• Quiet start. UK & US on holidays. European equities rise & bond yields slip back. Upbeat risk tone weighed on the USD & supported the AUD.

• ECB speakers. Several ECB members spoke with a rate cut next week strongly hinted at. What happens after that will depend on the data.

• AU data. Retail sales due today. Monthly CPI indicator released tomorrow. Weaker data could exert some near-term downward pressure on the AUD.

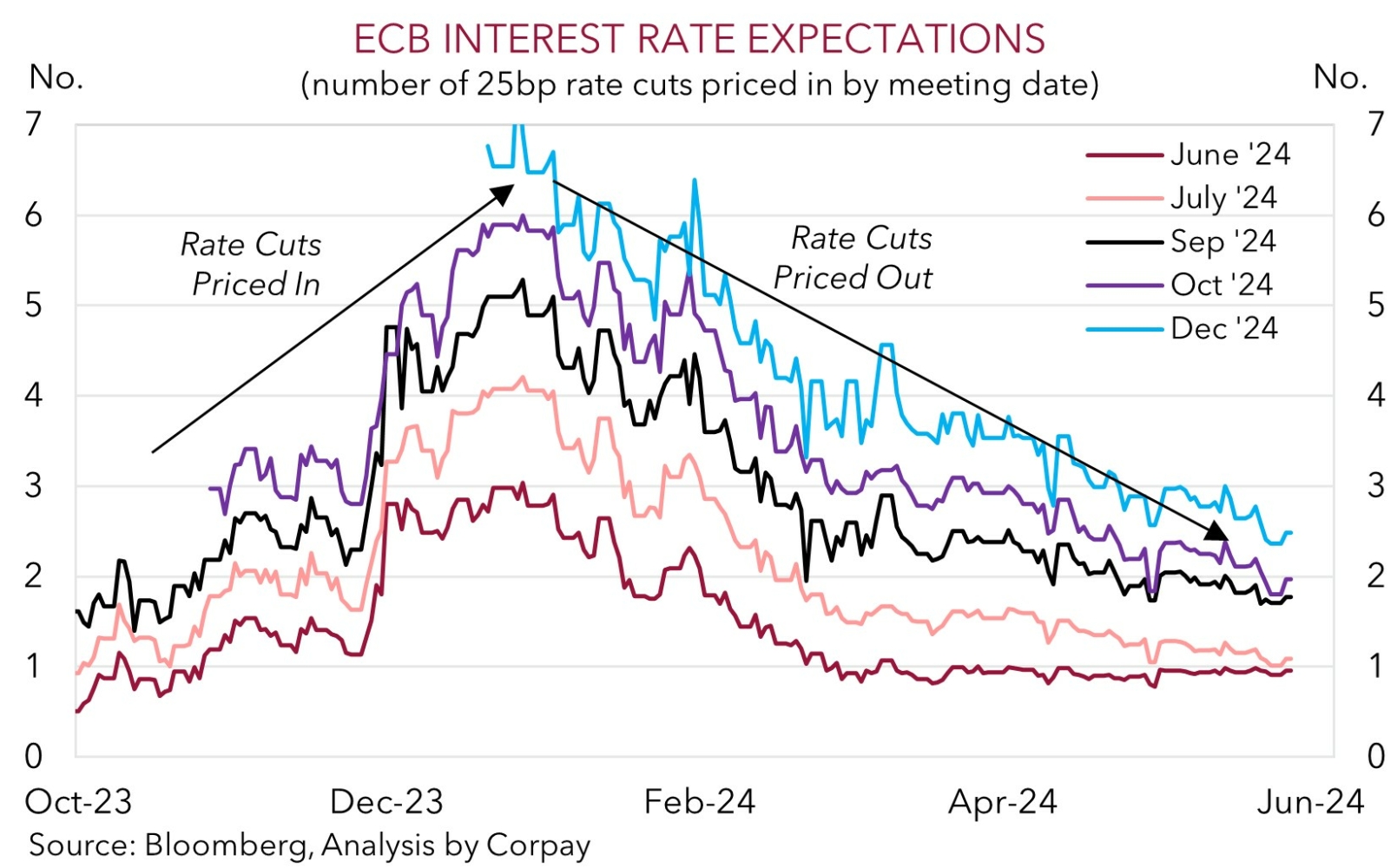

It has been a quiet start to the week across markets, unsurprising given the UK and US were off enjoying a long weekend and the limited news flow. Energy and base metals prices rose, while Asian and European equities also had a positive session with the latter helped along by a bit of a pull-back in bond yields. German yields declined ~4-5bps across the curve as traders tinkered with their ECB interest rate expectations following comments from a few policymakers. Chief Economist Lane reiterated the thoughts of many others by stating the downward trend in inflation means the ECB is “ready to start cutting interest rates” with a move in early June “appropriate” if the price outlook holds. And although Lane stressed the ECB isn’t pre-committing to a particular path France’s Villeroy weighed in by outlining he believed a follow up cut in July shouldn’t be ruled out. As our chart shows, a move in June by the ECB appears baked in. However, just like for the US Fed and other central banks, markets have unwound a lot of their H2 2024 ECB rate cut expectations over recent months.

In FX, despite the dovish tone from the various ECB members, the EUR held up (now ~$1.0860) with the positive risk sentiment exerting downward pressure on the USD. USD/JPY is treading water near ~156.90, and USD/SGD is hovering around ~1.3490. GBP nudged up (now ~$1.2770), with the NZD (now ~$0.6145) and AUD (now ~$0.6655) also firmer in quiet trade.

Over the next 24hrs several US Fed members speak. The list includes Mester & Bowman (2:55pm AEST), Kashkari (11:55pm AEST), and Cook & Daly (3:05am AEST). If policy is discussed a ‘higher for longer’ view is likely to be repeated. But based on market pricing, we doubt this type of rhetoric should generate that much reaction. Looking further out, on Friday, the US PCE deflator (the US Fed’s preferred inflation gauge), the China PMIs, and Eurozone CPI are due. These data points could spark some volatility. If we are right in our assessment that the US core PCE deflator moderates, the China PMIs improve, and/or statistical quirks sees Eurozone inflation re-accelerate, we believe the USD could lose ground later in the week.

AUD Corner

Upbeat risk vibes, as illustrated by the uptick in European/Asian equities and firmer base metal/energy prices, has helped the AUD edge a bit higher in holiday impacted trade. At ~$0.6655 the AUD is ~0.4% above where it closed last week. The backdrop has also helped the AUD strengthen a little on most crosses with gains of 0.2-0.4% recorded against the EUR, JPY, GBP, CAD, and CNH over the past 24hrs.

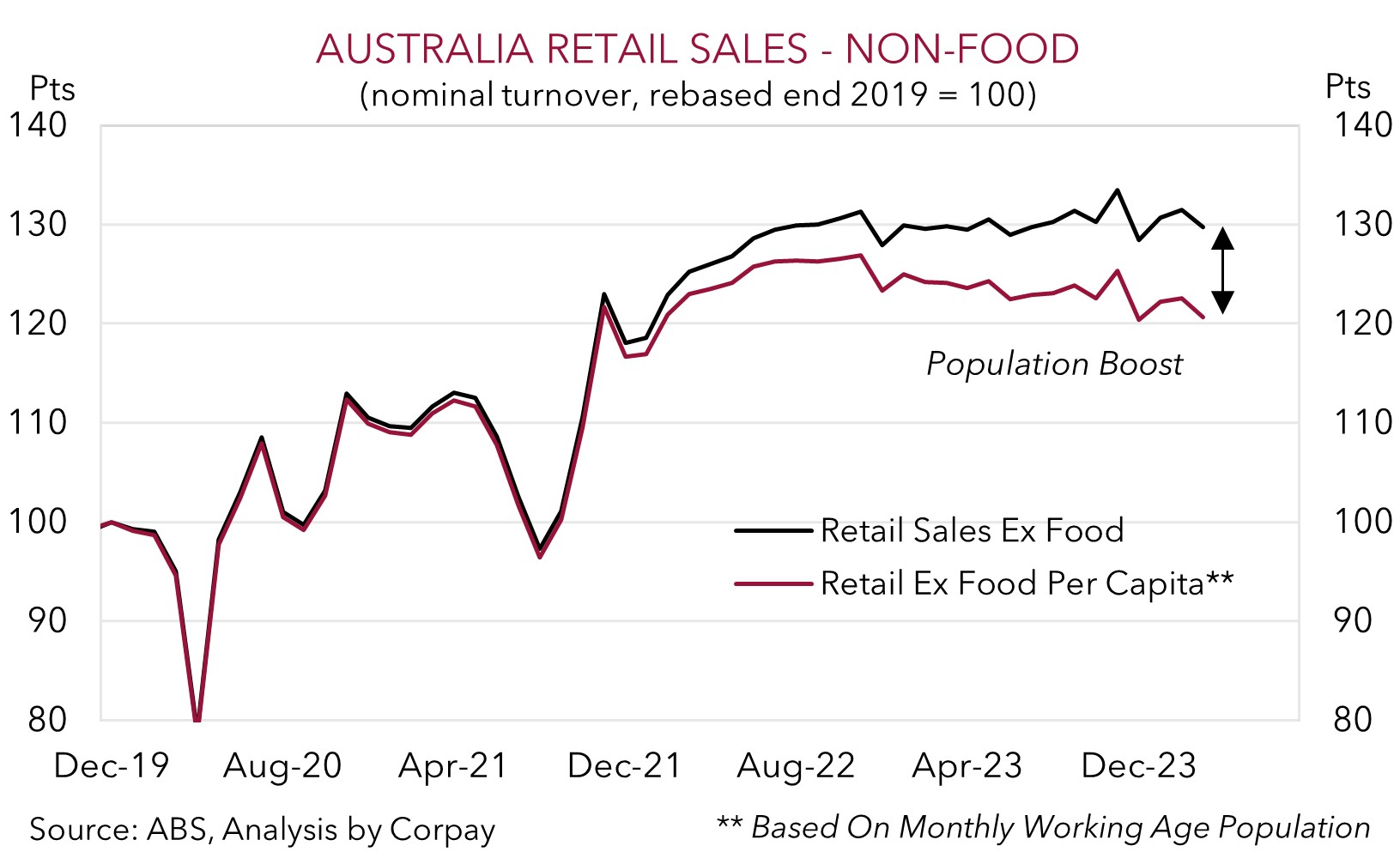

We think the AUD faces some short-term domestic data challenges. Today, April retail sales are due (11:30am AEST), and tomorrow the monthly CPI indicator is released. The jump up in mortgage rates, cost-of-living squeeze, and below average confidence are impacting consumer spending. As our chart shows, while the larger population is cushioning the hit to aggregate activity retail turnover per capita is falling. Retail sales have undershot consensus forecasts in five of the past six months. We think the underlying dynamics suggest it may underwhelm again (mkt +0.2%).

On the inflation side, annual headline CPI looks set to decelerate (mkt 3.4%pa), with a few factors potentially generating a slightly bigger than predicted slowdown. Just under two-thirds of the CPI basket is measured in April, and because April is the start of the new quarter the monthly indicator will have a greater skew towards ‘goods’ rather than ‘services’ prices. As it has done at the start of the past few quarters, we believe there is a chance headline inflation moderates more than forecast.

A run of weaker than anticipated domestic data could see RBA interest rate cut pricing lift, and this might exert some knee-jerk downward pressure on the AUD. But, as outlined above and yesterday, the global events later in the week such as the US PCE deflator, China PMIs and Eurozone CPI (all due Friday) could weigh on the USD. If realised, we think this would help the AUD bounce back from any near-term domestic data driven underperformance. Overall, although short-term AUD volatility looks likely, if we take a step back, we continue to believe the AUD is undervalued. The average across our suite of models is indicating ‘fair-value’ is currently around ~$0.68.