• Consolidation. US equities ticked up & based metals rose, while yields dipped despite ‘hawkish’ Fed rhetoric. USD & AUD tread water.

• Divergence. Slower Canadian inflation bolstered BoC rate cut bets. Will today’s UK CPI do the same? Divergence with the RBA is AUD supportive.

• RBNZ today. Rates expected to be held steady. Restrictive settings are working. Will the RBNZ tweak its forecast track to show earlier rate cuts?

Another quiet night with limited net moves across the major markets. In contrast to the modest dip in European equities US stock markets ticked up again with the S&P500 (+0.3%) recording its 12th rise in the past 14 sessions. Commodities were mixed with oil losing more ground. WTI crude is back down at ~US$79/brl, slightly above its 1-year average. By contrast, industrial metals remain firm with iron ore (+1.9% to US$122/tn) and copper (+0.5% to another record) rising.

Interestingly, bond yields across Europe and the US slipped back despite ‘hawkish’ rhetoric from US Fed officials (see below). The US 10yr rate lost ~3bps (now ~4.41%), and the policy expectations driven 2yr yield is 2bps lower (now ~4.83%). There were relatively larger moves in Canadian rates (2yr -6bps) after the latest inflation data showed price pressures continue to recede. The average of the core inflation measures is now running at 2.75%pa, setting the stage for a rate cut. Odds of a move by the Bank of Canada at the 5 June meeting have risen to ~63%, with more than 2 rate cuts factored in by year-end. The adjustment exerted a bit of downward pressure on the CAD. Ahead of today’s RBNZ decision (12pm AEST) the NZD also softened (now ~$0.6093) while the other major currencies tread water. EUR is hovering near ~$1.0850, GBP is at ~$1.2710 with todays UK CPI data (4pm AEST) predicted to show a sharp drop in annual inflation, USD/JPY is just above ~156, and the AUD is around ~$0.6665.

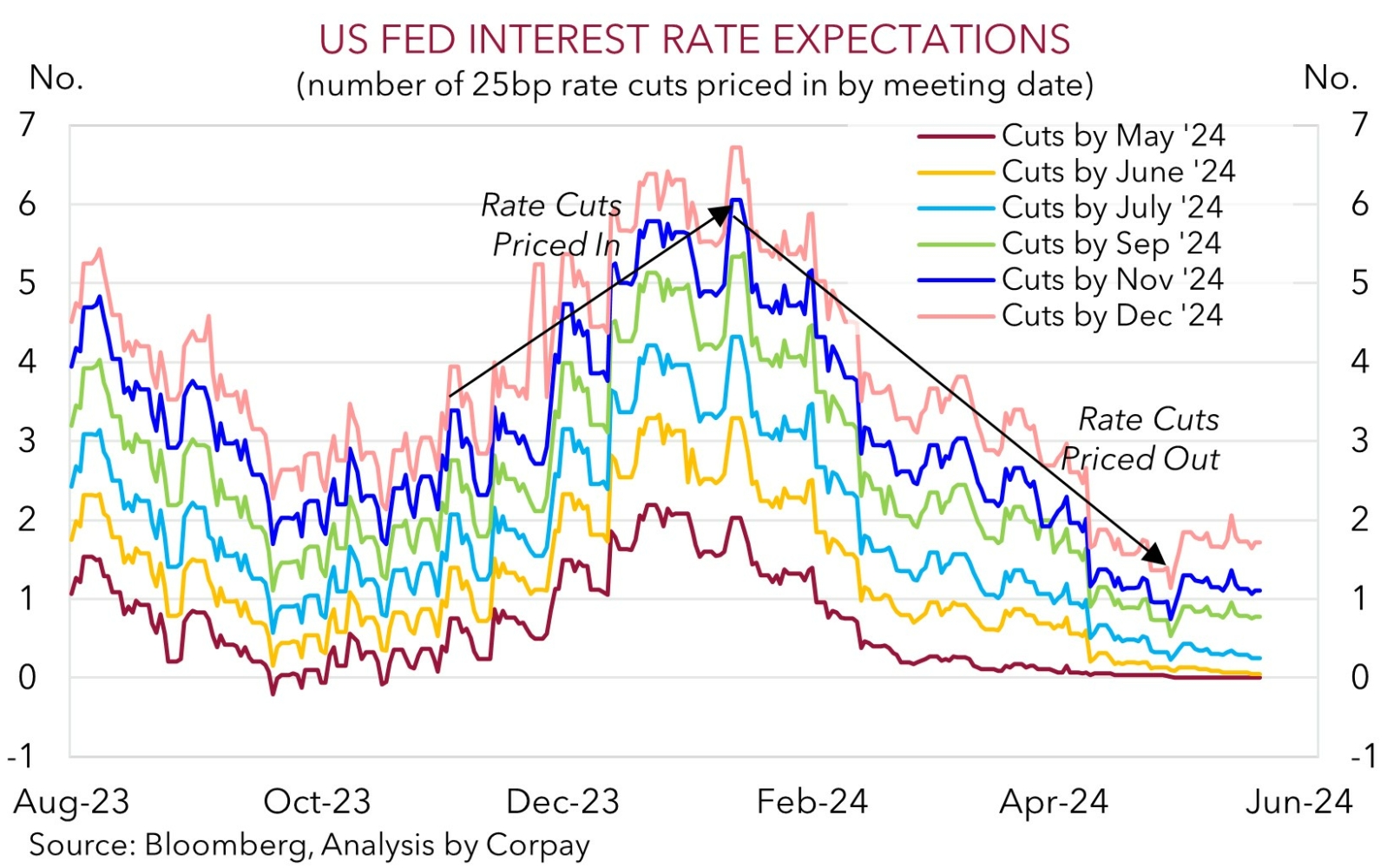

In terms of the Fed speakers, respected Governor Waller was in focus. Early on he noted that “in the absence of a significant weakening in the labour market” he would need to see “several more months of good inflation” before he would support policy easing. He was a little more explicit later by outlining if the data “were to continue softening throughout the next three to five months, you can even think about doing it (i.e. cutting rates) at the end of this year”. Waller’s timeline suggests that without a jobs market shock, September may be the earliest time for a Fed rate cut. As our chart shows, markets are already assuming a similar path with the first Fed rate reduction not fully priced in until the November meeting. Outcomes compared to expectations matter in markets, so while a ‘higher for longer’ Fed outlook can hold the USD up, given it is baked in it shouldn’t be assumed that it will push it higher, in our view. The minutes of the last US Fed meeting are released tonight (4am AEST). We think comments the Fed believes rates are at their peak and policy recalibration later this year is still the base case might see the USD ease.

AUD Corner

The AUD has consolidated with another uptick in US equities and gains in industrial metals prices helping the currency hold its ground. At ~$0.6665 the AUD is near the upper end of its ~4-month range. The AUD also held steady against the EUR (now ~0.6140), CNH (now ~4.83), JPY (now ~104.10) and GBP (now ~0.5245), while it nudged up against the CAD after the latest Canadian inflation data reinforced expectations the Bank of Canada could start cutting rates as soon as the June meeting. AUD/CAD (now ~0.9095) is just below its 1-year peak.

The minutes of the May RBA meeting were released yesterday. Given the post-meeting press conference and already released forecast update there wasn’t anything groundbreaking. Although the undertone in some of the commentary did support our long-held thoughts that while it would take another meaningful upside inflation surprise for the RBA to hike again given the economic slowdown, it doesn’t look to be in a rush to cut rates. And from our perspective, when the time comes, the RBA’s easing cycle could be more limited than many of its peers due to the stickiness in domestic services inflation, Australia’s lackluster productivity, income support from the stage 3 tax cuts, and fiscal impulse. All up, diverging monetary policy expectations between the RBA and other central banks should be AUD supportive over the medium-term, in our opinion (see Market Musings: AUD outperformance to continue?). This may be on show again later today with UK CPI (4pm AEST) forecast to slow sharply in April (from 3.2%pa to 2.1%pa). If realised, this might bolster thoughts the Bank of England could kick off its easing cycle in Q3, with wider rate differentials a positive for AUD/GBP.

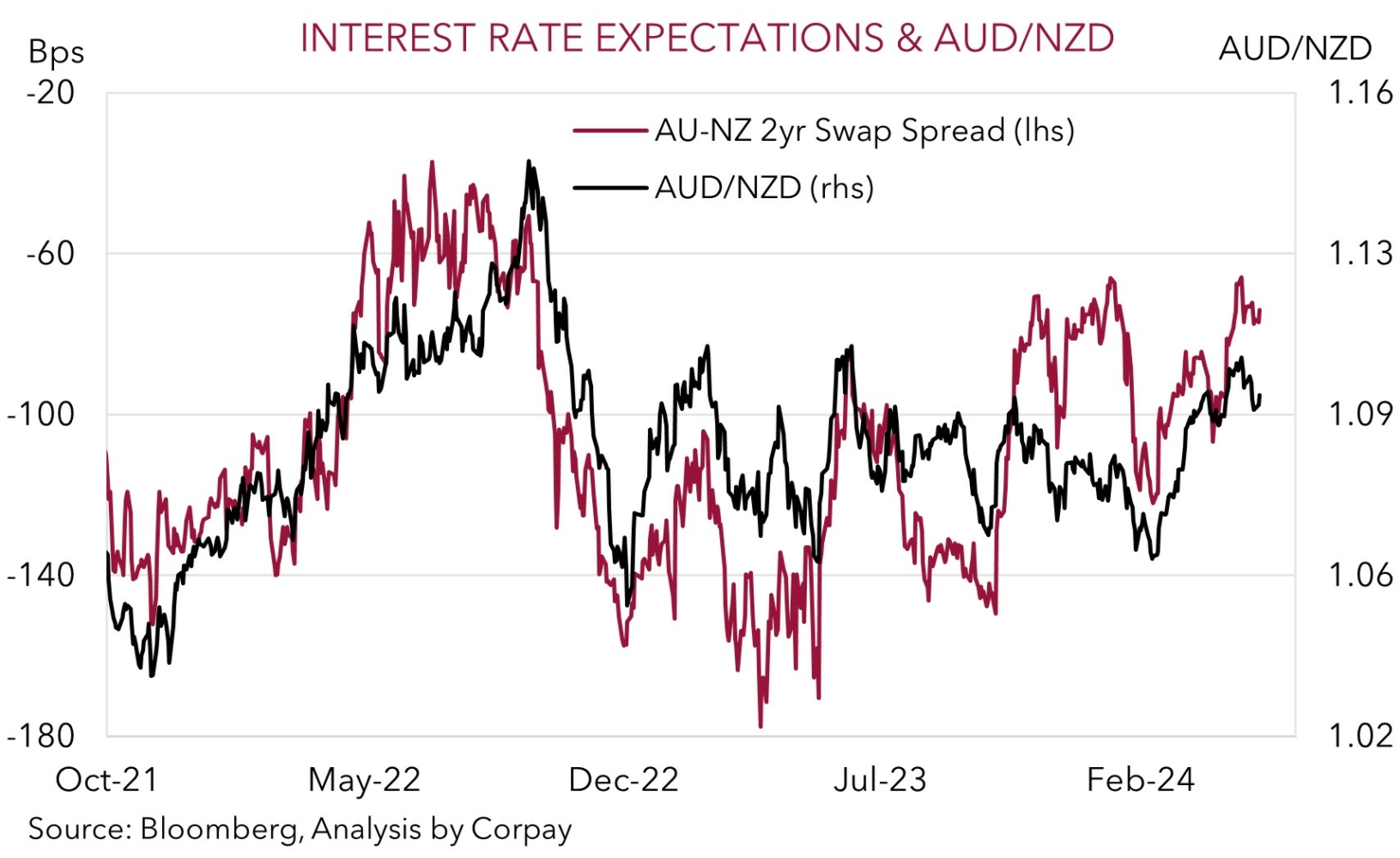

AUD/NZD is also in focus today with the RBNZ meeting (12pm AEST) and press conference (1pm AEST) on the schedule. Interest rates should be held steady at 5.5%, marking 1-year since the last RBNZ move. Economically, the RBNZ is facing a growth inflation trade-off given weak activity levels and a softening labour market but still elevated domestic inflation. In our view, the RBNZ is likely to reiterate that ‘restrictive’ settings are working but they may be needed for a little while yet. However, we do see a chance it starts to open the door to easing down the track by watering down the odds of another hike in its forecast track and possibly projecting the first rate cut sooner than its current Q2 2025 start date. If this comes through this may see AUD/NZD (which looks to be tracking too low compared to the AU-NZ 2yr swap spread) bounce back.