• Positive tone. US equities higher as bond yields dip. News the US Treasury had reduced its borrowing estimates a factor. USD slips back, AUD firmer.

• More vol? There is a long list of global data releases this week, with the US Fed also meeting. More bursts of short-term volatility likely.

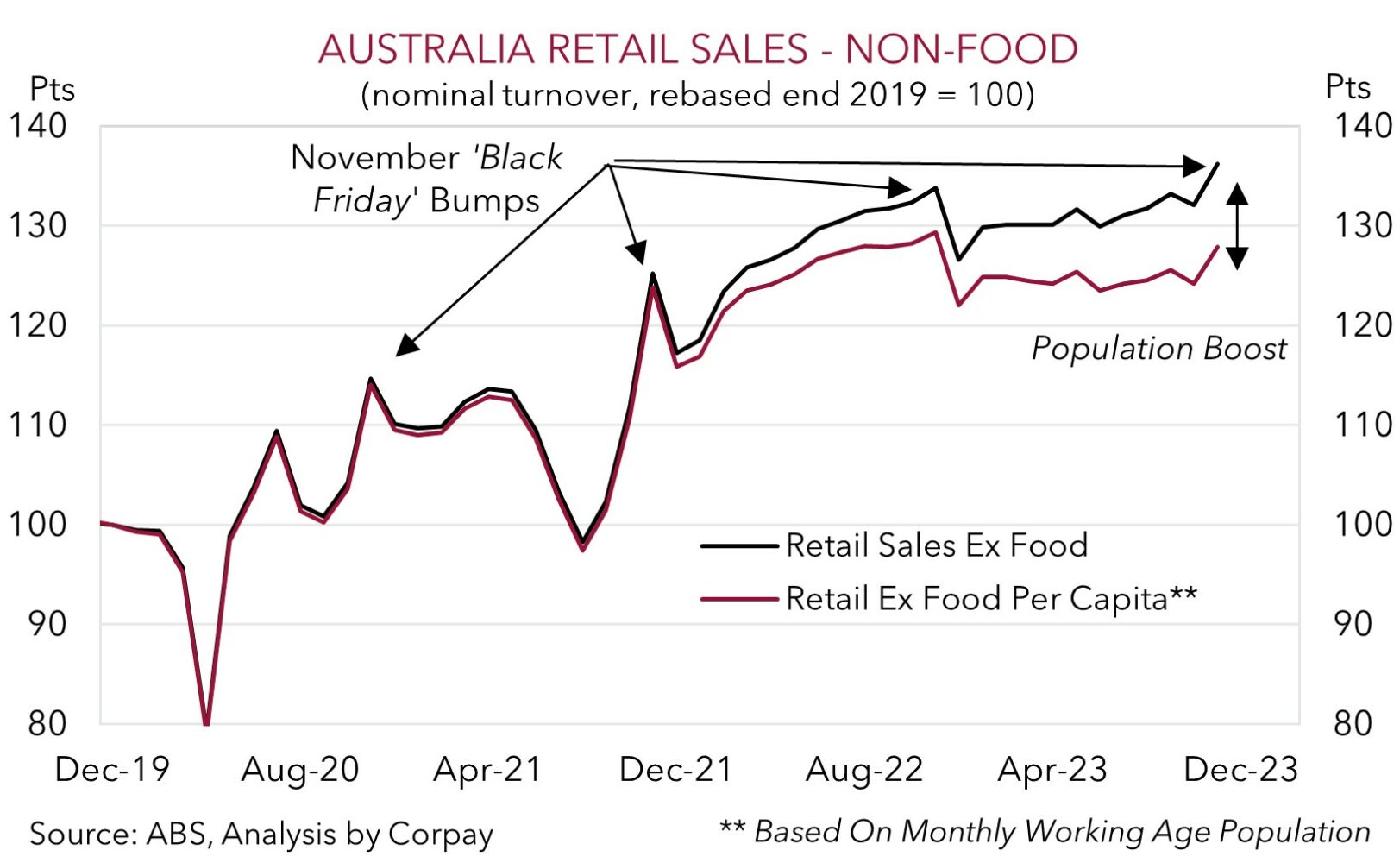

• AU data. Retail sales expected to decline as Black Friday boost unwinds. Q4 CPI (due tomorrow) likely to come in below the RBA’s thinking.

It has been a relatively positive start to an action-packed week that includes US Fed and Bank of England meetings, key global releases such as Eurozone GDP and CPI, the China PMIs, Australian inflation, and an array of US labour indicators, as well as earnings reports from several bellwether US stocks. Markets have taken yesterday’s news that a Hong Kong court issued a wind-up order for beleaguered Chinese property giant Evergrande Group in their stride. While the moves may exacerbate pessimism around the Chinese property sector, the liquidation process won’t be straightforward, especially as the bulk of Evergrande’s assets are in mainland China which operates under a separate legal system and might not recognize Hong Kong proceedings.

US equities had a positive session with the tech-focused NASDAQ outperforming (+1.1%). The S&P500 (+0.8%) touched a fresh record high as a drop in bond yields supported sentiment. A rally in European bonds (German yields fell 6-7bps across the curve) on the back of a lift in policy easing expectations was compounded by news the US Treasury had reduced its estimate for how much federal borrowing would need to be undertaken this quarter. The benchmark US 10yr rate fell ~7bps (now ~4.07%) with the 2yr yield ~5bps lower (now 4.30%). Worries about the market’s ability to absorb a substantial amount of bond supply on the back of the US’ large budget deficits was a factor that pushed up yields over September-October 2023.

In addition to boosting risk appetite the pull-back in US yields pressured the USD. EUR and GBP rebounded from their intra-session lows (now ~$1.0835 and ~$1.2715 respectively), and the rate sensitive USD/JPY slipped below ~147.30. USD/SGD dipped under 1.34 with yesterday’s decision by the MAS to maintain the “prevailing rate of appreciation” of the SGD NEER (i.e. 1.5%pa) in its ongoing inflation fight having limited direct impact. NZD has risen (now ~$0.6140) with ‘hawkish’ comments by the RBNZ’s Conway providing an added boost. According to Conway although policy is working there is still “a way to go” to get inflation to the target midpoint. AUD has gone along for the ride with the currency edging up to ~$0.6615.

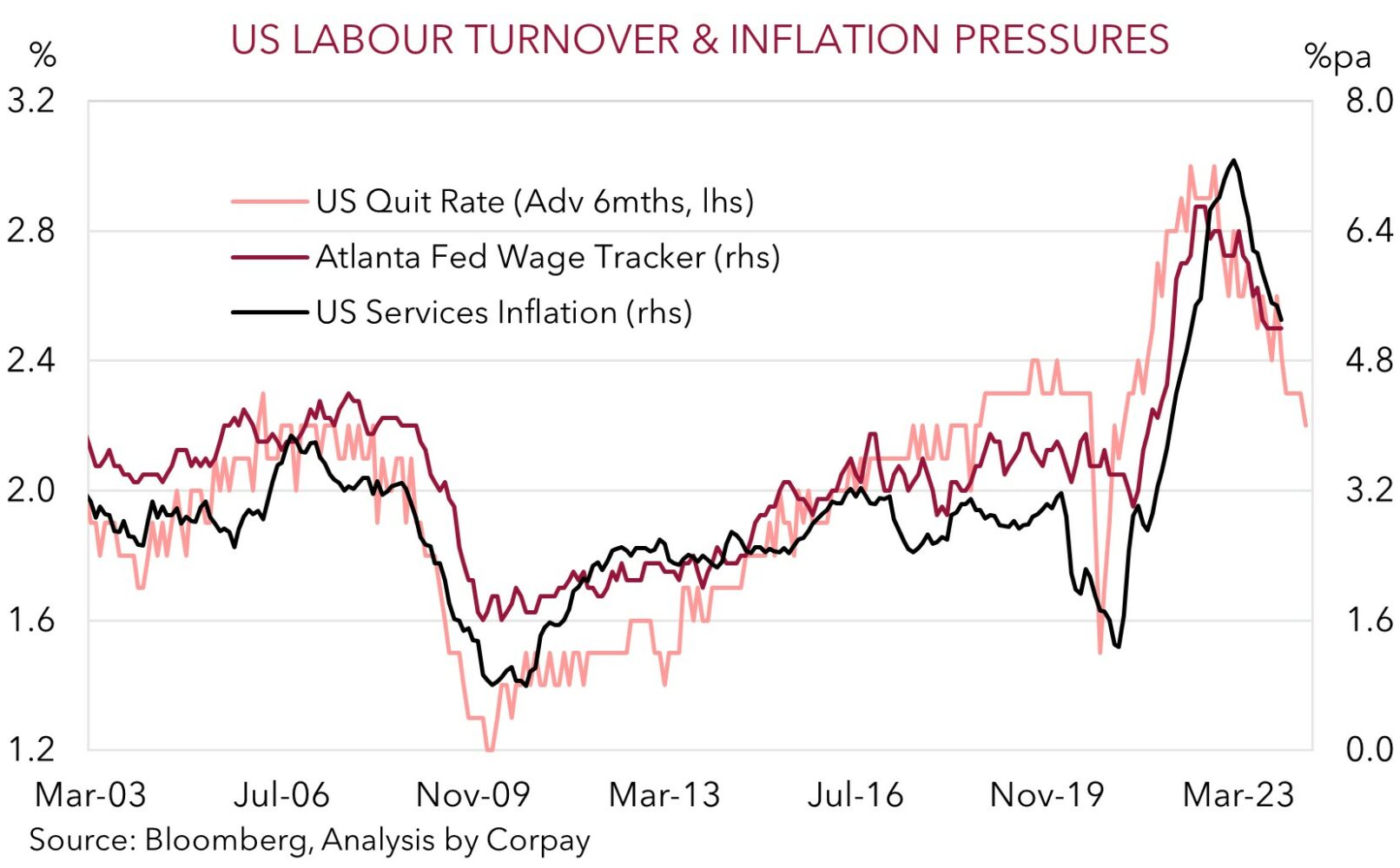

As outlined yesterday we think markets and the USD could be chopped around by upcoming data releases and policy meetings. Tonight, Q4 Eurozone GDP is due (9pm AEDT) with the data expected to show the region entered a mild technical recession late last year, while in the US the JOLTS Job Openings report (2am AEDT) will be looked at for signs the labour market is rebalancing. In our view, while another negative Eurozone GDP print may weigh on the EUR (and support the USD), another drop in US job openings and the ‘quits rate’ (which is a gauge of labour turnover and forward-indicator for wages and services inflation) could see the USD lose ground later on as this could bolster future Fed rate cut pricing.

AUD corner

The AUD has edged a bit higher at the start of the new week. The softer USD, stemming from the decline in US yields, and lift in equity markets has pushed the AUD towards ~$0.6615, the upper end of its ~2-week range (see above). The backdrop has also helped the AUD generally outperform on the crosses. AUD/EUR has ticked up to its 50-day moving average (~0.61), AUD/GBP is near ~0.52, and AUD/CNH has nudge above its ~1-yr average (now ~4.7535). Despite the ‘hawkish’ tone in this morning’s speech by the RBNZ’s Conway which looked to push back on the markets policy easing expectations (see above) AUD/NZD has consolidated with the pair tracking around its ~100-day moving average (~1.0788).

As discussed yesterday based on the long list of events and releases on the schedule bursts of intra-day AUD volatility are likely as the macro developments validates or questions the markets interest rate assumptions. In our opinion, the AUD could face some local data headwinds over the next few days with retail sales (11:30am AEDT) at risk of undershooting downbeat forecasts (mkt -2%) as the bring forward of spending to the Black Friday sales unwinds, and with Q4 inflation (released Wednesday) predicted to come in below the RBA’s thinking thanks to falling goods prices, favourable base-effects, and the dampening effect from government subsidies on electricity prices and rents. That said, at the same time, we believe external trends may be more AUD supportive with tomorrow’s China PMIs forecast to show an improvement, lower bond yields underpinning risk appetite, and with US JOLTS job openings (tonight 2am AEDT) likely to show a further cooling in labour market conditions. If realised, we think this could exert some downward pressure on the USD in the lead up to this Thursday’s US Fed meeting as markets reinforce their longer-term rate cut expectations.

All up, we feel these crosscurrents could see the AUD continue to be whipped around within its recent range (i.e. ~$0.6530-0.6630) over the near-term. Short-term gyrations are not that unusual at this point in the economic cycle as turning points are often difficult to judge and navigate (see Market Musings: AUD volatility: a taste of things to come?). However, while we see the AUD being pushed and pulled by the economic news flow over the near-term, on balance we continue to hold a positive medium-term bias with: (a) narrower Australia-US short-dated yield differentials (as the RBA lags the US Fed and other major central banks in the next easing cycle); (b) a sturdier Chinese economy as stimulus measures gain traction; (c) support to domestic activity from the incoming tax cuts and larger population; and (d) a paring back of ‘net short’ AUD positioning (as measured by the CFTC futures) projected to give the AUD a boost over the course of 2024.

AUD levels to watch (support / resistance): 0.6520, 0.6570 / 0.6620, 0.6660