• Positive sentiment. Softer US price & wage data supported risk appetite. Equities & commodities firmer, US yields lower. FX was more mixed.

• BoJ tweak. BoJ adjusted its yield curve control framework. Based on further steps & improvement in other fundamentals we see the JPY strengthening over time.

• RBA in focus. Will they hike or hold? Analyst community is leaning towards a move. Markets are less convinced. A change would generate a knee-jerk AUD lift.

Risk sentiment ended last week on firmer footing, although FX markets moved a bit more to the beat of their own drum. US equities rose on Friday, with the tech-focused NASDAQ outperforming (+1.9% vs S&P500 +1%). The S&P500 is near its highest level since March 2022. In bonds, US yields unwound an earlier modest BoJ policy tweak induced lift to end the day ~5bps lower across the curve (the US 2-yr and 10-yr yields are at 4.87% and 3.95% respectively). Across commodities oil prices increased (Brent crude +0.9%) and base metals like copper (+1.6%) also had a positive session.

In FX, the USD index was on net little changed, but this masked some renewed EUR strength (+0.4% to ~$1.1020) and a JPY reversal. USD/JPY (now ~140.95) traded in a ~2.3% range on Friday as the decision by the BoJ to shift from a rigid +/- 0.5% band around its 10-year Japanese bond yield target to more “flexible” approach was digested. We think this could be the first of many incremental steps undertaken by the BoJ over the period ahead. Pricing in of further policy normalisation combined with the improvement in Japan’s terms-of-trade and balance-of-payments positions are drivers behind our bullish medium-term JPY bias (see Market Wire: BoJ Loosens Its Grip). Despite the positive risk backdrop, the AUD has remained heavy. At ~$0.6655 the AUD is ~3.5% below its mid-July peak.

Softer than expected US price and wage data, which kept alive hopes that a ‘soft landing’ could unfold, was a catalyst behind the US market moves. The PCE deflator (the US Fed’s preferred inflation gauge) slowed to 3%pa, while the core measure (now 4.1%pa) fell slightly more than anticipated. The Employment Cost Index (a broad wages gauge) also lifted by less than projected (1%qoq vs market 1.1%qoq), consistent with a gradual deceleration in ‘sticky’ services inflation.

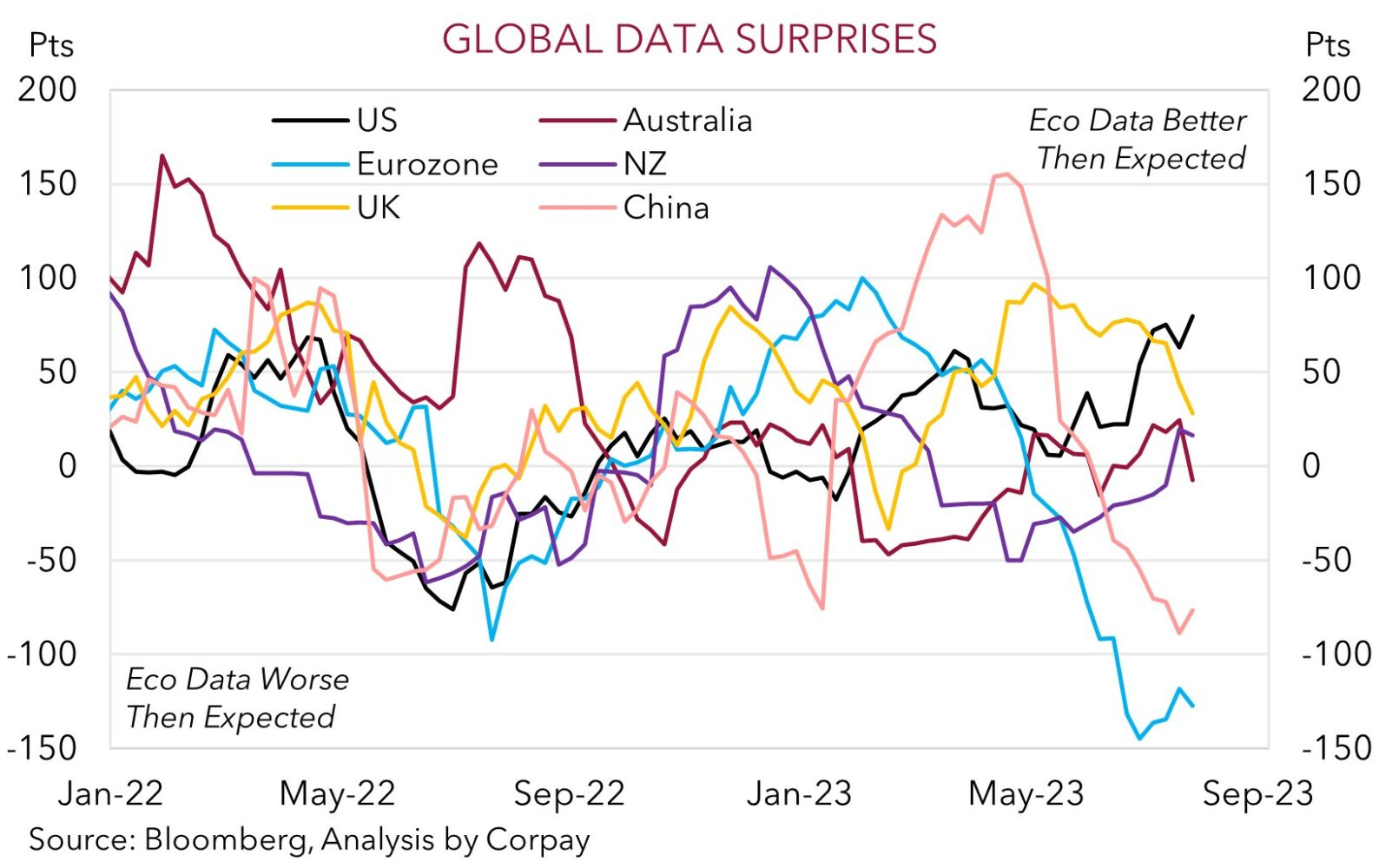

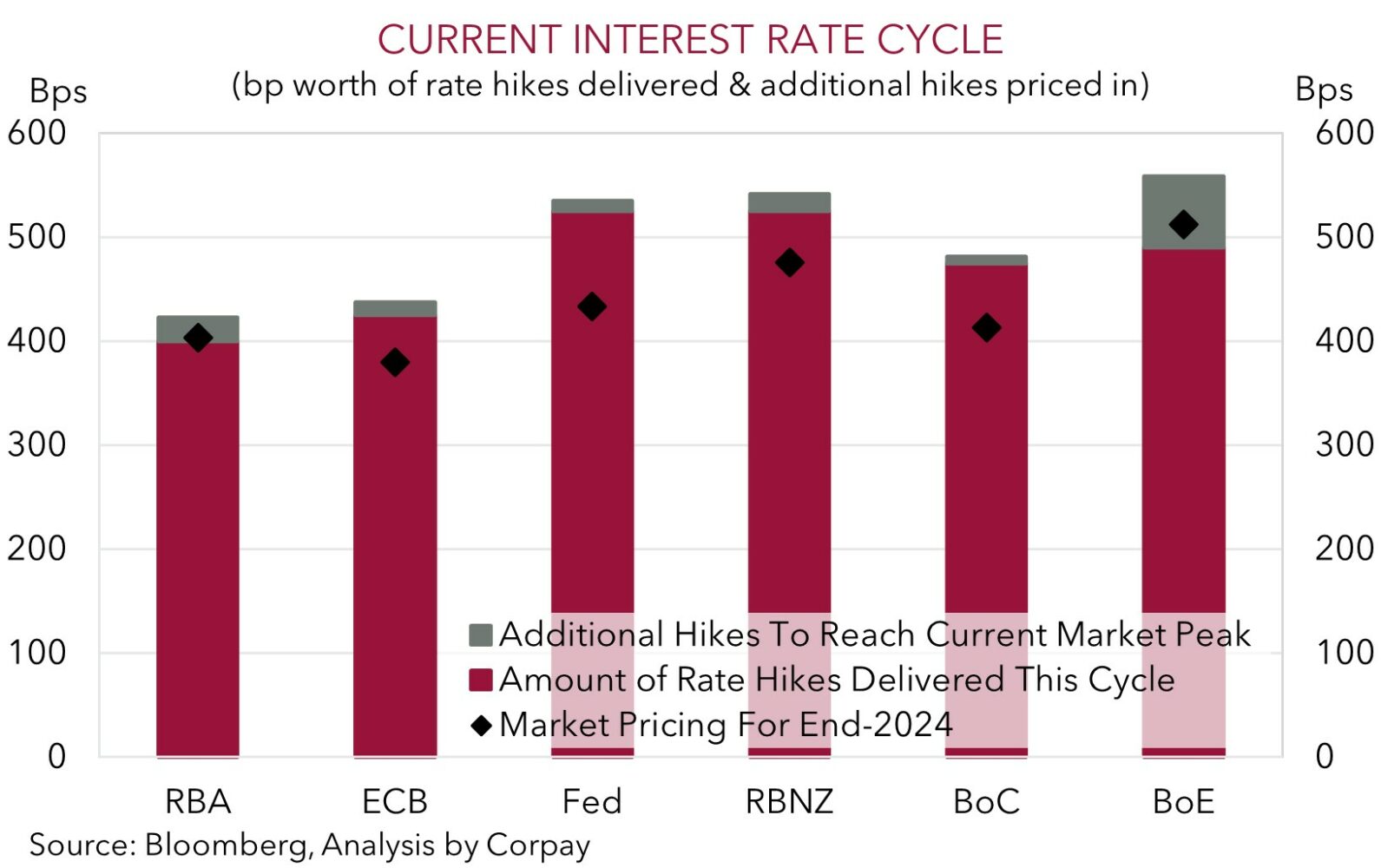

This week there are several global data points which may generate more bursts of volatility. The list includes the latest China PMIs (today 11:30am AEST), Eurozone CPI and Q2 GDP (today 7pm AEST), the RBA (Tuesday) and Bank of England policy decisions (Thursday), the US ISMs (Wednesday and Friday), and the important US non-farm payrolls report (Friday). On net, we think the events should be USD supportive over the week. Soft China PMIs may fan concerns about global growth, and while the BoE is expected to raise rates by another 25bps, markets are already discounting several more moves so it could be difficult to exceed ‘hawkish’ expectations. And in the US, we believe the key business surveys and labour market data risks coming in stronger than forecast, extending the run of positive US data surprises. In our view, signs that the US labour market remains uncomfortably tight could see odds of another Fed rate hike at the late September meeting tick up and/or future rate cut bets pushed out, boosting the USD.

Global event radar: China PMIs (Today), Eurozone GDP & CPI (Today), RBA Meeting (Tues), US ISM (Weds), US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

AUD corner

Despite the positive risk environment, as illustrated by the pickup in US equities and commodity prices (see above), the AUD has remained on the backfoot as an underwhelming Australian retail sales report dampened expectations of another RBA rate hike. Retail sales fell 0.8% in June with consumers pulling back on discretionary spending as higher mortgage costs and other pressures continue to bite. At ~$0.6655 the AUD is near a ~3-week low (~3.5% below its mid-July peak). The AUD also underperformed on most of the major crosses. AUD/EUR and AUD/GBP are over 1.2% lower compared to this time on Friday. AUD/EUR (now ~0.6040) is ~1.4% from its late-April low, while AUD/GBP (now ~0.5179) is near the bottom of its ~3-year range.

AUD/CNH has also extended its pull-back, with the pair now ~3.6% below its mid-July peak. Expectations of further policy support to reinvigorate Chinese growth and more direct steps by authorities to prop up the weak currency are boosting the CNH. And as with the other JPY crosses, AUD/JPY experienced a bit of intra-day volatility on Friday as markets processed the BoJ’s adjustment to its yield curve control framework. It will be a bumpy ride, but over the medium-term we think there are several drivers pointing to further JPY strength with AUD/JPY projected to fall back into the high 80’s by mid-2024 (see Market Wire: BoJ Loosens Its Grip).

There are several local and domestic events which could generate AUD volatility this week. Locally, all eyes will be on Tuesday’s RBA decision. As it has been the last few months, we believe it will be another ‘line-ball’ call. Notably, while the analyst community thinks another hike is more likely (15/25 analysts surveyed by Bloomberg have the RBA moving), interest rate markets are less convinced with only a ~22% chance of a hike factored in. There are arguments for and against a move, but on balance, based on the still strong labour market, faster wage growth, and other ‘sticky’ services price dynamics, we are leaning in the rate hike camp as this would enhance the RBA’s confidence inflation is on track to be back at target “within a reasonable timeframe”.

Given the low level of market pricing a ‘surprise’ change by the RBA would generate a knee-jerk spike higher in the AUD as rates markets adjust. However, as we have seen previously, we don’t think this move would extend too far or last too long given the global forces still at play and with the RBA nearing the end of its tightening phase. Slowing global growth remains an AUD headwind. The China PMIs (today 11:30am AEST) risk undershooting expectations. And later this week, as outlined above, we are looking for the USD to garner strength from solid US business surveys and another positive labour market report. If realised, better than predicted US data could see rate expectations shift in favour of a stronger USD.

AUD event radar: China PMIs (Today), Eurozone GDP & CPI (Today), RBA Meeting (Tues), NZ Jobs (Weds), US ISM (Weds), US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), AU Wages (15th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), AU Jobs (17th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

AUD levels to watch (support / resistance): 0.6547, 0.6600 / 0.6729, 0.6800

SGD corner

USD/SGD consolidated on Friday, trading in a tight 0.3% range centered on ~$1.3315. This is inline with the sideways move in the USD Index as some relative EUR strength offset the reversal in the JPY following its initial BoJ inspired appreciation (see above). EUR/SGD unwound the bulk of Thursday’s dip to be trading back above its 50-day moving average (~1.4649). SGD/JPY endured a bout of intra-day volatility, trading in a ~2.3% range on Friday with the pair ending the week up near ~106, where it was tracking earlier last week. In our view, the (tentative) change in trajectory by the BoJ, which we believe could build over time, coupled with the turnaround in Japan’s terms-of-trade and balance-of-payments positions should see the JPY strengthen over the medium-term. As a result we see SGD/JPY, which is still historically high, trending lower over time (see Market Wire: BoJ Loosens Its Grip).

As discussed above, in terms of this week we think that the key US ISM business surveys and the week ending US labour market report risk coming in better than anticipated. If realised, this may see pricing for another rate rise by the US Fed lift and/or see future rate cut expectations pared back. In our opinion, a shift in relative interest rates in favour of the US could be USD (and USD/SGD) supportive. At the same time, still tepid growth momentum in China (the July PMIs are released today) might be a headwind for cyclical regional currencies like the SGD.

SGD event radar: China PMIs (Today), Eurozone GDP & CPI (Today), RBA Meeting (Tues), US ISM (Weds), US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3423