• Shaky sentiment. US equities, yields & the USD a bit lower as Q1 US GDP was revised down. AUD rebounds up towards ~$0.6630 (its 1-month average)

• US politics. Former President Trump found guilty. Market impact has (so far) been limited. More twists & turns in US politics look likely.

• Data flow. China PMIs, Eurozone CPI, & US PCE deflator due today. Moderating US inflation & positive data elsewhere could weigh on the USD.

There was a ‘risk off’ tone across most markets overnight, although in FX the moves didn’t follow the usual script. US equities slipped back (S&P500 -0.6%) with weakness in the tech sector a drag on the overall market (NASDAQ -1.1%). Bond yields also declined with rates ~5-7bps lower across the US curve. The benchmark US 10yr yield is back near 4.55% with yesterday’s lift unwinding. In commodities, oil declined (WTI crude -1.7%), as did base metals like copper (-2.8%) and iron ore (-2.4%). That said, in FX, the USD lost ground as it tracked the retracement in US yields. As a result, EUR (now ~$1.0830) and GBP (now ~$1.2730) edged a bit higher and USD/JPY dipped below ~157. And despite the negative risk sentiment the AUD has clawed its way back up to ~$0.6630 (its 1-month average).

Macro wise, the trigger for some of the moves, particularly the pull-back in US yields and softer USD, was the downward revision to Q1 US GDP. The US economy is now estimated to have grown at a 1.3% annualised pace (previously 1.6%saar), with private consumption revised lower. Added to that US pending home sales fell more than anticipated, and weekly jobless claims nudged up. A moderation in the US growth pulse would be welcomed by US Fed policymakers as it shows higher rates and tighter credit conditions are working their way through the economy, and this in turn should help loosen the labour market and slow inflation down the track.

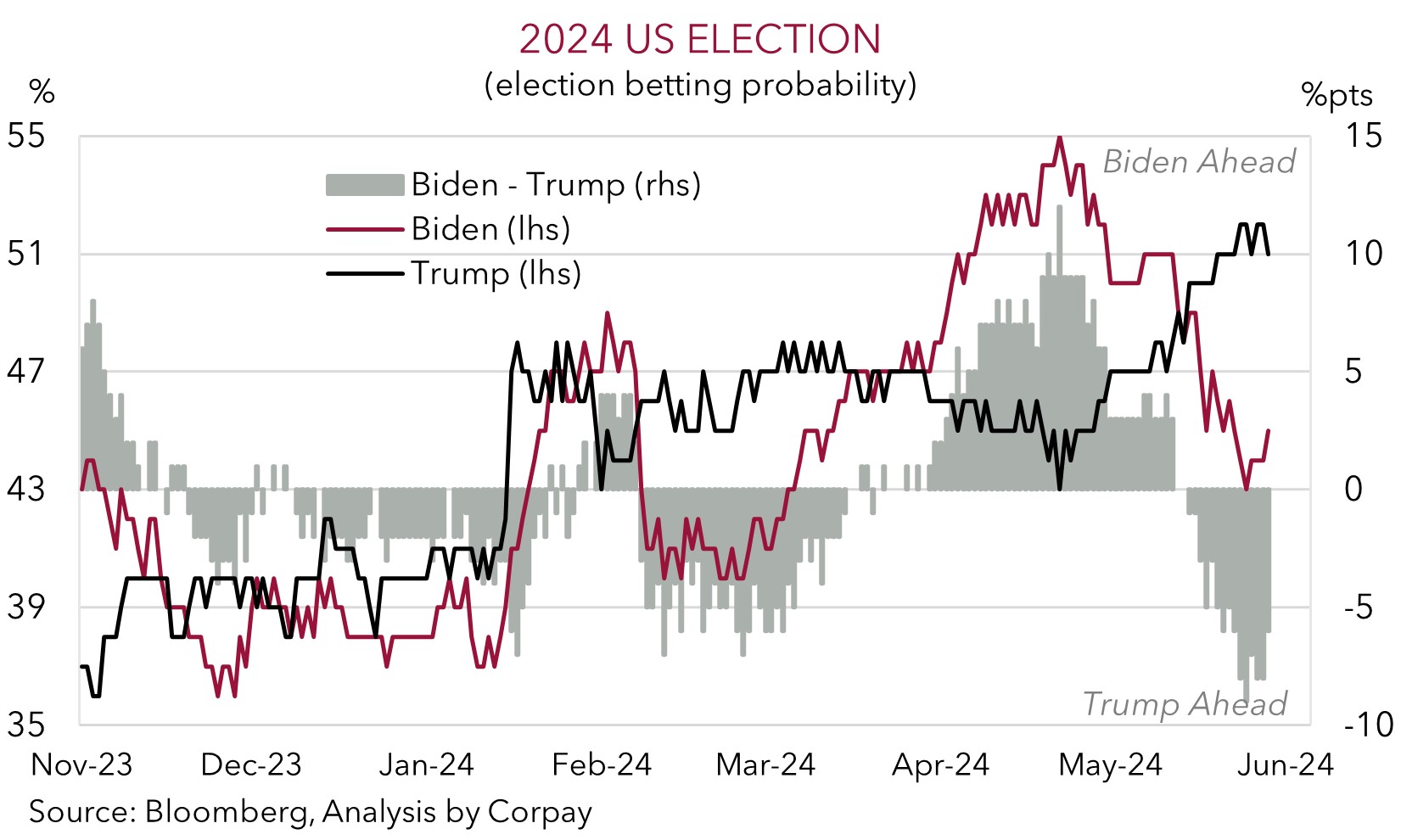

In addition to the economic news, late in the session, US geopolitical developments hit the wires, although reaction has (at least so far) been muted. Former US President Trump was found guilty on all counts in his ‘hush money’ trial. Sentencing is scheduled for 11 July, a few days before the Republican Convention where the party is set to officially announce Trump as its 2024 Presidential Election nominee. What this could all mean for the US election is a bit up in the air as we are navigating unchartered territory (this is the first time in history a former president has been found guilty of a crime). Mr. Trump has vowed to appeal. Time will tell whether this emboldens and broadens Trump’s following, or helps the Democrats drum up more support to keep a ‘convicted felon’ out of the White House. As our chart shows, betting markets have recently swung to favour Trump winning the election.

Economically, attention today will be on a few key releases with the China PMIs (11:30am AEST), Eurozone CPI inflation (7pm AEST), and US PCE deflator (the Fed’s preferred inflation gauge) (10:30pm AEST) due. Based on already released US CPI, PPI and import prices, core PCE inflation should moderate from its Q1 pace. If realised, we believe this, in combination with positive China PMI data and/or a slight re-acceleration in Eurozone inflation can keep the USD on the backfoot.

AUD Corner

After some underperformance yesterday the AUD has made its way back up towards ~$0.6630 (its ~1-month average) with the softer USD over-riding the negative risk sentiment washing through markets (see above). On the crosses the AUD has consolidated against GBP (now ~0.5210), EUR (now ~0.6120), and CNH (now ~4.8090) over the past 24hrs, while it has ticked up versus the NZD (now ~1.0845) and slipped back against the JPY (now ~103.97).

As discussed, the news regarding former President Trump’s conviction may generate headlines but its immediate market implications should be limited. There is still a lot of water to go under the US political bridge. Fundamentally, focus over the rest of the week will be on the China PMIs (11:30am AEST), Eurozone CPI inflation (7pm AEST), and US PCE deflator (the Fed’s preferred inflation gauge) (10:30pm AEST). All up, we think confirmation the US inflation pulse is moderating, signs of improvement in the China business surveys and/or an an uptick in Eurozone CPI could see the USD stay on the backfoot. This in turn may give the AUD a bit more support.

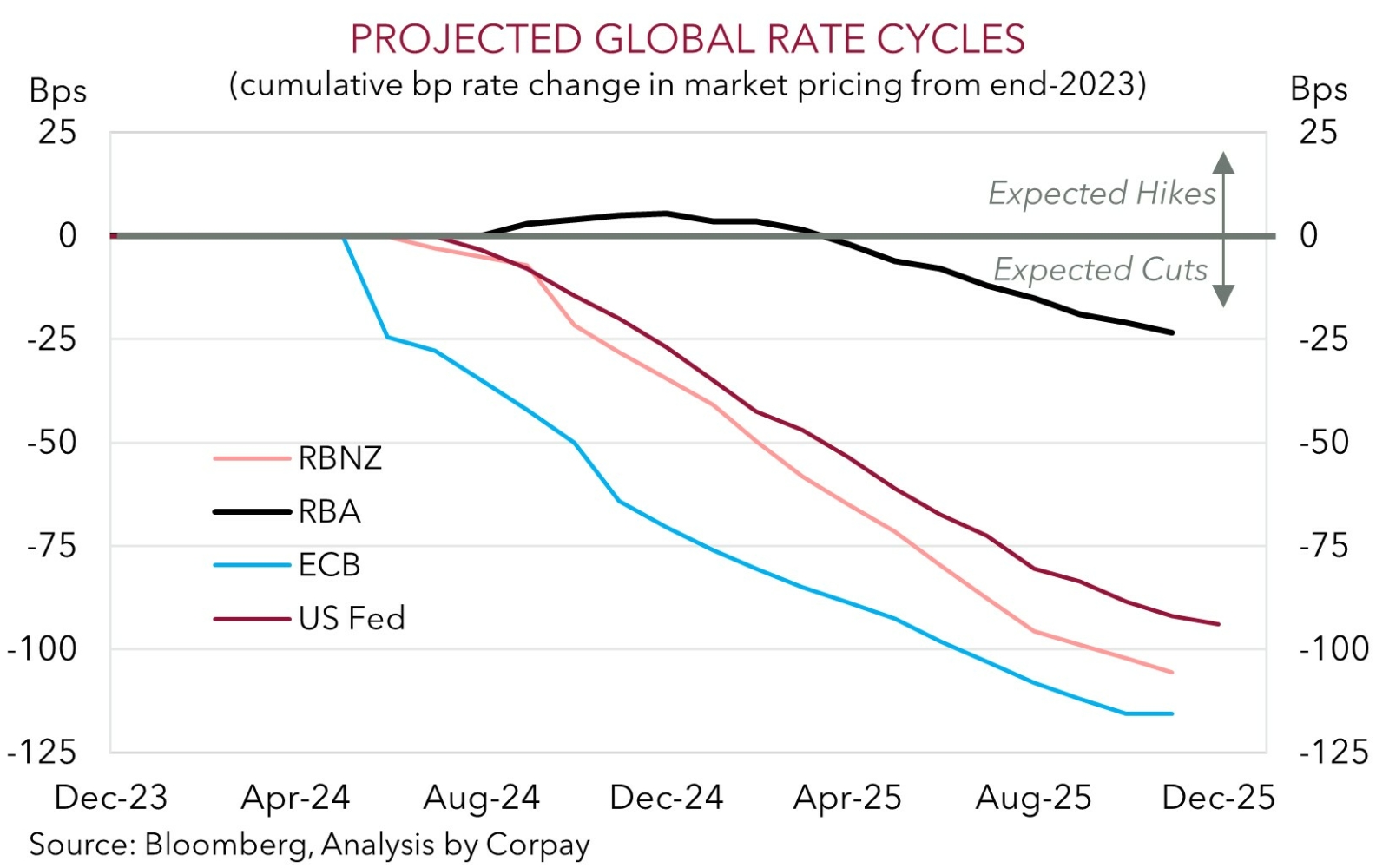

More broadly, if we take a step back, we continue to believe that the AUD is undervalued near current levels. The average across our suite of models is currently indicating ‘fair-value’ is around ~$0.68. Fundamentally, the latest read on monthly Australian CPI inflation, released a few days ago, reinforces our long-standing assumption that the RBA is set to lag its peers in terms of when it starts and how far it goes during the next easing cycle. The CPI data shows that domestic prices pressures remain elevated, with the improvement in core inflation stalling. In our view, while indebted households and some businesses are feeling the pinch from ‘restrictive’ settings, the stickiness in domestic inflation, income support from the stage 3 tax cuts, and fiscal impulse suggest RBA rate cuts remain a while away. In our opinion, the diverging monetary policy trends between the RBA and other central banks, coupled with an improvement in China/global industrial activity, and elevated base metal prices should be AUD positives over the medium-term.