• Eurozone inflation surprise. Eurozone bond yields jumped up after a run of higher than expected inflation prints.

• USD still firm. The USD remains near recent highs, with relative interest rate expectations still in favour of the US.

• AUD risk events. Q4 GDP, January inflation, and China PMIs are released today. AUD intra-day volatility should pick up, but will the underlying trend change?

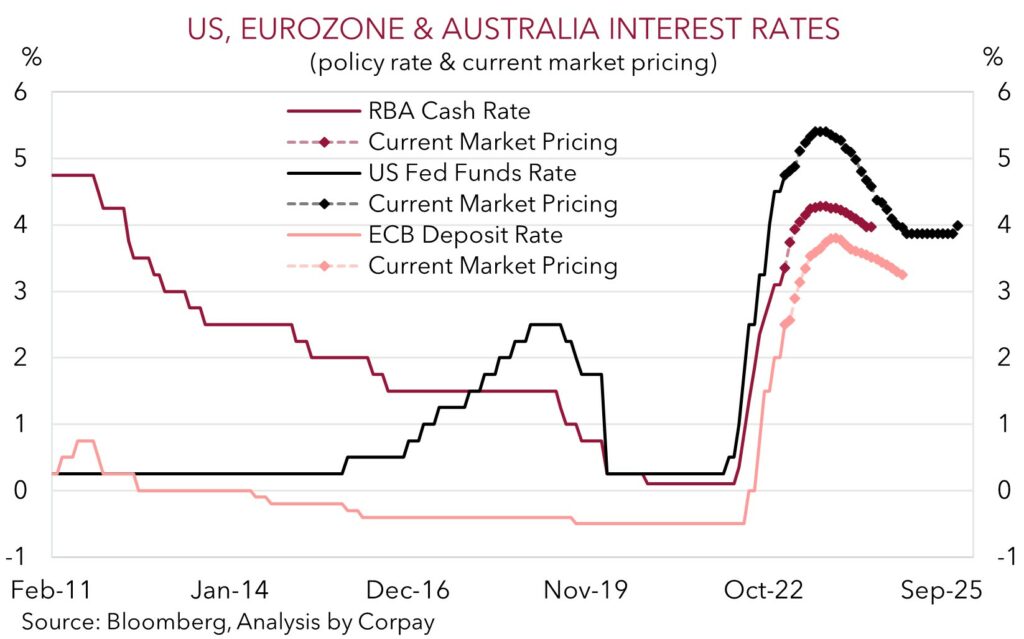

Interest rate expectations and bond markets remain in focus, though overnight attention was in Europe rather than the US. Bond yields across the Eurozone rose ~5-8bps as markets re-priced how high the ECB policy rate could end up. On the back of the adjustment, the German 10-year bond yield is now at 2.65%, its highest since mid-2011. The catalyst was higher than expected inflation data out of France and Spain which raised concerns tonight’s German inflation print and tomorrow’s Eurozone aggregate inflation result could also exceed expectations.

The European moves initially spilled into US bonds, however a run of softer than expected US consumer confidence and Chicago business PMI data saw US yields ease back. The US 10-year yield is hovering near ~3.91%, on net little changed on the day, and still up near its 2023 highs with markets continuing to factor in the US Fed could raise rates from 4.75% currently to ~5.4% by Q3. Elsewhere, US equity markets consolidated, while oil and industrial metals edged up 1-1.5%. In FX, moves have been modest. After tracking the rise in bond yields, EUR has fallen back below 1.06, while GBP is down near 1.2050. The intra-day USD rebound has exerted a bit of pressure on the AUD which continues to oscillate around its 100-day moving average (0.6734).

In terms of the US data, a tidbit we would call out is that the deterioration in US consumer confidence in February was driven entirely by the forward-looking expectations measure. Based on historical trends the declines in the expectations reading points to weaker demand going forward. This is in line with our thinking that the lagged effects of the aggressive policy tightening delivered by the US Fed and other central banks the past year could start to show up more meaningfully in the activity data over coming months (see Market Musings: Reality check, phase two). In our judgement, some assets like equities and credit markets don’t look to be factoring in much of an economic slowdown. This supports our view that volatility could lift as optimistic markets begin to crash up against a harsher economic climate. This is a backdrop that tends to weigh on risk sentiment and favours the USD. The February reading of the benchmark US ISM manufacturing survey is released tonight. Consensus is looking for a slight month-on-month improvement, though levels are still projected to remain in ‘contractionary’ territory.

Global event radar: China PMIs (Today), Eurozone CPI Inflation (Thurs), National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

AUD corner

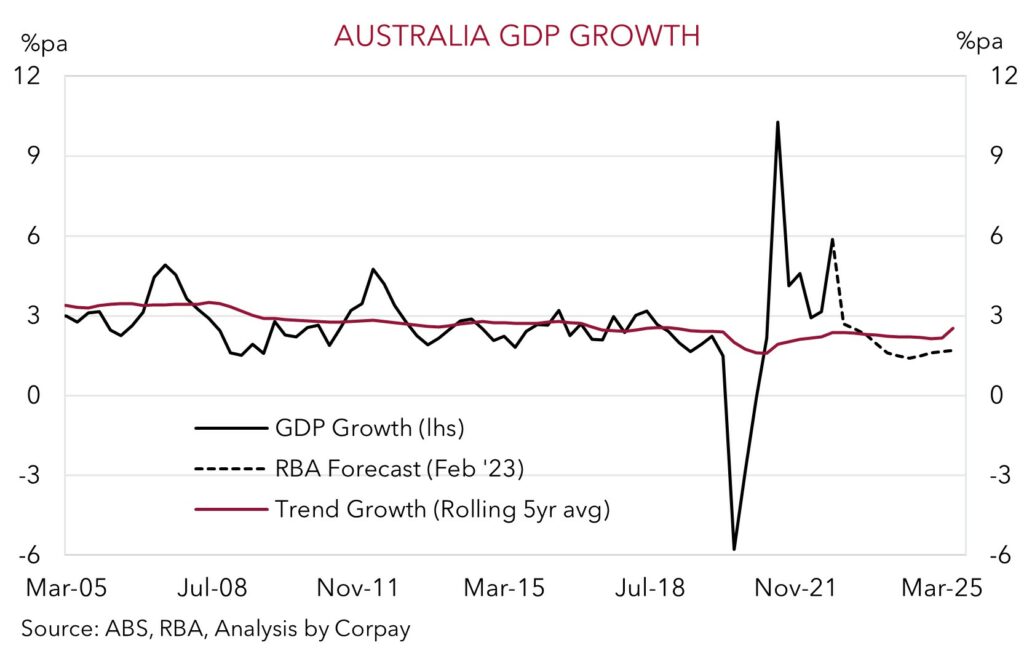

AUD has swung around its 100-day moving average (0.6734) so far this week. Intra-day volatility in the AUD is likely to pick up given the release of Q4 Australian GDP, the January estimate of the monthly CPI tracker (both 11:30am AEDT), and the February estimates of the China PMIs (12:30pm AEDT). In our opinion, the run of partial inputs released over the past few days suggests Q4 GDP risks coming in a touch below the consensus estimate (mkt +0.8%qoq/2.7%pa), with aggregate growth propped up by net exports, while base-effects are pointing to a deceleration in annual inflation. This type of mix could exert some downward pressure on the AUD. However, working in the opposite direction, the projected lift in the China PMI, on the back of the COVID reopening, could be supportive for risk sentiment, regional growth prospects, and in turn Asian currencies and the AUD.

Beyond the intra-day swings, we continue to have a positive underlying USD bias. The shift in relative interest rate differentials should remain in the USD’s favour given the stronger and stickier inflation pulse in the US. We expect this to remain an AUD headwind and limit the extent of any near-term rebounds. However, we also believe that any further moves lower in the AUD from here could be more of a grind, with intermittent bounces looking more likely due to the bearish market sentiment. As we have pointed out over recent days, over the past ~5-years AUD has tended to find solid support near ~0.67, and it has only moved below as exogenous factors like the initial COVID shock took hold.

On the crosses, we continue to see AUD/EUR moving down towards ~0.60-0.62 over coming months (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations). Following the upward repricing in ECB rate expectations (see above), our measure of relative terminal interest rates has moved further in favour of the EUR. We expect relative growth expectations to also move in this direction as dire forecasts for Eurozone growth are pared back and the Australian economy slows as RBA interest rate hikes bite. While growth in January Australian retail sales was a little higher than predicted, we would point out that the average run-rate over the past few months indicates momentum has stalled and higher prices are holding up nominal turnover. We expect consumer spending to slow materially over 2023 as higher mortgage costs and other pressures weigh on household budgets.

AUD event radar: AU GDP (Today), China PMIs (Today), National People’s Congress (5th Mar), China Trade Data (7th Mar), RBA Meeting (7th Mar), RBA Governor Lowe Speaks (8th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar).

AUD levels to watch (support / resistance): 0.6690, 0.6734 / 0.6895, 0.6916

SGD corner

USD/SGD has remained in a tight ~0.4% range so far this week, up near its 2023 highs. At ~1.3490 USD/SGD is ~3.5% above its early-February cyclical low. We continue to think that the upward adjustment in US, and global, interest rate expectations, and higher bond yields (see above) should continue to underpin the USD (and support USD/SGD). In our view, a further grind higher in USD/SGD looks likely over the period ahead, with any near-term pullbacks expected to be limited.

In today’s Asian trade, the February readings of the China PMIs are released. On the back of the COVID reopening, expectations are centred on the China PMIs rising over the month. If realised, this may provide some intra-day support for risk sentiment and Asian currencies as stronger growth in China is a positive for the region. However, we doubt this will change the positive underlying USD trend, particularly as the US ISM (released tonight) is also projected to show improvement. A lift in the US ISM should, in our judgement, reinforce the markets higher-for-longer US interest rate outlook.

SGD event radar: China PMIs (Today), Eurozone CPI Inflation (Thurs), National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

SGD levels to watch (support / resistance): 1.3317, 1.3377 / 1.3590, 1.3660