• European growth. EUR lower after Eurozone PMIs underwhelm. The shift in relative yield differentials supported the USD.

• China Politburo. The leadership acknowledged the “difficulties”, & while it signaled it may inject fresh stimulus, no concrete measures were unveiled.

• AUD events. Australia Q2 CPI due tomorrow, with the US Fed rate announcement & Chair Powell’s press conference on Thursday morning.

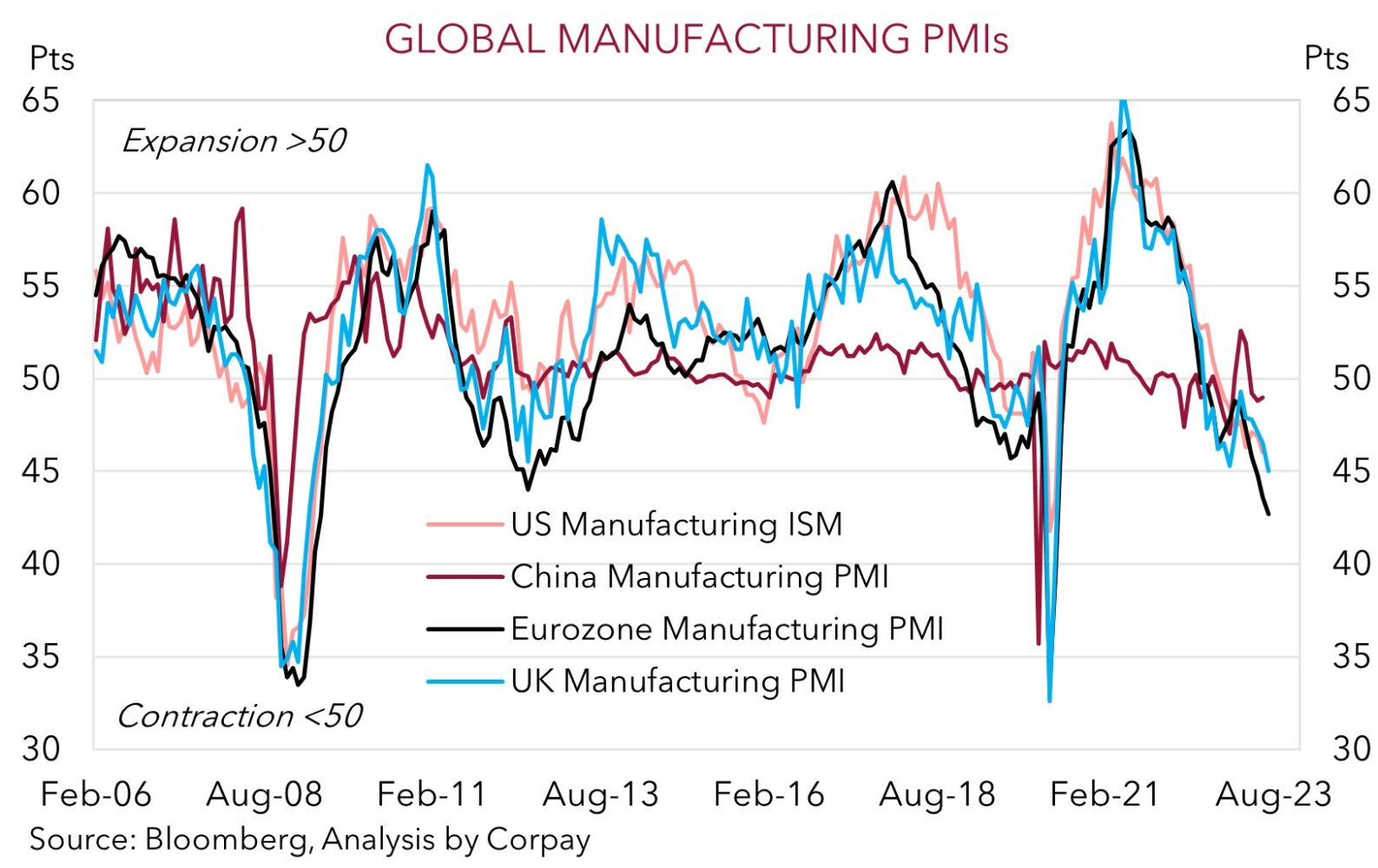

Mixed performance across markets overnight, with divergence in the US and European business PMI data in focus. The impact of the rapid-fire policy tightening is bubbling to the surface. In Europe, falls in the PMI suggest growth momentum has slowed further, with manufacturing underperforming. The Eurozone manufacturing PMI fell to 42.7, its lowest since 2020. The deceleration in services also extended, though at 51.1 services remain in ‘expansionary’ territory. There were similar falls in the UK PMIs. That said, while the activity components were soft, price metrics on the services side remain elevated and point to core inflation holding up. By contrast, the US manufacturing PMI exceeded expectations, rising back up to 49, and although services slipped back (now 52.4) the sector is still expanding.

Despite the signs of slowing global growth, US equities gained (S&P500 +0.4%), while the major European indices edged a bit lower (EuroStoxx50 -0.2%). There was a similar performance in bonds, with European yields falling (German 10-year dipped ~5bps to 2.41%), and US yields ending the day higher after unwinding earlier declines. On net, the US 10-year rose ~4bps (now 3.87%). In FX, the shift in relative interest rate expectations in favour of the US gave the USD index more support. Growth concerns weighed on the EUR (now ~$1.1065, -0.6%) and to a lesser extent GBP (now $1.2826, -0.2%). USD/JPY is hovering around ~141.50, while AUD consolidated just above its 200-day moving average (~$0.6722).

In China, the Politburo (the top decision-making body of China’s Communist Party) released a memo following its mid-year meeting. The leadership acknowledged “new difficulties” in economic development, called for actively expanding domestic demand, and in a signal that targeted measures to prop up the sluggish property sector are possible the mantra that “housing is for living, not for speculation” was removed. The comments support our thinking that more stimulus measures to reinvigorate China’s faltering recovery are likely over coming months. However, unlike the big bang post GFC infrastructure push, a more measured response aimed at fostering labour-intensive consumption growth (which may include steps to encourage greater housing turnover) and bringing down youth unemployment are anticipated.

The global calendar is fairly limited today with the German IFO, ECB bank lending survey (both 6pm AEST) and US consumer confidence (12am AEST) due. We expect the USD to remain firm leading into the US Fed meeting (Thursday 4am AEST). As stated yesterday, another 25bp rate Fed rate hike is predicted, so guidance from Fed Chair Powell about the outlook will be of more interest. While headline inflation has started to cool, underlying price pressures remain uncomfortably high, a function of still tight labour markets. As such, we think Chair Powell could reiterate that the inflation fight isn’t over, that the door to further tightening is open, and that thoughts of rate cuts are some ways away. In our opinion, a “higher for longer” rhetoric could rattle market nerves and support the USD.

Global event radar: US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US GDP (Thurs), Bank of Japan Meeting (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), US ISM (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

AUD corner

The AUD has held up in the face of a firmer USD, with the uptick in energy prices (Brent crude +2.1%) and US equities (S&P500 +0.4%) providing a bit of support. At ~$0.6740 AUD/USD is trading just above its 200-day moving average. Some relative outperformance against the major European currencies following the weaker Eurozone and UK PMI data also helped the AUD (see above). AUD/EUR has bounced back up to ~0.6090 (+0.7%), while AUD/GBP is near ~0.5255 (+0.4%).

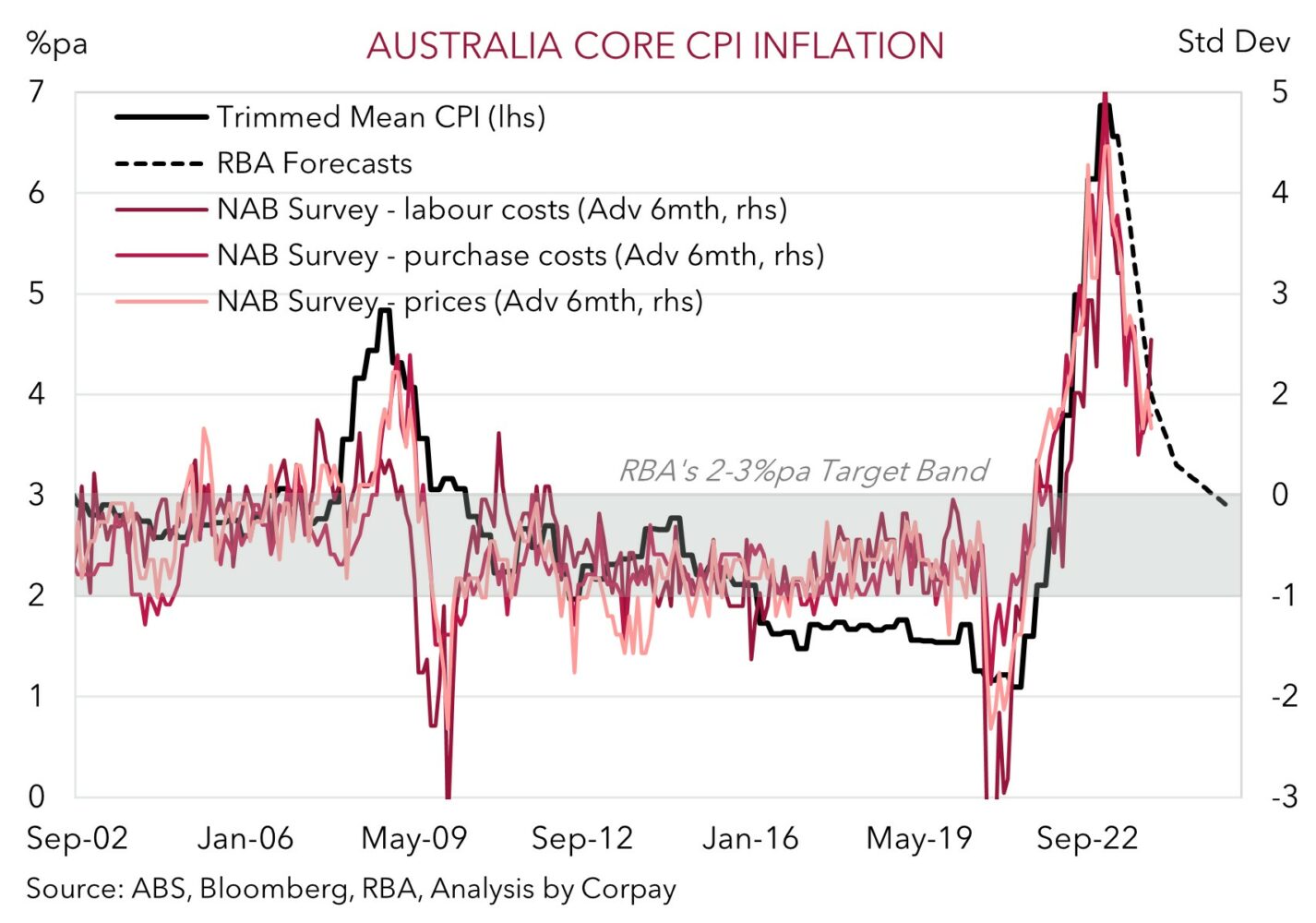

Given the top tier local and global economic data, and offshore central bank meetings on the schedule, we think AUD volatility should pick up as this week rolls on. On balance, we remain of the view that the events are likely to keep the AUD on the backfoot. Locally, Q2 CPI (Wednesday) is the next key release, with June retail sales due on Friday. In terms of inflation, the rolling off of some of last year’s large price rises and other factors such as government energy rebates are expected to pull down inflation. Markets and the RBA are looking for headline inflation to drop from ~7%pa to 6%pa, with core inflation also projected to ease to ~6%pa. In our view, such a result (or lower) may see RBA rate rise bets trimmed back, which in turn may weigh on the AUD.

Offshore, the next major focal points are the US Fed meeting (Thursday 4am AEST) and Chair Powell’s press conference (Thursday 4:30am AEST). As mentioned, we and the overwhelming market consensus expect the Fed to deliver another 25bp rate hike this week. Hence, what Chair Powell says about the future should be more market moving. While US inflation is improving, we think the still tight labour market conditions and robust wage growth point to the Fed maintaining a somewhat ‘hawkish’ stance. The central view among the FOMC put forward in June is for two more rate hikes this year. Markets still aren’t pricing that in, and look to be too eager to factor in the next easing cycle. In our judgement, comments by Chair Powell reiterating that the Fed is open to another hike, and/or that cuts aren’t likely for some time, could see rate expectations tick up, supporting the USD.

AUD event radar: AU CPI (Weds), US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US GDP (Thurs), Bank of Japan Meeting (Fri), AU Retail Sales (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug), US ISM (2nd Aug), NZ Jobs (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

AUD levels to watch (support / resistance): 0.6692, 0.6720 / 0.6781, 0.6850

SGD corner

USD/SGD has continued to grind higher, with the firmer USD on the back of the relatively sturdier US PMI data and shift in bond yield differentials in favour of the US the driver (see above). At ~$1.3320 USD/SGD is at its highest since mid-July. On the crosses, the softer EUR has seen EUR/SGD slip back (now ~1.4735), while SGD/JPY (now ~106.25) remains within striking distance of its cyclical highs.

As outlined, we believe volatility could lift later this week with the US Fed (Thursday), ECB (Thursday), and BoJ (Friday) all meeting. In terms of the US Fed, we are looking for another 25bp rate hike, but think there are risks Fed Chair Powell sounds more ‘hawkish’ than markets expect given the still low US unemployment rate and high/sticky core inflation. In our view, a message from Chair Powell that another rate hike is still possible and/or that policy easing is not being thought about could see USD/SGD nudge up, particularly with Singapore inflation cooling. This suggests that the (eventual) next step by the MAS could be to ease its policy stance. In June Singapore core inflation fell to 4.2%pa, a low since May 2022. A further slowdown in Singapore core inflation is expected over coming months as restrictive policy and a weaker growth pulse work their way through the economy.

SGD event radar: US FOMC Meeting (Thurs), Fed Chair Powell Speaks (Thurs), ECB Meeting (Thurs), US GDP (Thurs), Bank of Japan Meeting (Fri), US PCE Deflator (Fri), US Employment Cost Index (Fri), China PMIs (31st July), Eurozone GDP & CPI (31st July), RBA Meeting (1st Aug), US ISM (2nd Aug), Bank of England Meeting (3rd Aug), US Jobs (4th Aug).

SGD levels to watch (support / resistance): 1.3140, 1.3200 / 1.3377, 1.3434