• Positive tone. Equities higher, while bond yields fell. BoC delivered its first rate cut this cycle. There were more signs the US labour market is cooling.

• FX moves. Limited net moves in currencies. USD index a touch firmer, with a softer JPY the main driver. EUR & AUD treading water.

• Data flow. ECB tonight. A rate cut is fully priced. Q1 AU GDP confirmed growth momentum is weak. But this is what is needed to tame inflation.

It was a generally positive tone across markets overnight. European and US equities rose, with strong gains in technology stocks coming through. This saw the NASDAQ (+2%) outperform the broader US S&P500 (+1.2%). Across commodities, copper rose ~2% with WTI crude ~1.4% also higher. A further pull back in bond yields underpinned the buoyant risk sentiment as various data points and central bank actions reinforced views that a downward recalibration in interest rates is (slowly) unfolding.

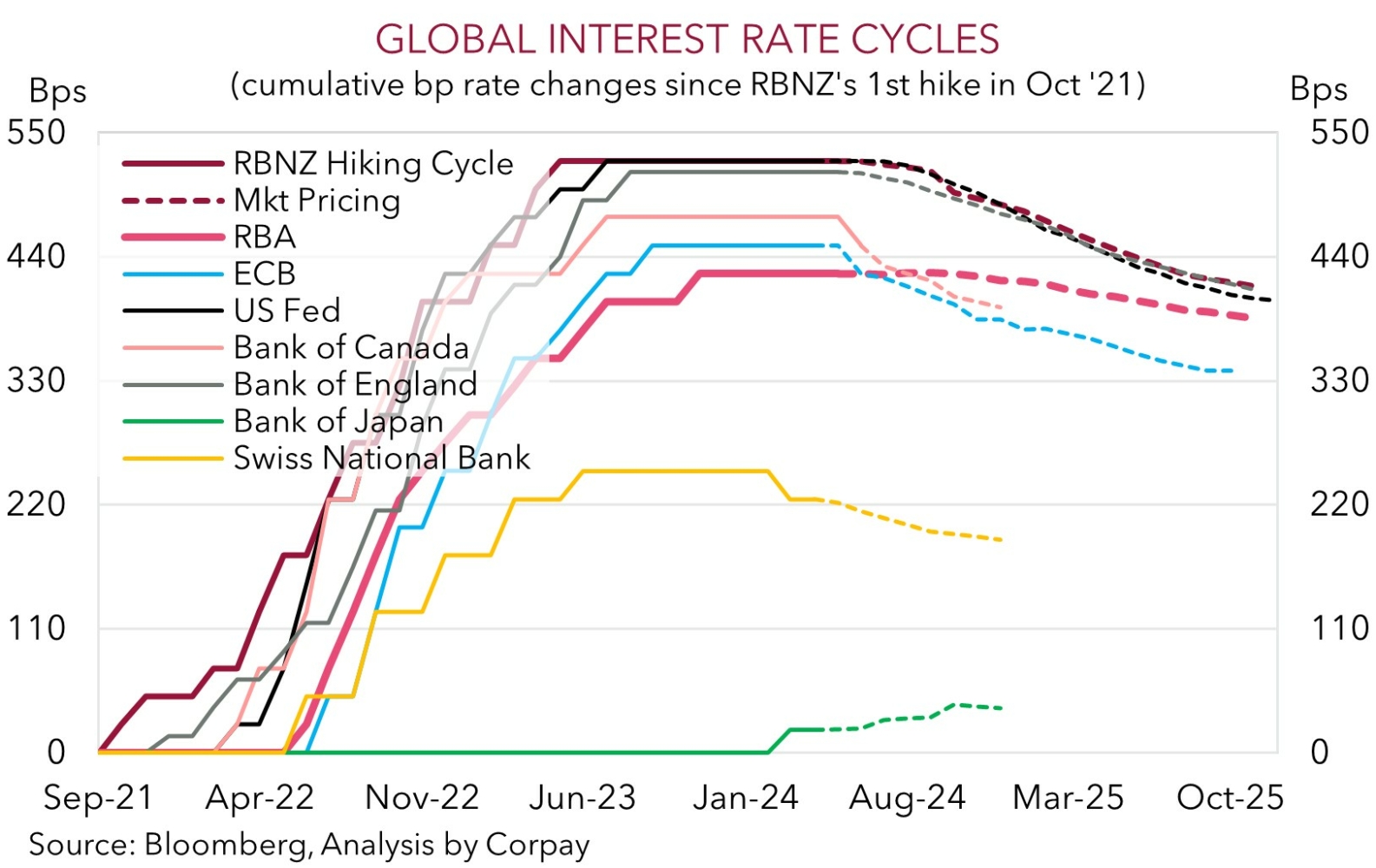

US bond yields declined by ~5bps across the curve, with the benchmark 10yr rate (now 4.27%) at its lowest level in two months. There were larger moves in Canadian yields after the Bank of Canada delivered its first rate cut this cycle. The 25bp reduction, which was ~80% factored in before the meeting, lowered the BoC policy rate to 4.75%. According to the BoC given inflation is slowing policy “no longer needs to be as restrictive”, with the Governor adding that if the disinflation trend continues “it is reasonable to expect further cuts”. That said, this will depend on the data with the BoC not on rate cutting autopilot. Markets are factoring in two more BoC cuts over the remaining four meetings of 2024. In the US, there were more signs the labour market is losing steam. ADP employment undershot forecasts with only 152,000 jobs added in May. And while the headline ISM services index bounced back, the prices paid subcomponent eased and hiring intentions remained in ‘contractionary’ territory. Almost two rate cuts by the US Fed are now discounted by year-end with the first move fully priced in by November.

Despite the macro news and swings in other markets, net moves in currencies were modest. Over the past 24hrs the USD index ticked up a touch with a slightly weaker CAD (USD/CAD nudged up 0.1% to ~1.3695) and JPY (USD/JPY edged above ~156 after Japanese wages underwhelmed) the drivers. The NZD is slightly firmer (now ~$0.6190, near the top of its ~4-month range), EUR is treading water around ~$1.0870, and AUD (now ~$0.6650) is unchanged compared to this time yesterday.

Central banks will remain in focus tonight with the European Central Bank decision (10:15pm AEST) and press conference (10:45pm AEST) on the radar. The ECB has strongly telegraphed that its first-rate cut will probably be delivered tonight. Markets are fully pricing in a move, with 54 out of 55 analysts surveyed also penciling it in. Hence, the focus will be on the ECB’s future plans. If the ECB stresses a cautious data-driven approach to subsequent moves we believe the EUR might garner support. If realised, this may weigh on the USD, which in turn could be compounded by a further cooling in US labour market conditions in the monthly jobs report (released Friday night AEST).

AUD Corner

The AUD has oscillated in a tight range centered on ~$0.6650 over the past 24hrs, in line with the limited net USD moves and with buoyant risk sentiment counteracting sluggish Australian growth data (see below). On the crosses, the AUD has also been fairly stable with AUD/JPY an exception (+0.8% to 103.75) as a bout of JPY weakness washed through. The AUD lost a bit of ground versus GBP (now ~0.52) and NZD (now ~1.0740), while it has ticked up against the CAD after the BoC delivered its first rate cut overnight (now ~0.9105) and EUR ahead of tonight’s ECB meeting (now ~0.6115).

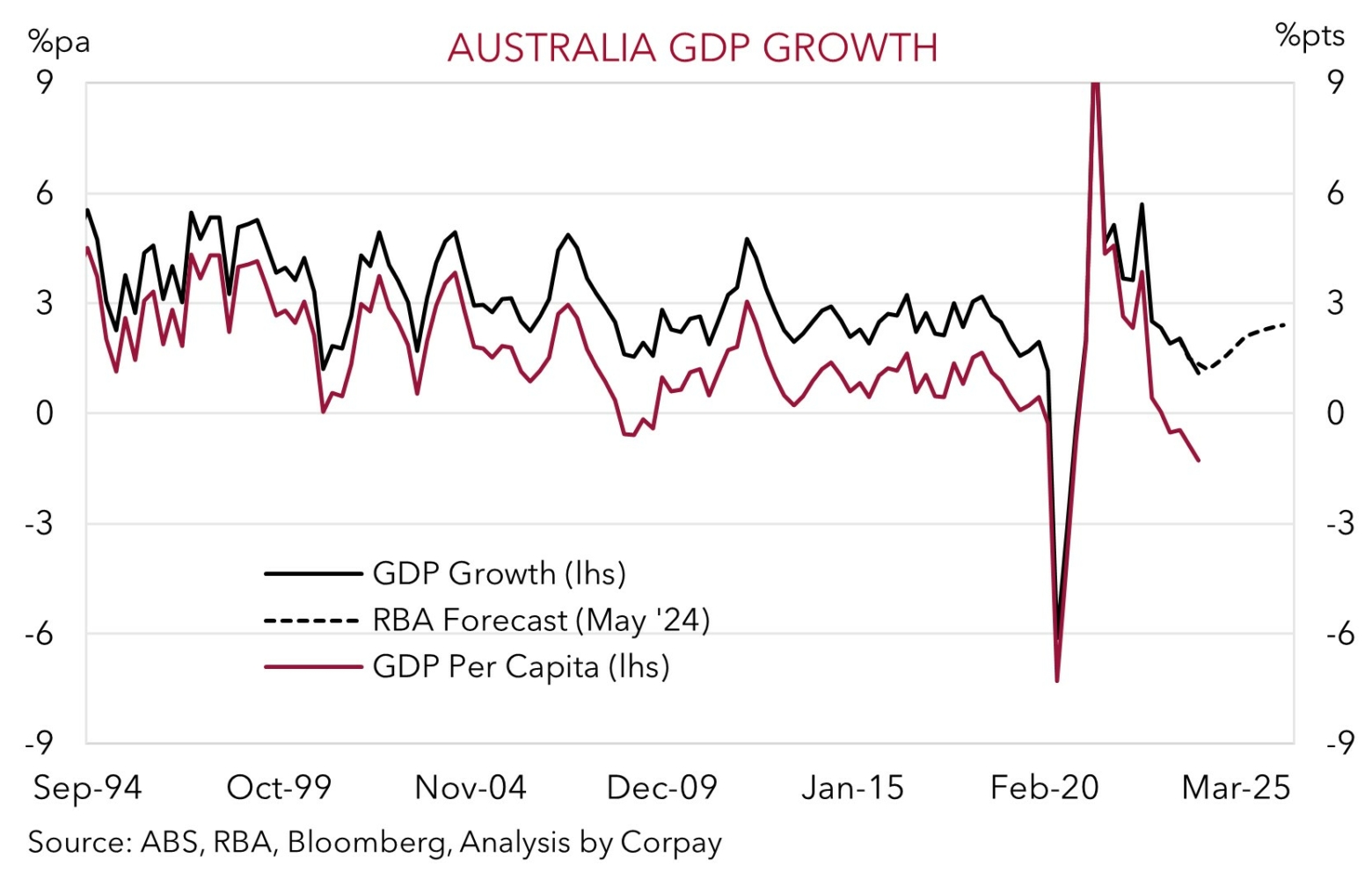

Locally, yesterday’s Q1 GDP largely confirmed what we already knew. Momentum across the economy is soft, with higher rates and the cost of living squeeze constraining activity. GDP grew by just 0.1%. As a result the annual pace slowed to 1.1%pa. Outside of the pandemic, this is one of the weakest annual run rates in ~30yrs. Stripping things back, the larger population is helping aggregate demand hold up somewhat as more people floating around supports volumes. Per capita GDP went backwards for the 5th straight quarter to now be 1.3% lower relative to a year ago.

Sub-trend growth should continue for a while yet, based on leading indicators like forward orders. However, this is what is needed to help tame inflation. On that front, unit labour costs moderated, but at nearly 6%pa they are still above levels consistent with the RBA’s inflation target. We continue to think the stickiness in domestic inflation, resilience in the labour market, income support from the stage 3 tax cuts, and improvement in China’s economy should see the RBA lag its peers in terms of when it starts and how far it goes during the global easing cycle. Over the medium-term, we believe the divergence between the RBA and others should be AUD supportive as yield differentials shift in Australia’s favour. Indeed, if the upcoming US jobs report underwhelms (released Friday night AEST), US Fed rate cut bets could be further revived and this in turn might exert pressure on the USD and boost the AUD.

Ahead of that, as discussed above, the ECB will be in focus tonight and a rate cut is widely anticipated (10:15pm AEST). That said, assuming the ECB lowers rates for the first time this cycle but is cautious about the speed/size of subsequent moves we feel this may generate a knee-jerk dip in AUD/EUR. Although we don’t expect dips in AUD/EUR to extend to far given the pair already looks too low compared to interest rate differentials and with Australia’s economy on (slightly) sturdier footing.