• Fed hike. Another rate rise from the US Fed. But it remains data dependent when it comes to future moves. USD a bit softer, tracking a slight dip in US yields.

• AUD weaker. AUD underperforms after Q2 CPI undershot predictions. In response markets have reduced RBA rate hike expectations.

• AUD events. ECB meeting, US GDP & jobless claims tonight. Australian retail sales & BoJ announcement tomorrow. RBA next week.

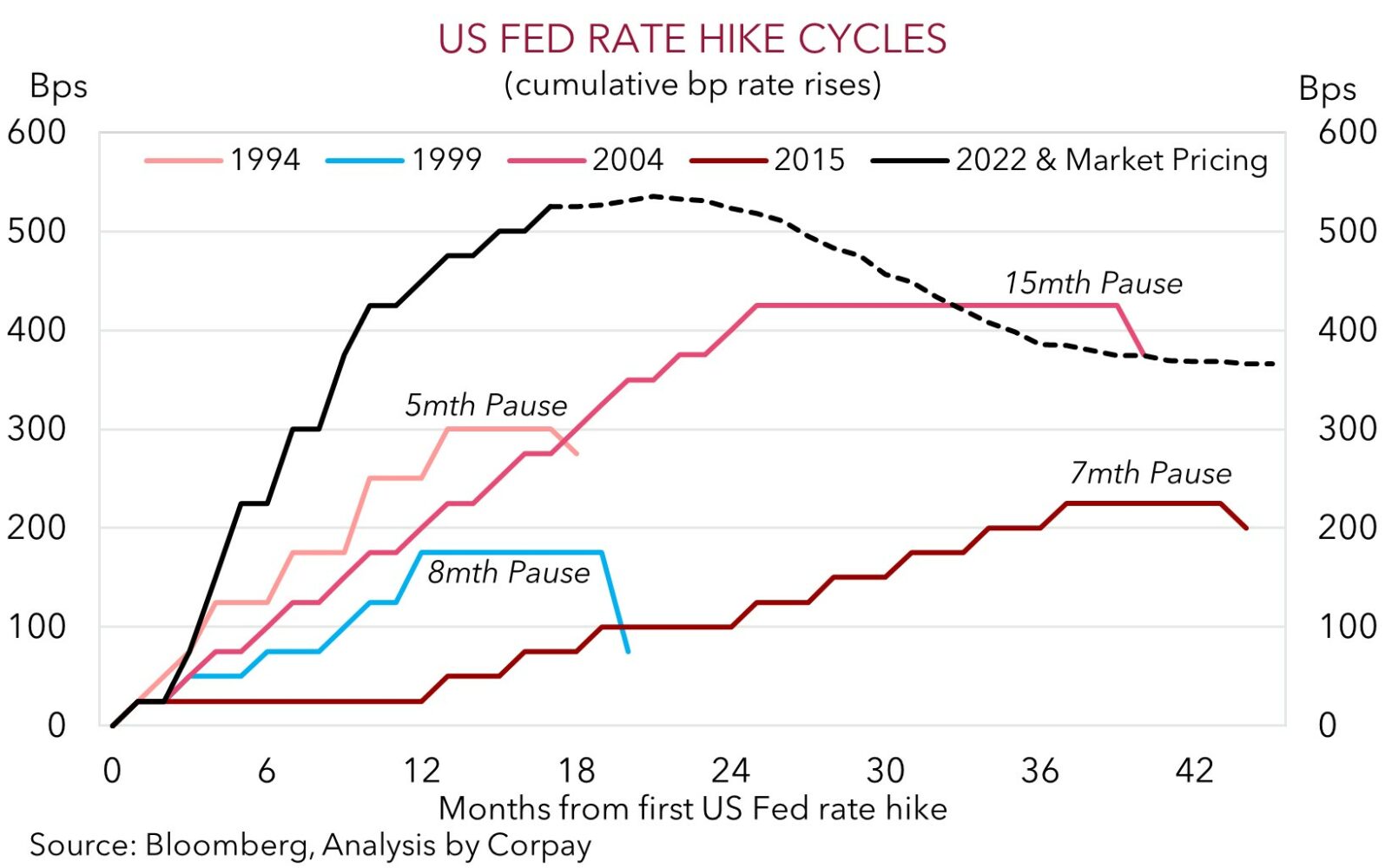

The US Fed decision and Chair Powell’s press conference were in focus overnight. As widely expected, the US Fed hiked interest rates by another 25bps, taking the target range up to 5.25-5.50%. This puts the US policy rate at its highest level in ~22-years. As our chart shows, this is by far the most abrupt tightening cycle in decades. The accompanying statement of the unanimous decision was more or less unchanged. Inflation is still seen as “elevated”, while the description that US growth was “moderate” rather than “modest” was the only noticeable tweak. The Fed remains data dependent when it comes to future moves (it will “continue to assess additional information”), with Chair Powell keeping options open. In our opinion, a mild tightening bias remains given another rate hike continues to be in the FOMC’s central case, and based on comments by Powell that they are “prepared to tighten further” and that policy will need to be “restrictive” for “some time” to deal with inflation. Indeed, Powell noted that the decision at the 21 September meeting could be to raise rates again or stay on hold with the upcoming US employment (4 August and 1 September) and CPI (10 August and 13 September) reports critical inputs. Given the Fed’s approach volatility could be even higher than normal around these key US data points.

Markets were whipped around a little intra-day in reaction to the comments, but on net, there was limited change. The US S&P500 was flat, in contrast to the earlier falls across Europe (EuroStoxx50 -1%). US Bond yields were also volatile. The US 2-year yield traded in a ~10bp range before ending the day ~2bps lower (now 4.85%). Markets are assigning a ~40% chance that the Fed hikes rates again by November, with the first full rate cut not factored in until May 2024. In FX, the USD Index eased slightly, with EUR edging back up towards ~$1.1085 and USD/JPY slipping towards ~140. AUD (now ~$0.6760) is ~0.4% lower compared to this time yesterday, with the weaker than expected Australian CPI report dampening RBA rate hike expectations.

There are a few offshore economic focal points tonight which can impact markets. The ECB interest rate decision (10:15pm AEST) and press conference (10:45pm AEST) are wrapped around the Q2 US GDP and initial jobless claims data (10:30pm AEST). Much like the Fed, we and the consensus predict the ECB will raise rates by another 25bps (taking the main rate up to 4.25%). And while it should continue to keep the door open to do more, we think the ECB is unlikely to pre-commit to another move at the next meeting. In our opinion, this may take the heat out of future ECB rate rise bets, and if combined with a solid US GDP and low jobless claims reading (which could raise the odds of another Fed hike), the USD could benefit.

Global event radar: ECB Meeting (Today), US GDP (Today), Bank of Japan Meeting (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), US ISM (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

AUD corner

The AUD has underperformed over the past 24hrs, with the slightly softer USD post the Fed decision providing only a little support (see above). AUD/USD is ~0.4% lower (now ~$0.6760), while on the crosses, AUD/EUR has slipped back under 0.61 (-0.7%), AUD/JPY has fallen ~1% (now ~94.75), and AUD/GBP has unwound this week’s gains to be down around ~0.5225.

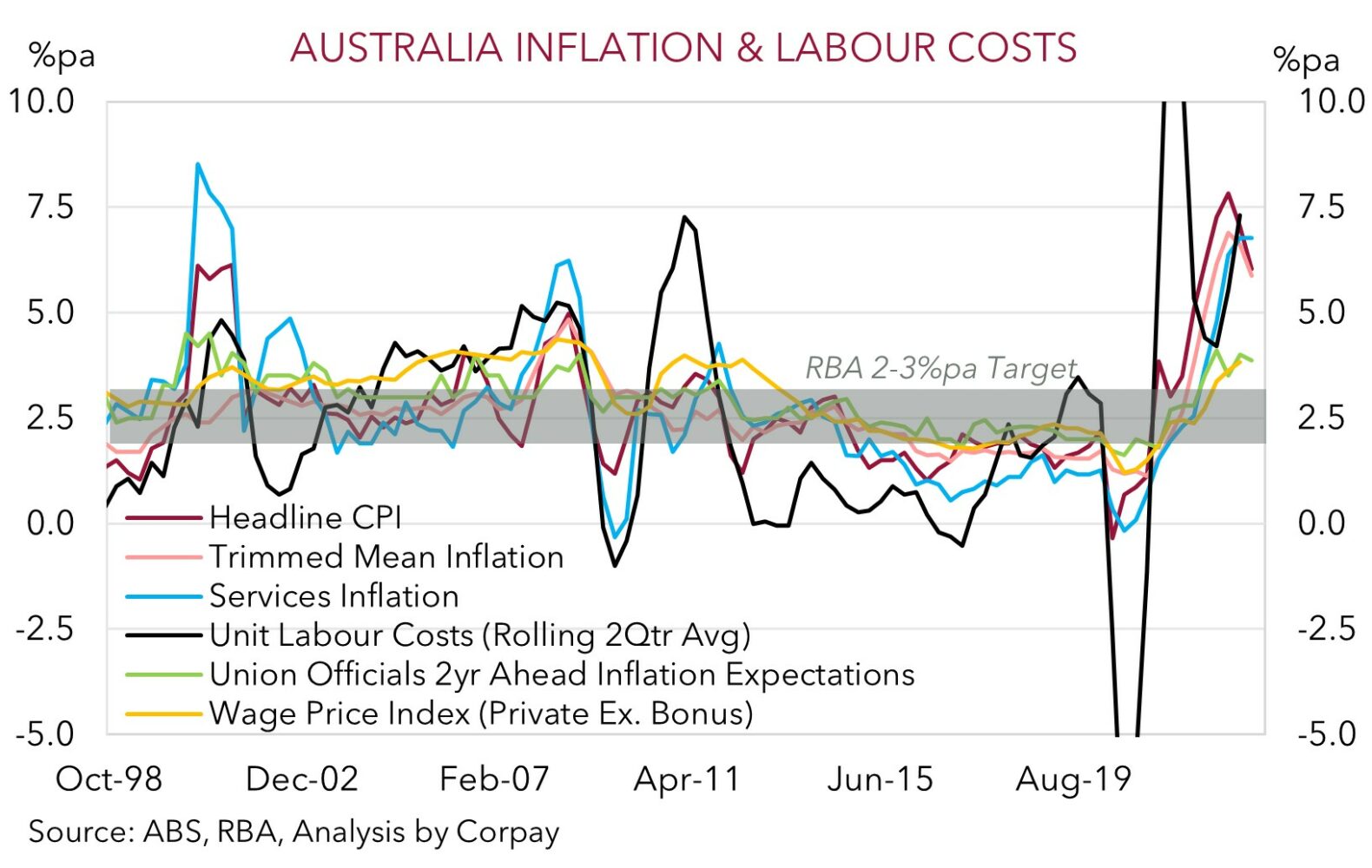

The catalyst for the AUD weakness was yesterday’s softer Q2 Australian CPI report, with the lower-than-expected result creating some doubt in the minds of markets as to whether the RBA will hike rates again. Headline inflation slowed to 6%pa. This is down from a peak of 7.8%pa in Q4 2022. Trimmed mean (the RBA’s preferred measure of core inflation) also moderated a bit more than anticipated, slipping back to 5.9%pa (the RBA and consensus were predicting it to come in at 6%pa).

While there are some positives across the report, a closer look also shows that the inflation genie is still a long way from being back in the bottle. ‘Sticky’ services inflation remains elevated, running at 6.8%pa in Q2. ~3/4% of the CPI basket is still growing at 3%pa or more, this is historically high. Markets are now assigning only a ~25% chance of another RBA hike next week. We think this looks underpriced. Although inflation is lower it still isn’t low, and given the labour market strength, unfolding pick up in wages and other services price dynamics, we still see the RBA delivering another hike this cycle, with a case to move as soon as August still in place. For more see Market Wire: Australian inflation: lower but not low.

For the AUD, we think downward pressure is likely to remain near-term. We see downside risks to tomorrows Australian retail sales data (mkt 0.0%). And as outlined above, while we expect the ECB to hike rates again (10:15pm AEST), we also think President Lagarde (10:45pm AEST) could follow the Fed’s playbook and stress its data dependence around future moves. In our opinion, this type of outcome, and solid US GDP and jobless claims data (10:30pm AEST) could see the USD bounce back, weighing on the AUD.

However, as outlined before, although we don’t see the AUD snapping back sharply for a while given sluggish global and domestic growth, we don’t want to be overly bearish down around current levels. After a few more tricky months, we continue to forecast the AUD to climb up into the low 0.70’s by early-2024. Developments in China should be AUD supportive over the medium-term. Stimulus to reinvigorate growth appears likely. A sturdier Chinese economy should encourage CNH-supportive capital inflows. Based on the strong correlation we think this can help the AUD grind higher over time.

AUD event radar: ECB Meeting (Today), US GDP (Today), Bank of Japan Meeting (Fri), AU Retail Sales (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug), US ISM (2nd Aug), NZ Jobs (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

AUD levels to watch (support / resistance): 0.6697, 0.6725 / 0.6781, 0.6850

SGD corner

USD/SGD has given back a little ground over the past few days, though at ~$1.3250 it remains ~0.6% above its mid-July low. As outlined above, the USD eased slightly overnight, tracking the modest dip in US bond yields, after the US Fed delivered yet another interest rate hike but provided no concrete guidance on a further move (see above). On the crosses, the firmer EUR has helped EUR/SGD nudge up towards ~1.47, while SGD/JPY (now ~105.89) is a touch lower, although it remains within 1.2% of its cyclical peak.

As discussed, following on from the US Fed, focus tonight will be on the ECB decision, ECB President Lagarde’s press conference, and the US data batch (which includes Q2 GDP and the weekly jobless claims figures). In our opinion, the ECB should also hike interest rates by another 25bps, but like the Fed we don’t think the ECB will give a strong signal about another move, with it going to be dependent on the incoming data. In our judgement, this type of outcome, coupled with solid US data, may weigh a bit on the EUR, thereby dragging EUR/SGD a bit lower and give USD/SGD a boost.

SGD event radar: ECB Meeting (Today), US GDP (Today), Bank of Japan Meeting (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug), US ISM (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3428