• Soft landing? US GDP & PCE inflation data supported ‘soft landing’ views. Growth was better than expected, while inflation pressures continue to ease.

• FX consolidation. Despite the macro signals FX majors have been range bound. USD is treading water, with AUD near its 200-day moving average.

• Event radar. It is a busy week with Eurozone GDP/CPI, China PMIs, Australian inflation, & a range of US labour stats wrapped around the US Fed meeting.

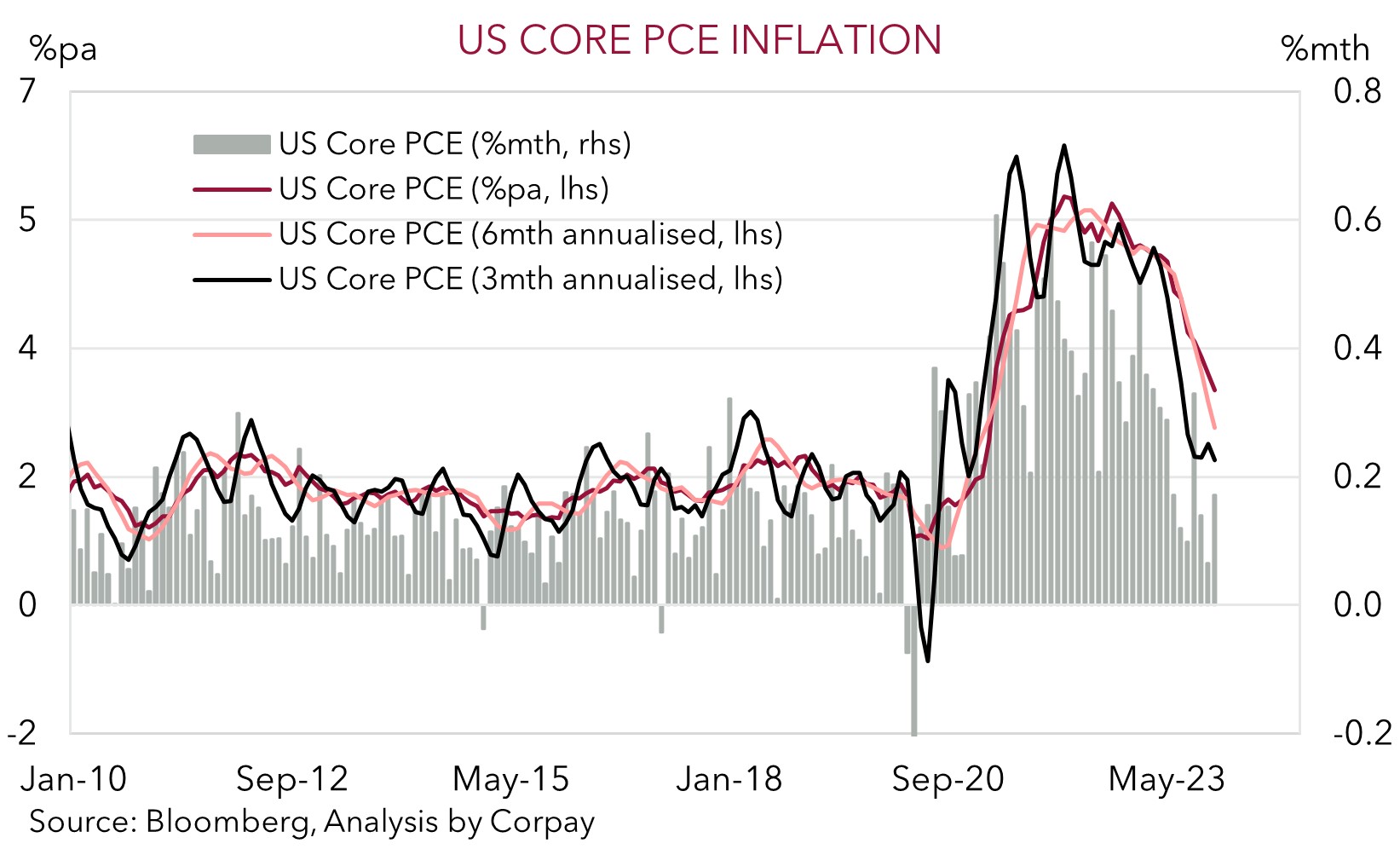

Last weeks economic dataflow supported views the US remains on the very narrow path towards a ‘soft landing’. US GDP exceeded expectations with growth running at a 3.3% annualised pace in Q4 thanks in large part to resilient consumer spending. At the same time US inflation pressures continue to cool. The PCE deflator (the US Fed’s preferred inflation gauge) remained at 2.6%pa, while the core measure (which strips out food and energy) decelerated to 2.9%pa, its slowest pace since early 2021. Notably, as our chart shows, the US’ inflation impulse continues to step down with both the 3- and 6-month annualised run-rates at multi-year lows.

Across markets US equities consolidated with the S&P500 (-0.1%) tracking just under its record highs. On net, bond yields eased over the back end of last week with the benchmark US 10yr rate (now 4.14%) ~5bps under its intra-week peak, and the Germany 10yr (now 2.30%) ~7bps from its highs. In addition to the US releases, Thursday nights ECB meeting was also in focus. As expected, the ECB kept its policy settings steady, though markets took comments by President Lagarde that the bank is “data dependent, not date dependent” as a dovish signal given the weak Eurozone growth outlook and falling inflation. Markets are discounting ~50bps worth of rate cuts by the ECB by the early-June meeting. Despite the macro signals, day-to-day swings in bond yields, and noticeable moves in other asset prices like oil (WTI crude rose another 1.2% on Friday) and industrial metals (copper increased 1.7% last week) FX markets remained range bound. The USD has tread water with EUR oscillating around ~$1.0850 and USD/JPY trading near ~148 (little different from this time last week). And although the NZD drifted a bit lower (now ~$0.6090) the AUD continues to hug its 200-day moving average (~$0.6577).

It is a fairly jam-packed week with several important data points and policy meetings on the schedule which we think could generate further bursts of short-term volatility. Eurozone GDP (Tues) and CPI (Thurs) are due, as are the latest China PMIs (Weds) and Australian inflation (Weds), with the Bank of England also meeting (Thurs). In the US, a range of labour market indicators (JOLTs on Weds, ADP on Thurs, and non-farm payrolls on Friday night) wrap around the Fed meeting and Chair Powell’s press conference (Thurs morning AEDT). In terms of the US Fed no change is anticipated, but with markets still assigning a ~50% chance of a cut by the March meeting, we believe policymakers may push back and stress cuts aren’t imminent. A paring back of near-term rate cut expectations may give the USD some support. However, signs heat is continuing to come out of the US labour market with non-farm payrolls predicted to slow and unemployment forecast to rise should reinforce calls looking for an easing cycle to kick off towards mid-year. If realised we think this may see the USD lose any recaptured ground later in the week.

AUD corner

The AUD continues to hover near its 200-day moving average (~$0.6577). Despite the rise in oil and base metal prices, and still high equity markets, the AUD’s uptick repeatedly ran out of puff last week around the ~$0.6610-0.6620 region. On the crosses the AUD has been mixed. The dovish comments by the ECB at last Thursday’s policy meeting has seen AUD/EUR edge up slightly with the pair wedged between its 100-day (~0.6057) and 200-day (~0.6065) moving averages. AUD/NZD’s post NZ CPI pull-back has also partially unwound with NZD’s retracement pushing the pair back up towards its 100-day moving average (~1.0789).

As mentioned above, there is plenty on the global economic calendar this week which we think could generate more short-term bouts of market and AUD volatility. In the Eurozone Q4 GDP (Tues) and CPI (Thurs) are released, as are the latest China PMIs (Weds). The Bank of England meets (Thurs), and in the US on top of the various labour market indicators (JOLTs on Weds, ADP on Thurs, and non-farm payrolls on Friday night) and manufacturing ISM (Fri) the Fed decision and Chair Powell’s press conference are due (Thurs morning AEDT) . On top of that, locally December retail sales (Tues) and the detailed Q4 CPI (Weds) are scheduled.

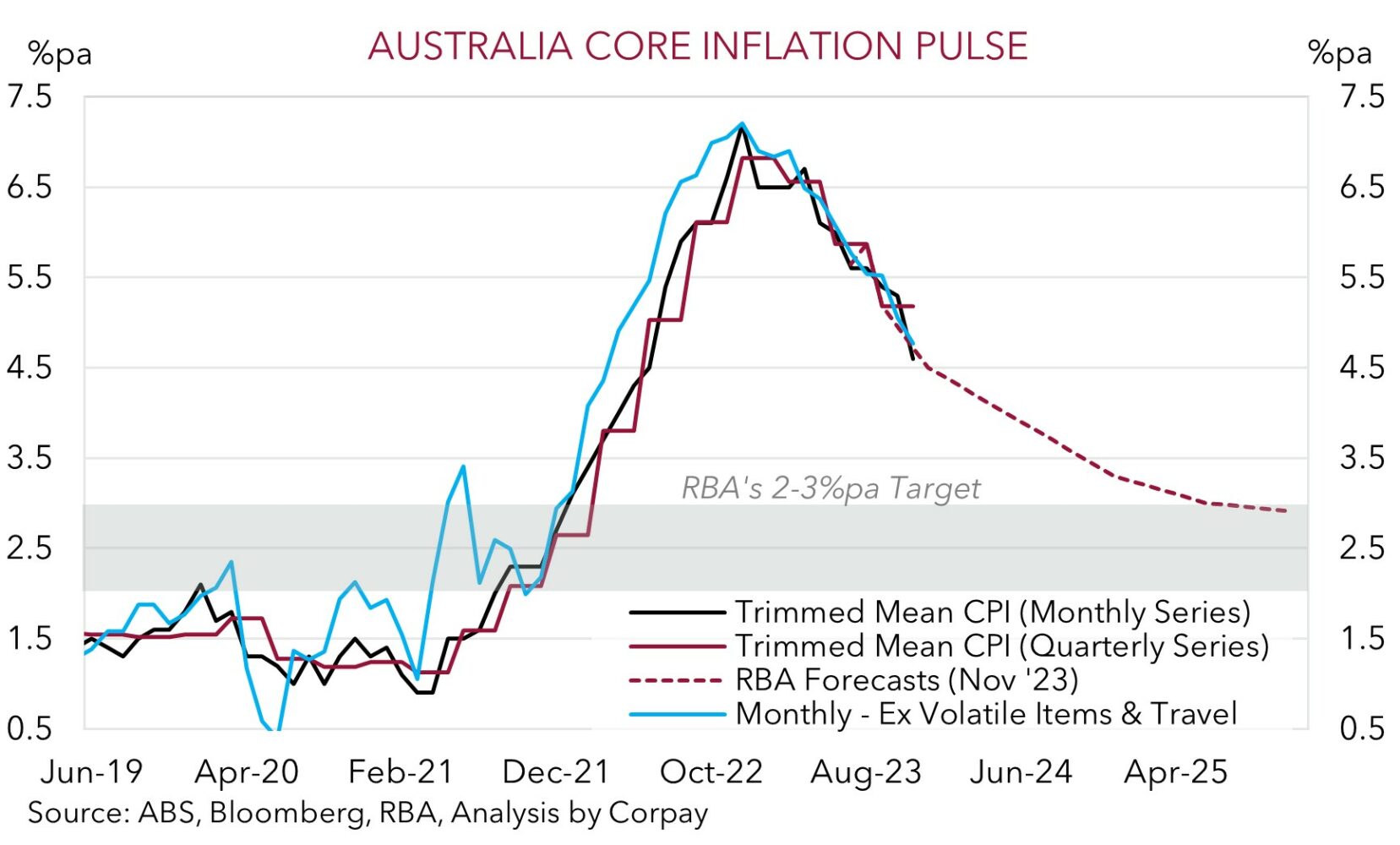

As pointed out in our recent research, bursts of AUD volatility should be anticipated this year as geopolitical risks wax and wane, growth/inflation data deviates from expectations, and interest rate pricing consequently adjusts (see Market Musings: AUD volatility: a taste of things to come?). This is not unusual as turning points in economic cycles are difficult to navigate. Based on the laundry list of macro events on the radar this could be one of those weeks where the AUD is pushed and pulled from day to day as the global and domestic data flows in. Indeed, while we think the AUD should be supported by a pick up in activity in China, the predicted drop in Australian retail sales (mkt -2%) as the bring forward of spending to the Black Friday sales unwinds and slowdown in inflation (mkt 4.3%pa) as falling goods prices, favourable base-effects, and government subsidies flow through could work in the other direction. Similarly, while a push back by the US Fed on near-term rate cut pricing may give the USD a boost we think it is likely to be temporary if as we expect the US labour market shows further signs of cooling. In our judgement, these crosscurrents could see the AUD whipped around within its recent range (i.e. ~$0.6530-0.6630) over coming sessions.

However, on balance, we continue to hold a positive medium-term bias for the AUD with: (a) narrower Australia-US short-dated yield differentials (as the RBA lags the US Fed and other major central banks in the next easing cycle); (b) a sturdier Chinese economy as policy stimulus measures gain traction; (c) support to domestic activity from the incoming tax cuts and larger population; and (d) a paring back of ‘net short’ AUD positioning (as measured by the CFTC futures) forecast to give the AUD a helping hand over the course of this year.

AUD levels to watch (support / resistance): 0.6480, 0.6520 / 0.6620, 0.6660

SGD corner

USD/SGD has consolidated over the past week with the pair trading in a ~0.5% range centered on ~1.3405. This is inline with the broader USD moves, with FX markets fairly contained and not exhibiting the same movements as other asset markets. On the crosses, EUR/SGD has dipped back slightly (now ~1.4542) with ‘dovish’ comments by the ECB at last week’s meeting exerting some pressure on the EUR. SGD/JPY (now 110.46) has tread water.

As mentioned, there are several global economic events this week that may generate further market volatility such as the US labour market stats, Eurozone GDP and inflation data, China PMIs, BoE meeting, and US Fed decision. On net, while we think the USD (and USD/SGD) may garner some support from the US Fed leaning against near-term rate cut market pricing, a loosening in US labour market conditions could see it reverse course later in the week. That said, on top of the global events, the SGD will also have to contend with today’s MAS decision. This is the first meeting under the new quarterly structure. In our opinion, given Singapore GDP growth and inflation has been running ahead of the MAS’ assumptions, we think the bank could maintain its ‘hawkish’ bias with a preference to “steer the SGD NEER” higher in the trading band likely to give the SGD a little support.

SGD levels to watch (support / resistance): 1.3310, 1.3360 / 1.3460, 1.3500