• Positive tone. US bond yields lost ground as more US data underwhelmed. This gave US stocks a boost on Friday & exerted pressure on the USD.

• AUD moves. AUD edged higher. Domestic & offshore data might generate some intermittent AUD swings this week.

• Event radar. Locally, Q1 GDP is due (Weds). Offshore, the BoC (Weds) & ECB (Thurs) could cut rates, while the US jobs report (Fri) will be a focal point.

There was a more upbeat tone across markets at the end of last week. US and European equities rose on Friday. The S&P500 outperformed (+0.8%), although this wasn’t enough to counteract falls over prior days. On net, the S&P500 had its first weekly fall since mid-April. A further pull-back in US bond yields on the back of data indicating the economy is losing steam and disinflation is re-asserting itself underpinned Friday’s moves. The US 10yr yield shed ~5bps (now ~4.50%) with the 2yr rate (-6bps to 4.87%) also lower.

US personal spending, the engine room of the consumer driven economy, undershot forecasts. The more sluggish Q1 growth pulse looks to have carried over into Q2. Added to that the Chicago business PMI extended its slide with the index plunging to 35.4, its lowest since the 2020 COVID shock. On the inflation front, while the PCE deflator (the Fed’s preferred measure) matched predictions, the details under the hood were encouraging with goods prices declining and some of the stickier services prices like housing/rents and health-care moderating. At 2.8%pa the US core PCE deflator is running at its slowest pace since early 2021.

The dip in US yields exerted downward pressure on the USD with higher than forecast Eurozone inflation also lending a helping hand to the EUR (now ~$1.0850). Eurozone core inflation re-accelerated a little more than anticipated (now 2.9%pa) due to a seemingly temporary jump in services prices in Germany after cheaper transport fares introduced a year ago rolled out of calculations. GBP consolidated (now ~$1.2740), while USD/JPY inched higher (now ~157.25, ~1.8% from its late-April peak). The NZD (now ~$0.6140) and AUD (now ~$0.6650) ended the week on firmer footing.

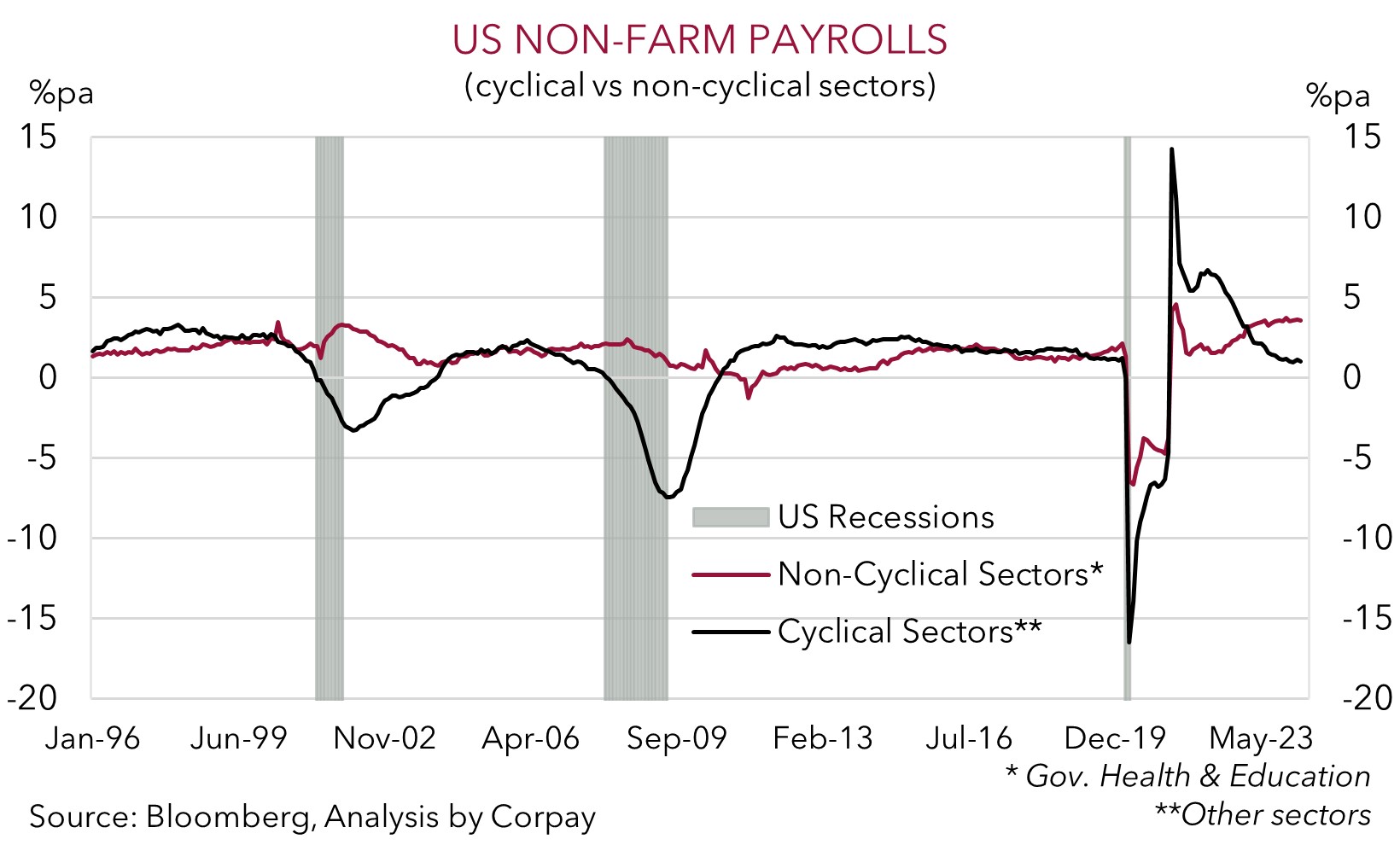

Looking ahead there are a few global events that could generate bursts of volatility this week. The Bank of Canada (Weds night AEST) and European Central Bank (Thurs night AEST) decisions are due. The US ISM manufacturing (tonight 12am AEST) and services (Weds 12am AEST) gauges are released, as are various labour market stats including the JOLTS report (Weds night AEST) and monthly non-farm payrolls data (Fri night AEST). The ECB is expected to cut rates for the first time this cycle (markets are assigning a ~95% probability), with the BoC also assumed to ease policy, although markets are less sure (a cut is ~80% factored in). We think both should provide rate relief. However, if the central banks, particularly the ECB, stress a cautious approach to subsequent moves rather than telegraph a quick follow up, we believe the EUR might garner some support. If realised, this may drag on the USD, which in turn could be compounded by signs the US jobs market is cooling. As our chart shows, inline with the step down in economic activity jobs growth across cyclical sectors has slowed meaningfully. In our opinion, another sub 200,000 non-farm payrolls print, uptick in US unemployment and/or softer wages may revive longer-term US Fed rate cut bets.

AUD Corner

The AUD inched a bit higher on Friday with the drop in US bond yields stemming from sub-par US activity data and encouraging disinflation signals in the latest PCE deflator exerting pressure on the USD (see above). At ~$0.6650 the AUD is a little north of its ~1-month average. The AUD also ticked up on some of the crosses. AUD/EUR (now ~0.6130) is ~0.6% from its multi-month high, AUD/GBP is above its 50-day moving average (~0.5216), AUD/CNH is hovering near the upper end of its ~4-month range (now ~4.8315), and AUD/JPY (now ~104.62) has pushed up towards its cyclical peak on the back of the more positive risk sentiment.

In addition to the global events on this week’s radar including the BoC (Weds AEST) and ECB (Thurs AEST) meetings and US jobs report (Fri AEST), locally the Award/Minimum Wage is announced today (from 10:30am AEST), Q1 GDP is due (Weds AEST), and new RBA Deputy Governor Hauser speaks (Fri AEST).

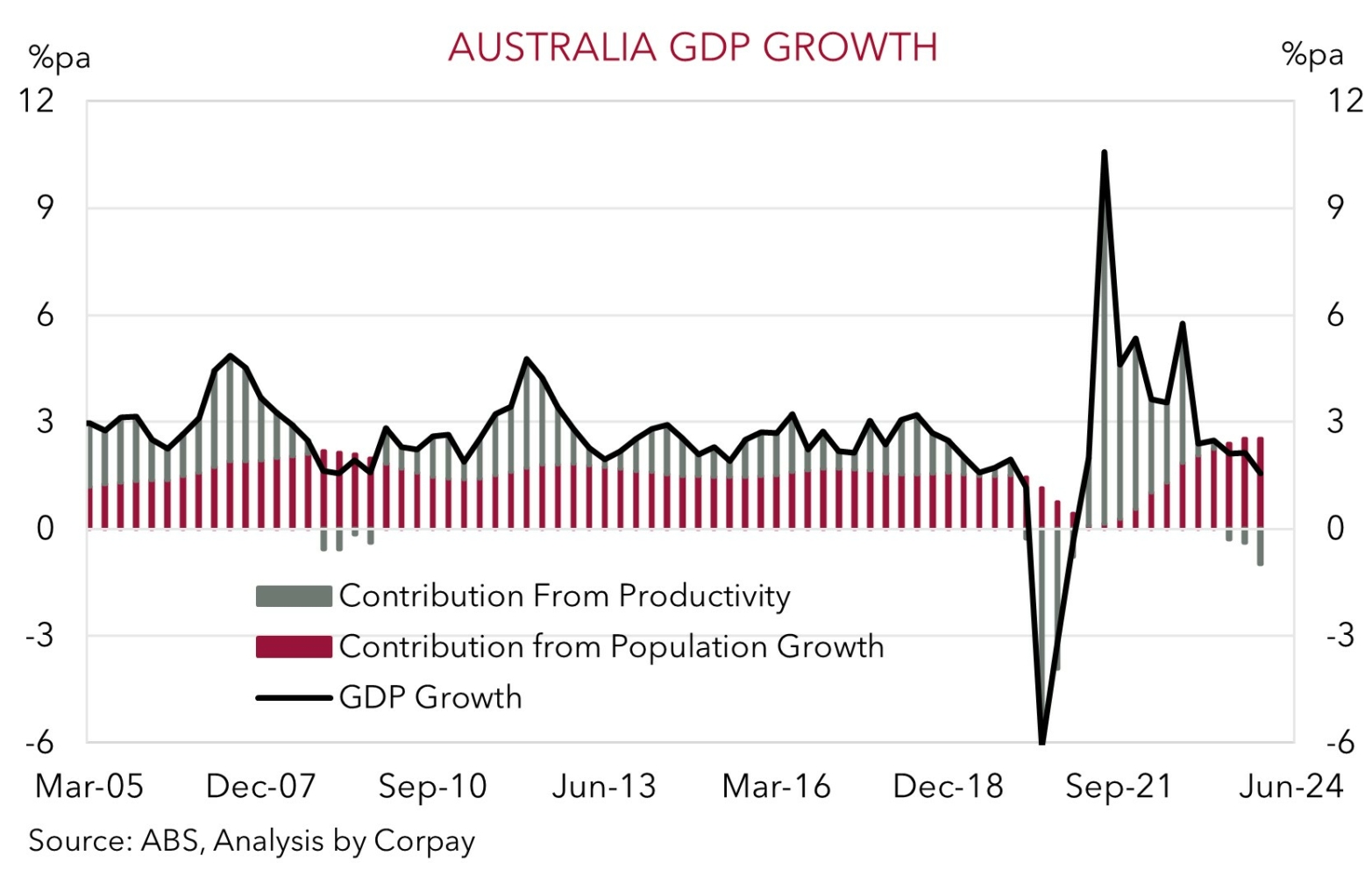

As is normally the case, the local data may generate some intermittent AUD volatility, but it will probably be overshadowed by offshore forces. Indeed, Q1 Australian GDP should confirm what is already known. Higher interest rates are working to slow demand, particularly across the household sector. And although the larger population may be holding things up to a degree on an aggregate level, activity per capita is moving backwards. Very modest GDP growth of ~0.1-0.2% is projected for Q1, which if realised would see annual growth slow to one of its lowest run rates, outside of the pandemic shocks, in the past 30 years. That said, given the stickiness in domestic inflation (which could be reinforced by another solid award/minimum wage hike), resilience in the labour market, and incoming income support from the stage 3 tax cuts the RBA may not be able to let up for some time. Markets appear to agree with the first full RBA rate cut now not discounted until late-2025.

In our opinion, the divergence between the RBA and other central banks should continue to give the AUD support over the medium-term. While ‘hawkish sounding rate cuts’ by the BoC and ECB this week might generate a knee-jerk dip in AUD/CAD and AUD/EUR (see above), we don’t believe the positive underlying trends should change. Moreover, as discussed, we feel the USD could remain on the backfoot if as we expect the string of US labour market data shows conditions are cooling and US Fed rate cut expectations are added to.