• Divergence. A ‘dovish’ ECB hike & solid US data weighed on the EUR. Reports the BoJ could tweak its policy settings today also boosted the JPY.

• AUD weaker. The USD rebound pushed down the AUD. Locally, retail sales are due today. The US PCE deflator & employment cost index are released.

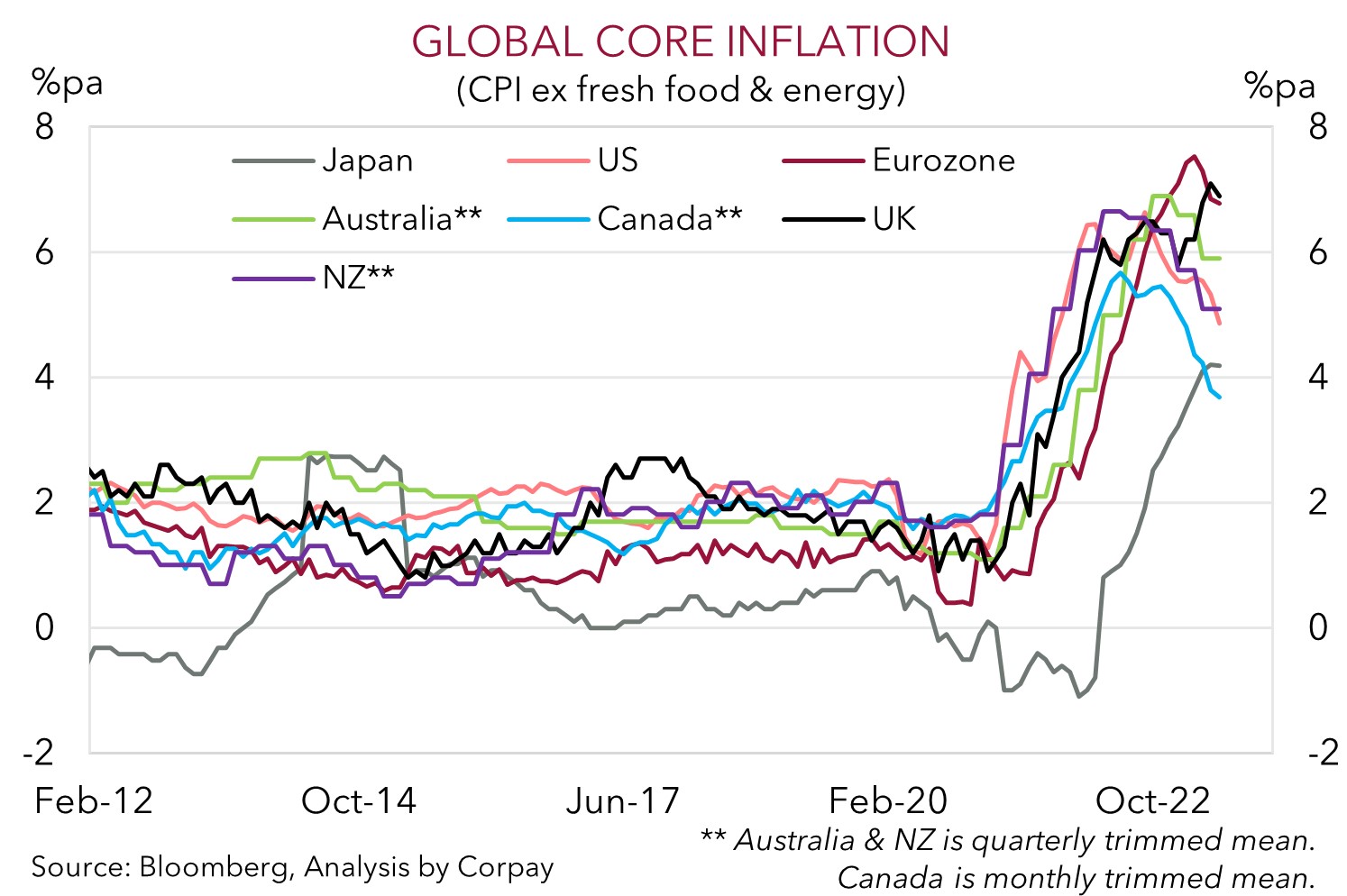

• BoJ in focus. Higher inflation means the BoJ’s ultra-loose stance is untenable. A change would be step along the normalisation path & could jolt markets.

Markets were jolted overnight by the combination of a ‘dovish’ ECB rate hike, strong US data, and reports the Bank of Japan could tweak its settings later today. In terms of the ECB, as expected, the range of policy rates were lifted by another 25bps. This takes the main rate up to 4.25%, a high since 2008. However, like the US Fed the ECB didn’t pre-commit to another move with the incoming data going to drive the outlook. According to the ECB, “future decisions” will ensure that rates are “set at sufficiently restrictive levels”, and from here this could be a meeting-by-meeting proposition.

ECB expectations were pared back in response, with markets taking the view that interest rates may now have ‘peaked’. After having been down as much as ~10bps, German 2-year yields ended the day ~5bps lower (now 3.03%), while European equities shot up (EuroStoxx50 +2.3%). By contrast, US bond yields rose, with the 2-year yield up ~8bps (now 4.93%) and the 10-year ~13bps higher (now ~4%), and US equities dipped (S&P500 -0.6%) after a string of US data came in better than predicted creating renewed doubts that the US Fed’s tightening is finished. US GDP indicated that the economy expanded at a 2.4% annualized pace in Q2, up from 2%saar in Q1, with strength in consumption and business investment underpinning the result. At the same time, labour market conditions remain tight with initial jobless claims (the number of people applying for unemployment benefits) falling to a ~5-month low.

These diverging trends supported the USD. EUR tumbled by ~1.5% from yesterday’s high (now ~1.0980, a ~3-week low), GBP fell below ~$1.28 (-1.5% from its intra-day high), while NZD and AUD also declined. The AUD is now tracking just above its 50-day moving average (~$0.67). Tonight, in the US the focus will be on the US PCE deflator (the Fed’s preferred inflation gauge) and the Employment Cost Index (a broad wage measure). Solid results could, in our view, continue to support the USD as they would bolster the ‘higher for longer’ rates case.

Despite the firmer USD, USD/JPY also declined (now ~139.43) with the JPY outperforming. A Nikkei news report stated that the BoJ will consider adjusting its yield curve control at today’s meeting by potentially allowing long-term rates to rise above the 0.5% limit. This is no surprise to us. We have repeatedly noted that the upturn in Japanese inflation (core CPI is running north of 4%pa) means it is a matter of when, not if, the BoJ shifts course and that the JPY should lift over time (see Market Musings: JPY: Asymmetric risks building). Today could be the day tentative steps are taken. There is no set time for the BoJ announcement. If an adjustment is made, we expect the JPY to strengthen as markets factor in further changes. Resultant falls in USD/JPY could ripple across other FX pairs, though possible risk aversion may also hold back cyclical currencies like the AUD.

Global event radar: Bank of Japan Meeting (Today), US PCE Deflator (Today), US Employment Cost Index (Today), China PMIs (31st July), Eurozone GDP & CPI (31st July), US ISM (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

AUD corner

The AUD lost ground over the past 24hrs, with the modest post US Fed meeting bounce more than unwound. At ~$0.6710 the AUD is ~1.6% below yesterday’s intra-day peak and is just above its ~3-month average. As discussed, the mix of a ‘dovish’ ECB rate rise, robust US economic data, and reports the BoJ may adjust its yield curve control settings later today has generated a USD supportive swing in relative bond yields. On the crosses, AUD/EUR has whipped around, but on net is ~0.2% higher than this time yesterday. By contrast, the stronger JPY has seen AUD/JPY slump down to ~93.50 (-1.3%), towards the bottom of the range it has occupied since mid-June.

There are several events which are set to impact the AUD into the end of the week. Locally, June retail sales are due (11:30am AEST), in the US the PCE deflator and employment cost index (both 10:30pm AEST) are released, and during the Asian session the BoJ announces its policy decision (no set time). Running through the list, we see downside risks to Australian retail sales (mkt 0.0%) given low consumer confidence and cashflow hit from higher mortgage costs. This, combined with signs US core inflation and wages remain uncomfortably high and inconsistent with the Fed’s 2%pa target, could exert further downward pressure on the AUD, in our view.

That said, the BoJ announcement, and spillovers into other asset markets and broader risk sentiment are a bit of a wildcard. As flagged above (and before), we think that based on the upswing in Japanese inflation, the BoJ’s ultra-accommodative stance is untenable, and that a policy shift is inevitable. This, and other fundamental forces such as the improvement in Japan’s terms of trade and balance of payments dynamics should support the JPY over the medium-term, in our opinion (we are forecasting AUD/JPY to fall into the high 80’s over the next year, see Market Musings: JPY: Asymmetric risks building). A stronger JPY, and a rebound in CNH, on the back of a policy induced re-acceleration in Chinese economic growth are factors supporting our medium-term outlook for the AUD to grind back into the low 0.70’s by H1 2024.

In terms of the short-term there are a few push-pull forces to consider when it comes to the AUD. A shift by the BoJ today should, in our judgement, further boost the JPY as a normalisation path is priced in. This in turn is likely to push USD/JPY (and AUD/JPY) lower, although the resultant USD impacts may give the AUD/USD some offsetting support. However, based on overnight moves, a now ‘surprise’ no change decision by the BoJ, would likely have the opposite effect.

AUD event radar: Bank of Japan Meeting (Today), AU Retail Sales (Today), US PCE Deflator (Today), US Employment Cost Index (Today), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug), US ISM (2nd Aug), NZ Jobs (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

AUD levels to watch (support / resistance): 0.6600, 0.6664 / 0.6781, 0.6850

SGD corner

USD/SGD rebounded overnight, with the pair moving back above ~$1.33. As discussed, the shift in relative interest rate expectations in favour of the US, as stronger US data pushed up US yields and a ‘dovish’ ECB rate hike dampened future rate rise bets, boosted the USD (see above). The resultant EUR weakness has weighed on EUR/SGD (now ~1.4615, ~1.3% below where it started the week), while expectations that the BoJ could adjust its policy settings at today’s meeting has also pushed down SGD/JPY (now ~104.65, -1.2% compared to this time yesterday).

As discussed, in the US tonight the latest PCE deflator and Employment Cost Index data is released. Solid outcomes are likely to further support US interest rate expectations, and in turn the USD (and USD/SGD), as markets question whether the US Fed’s tightening cycle is truly over. However, before that markets will need to navigate today’s BoJ announcement (no set time). As outlined before, in our view, it is a matter of time the BoJ changes course, and that over the medium-term there are more upside than downside JPY risks (see Market Musings: JPY: Asymmetric risks building). A tweak today could be an early step to bigger changes down the track, and if realised we would expect the JPY to strengthen broadly. This could also create volatility in USD/SGD as moves in USD/JPY flow through and other risk markets react.

SGD event radar: Bank of Japan Meeting (Today), US PCE Deflator (Today), US Employment Cost Index (Today), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug), US ISM (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3380, 1.3423