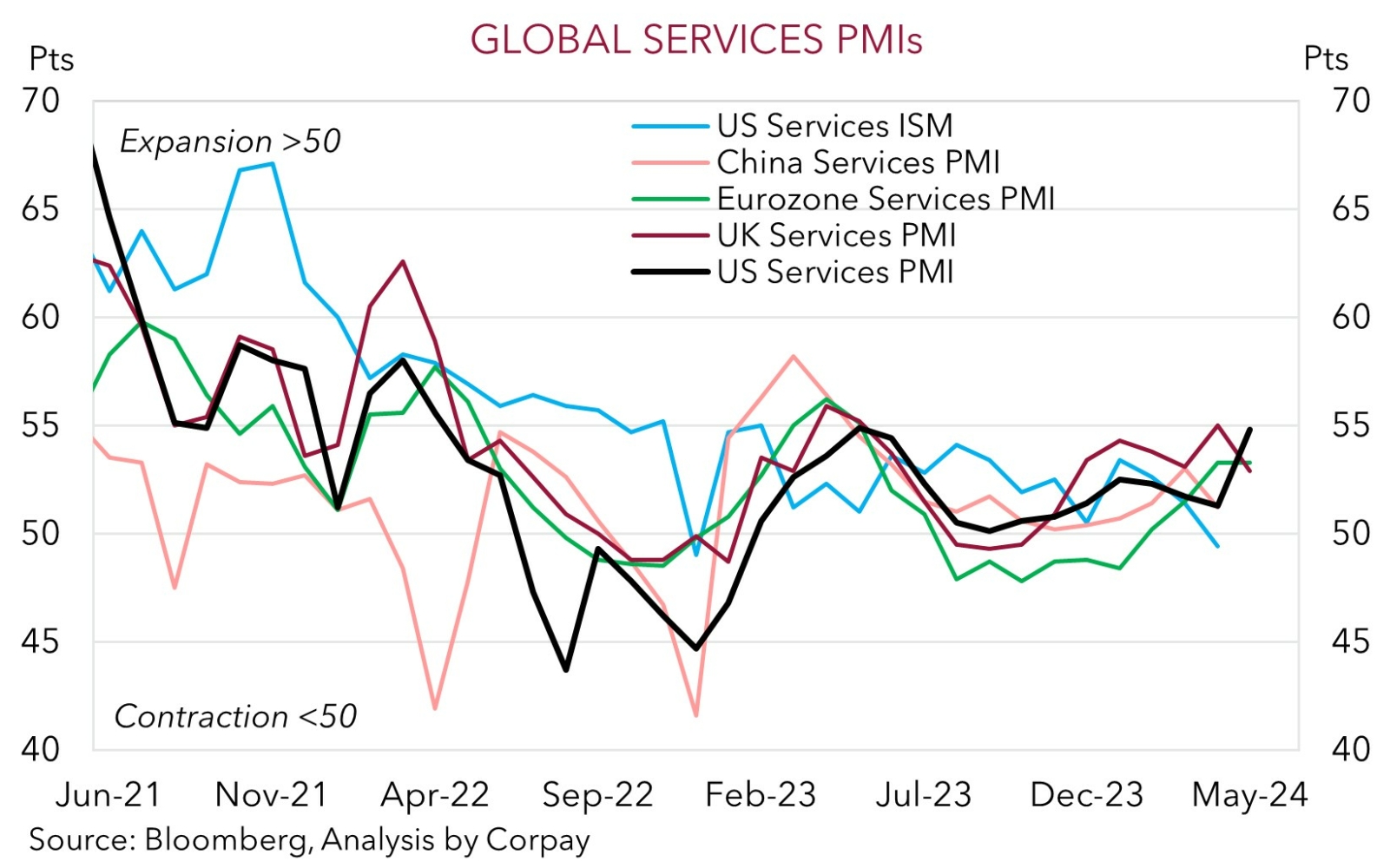

• US data. US PMIs stronger than expected. This fanned the flames of the ‘higher for longer’ rates view. US bond yields rose & equities dipped.

• FX moves. USD a bit firmer, but net FX moves have been modest. AUD extended its pull-back to be near ~$0.66, in-line with its 1-month average.

• Data calendar. A few bits & pieces released today such as UK retail sales & US durable goods orders. Next week AU retail sales & monthly CPI are due.

Some more twists and turns in the global economic data with the US business PMIs for May coming in better than expected, especially on the larger and more important services side. The US manufacturing and services PMIs moved further into ‘expansionary’ territory, with the ‘composite’ gauge at a ~2-year high as input/output prices, hiring intentions, and new business increased. The fact that most US data has underwhelmed over the past few weeks probably amplified the impact on some markets. By contrast, after robust gains in prior months the UK and Eurozone equivalent PMIs generally eased back.

In response bond yields rose with US rates up ~6-7bps across the curve (the US 2yr yield is back up near 4.94%) as traders watered down their US Fed rate cut bets. The first Fed rate cut has been pushed out a little to December as a ‘higher for even longer’ view takes hold. This sapped risk sentiment with US equities ending the day lower (S&P500 -0.7%) as the macro developments more than offset the tailwind from Nvidia’s earnings update. Oil prices (WTI crude -0.9%) and base metal (copper -1.5%, iron ore -1%) lost ground. In FX, the backdrop generated some USD support, although the net moves haven’t been that large. EUR (now ~$1.0815) has slipped back to where it was a week ago, while GBP (now ~$1.2695) remains near the top of its May range. USD/JPY nudged up, tracking the higher US yields (now ~156.95), NZD underwent a round trip to be effectively unchanged from where it was yesterday (now ~$0.61) as the ‘hawkish’ tone from this week’s RBNZ meeting continues to wash through, and the AUD ticked down towards ~$0.66 (its 1-month average).

There are a few bits and pieces released today around the world including Japanese CPI (9:30am AEST), UK retail sales (4pm AEST), Canadian retail sales (10:30pm AEST), and US durable goods orders (a proxy for business investment) (10:30pm AEST). US Fed heavyweight Waller also speaks again (11:20pm AEST). Japanese inflation is projected to cool, while UK and Canadian retail sales and US durable goods are forecast to decline. The data may generate a bit of intra-day volatility, but we think the USD should hold its ground particularly as market activity could be more subdued than normal given the UK and US public holidays on Monday.

AUD Corner

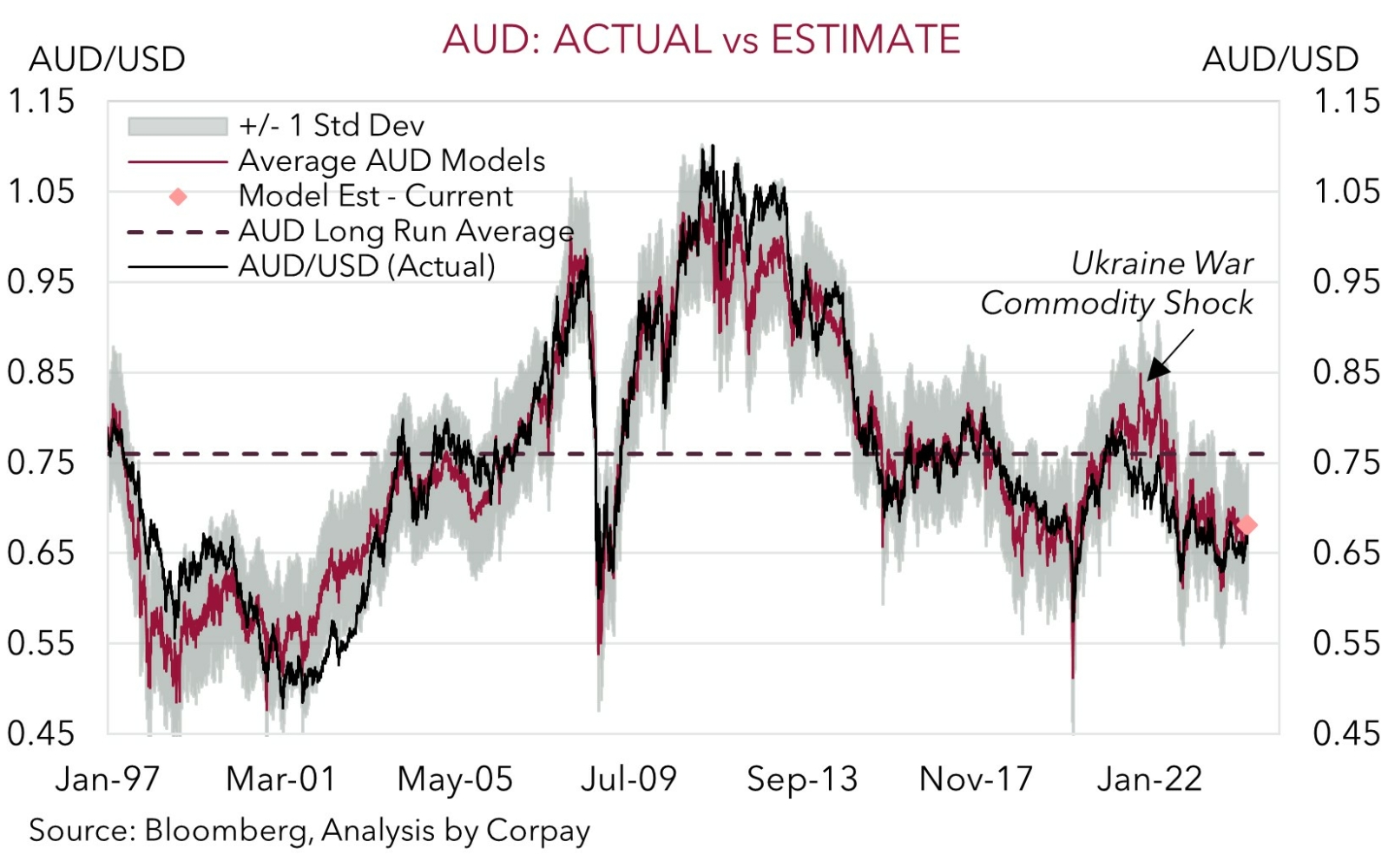

The AUD’s pull-back extended a bit further overnight. The modest pick-up in the USD due to stronger US PMI data, higher bond yields, and negative risk sentiment has pushed the AUD down towards ~$0.66 (see above). Taking a step back, despite the recent falls the AUD is only back around its ~1-month average and is still ~3.7% above last months Israel/Iran induced ‘risk off’ low. The backdrop also saw the AUD drift fractionally lower against EUR (now ~0.6110), CNH (now ~4.7940), and NZD (now ~1.0830). Although all three pairs remain above their respective 1-year averages.

As mentioned, there are a few releases around the world today which may generate the odd burst of intra-day volatility in some AUD crosses. The list includes Japanese CPI (9:30am AEST), UK retail sales (4pm AEST), Canadian retail sales (10:30pm AEST), and US durable goods orders (10:30pm AEST). Although with the UK and US on public holiday on Monday, barring an exogenous shock, we think market activity could be somewhat subdued with the AUD likely to tread water into the weekend.

Looking further ahead, next week Australian retail sales (Tues) and the monthly CPI (Weds) are due. Retail sales are forecast to rebound, while annual headline CPI inflation looks set to slow. Given April is the start of the new quarter the monthly CPI indicator will have a greater skew towards ‘goods’ rather than ‘services’ prices. The services side is the area of focus/concern for the RBA. Nevertheless, as it has done a few times over the past year, another soft print in the first month of the quarter could generate a ‘disinflation head-fake’ and exert more short-term pressure on the AUD. However, it may not be that long-lasting with next Friday’s US PCE deflator reading (the Fed’s preferred inflation gauge) at risk of moderating, which if realised may revive US rate cut expectations and weigh on the USD.

Overall, while the incoming data is likely to generate some bouts of AUD volatility, we think the AUD should soon level off and climb back up with underlying drivers such as: the diverging policy outlooks between the RBA and other central banks; signs the industrial (and commodity intensive) side of China’s economy is turning the corner; and the flow support stemming from Australia’s current account surplus (~1.2% of GDP) coming through. In our opinion, the AUD looks undervalued, with the average across our suite of models indicating ‘fair-value’ is closer to ~$0.68.