• Holding steady. A quiet start to the week with US bond yields easing back slightly and US equities edging a little higher.

• GBP & EUR bounce. UK and EU agreed a new deal on Northern Ireland’s trading arrangements. But GBP continues to face structural headwinds.

• Retail sales in focus. AUD has consolidated. After softening into year-end consensus is looking for Australian retail sales to bounce back in January.

A quiet start to the week. The adjustment in expectations around how high the US Fed could lift interest rates this cycle and the flow through to bonds have driven markets over recent weeks. With little out to shift the policy expectation dial overnight, markets have taken a bit of a breather. US bond yields eased 2-4bps across the curve, though at 3.93% the US 10-year yield remains near its year-to-date highs. Markets continue to factor in the Fed Funds Rate (now 4.75%) peaking at ~5.4% in Q3. Elsewhere, no news is good news for the US stock market, with equities edging higher (S&P500 +0.3%), while the USD Index has given back some ground due to a bounce in the EUR and GBP. AUD remains just above its 100-day moving average (0.6730).

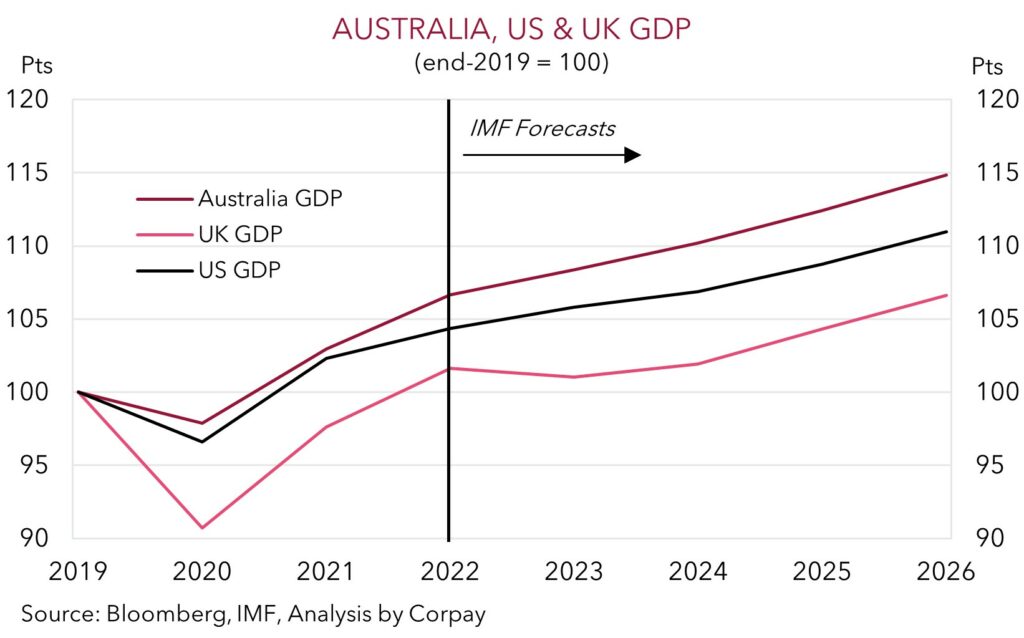

News the UK and EU agreed to a new deal on Northern Ireland’s trading arrangements has given the European currencies a bit of a boost. This issue has been a major sticking point over recent years. The agreement softens the Northern Ireland protocol contained in the 2019 Brexit divorce deal, and should reduce trade issues between the UK and Northern Ireland (which remains part of the EU single market). This is a positive step and indicates relations between the UK and EU are warming after a few tricky years. That said, in our mind, the modest FX reaction (GBP is up ~1.1% from its intra-day low to be back where it was trading last Thursday, while AUD/GBP is back below 0.56) also indicates that markets: (i) were anticipating it; (ii) think there could be some potholes along the way to a final sign-off; and/or (iii) understand there are structural issues still in place that should work against the UK and GBP, such as lower potential GDP growth and a sizeable current account deficit, over the medium-term.

Over the coming days the US economic calendar heats up. The US economic data is generally forecast to improve or remain at levels indicative of positive momentum, while at the same time the Fed members speaking tend to lean ‘hawkish’. We continue to think that US rate expectations should remain elevated in the near-term, and that this should continue to be USD supportive.

Global event radar: China PMIs (Wed), Eurozone CPI Inflation (Thurs), National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

AUD corner

After briefly slipping below 0.67 late yesterday, the AUD has nudged back above its 100-day moving average (0.6730) as the USD drifted lower and equity markets rose. On the crosses, the rebound in EUR and GBP has pushed AUD/EUR and AUD/GBP lower. Over the past few sessions AUD/EUR has dipped down towards 0.6350. As we outlined recently, we see AUD/EUR moved down towards ~0.60-0.62 over the period ahead as relative growth expectations and interest rate differentials move in favour of the EUR (see Market Musings: Cross-Check: AUD/EUR – Shaky Foundations). By contrast, while the positive Brexit related news may give GBP a bit more short-term support, our medium-term thinking is that AUD/GBP should track in a higher range with key fundamentals such as labour market and the terms-of-trade trends relatively more supportive for the AUD. A structurally higher AUD/GBP has been unfolding over recent years. Since 2010 AUD/GBP has spent ~2/3’s of the time at 0.55 or above.

In terms of AUD/USD, we continue to have a positive underlying USD bias. In our judgement, this week’s US economic data and Fed speakers should reinforce the jump up in US interest rate expectations and continue to underpin the USD. That said, although we think this can continue to act as an AUD headwind, we also believe that given how far and how quickly the AUD has fallen since early-February, a period of consolidation is increasingly likely and any further moves lower could be more of a grind with sharp sporadic bounces also potentially occurring. As we pointed out yesterday over the past ~5-years AUD has tended to find solid support ~0.67, having only fallen convincingly below as exogenous shocks took hold (i.e. the early-COVID USD liquidity squeeze, and last years sharp EUR slide stemming from deep Eurozone recession fears).

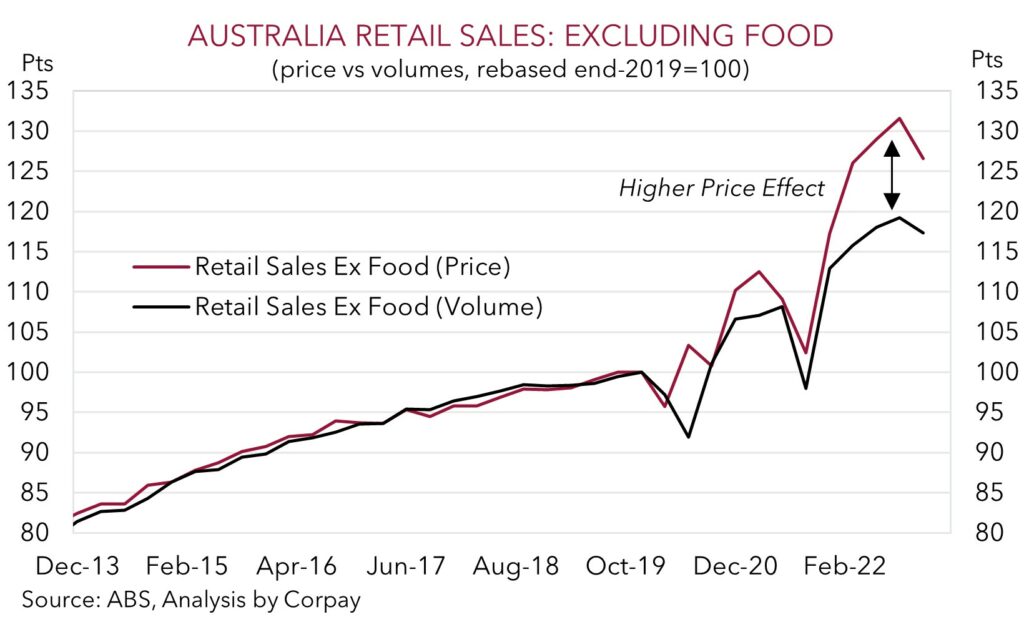

Today, local market attention will be on the latest retail sales report (11:30am AEDT). Retail spending softened into year-end; however consensus is looking for a solid bounce in January (mkt +1.5%), with higher prices playing a role. A snap back in consumer spending would solidify the markets thinking that further RBA rate hikes are coming down the pipe. This, coupled with a decent Q4 Australian GDP print and lift in the China PMIs (both released tomorrow) may, in our view, help partially offset the firmer USD, and generate some short-term AUD support.

AUD event radar: AU Retail Sales (Today), AU GDP (Wed), China PMIs (Wed), National People’s Congress (5th Mar), China Trade Data (7th Mar), RBA Meeting (7th Mar), RBA Governor Lowe Speaks (8th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar).

AUD levels to watch (support / resistance): 0.6690, 0.6730 / 0.6894, 0.6916

SGD corner

In a rather uneventful start to the week USD/SGD has consolidated near 1.3470. As discussed above, US bond yields and the USD Index have drifted back slightly, with the FX moves due to the bounce in EUR and GBP. We don’t think the pull-back in the USD (and USD/SGD) will extend too far, and we remain of the opinion that USD/SGD should remain supported and can continue to grind higher over the coming weeks. This is based on our view that the uplift in US Fed interest rate expectations should remain in place. This in turn should keep US bond yields elevated and be USD supportive. The major US economic data released over the rest of this week is predicted to once again show that the economy started 2023 on solid footing. An extension of the positive run of US data should reinforce expectations that the US Fed has more work to do to slow down the economy and win the battle against inflation.

SGD event radar: China PMIs (Wed), Eurozone CPI Inflation (Thurs), National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

SGD levels to watch (support / resistance): 1.3318, 1.3377 / 1.3590, 1.3660