• Market wobbles. Higher yields dampened risk appetite. USD stronger. News that Fitch downgraded the US may add to market nerves.

• Weaker AUD. Shaky risk sentiment & a paring back of RBA rate hike pricing following yesterday’s on hold decision have weighed on the AUD.

• US focus. In addition to any spillovers from the US ratings news, attention will remain on the US over coming days with non-farm payrolls due Friday.

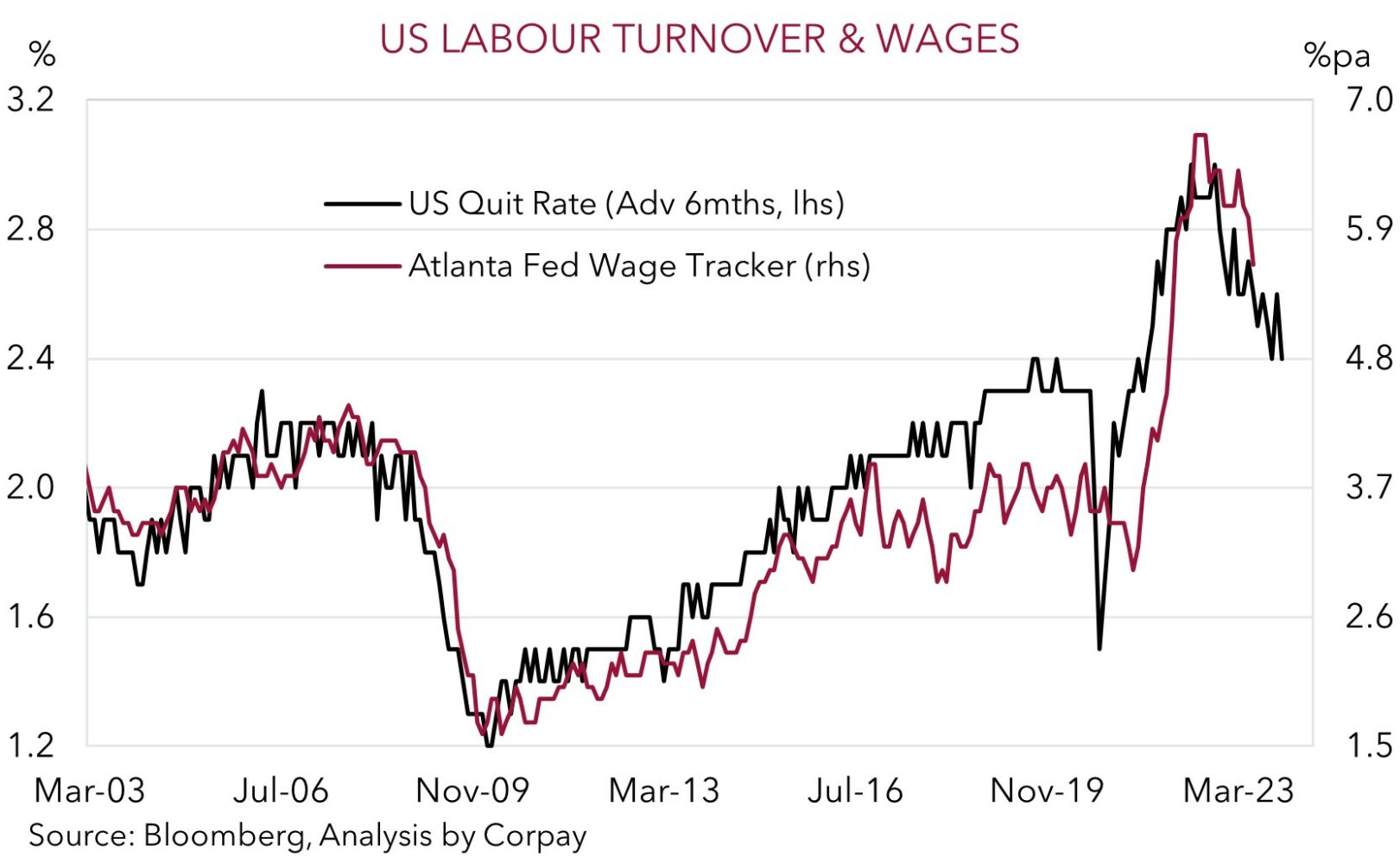

The new month has started with a bit of renewed turbulence. Bond yields across Europe and the US rose, led by long-end rates. The US 10yr yield increased ~6bps to 4.02%, while the UK and German equivalents are ~9bps higher. Data showing that labour markets remain tight was a factor at play. Eurozone unemployment moderated to 6.4%, matching its euro-era record low. In the US, although job openings eased in June, they remain quite high. There are still ~1.6 vacancies for each unemployed person. This ratio needs to be closer to ~1 for wages to be consistent with the US Fed’s 2%pa inflation target. And as our chart shows, while the quit rate (i.e. the percentage of voluntary job leavers) has drifted lower, pointing to more labour market slack and slowing wage growth down the line, things are still a long way from where they need to be for the US Fed to declare victory on inflation.

Also playing on fixed income investor minds, and contributing to the lift in yields, are expectations of greater bond supply due to the US’ persistently large budget deficits. The US Treasury indicated that its net borrowing estimate for Q3 is now US$1 trillion (up from US$733bn previously projected), with another US$852bn to be borrowed in Q4. The lift in yields flowed through to other asset classes. Equities were in the red overnight. The EuroStoxx50 fell 1.4% and the US S&P500 declined 0.3%. Across commodities, WTI crude eased (-0.5%), and base metals like copper lost ground (-2.5%). Soft manufacturing data out of the US and China shows that the pressure on commodity intensive industrial activity remains in place. The China Caixin PMI slipped back in July, and the US manufacturing ISM survey came in at a weak/below average 46.4. This is the 9th straight month the US gauge has been in ‘contractionary territory’.

In FX, the USD has strengthened. EUR is hovering sub ~$1.10, USD/JPY has popped back over ~143, and GBP has dipped under ~$1.28. NZD is tracking below its 50-day moving average (~$0.6167) with another poor dairy auction compounding the other factors mentioned. Whole milk powder prices tumbled another ~8%. The AUD has underperformed, with the RBA’s on hold decision seeing markets pare back future rate hike bets. We believe these FX trends can continue. Later this week the US non-farm payrolls report is due (Friday). We think risks are tilted to another solid US jobs report. If realised, this may see relative rate expectations shift in favour of a stronger USD.

News this morning that ratings agency Fitch has downgraded the US sovereign rating from AAA to AA+ may add to market nerves, and exert more pressure on risk assets and cyclical currencies like the AUD. That said, we don’t expect any bouts of risk aversion to mirror the moves triggered by S&P’s 2011 US downgrade. According to Fitch the US’ fiscal deterioration and erosion of governance, which has led to repeated debt limit standoffs and last-minute resolutions, was behind the decision.

Global event radar: US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

AUD corner

The AUD has come back down to earth with the positive start to the week more than unwinding over the past 24hrs. AUD/USD has fallen to ~$0.6620, near the bottom of its ~1-month range, with the AUD also underperforming on the crosses. AUD/EUR (-1.4%) is back just above ~0.60, AUD/GBP (-1%) is hovering near its 2023 lows, AUD/JPY is under ~95, and AUD/CNH (-1%) is around a ~2-month low. AUD/NZD is below 1.08, though it has garnered a little support from this mornings NZ jobs report which showed that unemployment increased to 3.6% (largely due to greater labour supply).

The shaky risk sentiment, as illustrated by the overnight dip in equity markets and base metal prices, and soft US and China manufacturing data compounded yesterday’s decision by the RBA to hold interest rates steady at 4.1%. Going into the RBA meeting there was some chance priced in for a move, with most analysts (18/30 surveyed) predicting another hike. In the end, despite inflation still being “too high”, the RBA held firm, with greater focus now seemingly on the unfolding economic slowdown. While the RBA has retained a mild/conditional tightening bias, we think the hurdle to raise rates again looks quite high, and we doubt the economic trends will justify further RBA action (see Market Wire: RBA holds firm).

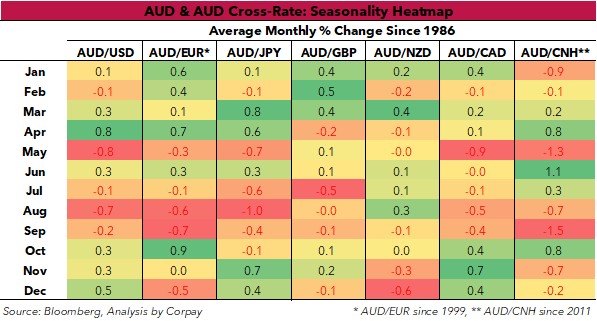

The paring back of future RBA rate hike expectations can continue to exert pressure on the AUD over the near-term, in our view. Especially when coupled with our thoughts that the upcoming US labour market report (Friday) risks coming in stronger than predicted, triggering a USD supportive lift in US rate expectations. Also of note is the AUD’s negative seasonal bias in August. As our heatmap illustrates, on average the AUD, and a range of AUD crosses, tend to weaken in August before picking up later in the year. Seasonal forces in things like iron ore production and trade flows play a role, while risk markets like equities typically endure bouts of volatility at this time of the year as economic issues re-emerge. This morning’s announcement by ratings agency Fitch that it has downgraded the US’ sovereign rating could be yet another example of this.

That said, as discussed previously, while we foresee a few more tricky months for the AUD as the slowdown in global industrial activity gathers pace, we also don’t want to be overly bearish down near current levels. From our perspective, fundamental supports such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should act as downside cushions. Since 2015, when these factors kicked into gear, the AUD has only traded sub-$0.6650 ~6% of the time.

AUD event radar: US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), AU Wages (15th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), AU Jobs (17th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

AUD levels to watch (support / resistance): 0.6547, 0.6600 / 0.6700, 0.6732

SGD corner

USD/SGD bounced back overnight, with the lift in US yields and stronger USD pushing the pair up to ~$1.3350 (see above). This is a high since 12 July. On the crosses, EUR/SGD has also edged higher (now ~1.4690), with the still low Eurozone unemployment rate also supporting the EUR.

We expect these trends to remain in place over the near term. As mentioned, on the data front, we believe the week-ending US labour market report may come in better than anticipated. Stronger US data could see pricing for another US Fed rate rise lift and/or see future rate cut expectations pushed out. This in turn could give the USD (and USD/SGD) some support. At the same time, the growth sensitive SGD may continue to be weighed down by slowing industrial activity, and/or any negative spillovers into risk markets generated by news ratings agency Fitch has downgraded the US sovereign rating.

SGD event radar: US ISM Services (Thurs), Bank of England Meeting (Thurs), US Jobs (Fri), US CPI (10th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3417