• Positive tone. Equities & commodities higher. US bond yields rose. EUR, GBP & NZD firmer while the AUD has range traded over the past 24hrs.

• China & tax cuts. Policymakers in China cut the RRR. Locally, changes to stage 3 tax cuts could see more relief flow to low/middle income earners.

• ECB & US GDP. No change expected from the ECB. But will it push back on rate cut pricing? US GDP should confirm another solid quarter of growth.

A generally positive mood across markets overnight. Equities rose with the S&P500 (+0.2%) touching a new record high. The EuroStoxx50 surged (+2.2%) to hit its highest level since 2001. US bond yields ticked up ~4-5bps across the curve (the benchmark 10yr rate is up at 4.18%) with UK rates also ~2-4bps higher following improvement in the UK PMIs. Across commodities, WTI crude increased ~1% while industrial metals like copper (+1.7%) and iron ore (~3%) powered ahead on the back of macro and policy developments. At ~US$136/tonne iron ore is over 30% above its ~5-year average. In FX, the USD index lost some ground to be back where it was earlier in the week. EUR rebounded up towards ~$1.09, GBP is north of ~$1.27, and USD/JPY dipped (now ~147.60). By contrast, the CAD underperformed post the BoC announcement (see below). Elsewhere, USD/SGD has drifted below ~1.34, and after pushing higher during European trade the AUD subsequently eased to be little changed from this time yesterday (now ~$0.6576).

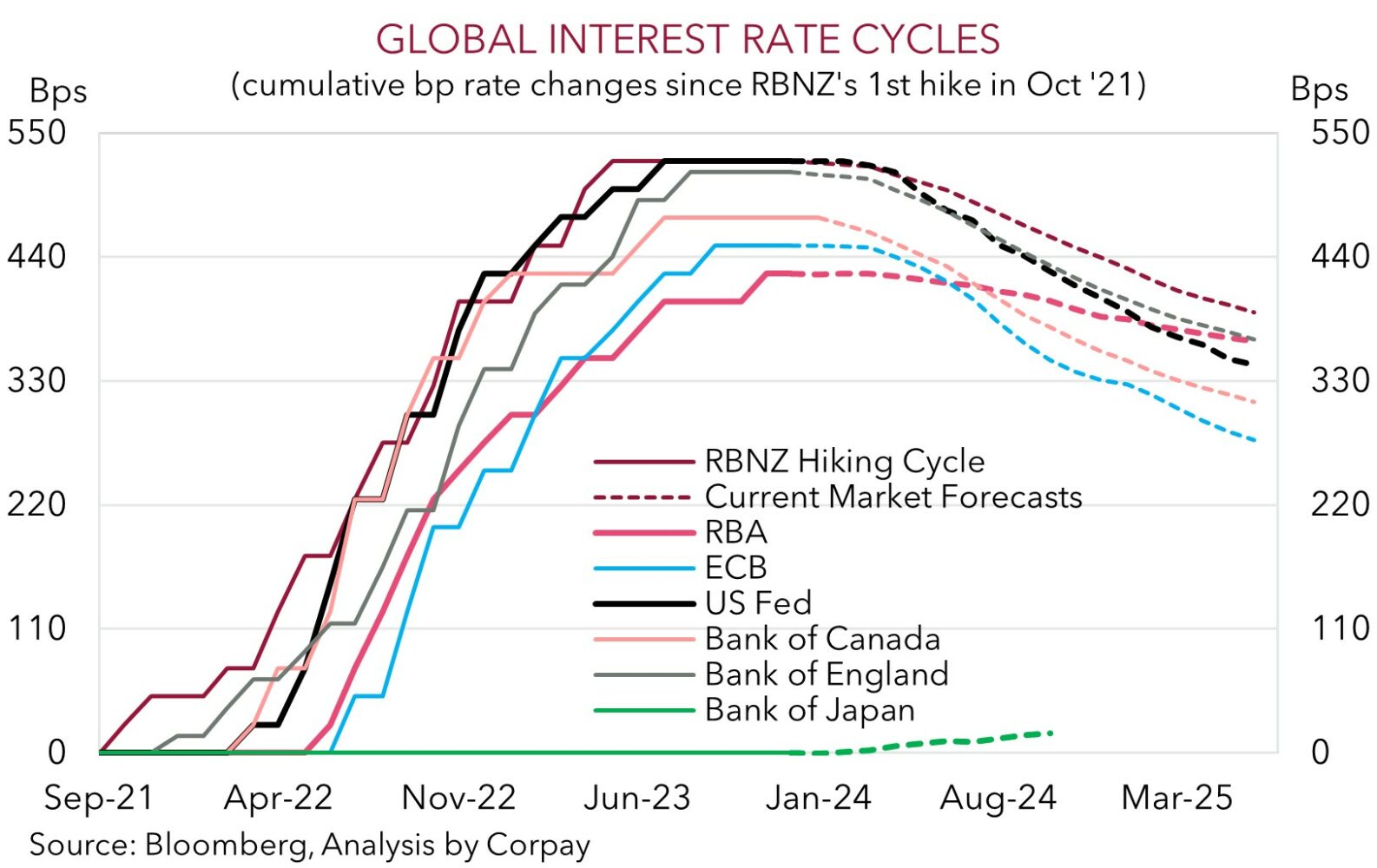

There were a few catalysts behind the relatively upbeat tone. In China policymakers pulled more policy support levers. In a surprise move, for the first time since September, the PBoC announced it would cut the Required Reserve Ratio by 50bps to 7% and hinted more measures could follow. The latest RRR reduction will unlock ~CNY 1trn in liquidity ahead of the Lunar New Year holidays and large government bond issuance in the pipeline. In Canada, as expected the BoC kept rates steady at 5%, however it shifted from a ‘tightening’ to a ‘neutral’ bias with focus no longer on whether policy is restrictive enough but rather how long settings will need to be maintained. The tweaks reinforced views that the next move by major central banks will be to cut rates, with the timing the uncertainty. As our chart shows, markets are factoring in a similar easing path for most central banks with a full 25bp reduction generally priced in around May/June. Data wise there was also encouraging signs across the business PMIs. Although the Eurozone measures remained in ‘contractionary’ territory, manufacturing improved with an upturn in several forward-looking components. The UK and US manufacturing and services gauges also lifted, with services moving further into ‘expansion’.

Tonight, market attention will be on the ECB decision and press conference (12:15am and 12:45am AEDT), the first estimate of Q4 US GDP and weekly jobless claims data (12:30am AEDT). The US PCE deflator (the Fed’s preferred inflation gauge) is released tomorrow night. The data flow points to a potential burst of USD volatility. Although we think confirmation of another solid quarter of US growth might generate some intra-session USD support (mkt 2%saar), on net, push back by the ECB on near-term rate cut pricing given lingering wage/inflation concerns could be a more influential driver which sees EUR rise (and USD fall) over the day.

AUD corner

The AUD continues to oscillate around its 200-day moving average (~$0.6579), with the move up in yesterday’s European trade post the latest stimulus announcement from China fading as US bond yields rose and equities drifted from their highs. On the crosses, AUD/NZD has remained on the backfoot (now ~1.0760) with the stickiness in NZ domestic/non-tradables inflation tempering views that the RBNZ could be quick to cut interest rates this year. The AUD also underperformed the EUR and GBP by ~0.3% with the general improvement in the business PMIs generating support for the European currencies. At ~0.6040 AUD/EUR is tracking below its 100-day moving average with tonight’s ECB decision a potential catalyst for it to fall back a bit further in the near-term if we are right in thinking policymakers might lean against expectations assuming a high chance rate cuts start in H1.

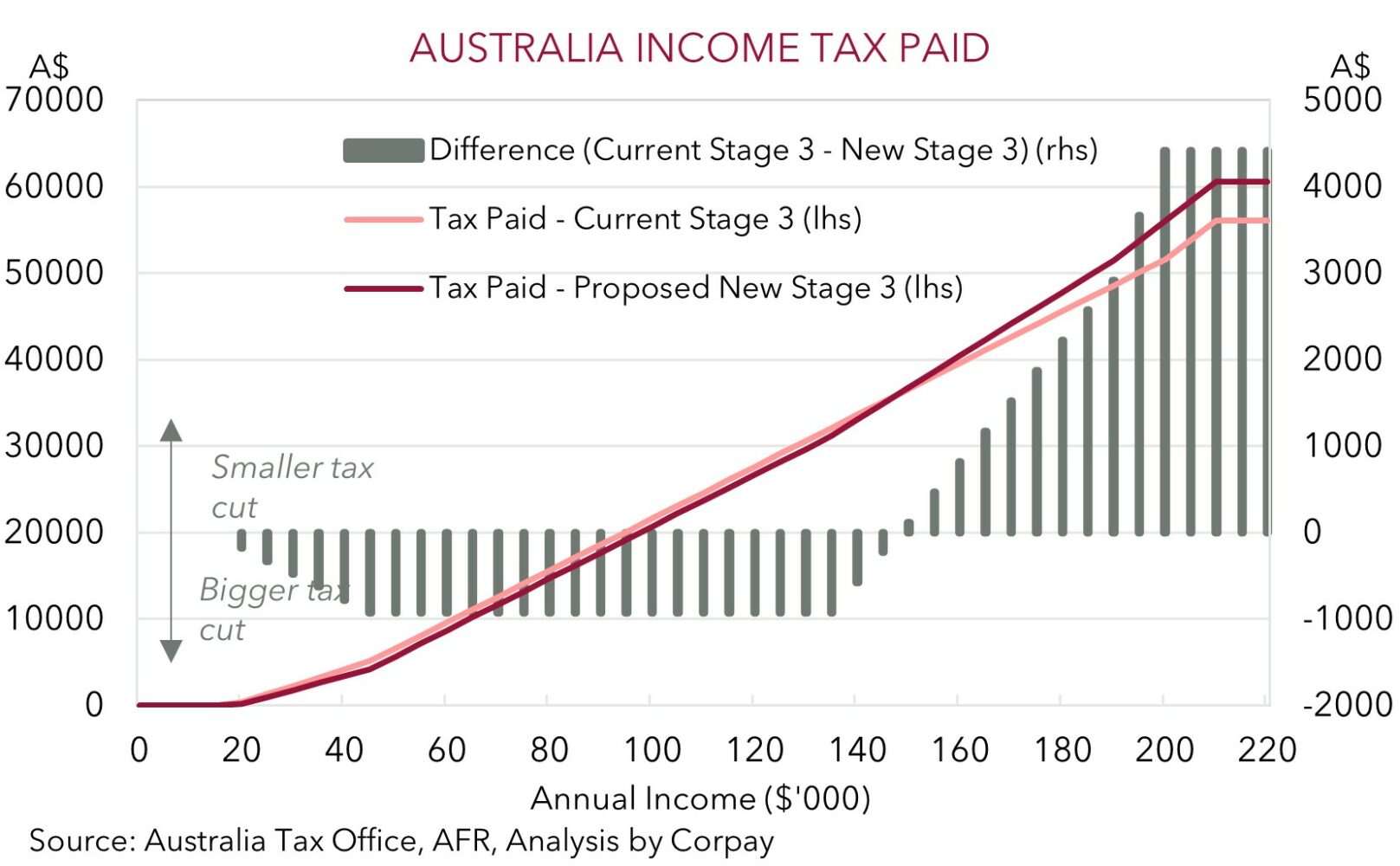

Locally, media focus has been on the mooted changes to the incoming stage 3 tax cuts. As the chart below illustrates, income support is still set to flow, but based on media reports, the distribution is changing. Low to middle income earners look set to receive more support while people earning over ~$150,000/pa won’t get as much tax relief as they would under the current set up. Our general thoughts have been that the incoming stage 3 tax cuts (which are estimated to be worth the equivalent of ~2 rate cuts across the household sector) would be one of the reasons why the RBA lags its global counterparts in terms of when it starts and how far it goes during the next easing cycle and this should see short-dated yield differentials move in favour of a higher AUD over the medium-term. Arguably, we believe the proposed adjustments might make the RBA’s a little tougher given low to middle income earners typically have a higher propensity to consume and this is a larger/growing share of the burgeoning population. At the margin, aggregate consumer spending and the labour market may hold up better and this in turn means it takes core inflation longer to return to the middle of the RBA’s target band.

Over the near-term, as discussed above, market focus will be on any further stimulus measures out of China, the ECB meeting and press conference (12:15am and 12:45am AEDT), and Q4 US GDP (12:30am AEDT) with the US PCE deflator (the Fed’s preferred inflation measure) due tomorrow night. More short-term bouts of AUD volatility are possible given the list of events. But, on balance, we think the evolving backdrop should see the find support and nudge up if, as we anticipate, the USD softens on the back of the ECB closing the door on the prospect of a rate cut at upcoming meetings and/or the US PCE deflator decelerates, reinforcing forecasts looking for the US Fed’s easing cycle to start around mid-year.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6620, 0.6660