AUD/JPY has perked up a bit over the past few weeks, with the ~4% rebound since late-March helping push the pair back into positive territory for the year-to-date. In our view, the bounce back in AUD/JPY is unlikely to extend much further, at least not on a sustainable basis, and we would look to use any spikes back into the low- to mid-90s opportunistically. We think the unfolding macro environment is likely to see AUD/JPY fall back down to the mid-80’s over the coming months, largely as a reflection of JPY strength which we believe is likely to come about because of a few factors.

A policy shift by the Bank of Japan

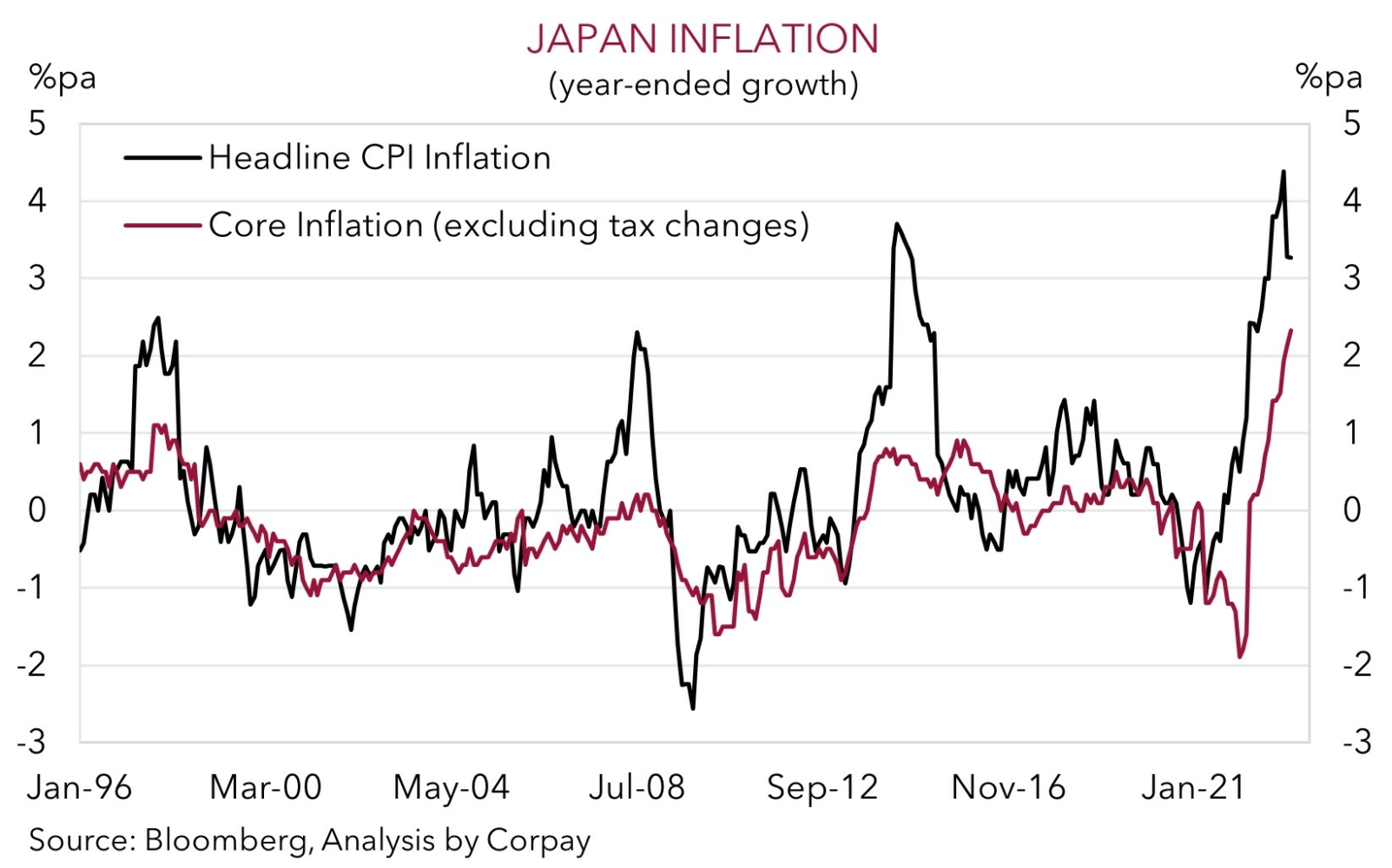

After years of providing wave after wave of extraordinary stimulus to weaken the JPY, boost growth and lift inflation, the stars finally look to be aligning for the BoJ’s policy impulse to change direction. It seems to be a matter of when, not if, meaningful adjustments are made, with the BoJ’s ultra-accommodative policy stance looking increasingly untenable based on the upswing in Japanese inflation and signs wage pressures are building. New BoJ Governor Ueda took the helm earlier this month, with the 28 April meeting his first in charge.

The upcoming meeting should be considered ‘live’, but, on balance, we think large policy changes, such as the removal of yield curve control, and/or ending the negative interest rate regime or asset purchases are more likely to be announced around mid-year, after the Shunto and Rengo wage outcomes are known. However, some tweaks at the late-April meeting shouldn’t be ruled out. At a minimum, we judge that an announcement of a ‘review’ of current measures could be a possible first step on the normalisation path that could see markets start to discount a BoJ policy sea change down the track.

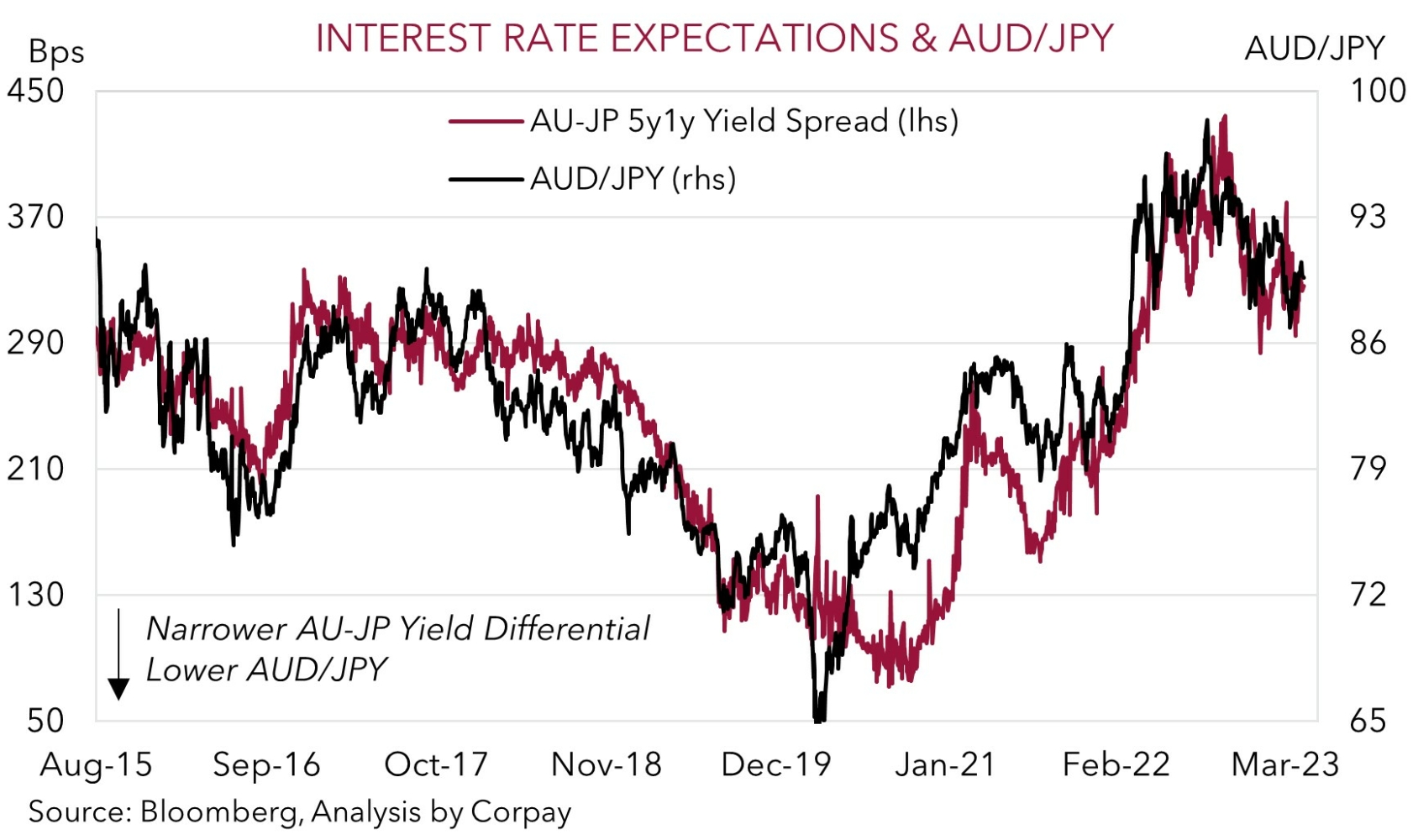

By contrast, the RBA looks to be near, or even at, the end of its interest rate hiking cycle. There are increasing signs the aggressive rate hikes delivered by the RBA over the past year are working to slow spending and activity across the economy. These negative effects should intensify as the large cumulative cashflow hit on the indebted household sector gains traction and the labour market begins to weaken. Over time, the diverging RBA and BoJ policy trends should, in our view, see relative yield differentials shift in favour of a stronger JPY (i.e. lower AUD/JPY).

Japan’s flow dynamics

Japan’s trade and balance-of-payments positions, historically sources of JPY strength, have turned more favourable after a torrid 2022. A large spike in energy prices saw Japan’s goods trade balance move to a deficit exceeding 5% of GDP last year. This, and a big deterioration in Japan’s terms-of-trade, were fundamental forces that weighed on the JPY. However, the pullback in energy prices is beginning to reverse these trends, acting to reinvigorate the JPY.

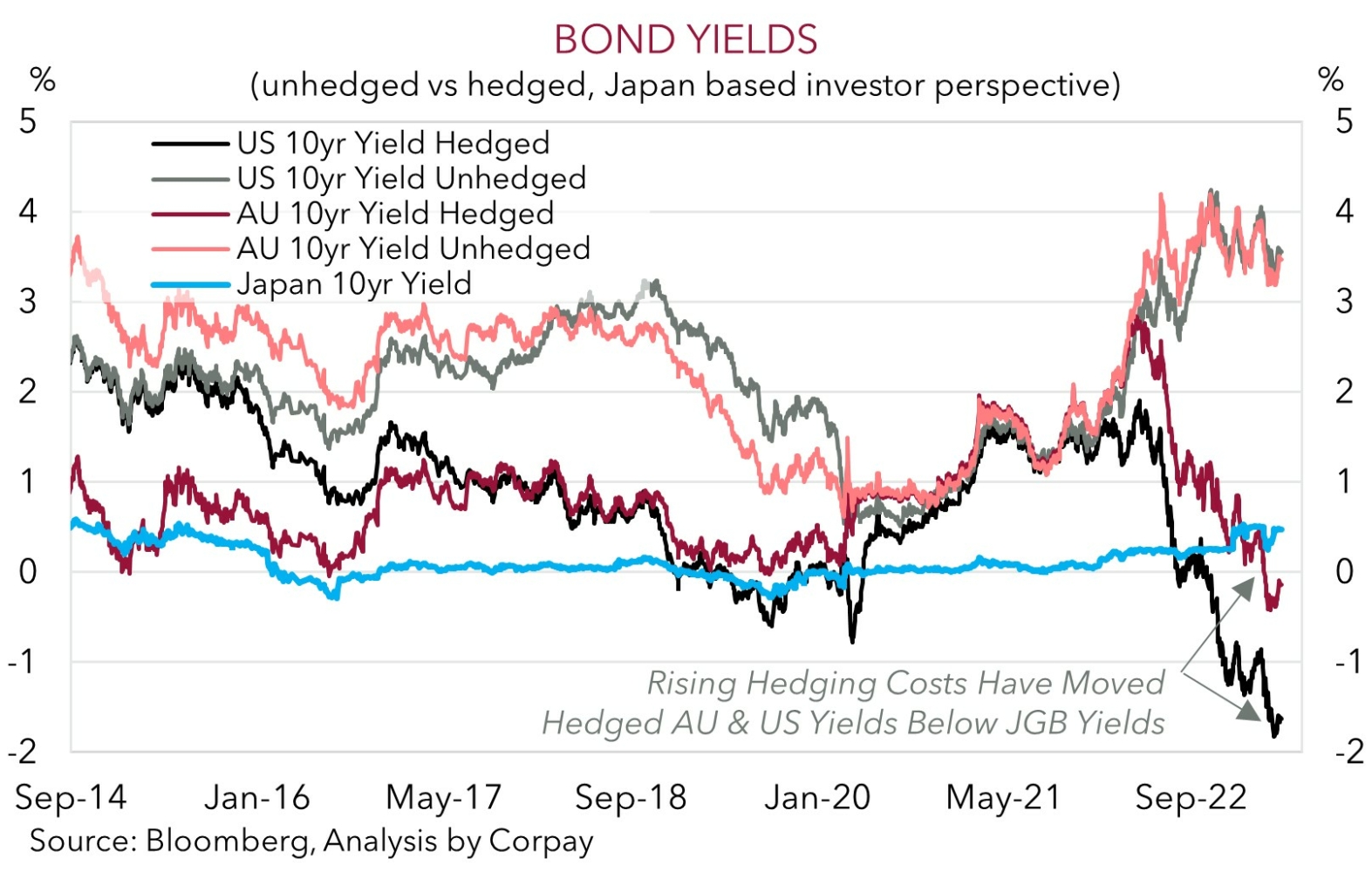

At the same time, the anticipated policy normalisation steps by the BoJ, especially at a time other major central banks look to be in the latter stages of their respective tightening phases, could encourage greater inflows into Japan and/or discourage offshore allocations by Japanese investors. We believe this should be a JPY tailwind. Indeed, as the chart below illustrates, although headline bond yields in places like the US and Australia are tracking above Japanese equivalents, after accounting for the large jump up in hedging costs, from a Japan-based investors perspective, offshore bond investments appear to be becoming increasingly unattractive.

Risk and global growth barometer

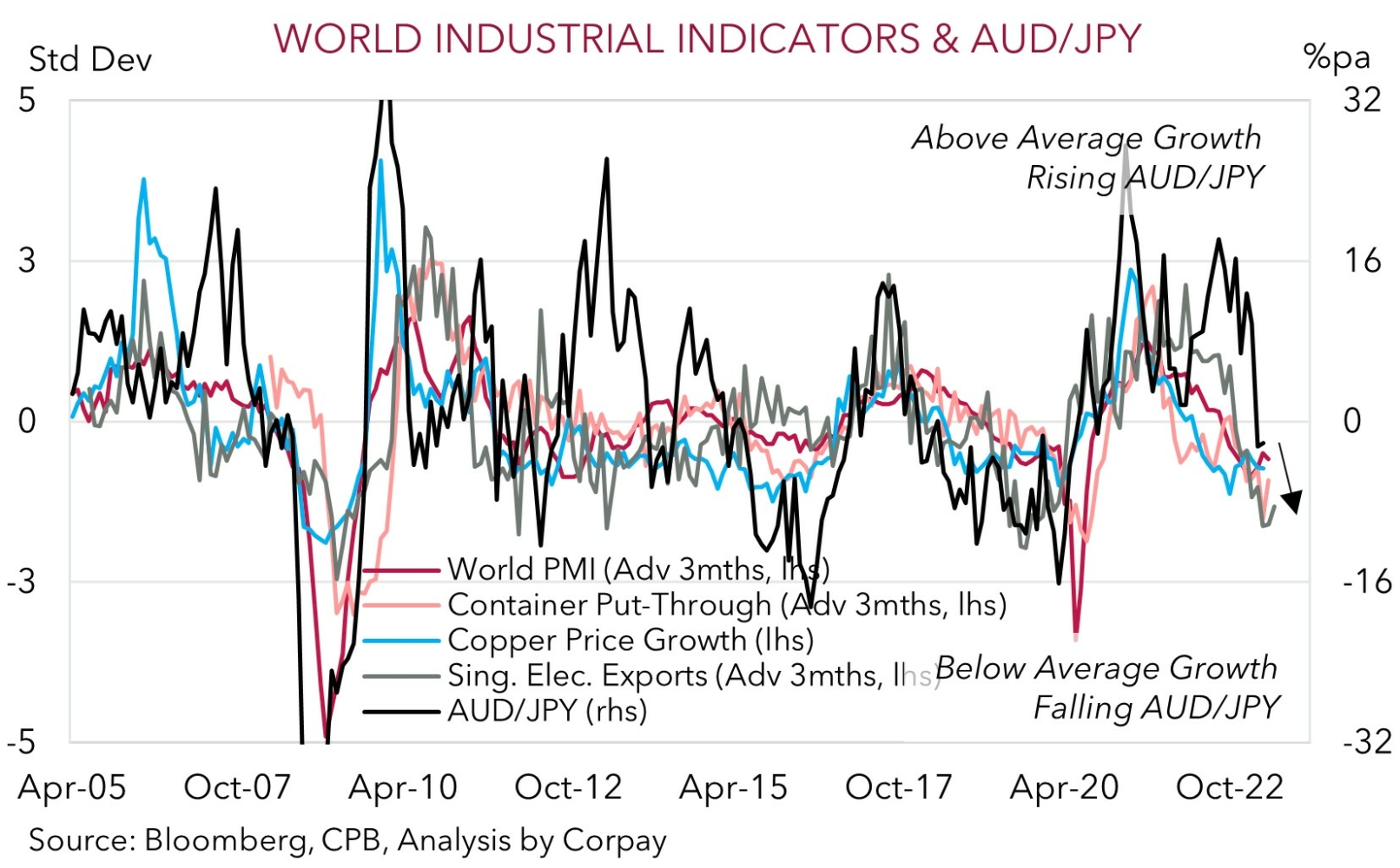

While China’s reopening should help cushion the blow to global growth, recession risks across many major economies remain given the sharp rise in interest rates and cost-of-living pressures. In our assessment, the outlook for industrial activity looks particularly troublesome based on China’s focus on supporting services/consumption to boost activity rather than infrastructure investment, the high inventory levels in major economies like the US, and tighter credit conditions which should constrain demand for ‘discretionary goods’.

A range of forward-looking indicators we track point to a further step down in global industrial activity over the next few months. This, and our expectation that further bouts of market volatility are probable as the ‘aftershocks’ of the most abrupt global tightening cycle in several decades continue to manifest, is normally a negative backdrop for AUD/JPY (see Market Musings: Buckle up, volatility should continue).