• Consolidation. US equities & yields little changed. USD slightly softer with EUR inching up after the ECB cut rates but was vague about future moves.

• US jobs. Monthly US employment report in focus tonight. Signs conditions are cooling could revive US Fed rate cut bets. This may drag on the USD.

• Other data. China trade figures out today. New RBA Deputy Gov. Hauser speaks. Next week US Fed meets, with US CPI & AU jobs also due.

Consolidation was the name of the game across most major markets overnight. While European equities edged up (EuroStoxx600 +0.7%) the US S&P500 held steady. Similarly, a relatively ‘hawkish rate cut’ by the European Central Bank (see below) saw European bond yields nudge up ~3-4bps, but US rates were on net unchanged. The US 2yr yield is hovering near 4.72%, with the benchmark US 10yr rate at 4.29% (the bottom end of its 2-month range). By contrast, base metals rose (copper +1.4%, iron ore +4.8%), as did oil (WTI crude +2.2%). Following its recent slide oil prices were supported by comments from the Saudi Energy Minister that OPEC+ can pause or reverse scheduled production changes if required to recalibrate demand and supply.

In FX, the USD Index drifted back a bit with USD/JPY a little lower (now ~155.60) and EUR a touch higher (now ~$1.0890). As mentioned, the ECB delivered its first rate cut for this cycle. The well telegraphed 25bp reduction lowered the main refinancing rate to 4.25% as the ECB looked to remove a level of “excess monetary restriction”. As we have repeatedly outlined outcomes compared to expectations are what drive markets. Hence with traders having fully factored in the rate cut ahead of the event the ECB’s guidance about subsequent moves was of most interest. And on this front the ECB stressed that the future path for rates was data- and forecast-dependent. Indeed, a post meeting media story indicated that ECB officials have all but ruled out a follow up move in July, with another rate cut in September also unclear at this stage. In response markets trimmed some of their ECB rate cut pricing with less than 2 more cuts over the rest of 2024 baked in. Elsewhere, the softer USD and firmer commodity prices helped the NZD (now ~$0.62, the top of the range it has occupied since mid-January) and AUD (now ~$0.6668) tick up, while USD/SGD slipped back towards ~1.3460.

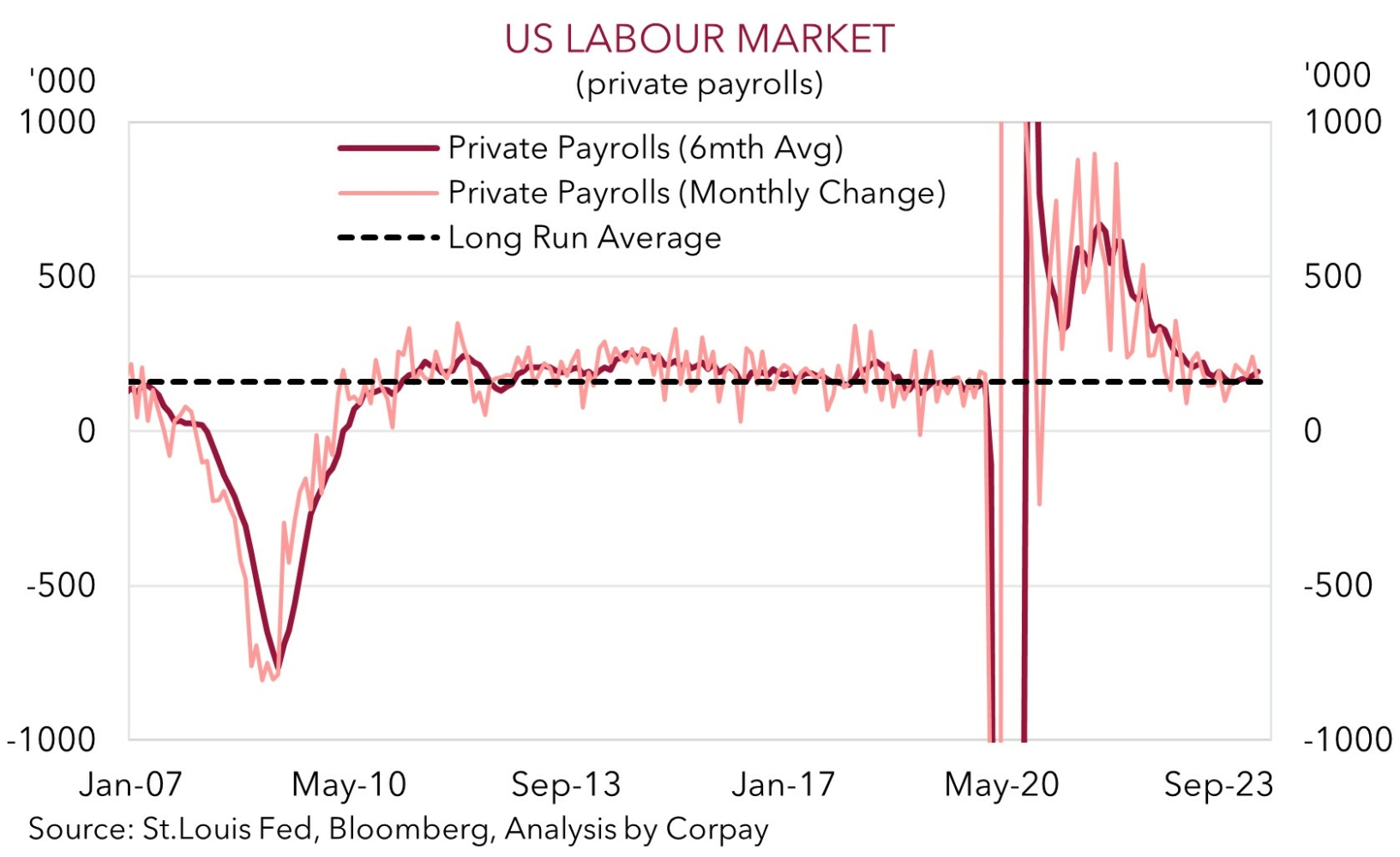

The China trade data for May is due today (no set time), however market focus, as it normally is, will be on the monthly US employment report (10:30pm AEST). Inline with the step down in US economic activity various gauges are indicating the US jobs market is cooling. Greater slack in the labour market is what the US Fed wants to see as it means slower wages and lower inflation down the track. We think a mix of subdued growth in US non-farm payrolls (mkt +180,000) and/or a lift in unemployment (mkt 3.9%) could revive longer-dated US Fed rate cut bets. Markets are factoring in the first US rate cut by November, with a second discounted by January. If realised, this might exert downward pressure on US bond yields and the USD.

AUD Corner

The AUD inched up overnight on the back of the softer USD as the ECB’s ‘hawkish rate cut’ helped the EUR (the major USD alternative) tick higher, and firmer commodity prices (see above). At ~$0.6668 the AUD is approaching the upper bound of its multi-month range. The backdrop also helped the AUD on a few crosses with gains of 0.1-0.3% recorded against GBP, NZD, CAD, and CNH over the past 24hrs. By contrast, AUD/JPY (now ~103.70) and AUD/EUR (now ~0.6122) consolidated. In our view, the diverging monetary policy trends between the RBA and ECB and Australia’s relatively sturdier economic footing could see AUD/EUR lift a bit further over the coming weeks.

Today, China import/export data is due (no set time), new RBA Deputy Governor Hauser speaks (1pm AEST), and the monthly US jobs report is released (10:30pm AEST). Improvement in China’s export growth would be another signal that global industrial activity is turning the corner. This is normally a positive underlying environment for the AUD. RBA Deputy Governor Hauser, who is speaking on “the state of Australia’s economy, monetary policy, and the global fight against inflation”, could note that although growth is weak, the battle against inflation is still not over, especially given the resilience in the labour market. If we are right, this type of messaging would reinforce our view that the RBA is on a slightly different path and looks set to lag its peers in terms of when it starts and how far it goes during the next easing cycle.

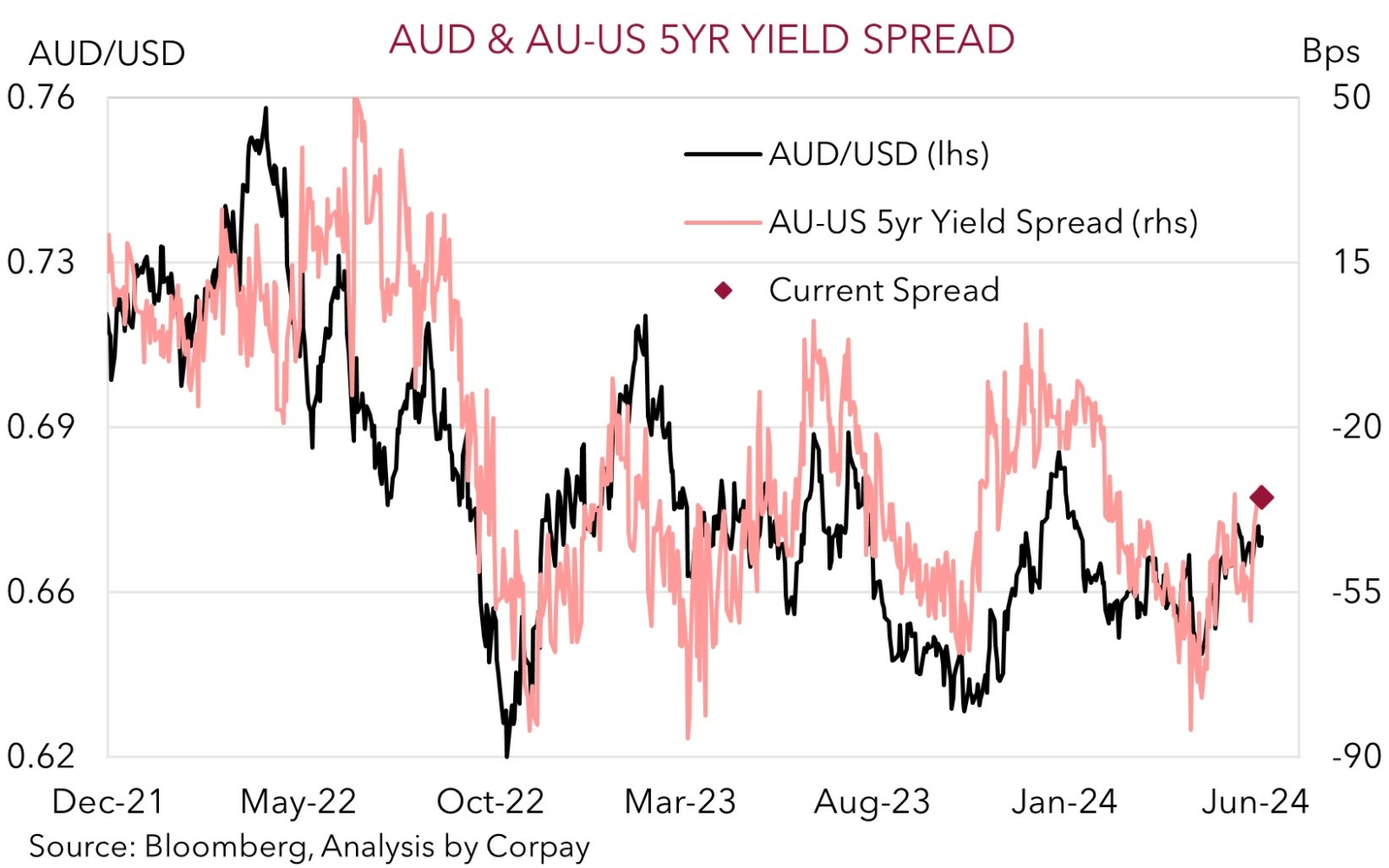

Indeed, as mentioned above, if tonight’s US employment report shows conditions are continuing to loosen, we believe market pricing for future US Fed rate cuts could lift, which in turn might exert downward pressure on the USD, boost risk sentiment, and support the AUD. As our chart shows, the current level of the AU-US 5yr bond yield spread already looks to be pointing to a slightly higher AUD. The average across our broader suite of models suggests ‘fair value’ is currently around ~$0.68.