• Mixed signals. Equities & bonds consolidate. Commodities firmer. In FX, the JPY has weakened, while the AUD has outperformed.

• AUD rebound. More reports out of China pointing to growth-supportive measures coming through have boosted the AUD in the lead up to today’s RBA decision.

• Hike or hold? There are arguments for & against a move. Markets & analysts are split. Given pricing a hike could see the AUD spike higher, but it may not last.

It was a quiet end to the month for most markets. US equities edged higher (S&P500 +0.2%), bond yields consolidated (US 2yr and 10yr yields are at 4.88% and 3.96% respectively), while energy and base metal prices rose. WTI crude (+1.6%) is back around US$82/brl, a high since mid-April and ~22% above its late-June low. Copper increased by more than 2% to now be ~13% above its lows. These trends point to renewed inflation pressures down the track, which in our view could catch out complacent markets that appear to be assuming the inflation genie has been put back into the bottle.

In FX, the USD Index ticked up slightly, with EUR slipping below ~$1.10 and USD/JPY back over ~142. USD/JPY is now ~3% above Friday’s post-BoJ policy tweak low, with the JPY losing ground yesterday after the BoJ sprung a surprise and waded into the Japanese bond market to smooth out the upturn in yields. The AUD also strengthened (now ~$0.6720) with month-end portfolio rebalancing flows on the back of the positive equity market run (the MSCI world index rose ~3% in July) and improved sentiment following the release of more detail on how Chinese policymakers are looking to spur growth. Based on the document put forward by China’s top economic planning agency boosting labour-intensive consumption remains the focus, though many of the measures have been flagged already.

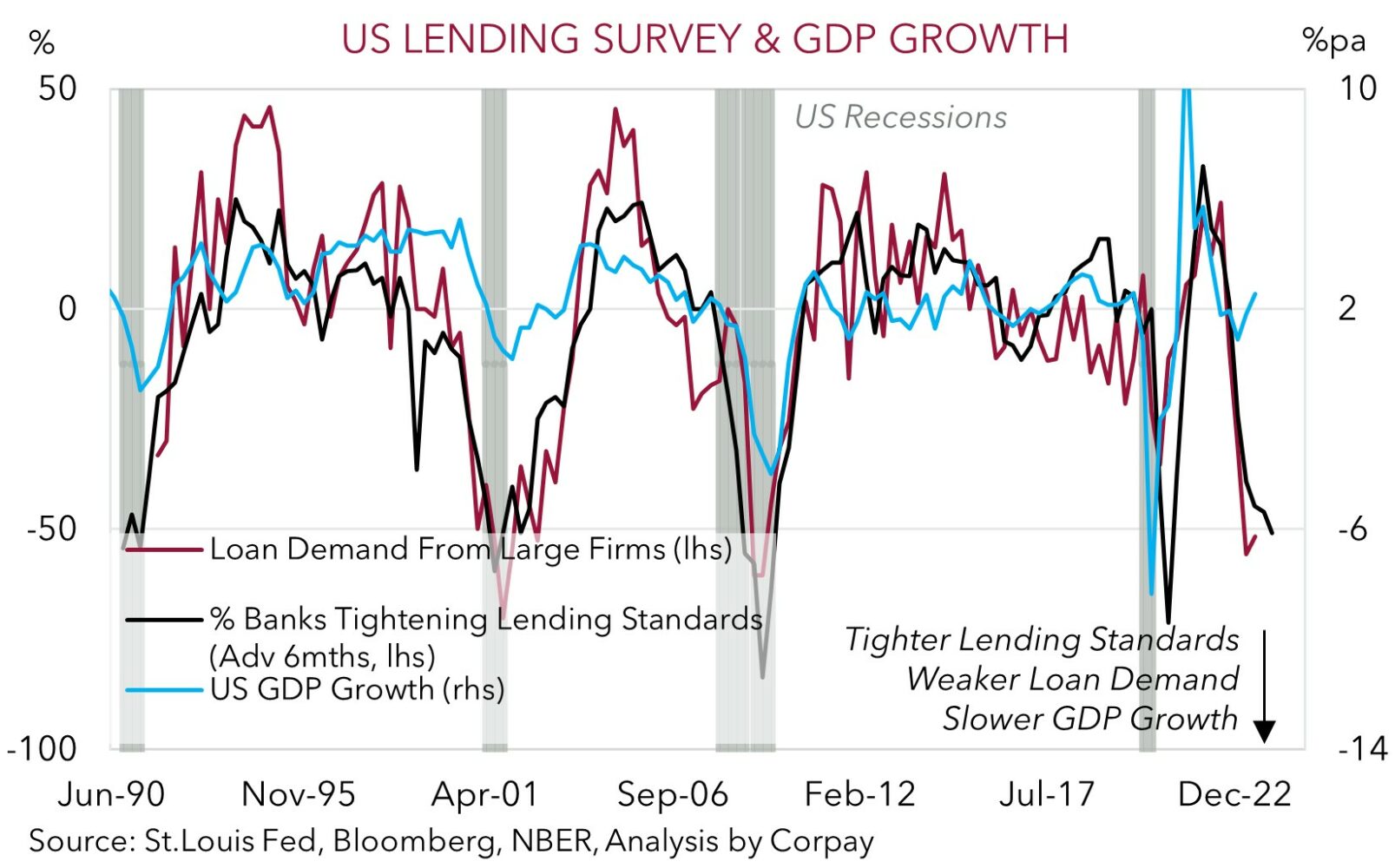

Data wise there have been mixed signals. In China, the business PMIs for July showed that momentum remains sluggish. At 51.1 the composite gauge is at its lowest since last December. By contrast, Eurozone Q2 GDP was a touched better than anticipated with the region returning to growth (+0.3%qoq), although core inflation held steady at historically high 5.5%pa as sticky services prices increased further. In the US, the latest reading of the Fed’s Senior Loan officer survey is worth calling out. The Q2 readings show that lending standards are tight and demand for credit (the lifeblood of an economy) is weak. As our chart shows, these types of trends typically result in a sharp slowdown in US growth over future quarters. This is one reason why we are skeptical that the markets optimistic ‘soft landing’ narrative will hold, with a ‘growth shock’ on the back of the lagged impacts of the rapid-fire policy tightening a possible trigger for market turbulence over the months ahead.

Offshore, attention tonight will be on the US manufacturing ISM and JOLTS job openings reports (both 12am AEST). The ISM is expected to improve slightly, and although job openings are forecast to ease, they should remain at levels indicative of a tight labour market. Later this week US non-farm payrolls is due (Friday). In our opinion, risks appear tilted to another solid US jobs report. If realised, this may see rate expectations shift in favour of a stronger USD.

Global event radar: RBA Meeting (Today), US ISM (Tonight), US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

AUD corner

The AUD has enjoyed a positive start to the week. AUD/USD (+1%) is approaching its 200-day moving average (~$0.6732), and the AUD has also outperformed on the crosses. AUD/EUR (+1.2%) has ticked back over ~0.61, AUD/GBP (+1.1%) is near ~0.5230, and AUD/JPY (+1.9%) has leapt back above ~95.50. As mentioned, the surprise decision by the BoJ to step back into the Japanese bond market to slow and control the lift in yields following last Friday’s policy tweak has weighed on the JPY. At the same time, the AUD looks to have been bolstered by more reports out of China pointing to growth-supportive measures coming through, and month-end portfolio rebalancing flows following another strong month for global equities.

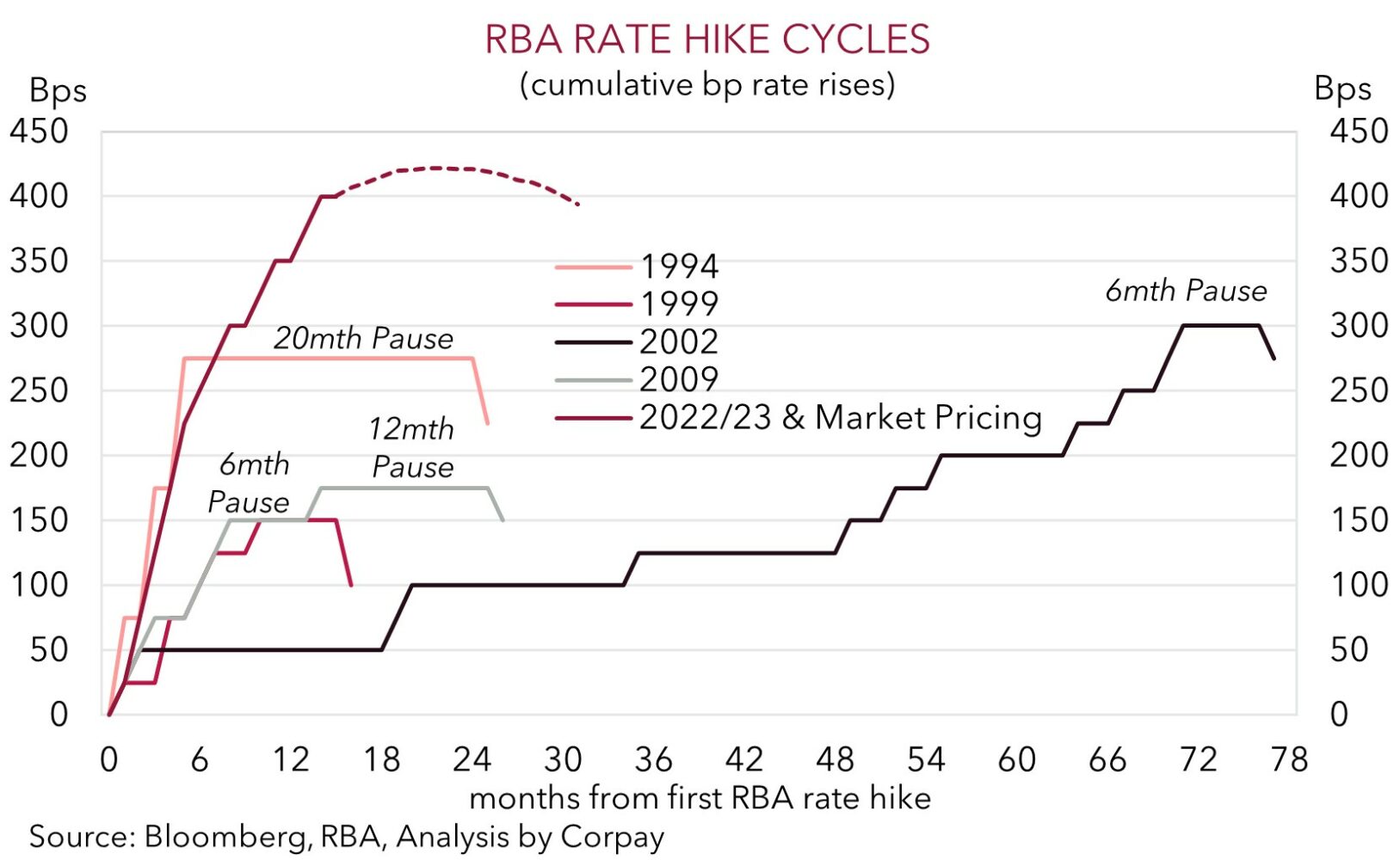

Today, focus will be on the RBA (2:30pm AEST). As it has been the last few months, we think it will be another ‘line-ball’ call. Interestingly, although the analyst community believes another rate rise is more likely (18/30 analysts surveyed by Bloomberg have the RBA hiking), interest rate markets aren’t as sure with only a ~28% chance of a hike factored in (although there is another full 25bp increase discounted by Q1). There are arguments for and against a move today, but on balance, given the still strong labour market, upturn in wage growth, and other ‘sticky’ services price pressures, we are leaning in the rate hike camp as this could help solidify the RBA’s confidence inflation is on track to be back at target “within a reasonable timeframe”.

Based on the level of market pricing a ‘surprise’ change by the RBA today would generate a knee-jerk spike higher in the AUD as rates markets adjust. However, the durability of such a move would depend on the RBA’s forward guidance. A ‘dovish hike’ (whereby the RBA lifts rates again but gives no strong hints about further action) could see the AUD quickly reverse course. Conversely, AUD downside on the back of a ‘hawkish hold’ (whereby the RBA remains at 4.1% but keeps the door open to do more based on the dataflow) should be limited.

Overall, even if the RBA comes through with another rate rise today, as we have observed over the past few months the AUD’s rebound may not extend too far or last too long given the more powerful global forces still at play. The slowing global economy remains a strong headwind for cyclical currencies like the AUD. And as discussed, we think upside surprises in the upcoming US data (especially Friday’s non-farm payrolls report) could be USD supportive.

AUD event radar: RBA Meeting (Today), US ISM (Tonight), NZ Jobs (Weds), US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), AU Wages (15th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), AU Jobs (17th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

AUD levels to watch (support / resistance): 0.6547, 0.6600 / 0.6729, 0.6800

SGD corner

USD/SGD has drifted a bit lower to start the new week, with the pair easing down towards ~$1.3290. On the crosses, EUR/SGD has also slipped back (now ~1.4620, -0.4%), while SGD/JPY has pushed back over ~107. As discussed above, yesterday’s surprise decision by the BoJ to wade back into the Japanese bond market to smooth the upturn in yields has exerted pressure on the JPY, while cyclical currencies like the AUD and SGD look to have received a boost from further reports out of China around how policymakers may reinvigorate the faltering recovery. As outlined previously, in our view, over the medium-term there are more upside than downside risks for the very weak JPY, with the (tentative) change in trajectory by the BoJ combined with the turnaround in Japan’s terms-of-trade and balance-of-payments positions expected to strengthen the currency over time (see Market Wire: BoJ Loosens Its Grip).

Over the rest of this week, the data focus will be in the US. The US manufacturing ISM and JOLTS job openings are released tonight, while later this week the services ISM and non-farm payrolls data are due. On net, we think the data, particularly the labour market report, may come in better than anticipated. Stronger US data could see pricing for another US Fed rate rise lift and/or see future rate cut expectations pushed out, which in turn could give the USD (and USD/SGD) some support.

SGD event radar: RBA Meeting (Today), US ISM (Tonight), US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3423