• Shaky sentiment. A better than expected US ADP employment report pushed up US bond yields. This supported the USD & weighed on equities.

• AUD weaker. Negative risk sentiment & a stronger USD have exerted more pressure on the AUD. We think this can continue near-term.

• Seasonal forces. August tends to be a negative month for growth-linked assets like the AUD. With the USD typically strengthening at this time of year.

Risk sentiment remained negative overnight. Yesterday’s news that ratings agency Fitch had downgraded the US’ sovereign credit rating somewhat dampened risk appetite, though it was another strong US ADP employment report which caught the markets attention. ADP employment rose 324,000 in July, well above the 190,000 increase expected. The ongoing strong US job creation challenges the markets optimistic “soft landing” expectations as a tight labour market points to ‘sticky’ core inflation holding up which in turn could see the US Fed tighten policy further, or hold settings in ‘restrictive’ territory for quite some time. US yields rose following the ADP release with the 10-year up ~6bps (now 4.08%, a high since last November).

The lift in bond yields flowed through to other asset markets. US equities fell back, with the rate sensitive NASDAQ underperforming (-2.2% vs S&P500 -1.4%). Commodities remained on the back foot with WTI crude down 2.3%, and base metals like copper (-1.7%) giving back more ground. In FX, the USD’s revival continued. The negative backdrop has maintained the pressure on the AUD which hit its lowest level since 1 June overnight (now $0.6537). Elsewhere, EUR has dipped back to ~$1.0940, USD/JPY has held above ~143, and GBP has slipped down towards ~$1.27. GBP is now over 3% below its mid-July peak. The Bank of England meets tonight (9pm AEST). Another 25bp rate hike is the base case for most, though high UK inflation means there is a chance the BoE announces another outsized 50bp move. Outcomes relative to expectations drive markets. Given the large amount of tightening already factored into the UK interest rate curve we wouldn’t be surprised to see GBP fall back if the BoE only delivers a 25bp hike and/or indicates that future tightening is data dependent.

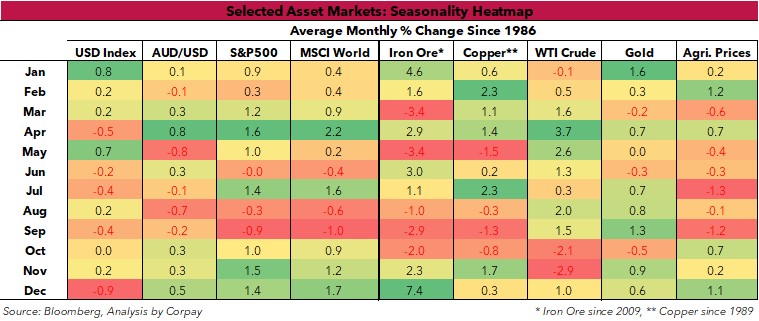

In addition to the BoE announcement, focus will also remain on the US over the next few days. Tonight, US jobless claims (10:30pm AEST) and the ISM services index (12am AEST) are the highlights, with the non-farm payrolls report released tomorrow night. As highlighted throughout this week, we expect the USD to remain firm with risks tilted to the US data (particularly the jobs report) coming in better than anticipated. And as our heatmap below shows, the market turbulence and lift in the USD that we are seeing currently is broadly inline with the historical patterns for this time of the year. August tends to be a negative month for growth-linked assets like equities, industrial metals, agricultural commodities, and the AUD, with the USD typically strengthening.

Global event radar: US ISM Services (Tonight), Bank of England Meeting (Tonight), US Jobs (Fri), US CPI (10th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

AUD corner

The AUD has remained under pressure with the negative risk sentiment (as illustrated by the falls in US equities and commodity prices) compounding the hangover from this week’s no change decision from the RBA and stronger USD stemming from the positive ADP employment report and higher US bond yields (see above). AUD/USD (now ~$0.6537) touched its lowest level since 1 June, with the AUD continuing to underperform on the crosses. AUD/EUR has dipped under ~0.60 and is within striking distance of its 2023 lows. Ahead of tonight’s BoE meeting (9pm AEST), AUD/GBP (now ~0.5143) touched its lowest level since May 2020, while AUD/JPY and AUD/CNH have declined by ~1-1.2% from where they were tracking this time yesterday.

On the local data front the June trade balance and Q2 retail sales volumes are released today (11:30am AEST). The latter is set to show another sizeable fall in retail volumes, confirming the slowdown in consumer spending that is coming through, and supporting the view that further RBA rate rises aren’t likely. As outlined over the past few days, this, combined with our thoughts that the upcoming US jobless claims data (10:30pm AEST), US services ISM (12am AEST), and US labour market report (released Friday) risks coming in stronger than predicted, and the negative seasonal bias for the AUD and other risk/growth-linked assets in August, may continued to exert downward pressure on the AUD near-term.

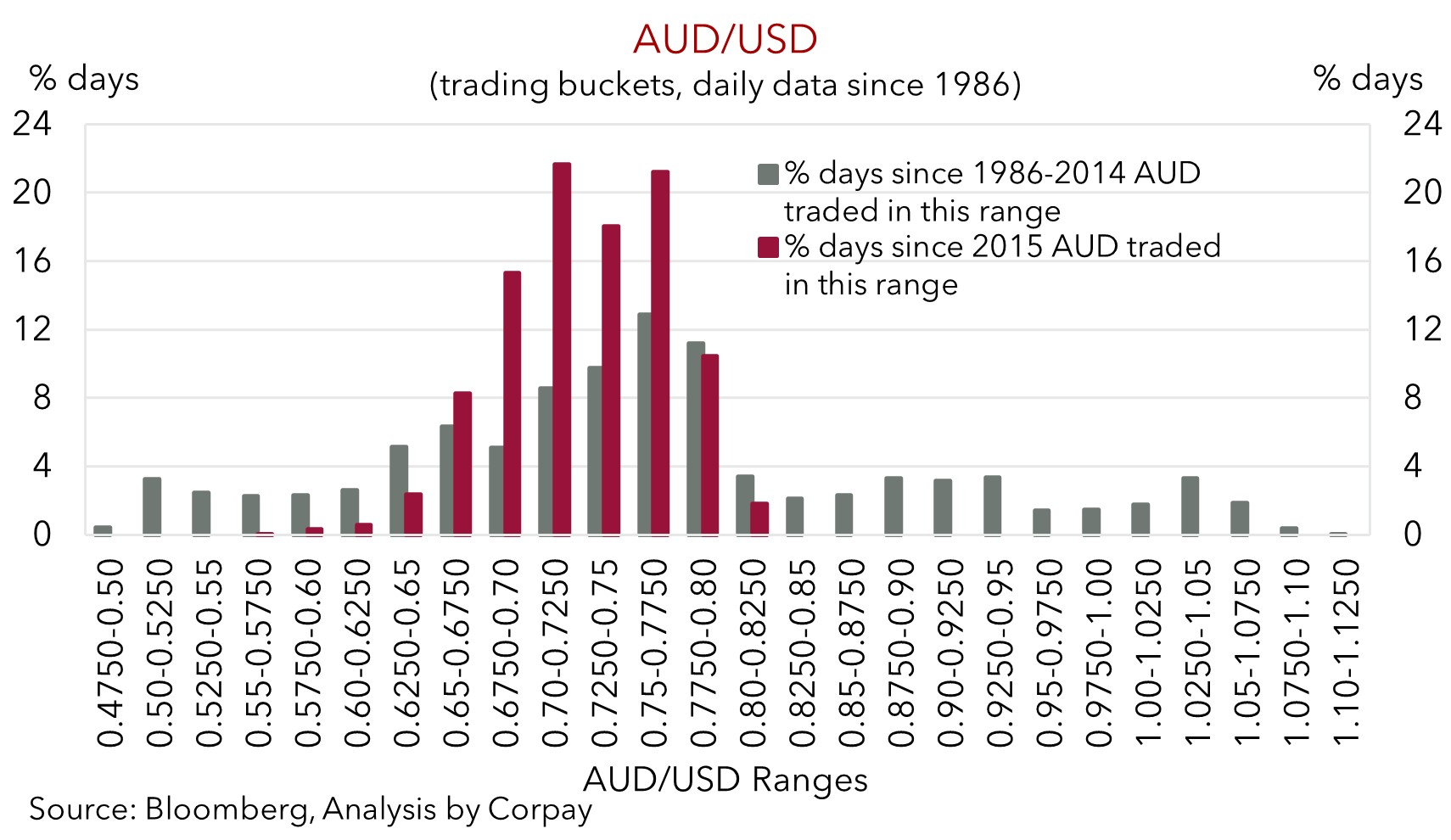

However, as we have flagged previously, while we believe the AUD is in for a few more tricky months as the slowdown in global industrial activity gathers pace, we don’t want to be overly bearish around current levels. Fundamental supports such as Australia’s current account surplus (now ~1.4% of GDP) and the high level of the terms-of-trade should act as downside cushions. As our chart illustrates, since 2015, when these forces kicked into gear, the AUD has only traded sub-$0.6550 ~4% of the time. Looking ahead seasonal trends should become more positive for the AUD (and negative for the USD) later this year. This, in our view, looks set to coincide with China’s economy picking up steam as growth-supportive policy measures are pushed through.

AUD event radar: US ISM Services (Tonight), Bank of England Meeting (Tonight), US Jobs (Fri), US CPI (10th Aug), AU Wages (15th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), RBNZ Meeting (16th Aug), UK CPI (16th Aug), AU Jobs (17th Aug), Japan CPI (18th Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

AUD levels to watch (support / resistance): 0.6403, 0.6500 / 0.6664, 0.6732

SGD corner

USD/SGD’s upswing has continued, with the bout of risk aversion, higher US bond yields on the back of a better than predicted ADP employment report, and stronger USD pushing the pair above ~$1.34 for the first time since 12 July (see above). On the crosses, EUR/SGD (now ~1.4680) has remained range bound, with EUR and SGD both losing ground to the USD. SGD/JPY has dipped back under ~107, although this is still a historically high level.

As discussed, we expect recent trends to continue over the near term. Data wise, US jobless claims and the ISM services gauge are released tonight, with non-farm payrolls closing out the week on Friday. We believe the US data risks exceeding analyst expectations. If realised, this could see pricing for another US Fed rate rise lift and/or see future rate cut bets pushed out, supporting the USD (and USD/SGD). USD/SGD is currently tracking just under its 200-day moving average (~$1.3440).

SGD event radar: US ISM Services (Tonight), Bank of England Meeting (Tonight), US Jobs (Fri), US CPI (10th Aug), China Activity Data (15th Aug), US Retail Sales (15th Aug), UK CPI (16th Aug), Japan CPI (18th Aug), Singapore CPI (23rd Aug), Eurozone PMIs (23rd Aug), Jackson Hole Symposium (24-26th Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3443, 1.3510