forecasts? Fed assuming only 1 cut this year. Fed has moved to match the market. But Chair Powell noted ‘most’ didn’t tweak forecasts after the CPI.

• AUD outperformance. Backdrop helped the AUD outperform. AU jobs report today. Could the ‘labour force lottery’ spring another surprise?

US events generated a burst of market friendly volatility overnight with softer than predicted CPI inflation overpowering a more cautious ‘higher for longer’ message from the Federal Reserve. While there was a modest retracement following the US Fed announcement, on net, US bond yields fell with the benchmark 10yr rate ending the day ~9bps lower (now ~4.32%, the bottom end of its 2-month range), equities rose (S&P500 +0.9% to a fresh record high), energy and base metal prices increased, and the USD weakened. EUR is back up around ~$1.0810, GBP is near ~$1.28, USD/JPY slipped to ~156.60, USD/SGD is down at ~1.3470, and the backdrop helped the NZD (now ~$0.6185) and AUD (now ~$0.6665) outperform.

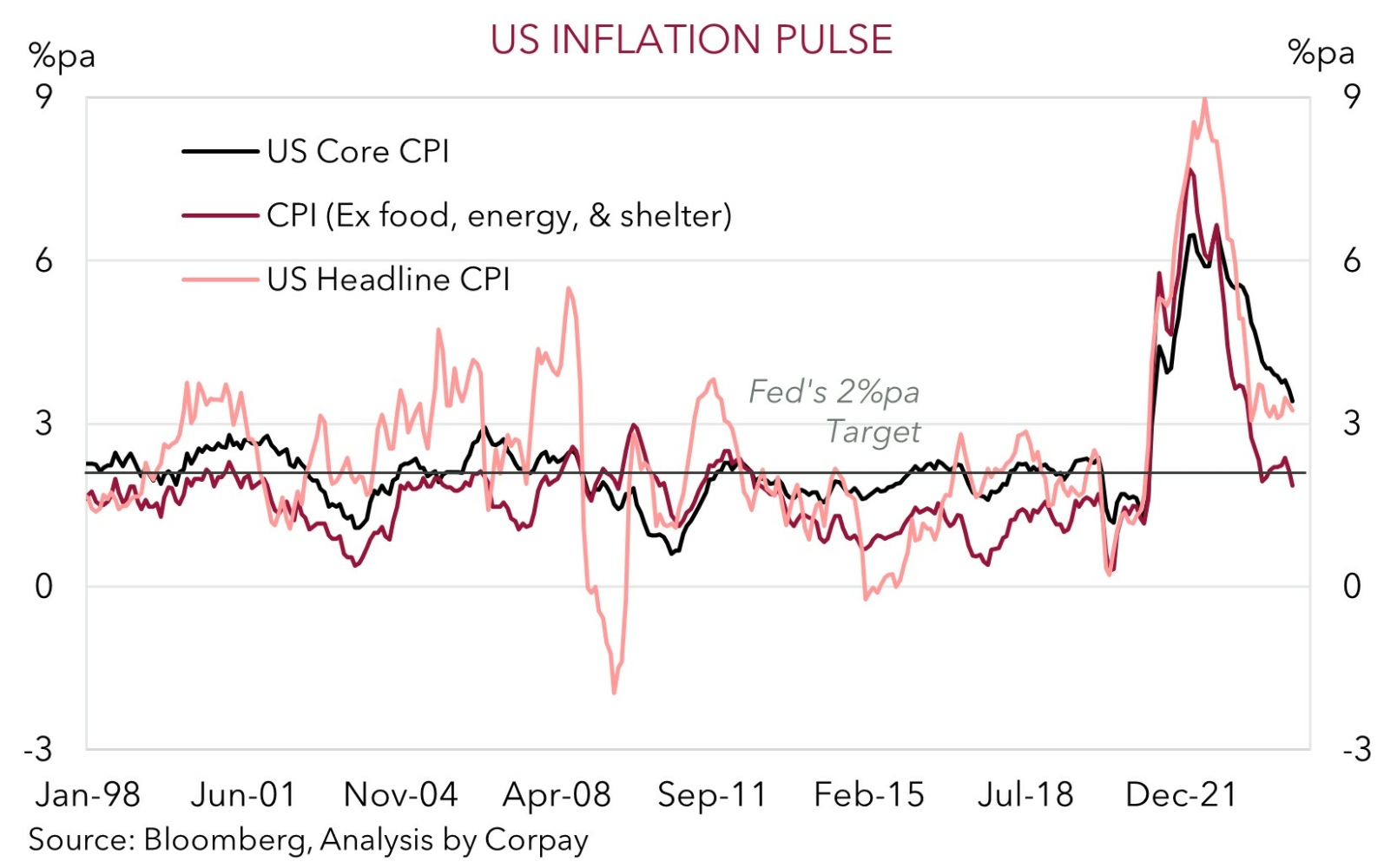

In terms of the US data, headline and core CPI inflation undershot consensus forecasts. US core inflation moderated to 3.4%pa, its slowest annual pace since April 2021. Within that there were encouraging signs with sluggish consumer demand keeping ‘goods’ prices under pressure while sticky ‘services’ inflation also decelerated. In our view, signals from forward indicators like energy prices, labour market ‘jobs churn’, and market rents, coupled with slower economic activity points to a further improvement in US inflation over coming months.

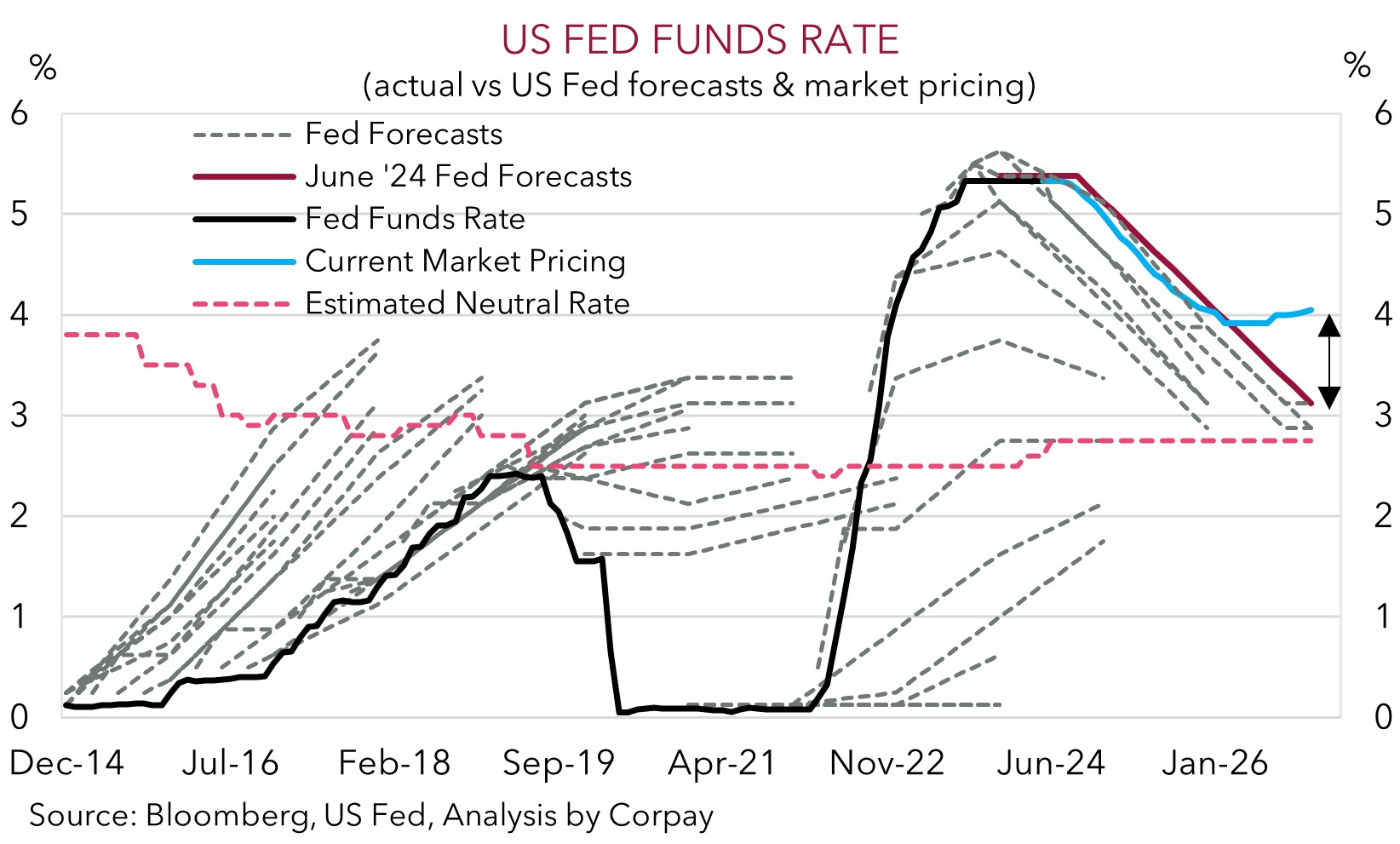

That said, the US Fed will need more convincing before it starts to dial back its ‘restrictive’ settings. As Chair Powell outlined, the better news in the May CPI data comes “after several reports that were not encouraging”. As expected, the US Fed kept interest rates on hold, but in response to the accumulation of inflation developments the FOMC surprised by revising up its 2024 projections more than anticipated with only 1 rate cut assumed in 2024 (previously 3). This is expected to be followed up with 4 cuts in 2025 and another 4 in 2026 as growth weakens, the labour market loosens, and inflation steps down to target. However, as our second chart shows, this is only a guide with the Fed’s track record not great and the latest changes effectively moving to match what markets had been factoring in for some time. Indeed, Chair Powell also poured cold water on the importance of the ‘dots’ as many members had a hard time determining whether a 2 cut or 1 cut scenario in 2024 was more likely. On top of that, Powell stated officials had the option to revise their forecasts, which were submitted last week, after the CPI but “most” didn’t.

In our view, forward looking markets are right to focus more on the underlying detail in the latest US CPI report and evolving macro signals rather than be too bogged down on what the slow moving (and often inaccurate) US Fed is guiding towards over the near-term. We think more signs US price pressures are moderating in the PPI data (10:30pm AEST) could see the USD lose more ground, particularly if the Bank of Japan also comes through tomorrow and scales back its bond purchases or gives hints about another rate hike.

AUD Corner

The US data and Fed meeting generated some AUD volatility overnight. In the end, as discussed above, the softer US CPI won out with the encouraging inflation trends more than offsetting the seemingly ‘stale’ near-term Fed rate projections. The more upbeat risk sentiment, as illustrated by the lift in equities and base metal prices, on the back of lower US bond yields and a weaker USD has pushed the AUD up towards $0.6665 (where it was tracking ahead of last Friday’s US jobs report). The environment has also helped the AUD outperform on the crosses. AUD/EUR (now ~0.6165) is at the top of its multi-month range, as is AUD/CNH (now ~4.84). AUD/GBP (now ~0.5205) is firmer, AUD/JPY (now ~104.35) is grinding up towards its cyclical peak, and AUD/CAD (now ~0.9140) is at a 1-year high.

Today, in addition to reaction to the overnight US events the AUD will also contend with the monthly Australian ‘labour force lottery’ (11:30am AEST). Domestic economic activity has slowed as higher interest rates constrain spending; however the labour market is still holding up. Indeed, after underwhelming last month we think there could be positive statistical payback in the May jobs report. Last month the ABS flagged that more people than normal which were deemed to be unemployed were waiting to start a new job. As those people re-enter the workforce, we believe employment could lift (mkt +30,000) and the unemployment rate could dip (mkt 4%).

A relatively positive Australian labour market report is likely to be AUD supportive (especially on the crosses), in our view, as it would reinforce thinking that the RBA could lag its global peers in terms of when it starts and how far it goes during the next easing cycle. Based on the stickiness in domestic inflation, incoming income support from the stage 3 tax cuts, and signs of improvement in China’s economy a modest rate cutting cycle by the RBA looks to be a story for 2025. From our perspective, crosses like AUD/EUR, AUD/GBP, and AUD/NZD already look too low compared to relative long-term interest rate differentials. As does AUD/USD, albeit to a lesser degree. The average across our suite of models suggests ‘fair value’ is currently around ~$0.6750.