• Higher bond yields. Inflation pressures and ‘hawkish’ rhetoric continues to fuel expectations of ongoing rate hikes by the major central banks.

• China reopening. Large lift in the PMIs on the back of the reopening. This has supported commodities. But it may add to inflation down the track.

• AUD range bound. Positive China developments has been offset by sluggish domestic growth and signs inflation has passed its peak.

The upswing in global bond yields has continued, with inflation concerns front-of-mind for investors. Positive risk sentiment in yesterday’s Asian trade generated by the large lift in the China PMIs as the COVID reopening boosted activity unwound as a combination of stronger than expected German inflation, a larger than predicted increase in the prices paid component of the US ISM manufacturing survey, and ‘hawkish’ rhetoric from central bankers fueled expectations of ongoing rate hikes.

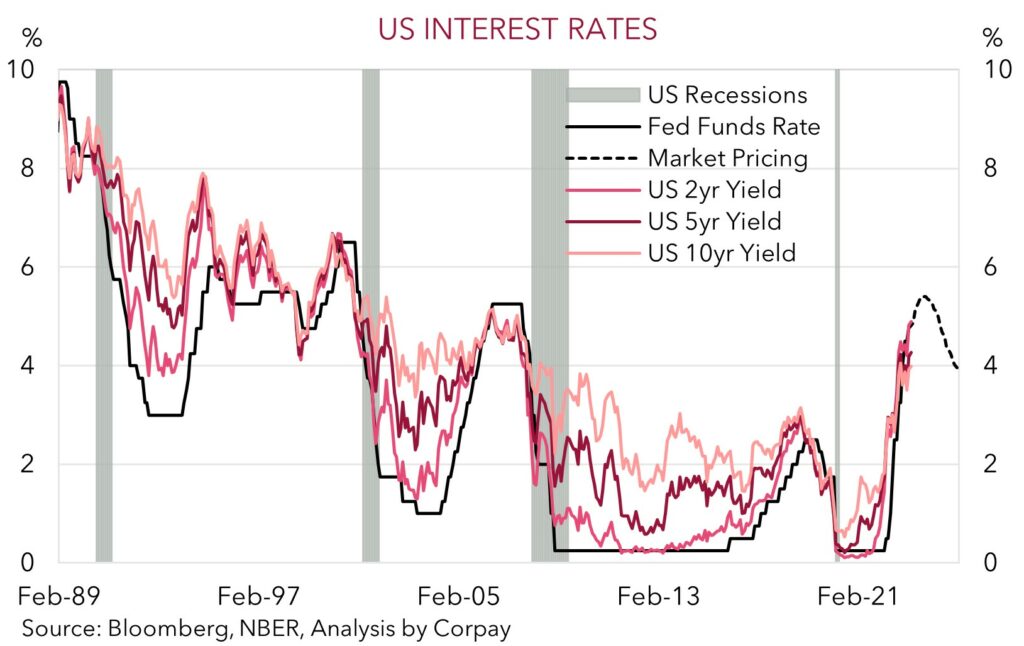

Eurozone and US bond yields rose another 7-9bps across their respective curves. The German 10yr yield is up at 2.7% (the highest since mid-2011). In the US the 10yr yield is near 4% while the 2yr yield touched a new cyclical high of 4.90% as markets adjusted expectations of how high the US Fed could raise rates and how long they may stay in place. Markets are forecasting the US Funds Rate (now 4.75%) to peak near 5.5% later this year, with some modest cuts factored in over H1 2024. For the ECB the market is projecting the policy rate to reach 4%, implying another ~150bps of tightening from here.

The rise in bond yields has exerted a bit of pressure on equities. The US S&P500 dipped ~0.6%, with the index around its lowest since mid-January. By contrast, oil and base metal prices have risen, with China’s reawakening expected to support demand. We would note that down the track higher commodity prices due to stronger growth in China may generate another wave of global inflation. This is a second-round effect markets may only be starting to come around too. In FX, the moves have again been modest and mixed. The USD Index has given back a little ground, thanks to the bounce in the EUR stemming from the ECB rate path repricing. AUD has remained range bound near 0.6750, while GBP has underperformed as markets lowered their ‘peak’ Bank of England interest rate forecasts after Governor Bailey bucked the trend and stated that “nothing is decided” about further hikes.

In our view, the pullback in the USD shouldn’t extend too far, with higher US rates a source of support. Indeed, using history as a guide US yields could have further to run. As the chart shows, US yields have tended to only peak around the time and level the Fed Funds Rate tops out at. Higher yields because of sticky inflation, coupled with slowing growth as the lagged impacts of aggressive policy tightening materialise is a recipe for heightened market volatility. This is a backdrop that tends to weigh on risk sentiment and favours the USD (see Market Musings: Reality check, phase two).

Global event radar: Eurozone CPI Inflation (Today), National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

AUD corner

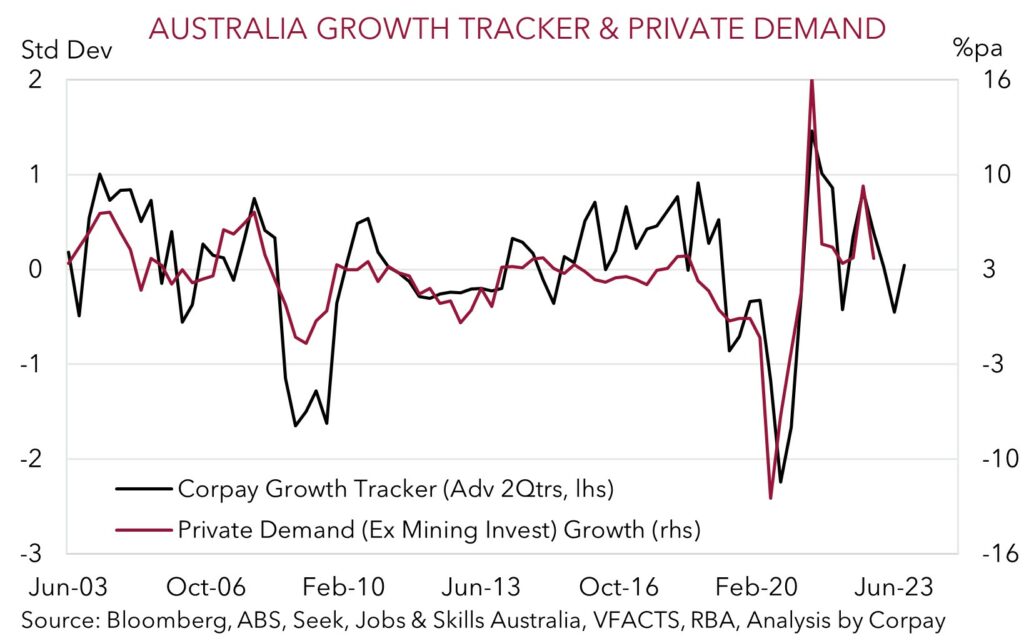

As anticipated intra-day volatility in the AUD picked up yesterday on the back of domestic and global trends. On the negative side, Q4 Australian GDP and the January read of the monthly CPI indicator both undershot expectations. The domestic economy expanded by a sluggish 0.5% in Q4, with the detail not painting a rosy picture given signs higher interest rates are already constraining activity even though the full effects haven’t flowed through yet, and with further RBA hikes to come. The outlook for slower growth over 2023 remains firmly intact, with our Private Demand Tracker pointing to a material deceleration over H1 (see Market Wire: Growth Momentum Slowing). On the positive side, the China PMIs rose sharply, with the manufacturing index hitting its highest level since 2012. This has supported commodity prices.

On net, the AUD, which is tracking just above its 100-day moving average (0.6739), is only slightly higher (~0.4%) compared to where it started the week. In our view, the AUD is likely to remain range bound over the near-term, as push-pull factors continue to play out. We continue to believe the AUD should find solid support around ~$0.66-0.67, though at the same time the unfolding interest rate story should also act to limit AUD rebounds. We think relative interest differentials should remain in the USD’s favour given the stronger and sticker US inflation pulse, and our judgement that the markets pricing looking for the RBA cash rate to reach ~4.2% later this year remains too high (we see the cash rate peaking at ~3.85-4.1%). However, at the same time the higher level of commodity prices and optimism around regional growth stemming from China’s reopening is likely to be an offsetting force.

That said, on the crosses, we continue to see AUD/EUR moving down towards ~0.60-0.62 over the period ahead (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations). The upswing in ECB interest rate expectations and even larger lift in the China services PMI should be relatively more supportive for the EUR given the Eurozone is arguably more plugged into this side of the China story. In addition, we also expect the cross-currents of a resurgent Chinese domestic economy/services sector and the Australian growth risks to keep AUD/CNH under downward pressure.

AUD event radar: National People’s Congress (5th Mar), China Trade Data (7th Mar), RBA Meeting (7th Mar), RBA Governor Lowe Speaks (8th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar).

AUD levels to watch (support / resistance): 0.6690, 0.6739 / 0.6895, 0.6916

SGD corner

USD/SGD has fallen slightly over the past 24hrs as the mix of a bounce in the EUR weighed on the USD, and better than forecast China PMIs bolstered regional growth prospects and Asian currencies. That said, at ~1.3425 USD/SGD remains ~3% above its early-February cyclical low, with the pair only back at levels it was trading at a week ago.

While USD/SGD may continue to pause for breath and ease back a bit more in the near-term, we don’t expect the moves to extend that far. We think USD/SGD should find solid support around the 1.3315-1.3375 range. We remain of the opinion that the uptrend in US interest rate expectations, which were added to once again overnight (see above) should remain an underlying support for the USD, and could weigh on risk sentiment over coming months. Once a short-term period of consolidation has past, our view is that USD/SGD can resume its grind higher, with a move up towards the 100-day moving average (1.3582) possibly on the cards over the period ahead.

SGD event radar: Eurozone CPI Inflation (Today), National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

SGD levels to watch (support / resistance): 1.3316, 1.3377 / 1.3582, 1.3660