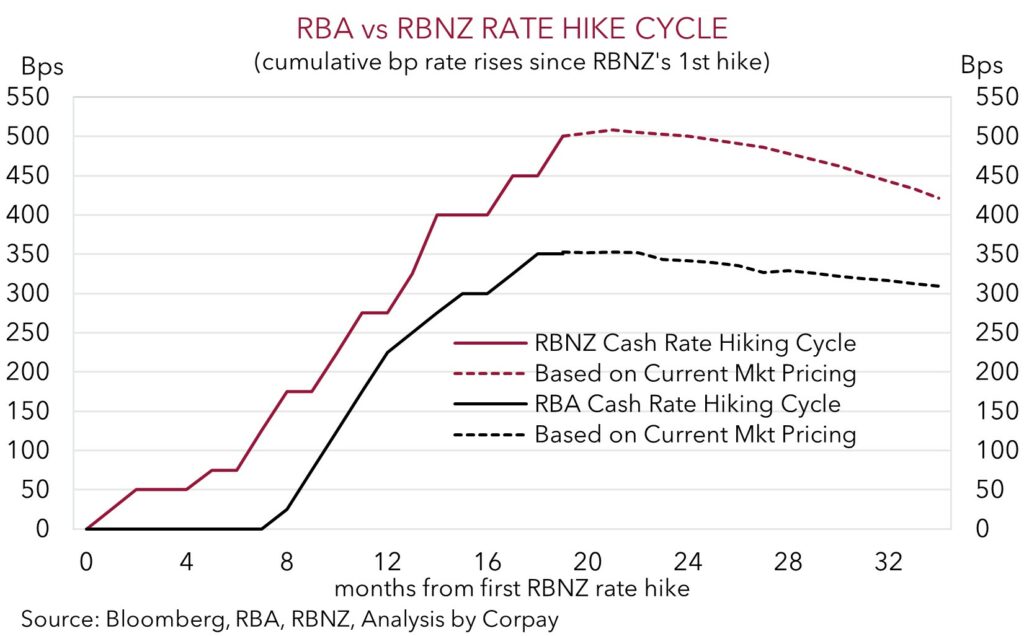

AUD/NZD has slipped below ~$1.0630, touching a new 2023 year-to-date low in the wake of the diverging RBA and RBNZ decisions and shift in relative interest rates. The policy-driven Australia-NZ two-year swap spread has slumped to -175bps, the most negative since mid-2007. In contrast to the RBA who ‘paused’ its rate hike cycle and softened its conditional tightening bias at its April meeting (see Market Wire – RBA: over and out), the RBNZ unleashed its inner hawk and delivered another outsized 50bp hike. Consensus expectations were looking for a smaller 25bp lift, so the direction of travel wasn’t surprising, just the size of the move.

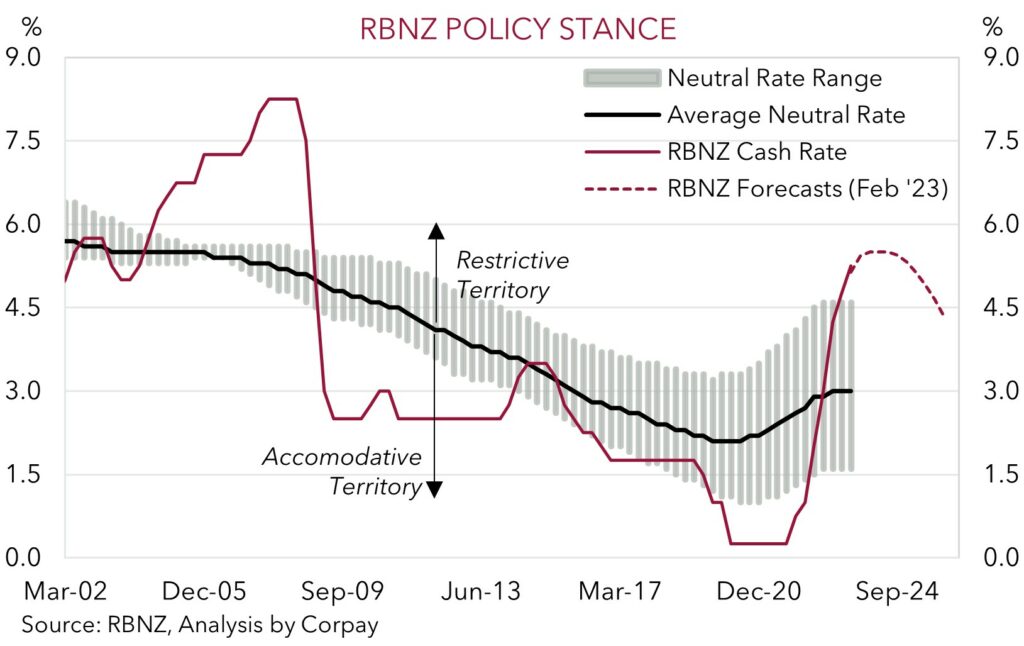

RBNZ Governor Orr has a tendency of shocking markets, this was just the latest example. According to the RBNZ, the larger hike was designed to counteract the fall in wholesale interest rates stemming from the global banking and growth concerns. This had pushed lending rates faced by NZ businesses and households down to levels that the RBNZ seemingly deems weren’t consistent with slowing the economy enough to bring inflation down to target over the next few years.

Even though it provided little in the way of forward guidance, given its resolve to tackle inflation with seemingly little regard to the near-term economic costs, we think the RBNZ is likely to crystallise its February projections and deliver another 25bp hike at the 24 May meeting. However, that should be it when it comes to the RBNZ tightening cycle. Indeed, we believe the RBNZ has already done more than enough, and another move in May is a line ball call given the odds of a policy mistake have jumped up. The RBNZ Official Cash Rate is now 5.25%, a high since 2008. As a result, settings are now very ‘restrictive’.

In our opinion, NZD should remain supported over the near-term as the RBNZ’s larger than anticipated hike is digested. AUD/NZD could linger down near ~$1.05-1.06 for a bit of time. However, over the medium-term we continue to project AUD/NZD to rebound. The last stages of the RBNZ’s interest rate cycle now look well priced. This suggests that the positive impulse on the NZD from RBNZ rate rises should be coming to an end. Importantly, we continue to think that once the tightening phase is over, FX markets will focus more on other relative differentials such as growth, labour market trends, current account positions, and commodity prices. And on these metrics, we judge that the AUD should relatively outperform the NZD.

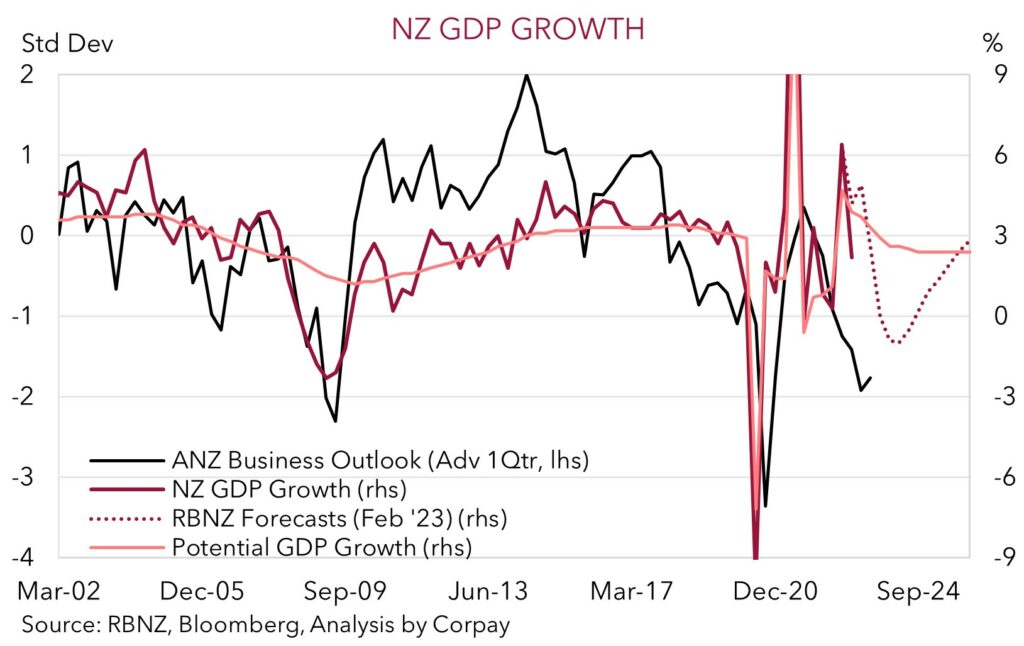

Growth-wise, the RBNZ moved earlier and has been far more aggressive than the RBA. As a result, while both economies look set to slow under the weight of higher mortgage rates and tighter conditions, we expect the NZ to underperform with negative impacts piling up across an economy already on the cusp of another recession. As our chart shows, business surveys are pointing to a sizeable fall in NZ GDP over Q2/Q3. At the same time, the more pragmatic approach and focus by the RBA on trying to keep things on “an even keel”, coupled with reaccelerating population growth could see the Australian economy hold up comparatively better.

In time, we envisage these growth trends to materialize in the respective labour markets, with the more negative outlook for NZ also potentially opening the door to a much earlier RBNZ rate cutting cycle. The RBA remains focused on trying to preserve as much of the labour market strength since COVID as it can. Across the Tasman, the RBNZ is forecasting the NZ unemployment rate to rise from 3.4% to ~5.7% by mid-2025, with the hit to growth and labour market slack the price willing to be paid to squash inflation. Unemployment swings have historically provided a good guide to medium-term AUD/NZD direction, with a relatively lower Australian unemployment rate typically an environment where the AUD is the stronger currency.

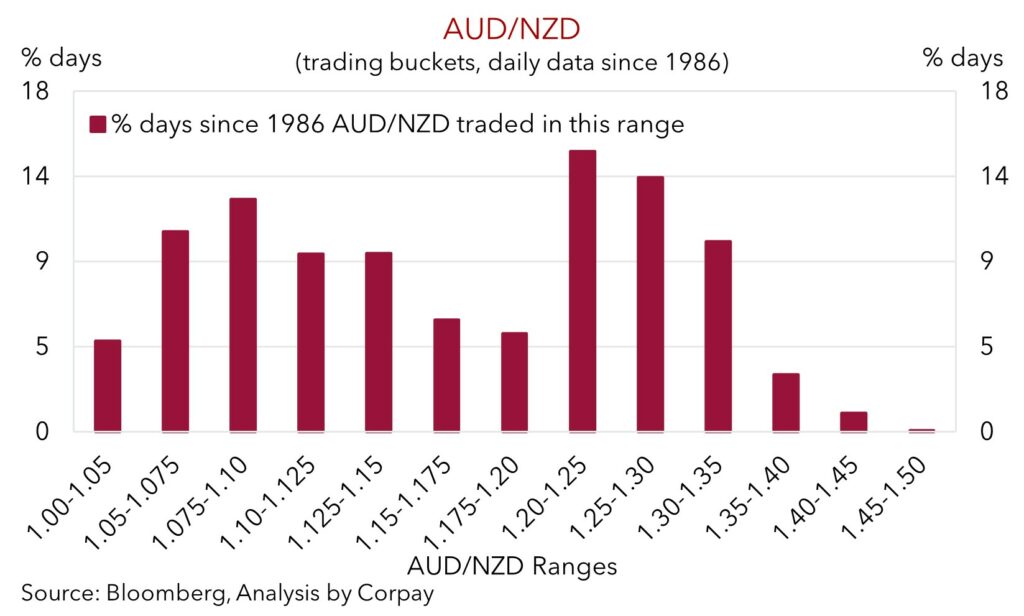

Statistically, AUD/NZD is also now in rarefied air. At ~$1.0620 AUD/NZD is tracking well below its long-run average (~$1.18). Our analysis also finds that since 1986 AUD/NZD has only traded below current levels ~8% of the time. As the focus on interest rate changes gives way to broader macro trends, we believe there is scope for AUD/NZD to snap back sharply as 2023 rolls on.