• Consolidation. Better than expected US labour & Eurozone GDP data pushed up front-end bond yields. But FX moves were limited. AUD near $0.66.

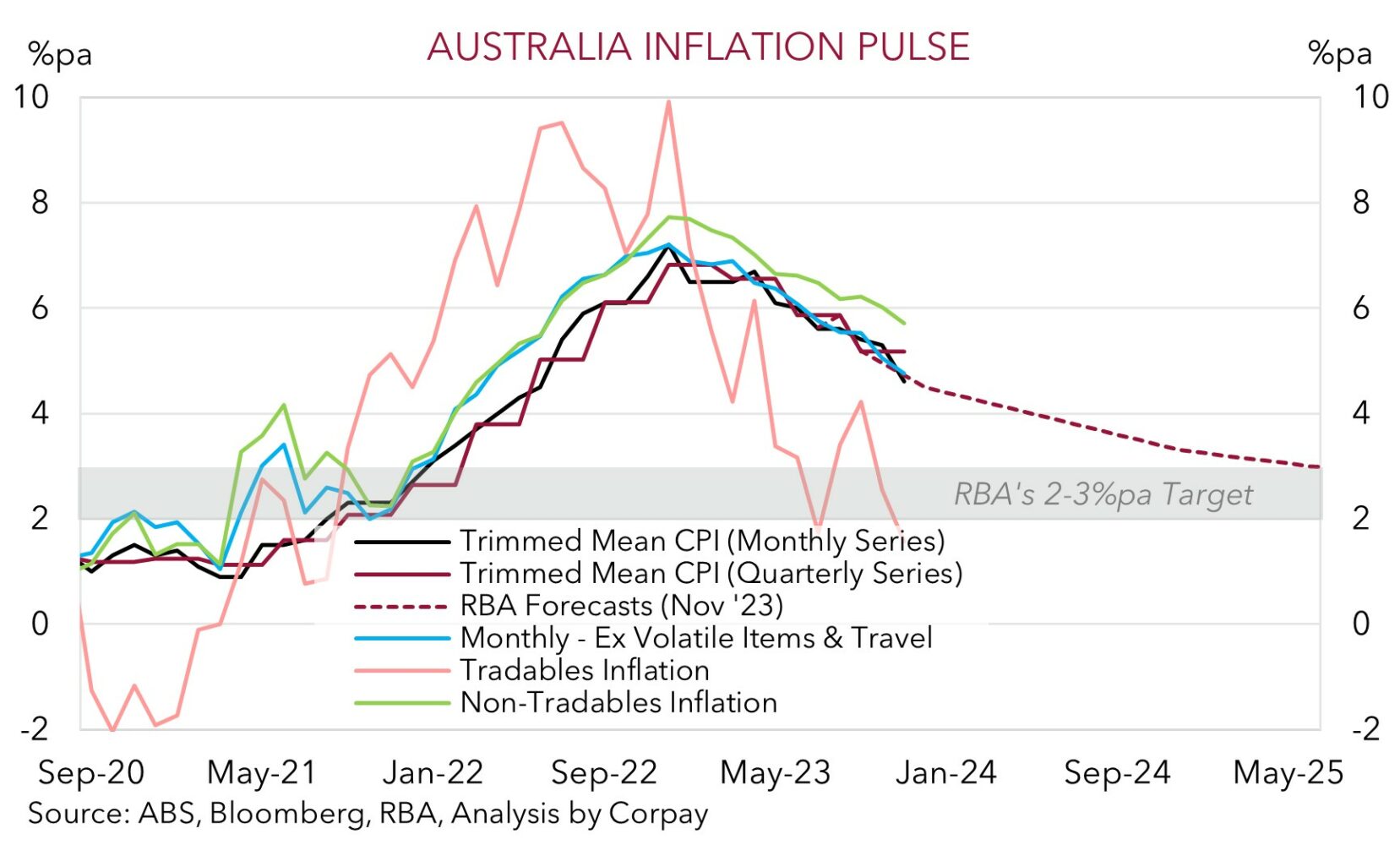

• AU inflation. Q4 CPI forecast to slow a little more than the RBA was thinking. But details matter. Attention will be on how services prices are evolving.

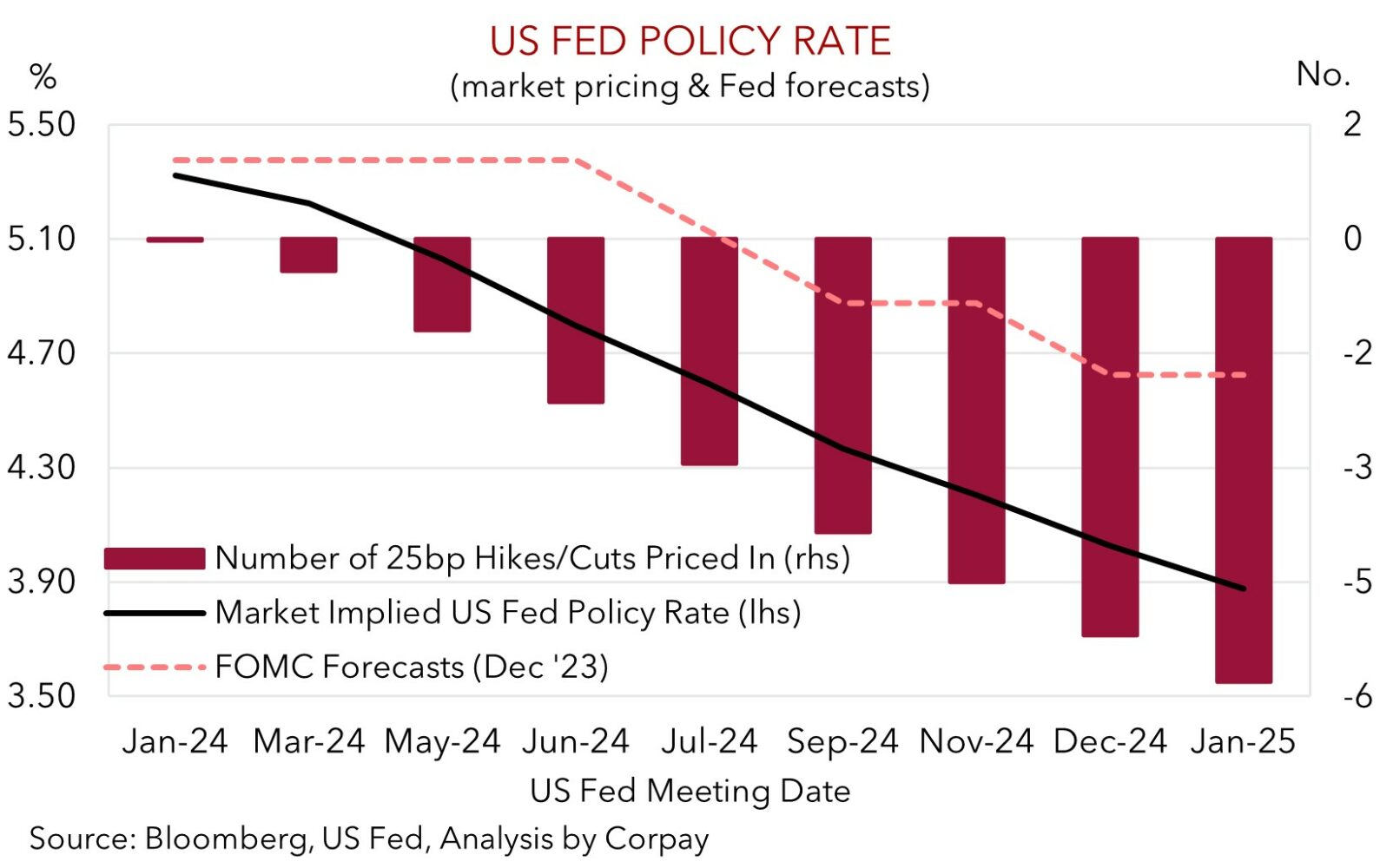

• US Fed. Focus will be on the Fed’s guidance. Risks the Fed pushes back on near-term rate cut pricing appear high. This may give the USD a boost.

Consolidation across markets overnight with sentiment waxing and waning as the data rolled in and with participants focused on tomorrow mornings US Fed meeting (6am AEDT) and press conference (6:30am AEDT). In contrast to the rise in European equities (EuroStoxx600 +0.2%), the US upturn stalled with the tech-focused NASDAQ slipping (-0.7%) ahead of the release of results from some major companies. Across bonds, yield curves generally flattened a touch with front end yields rising. The US 2yr rate rose ~6bps (now 4.36%) while the UK 2yr yield lifted ~8bps (now 4.31%) as near-term rate cut expectations were tempered following some better than anticipated releases. Odds of a rate reduction by the US Fed at the March meeting eased to ~40% (in late-December the probability had been as high as 90%). That said, FX moves were limited with the USD Index treading water. EUR is hovering near ~$1.0840, GBP has ticked back below ~$1.27, and USD/JPY is tracking just above ~147.50. USD/SGD has moved sideways (now ~1.3395), and the AUD was continued to whip around in its recent range (now ~$0.66).

Data-wise the Eurozone narrowly avoided a technical recession in H2 2023, with the economy stagnating in the final quarter as positive surprises in Spain and Italy offset a contraction in Germany. Eurozone inflation for January is released tomorrow and it may shift the ECB rate cut dial with President Lagarde this morning noting everyone “agrees the next move is a cut” though policymakers need to see more data with wages “critically important”. In the US consumer confidence improved with people more upbeat about the current situation thanks to expectations of lower inflation and interest rates, and a booming stock market. Added to that US job openings (a gauge of labour demand) lifted to the highest level in 3-months. While this points to resilience in the labour market, we would note that the bulk of the improvement was concentrated in a few sectors. Other underlying measures such as the ‘quit rate’ (an indicator of job hopping and leading wages gauge) remains at pre-COVID levels, and over the past year the ‘hiring rate’ has fallen.

Another burst of market volatility could be on the cards over the next 24hrs given the release of the China PMIs (12:30pm AEDT), US ADP employment (12:15am AEDT) and the US Employment Cost Index (12:30am AEDT), and with the US Fed handing down its decision tomorrow morning. The Fed is the main event and given market pricing there is scope for USD intra-day swings as we believe the FOMC will remove its tightening bias (acknowledging that the next move should be a cut) but with Chair Powell also set to stress they may proceed carefully and that a move in March isn’t anticipated. If realised, we think a reduction in near-term rate cut bets could give the USD a bit of a temporary boost.

AUD corner

The AUD oscillated within a ~0.7% range yesterday with the incoming data and swings in sentiment pushing and pulling the currency (see above). At ~$0.66 the AUD is tracking just above its 200-day moving average with the AUD also generally consolidating on the crosses over the past 24hrs. A slightly better than predicted Eurozone Q4 GDP print, with the region managing to avoid a technical recession, helped AUD/EUR dip back below 0.61 overnight. At the same time concerns about the health of the Australian consumer flared up again. December retail sales were released yesterday. And as has been the norm over the past few years given the increased prevalence of Black Friday sales turnover fell in December (-2.7%) after a solid rise in November (+1.6%). There has typically been a rebound in January but based the squeeze on household budgets from cost-of-living pressures and rising mortgage rates, and below average consumer sentiment this may not occur this year.

Based on the list of upcoming events we believe more short-term gyrations are probable with the AUD continuing to whip around within its recent range (i.e. ~$0.6530-0.6630). In today’s local trade eyes will be on the Q4 Australian CPI data (11:30am AEDT). Thanks to falling goods prices, favourable base-effects, and the dampening effect from government subsidies on electricity prices and rents the data is expected to show inflation slowed a little more than the RBA was thinking (mkt 4.3%pa/RBA ~4.5%pa from 5.4%pa in Q3). Another step down in inflation would cement views that interest rates have peaked, and this may exert some knee-jerk pressure on the AUD intra-day, particularly on the crosses.

However, with the RBA increasingly focused on services prices signs domestic inflation pressures are ‘sticky’ may see markets continue to factor in a relatively more gradual and limited easing cycle compared to its global central bank peers. This underlying detail, in our opinion, coupled with an improvement in the China PMIs (12:30pm AEDT) may limit any headline CPI inspired AUD downside ahead of tomorrow morning’s Fed decision (6am AEDT) and press conference (6:30am AEDT). As mentioned above, given the communication challenge the US Fed is facing there is scope for a bout of volatility as markets juggle the likely removal of the Fed’s tightening bias and views rates will eventually fall against a cautious tone around the potential timing of the first cut. On balance, while this may see the USD lift and the AUD slip back, we don’t think such a move should be long lasting based on our thoughts the upcoming US labour market report risks underwhelming consensus forecasts (Friday night AEDT), with risk appetite still positive, and ‘net short’ AUD positioning (as measured by CFTC futures) already quite stretched.

AUD levels to watch (support / resistance): 0.6520, 0.6570 / 0.6620, 0.6660