Markets have hit an air pocket, with bonds in particular experiencing some extreme moves over recent days in reaction to the unfolding US regional banking situation. In our mind, the rather forceful emergency support measures unveiled yesterday by the US FDIC, Fed, and Treasury should help contain broader financial contagion risks. That said, while this should be somewhat of a short-term circuit breaker, and suggests that the scale and speed of the adjustment in some markets like bonds and the USD may be overdone, it doesn’t necessarily mean all is right in the world and that further market ructions shouldn’t be anticipated over the period ahead.

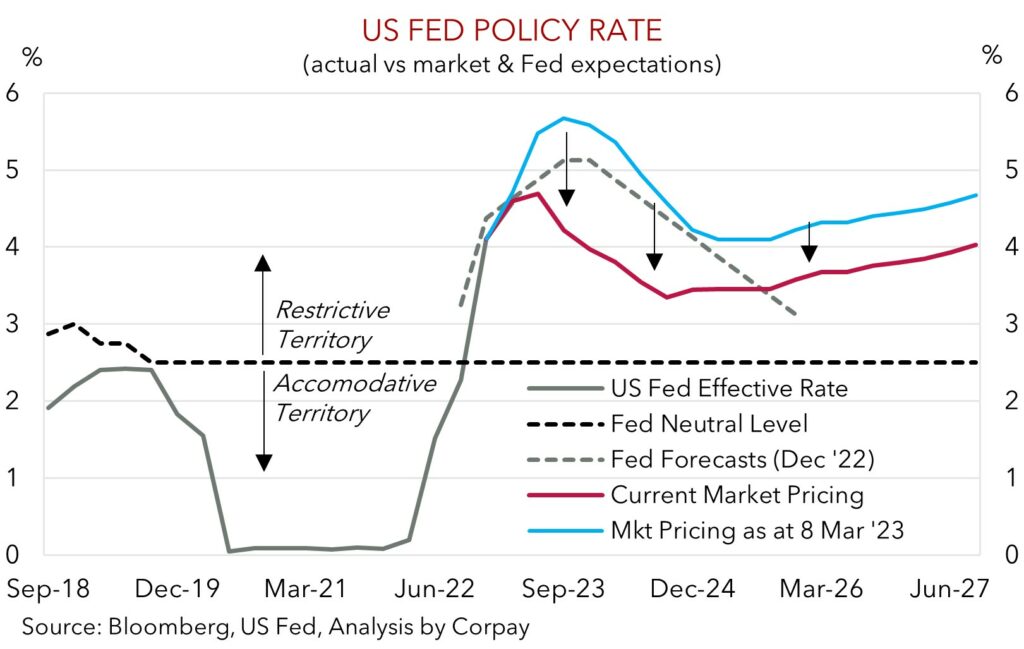

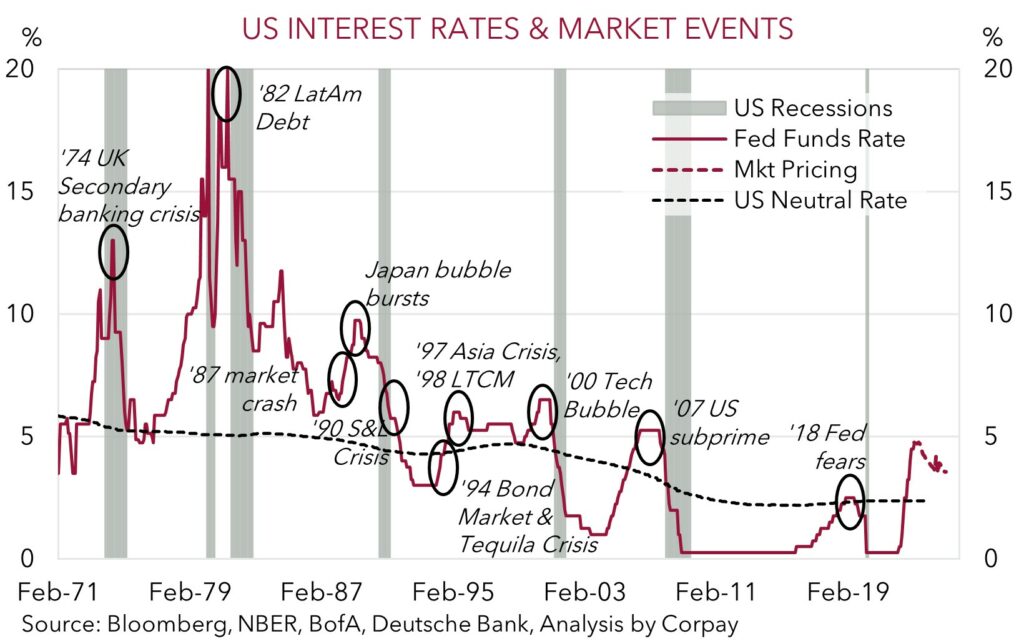

Indeed, while there are some company specific issues, such as poor risk management, that exacerbated the Silicon Valley Bank situation, the US Fed’s aggressive policy tightening and jump up in interest rates in the effort to tame rampant inflation has also played a role. This isn’t unusual. As Warren Buffet famously said, “only when the tides goes out do you discover who’s been swimming naked”. And as our first chart shows, Fed rate hike cycles, especially ones that move settings well into ‘restrictive’ territory (as the current one has) have a long history of exposing vulnerabilities and excesses that have built up in different parts of the system. It would be unrealistic to think that the most abrupt global tightening cycle in several decades, which followed one of the most accommodative periods in history that propelled asset prices higher, wouldn’t generate intermittent market swings.

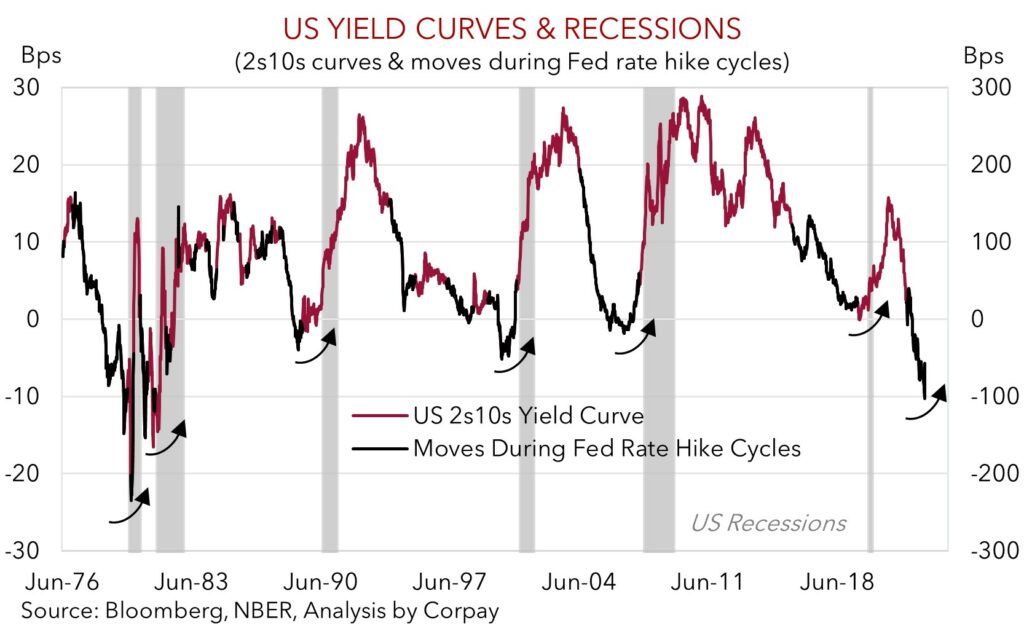

Elsewhere, the shifts in the US yield curve are also notable and should continue to be monitored. The US 2s10s spread has become substantially less negative over the past week as investor nerves about the economic landscape have grown and the next Fed easing cycle has been discounted. As shown, a “bull-steepening” (i.e. short-end yields fall faster than long-end yields) of a deeply inverted US yield curve has proven to be a useful timing tool for an impending US recession. While we don’t agree with the market’s latest Fed assumptions looking for rate cuts near-term (see below), as we outlined previously, from an economic perspective, the yield curve signal looks correct. Given the policy lags we think the die has already been cast and ‘the recession the US has to have’ to defeat inflation is set to materialise from mid-year. All up, recent developments only reinforce our prior thinking that market volatility should remain elevated over the next few months as the macro and market consequences from restrictive policy conditions play out (see Market Musings: Reality check, phase two).

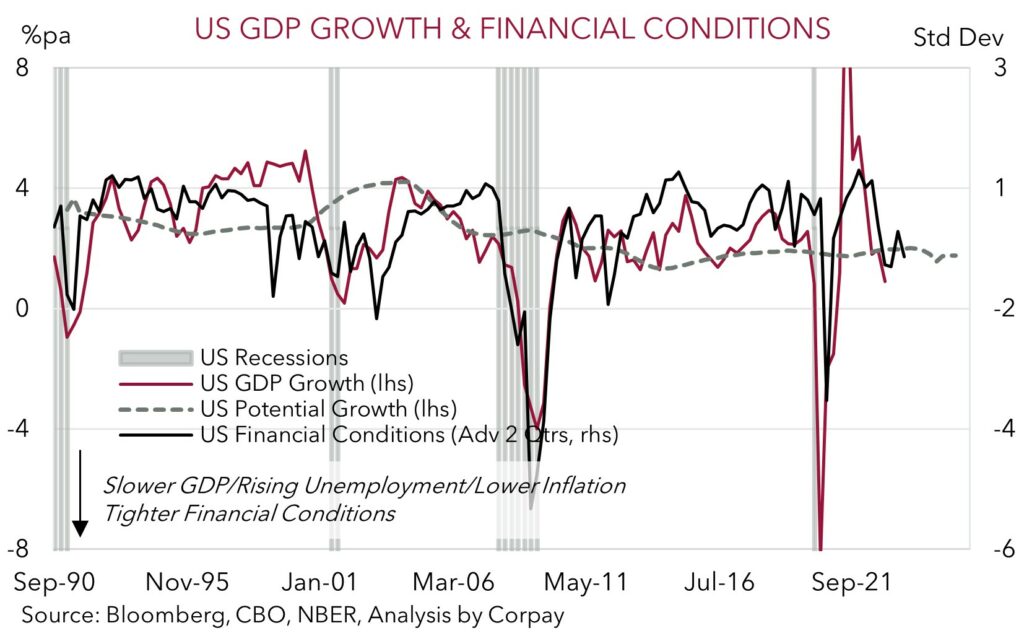

Feeding into our broader underlying volatility views are our thoughts that, in the short-term, markets may have gone too far too fast when it comes to repricing the outlook for US interest rates. In contrast to mid-last week when markets were anticipating ~another 100bps of rate hikes by the US Fed, the current expectation is for the Fed’s next move to be a rate cut around mid-year. This large swing has weighed on the USD. Although we believe the US Fed should tread more carefully from here, given the ‘long and variable’ policy lags, and the case for a temporary ‘pause’ at the 23 March meeting has risen, the inflation dynamics should win out in the end. Our belief is that the US’ sticky services-driven inflation problem still warrants further modest rate rises this cycle. At the very least, we think the higher level of rates may need to be maintained for longer than markets now predict.

In our opinion, the bar for the US Fed to crystallise the markets updated ‘dovish’ thinking and cut rates soon is still quite high. Inflation trends mean the Fed’s reaction function is different to what markets grew accustomed to after the GFC. The current macro backdrop is very different to the post-GFC world when low/stable inflation allowed the US Fed to quickly shift course once growth or financial risks flared up. If anything, we think the measures announced by the Fed and other US authorities, which are designed to quell financial stability concerns, should enable the Fed to also continue its monetary policy fight against inflation. It is too early to make the call that recent developments in parts of the US’ regional banking sector could disrupt broader credit channels and feed through very negatively to the broader US economy.

More generally, in our judgement, a premature loosening in monetary/financial conditions could see US economic activity reaccelerate, which in turn could feed back into the labour market and boost inflation at a time it is still traveling well above the Fed’s 2%pa target. Pivoting too early was the policy mistake central banks made in the 1970’s. This saw inflation come back even stronger a few years later and is an error policymakers are trying to avoid this time around. The UK experience over Q3 2022 may prove to be a helpful guide to how the US Fed could approach things. In response to the bond market dislocation in the wake of the UK mini-budget chaos, the Bank of England intervened to manage financial stability risks, yet continued to raise the bank rate once things settled down due to high inflation. Based on recent trends we believe that a rebound in US interest rate expectations could provide some renewed support for the beleaguered USD. Although it may also add to volatility across other markets and/or further dampen risk sentiment. These are all headwinds for pro-cyclical currencies such as the AUD, NZD, and Asian FX which, in our thinking, are at risk of underperforming over the near-term.