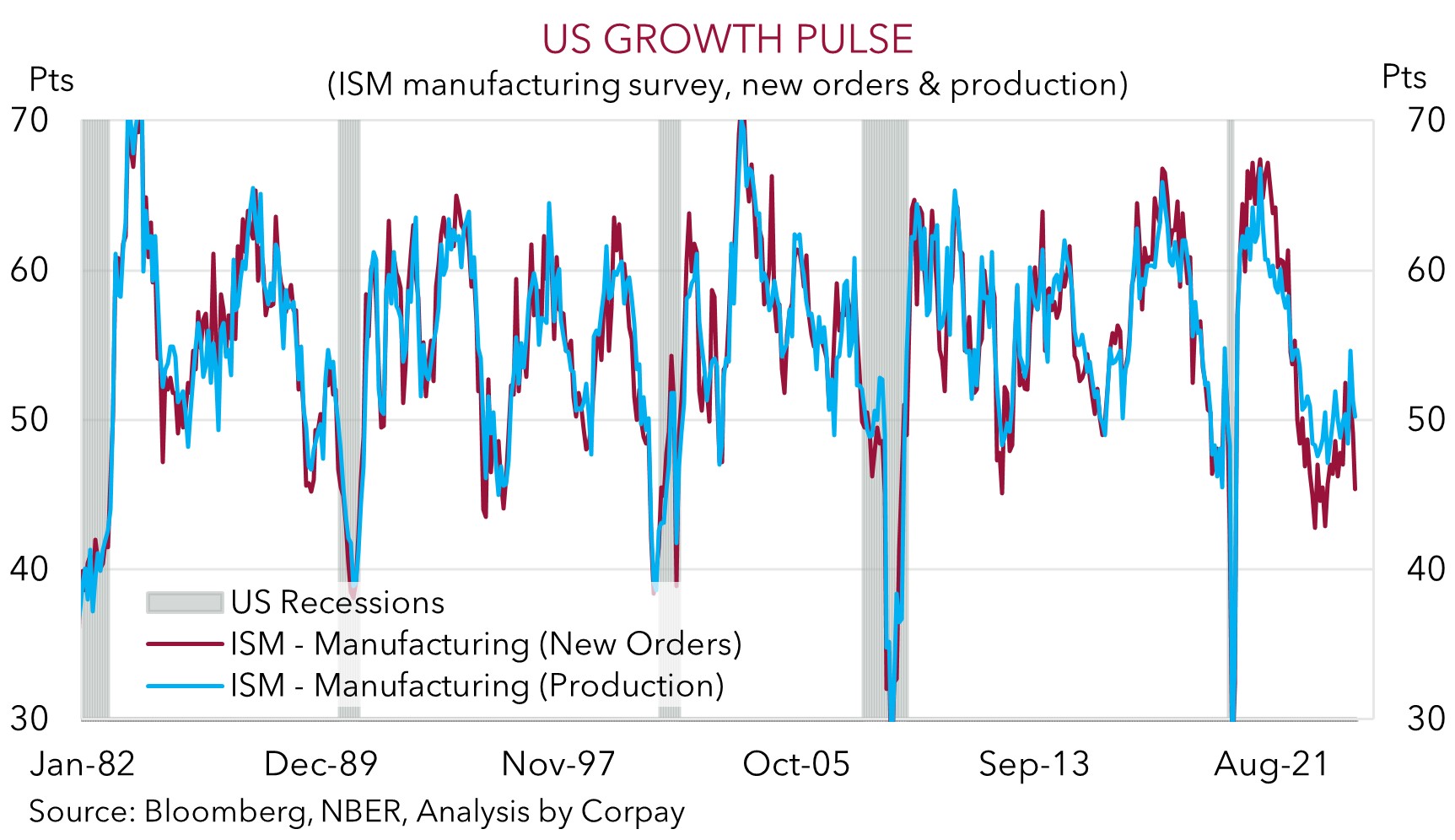

• US ISM. A weaker US manufacturing ISM rattled nerves. The drop in US bond yields has weighed on the USD & supported the AUD.

• Labour market. US JOLTS due tonight. Non-farm payrolls out on Friday. Signs the US jobs market is cooling may exerted more pressure on the USD.

• AU data. Q1 GDP due tomorrow. More inputs released today. Modest growth anticipated. But offshore forces/USD trends have more of an AUD impact.

A surprisingly weak US ISM manufacturing survey, a leading indicator for cyclical momentum in the economy, rattled a few market nerves overnight. In contrast to expectations predicting a small lift, the ISM fell further into ‘contractionary’ territory (now 48.7, a 3-month low). Weaker demand was the driver. Production declined and new orders touched their lowest level since early-2023 (see chart below). This points to further weakness across US production over the months ahead. In response there was a sizeable drop in US bond yields. The US 2yr yield declined another ~7bps (now 4.81%) while the benchmark 10yr rate fell ~11bps (now 4.39%) as participants adjusted their US Fed rate cut expectations. The first Fed rate reduction is again fully discounted by November, with a second move priced in by January.

While the dip in US yields helped the stock market hold up (the S&P500 rose a modest +0.1%) the USD lost ground. EUR has moved above ~$1.09 for the first time since late-March, GBP is a touch over ~$1.28, and the interest rate sensitive USD/JPY has slipped down towards ~156 as yield differentials shifted against the USD. USD/SGD has eased to ~1.3460, while the NZD (now ~$0.6190, the top of its 3-month range) and AUD (now ~$0.6685) have started the week on positive footing. The softer USD more than offset the mostly negative signals from commodities. Although the copper price increased (+1.7%), iron ore (-1.8%) went the other way with an even bigger move coming through in oil. WTI crude shed ~3.9% to be near US$74/brl (a multi-month low) after traders were disappointed by weekend news OPEC+ had agreed to start phasing out production cuts from October.

Tonight, the US JOLTS job openings report is released (12am AEST). This is a data set closely monitored by the US Fed as it provides a guide to labour demand, hiring and firing rates, and jobs churn which is a leading indicator for wages and inflation. Based on the step down in US economic activity jobs growth across cyclical sectors has decelerated. In our view, more signs the US labour market is cooling could further revive longer-dated US Fed rate cut bets which may in turn exert additional downward pressure on bond yields and the USD. In addition to the JOLTS report, later this week US ADP employment (Weds night AEST), the ISM services gauge (Weds night AEST), and the monthly non-farm payrolls data (Fri night AEST) are due. On top of that the Bank of Canada (Weds night AEST) and European Central Bank (Thurs night AEST) hand down their decisions.

AUD Corner

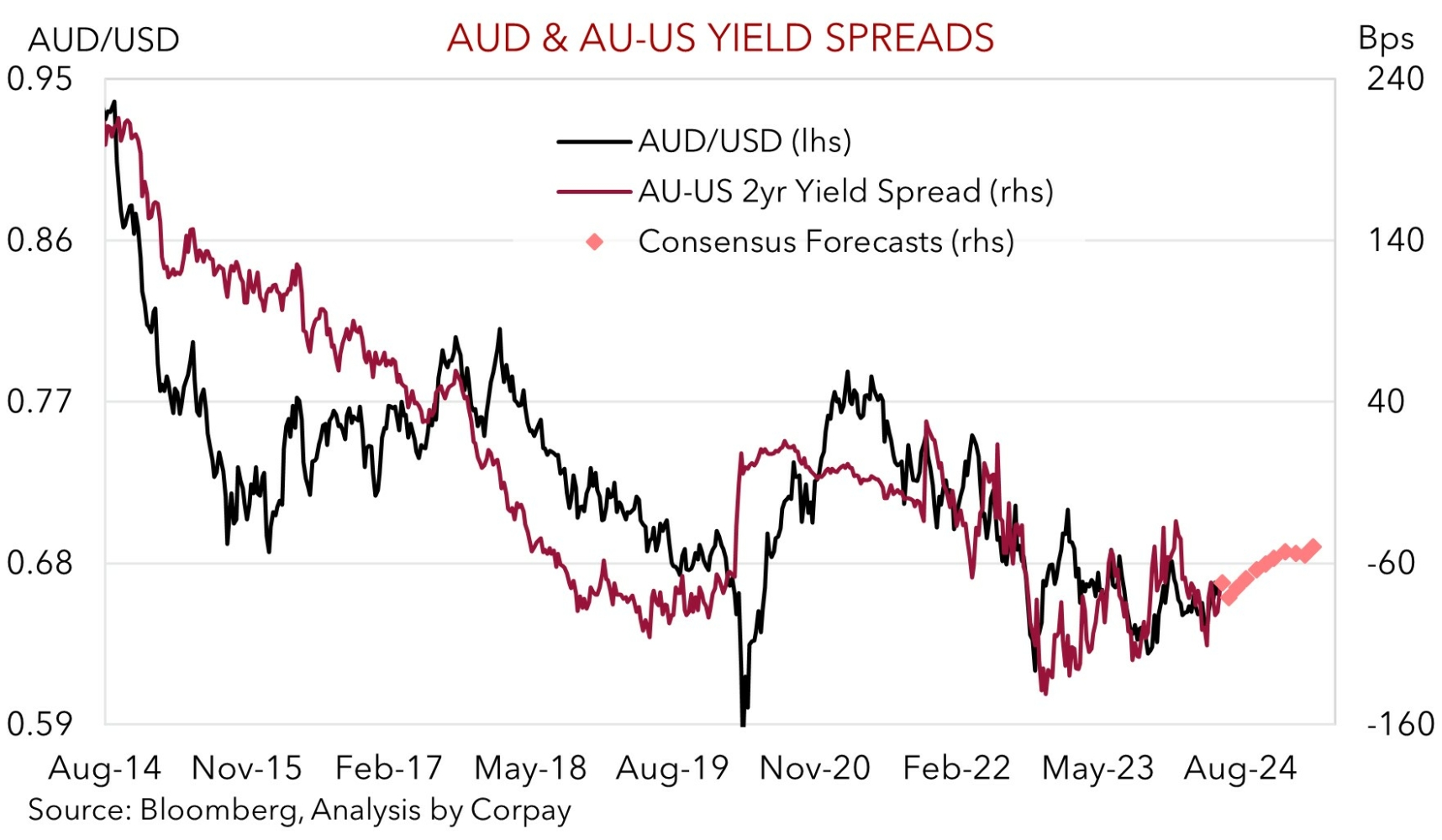

The AUD has kicked off the new week on a positive note. The weaker USD stemming from the negative surprise in the US ISM manufacturing survey and decline in US bond yields has helped push the AUD up to ~$0.6685 (the upper end of the range occupied since mid-January) (see above). In an indication of how USD-centric the moves have been the AUD has been mixed on the crosses. AUD/EUR (now ~0.6130) and AUD/GBP (now ~0.5220) consolidated, a firmer JPY has seen AUD/JPY slip back a little (now ~104.35), while AUD/NZD has also drifted down towards ~1.0810. By contrast, ahead of tomorrow nights Bank of Canada meeting where markets are assigning an 80% chance of a rate cut, AUD/CAD edged up towards its ~1-year high (now ~0.9120). Lower oil prices are also likely to have held down the CAD.

Locally, the Fair Work Commission announced an increase to minimum/award wages of 3.75% from 1 July. The FWC considered the rising cost of living and rejigged stage 3 tax cuts, which are also due to start next month, in its decision. This compares to an increase of 5.75% for most awards last year. The decision directly applies to ~21% of employees, though there are also some broader indirect effects. In our opinion, the outcome supports the view wage growth has peaked, however, given the lingering tightness in the labour market and slow-moving dynamics because of multi-year Enterprise Bargaining Agreements, the deceleration could be drawn out. While the RBA is likely to be comforted by the decision, we don’t think it is to far different from what it was assuming, hence near-term policy implications should be limited.

Tomorrow Q1 Australian GDP is released. As outlined yesterday, it will confirm what is already known. Meagre growth of ~0.1-0.2% is projected for Q1 as high interest rates slow demand, particularly across the household sector. While the local data may generate some intermittent AUD volatility (and media headlines), as is normally the case, the impact on the AUD will probably be overshadowed by offshore forces such as signs the US labour market is cooling and a USD negative bring forward of US Fed rate cut expectations. We remain of the view that the RBA looks set to lag its global peers in terms of when it starts and how far it goes during the next easing cycle. The divergence between the RBA and other central banks, and shift in relative yield differentials, should be AUD supportive over the medium-term.