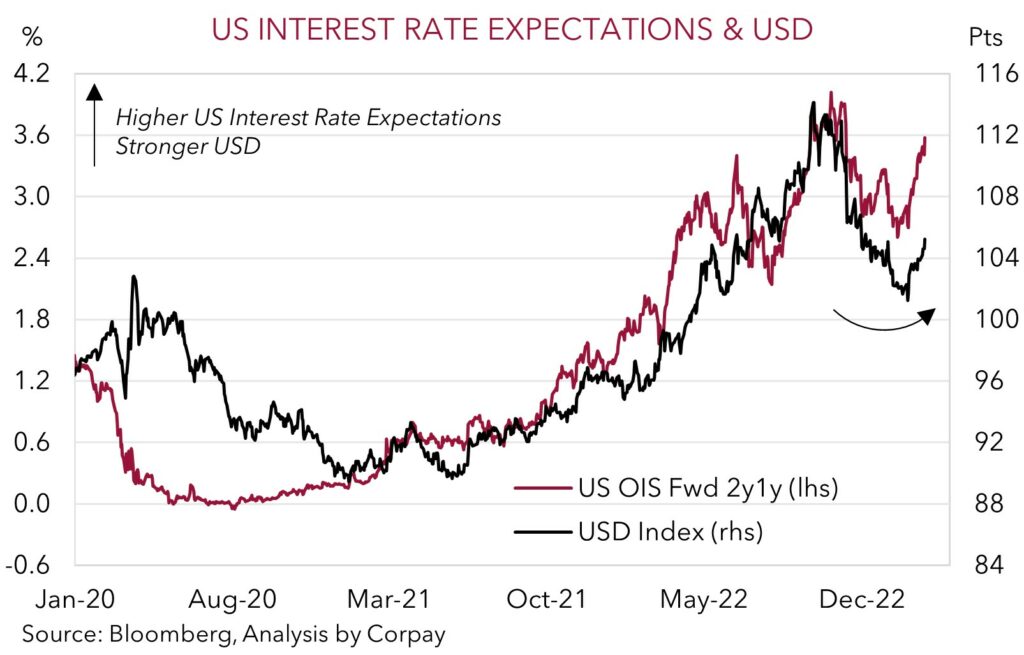

• Higher US rates. Strong US inflation data generated another repricing in US rate expectations, propelling the USD even higher.

• Fed needs to do more. Sticky inflation means the US Fed has more work to do. Positive US data can reinforce the upswing in US yields.

• AUD slump. AUD is now ~6% below its early-February peak. Will this weeks Australia/China data provide an offset to the stronger USD?

The outlook for US Fed policy continues to drive markets. US rate hike expectations took another leg higher on Friday, pushing US bond yields back up towards their peaks. This in turn weighed on risk sentiment and propelled the USD even higher. The US 10yr rose 6bps to 3.94% and the 2yr yield touched a new cyclical high (4.84%). The prospect of continued Fed rate hikes and slower growth saw the US S&P500 dip back by ~1%. The S&P500 is now over 5% below its February highs, with last week’s fall the biggest so far this year. In FX, in line with our thinking, the USD has remained in its uptrend. EUR is down near 1.0550 (a low since early-January), USD/JPY is above 136 for the first time since mid-December, and the AUD has slumped towards its 100-day moving average (0.6730).

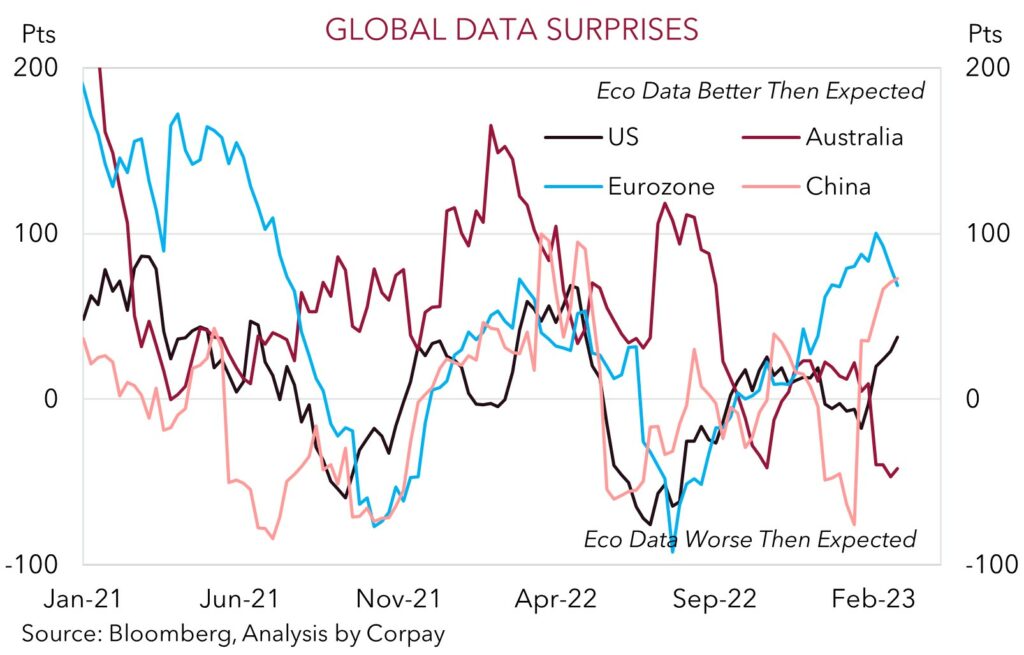

The catalyst was another batch of positive US data, particularly the much higher than expected PCE inflation print. The PCE deflator is the Fed’s preferred inflation gauge, and on this measure core inflation rose 0.6% in January to be up 4.7%pa. This was well above market predictions, with the detail once again showing strong price pressures across key services sectors. This is problematic as services inflation is sticky and slow moving given it is linked to wages, and it points to the Fed having more work to do to slow growth and take the heat out of the US labour market. Elsewhere, real personal spending was also positive (+1.1%), tracking the strong retail sales released a few weeks ago, new home sales jumped over 7% in the month, and the Fed members that spoke again stressed that further tightening is needed.

Markets are now pricing in the funds rate (currently 4.75%) to peak at 5.4% in August, with recent data raising the odds the Fed hikes rates by 50bps rather than 25bps at its 23 March meeting. This week the US economic data is generally forecast to improve or remain at levels indicative of positive momentum, and the Fed members speaking tend to be at the ‘hawkish’ end of the spectrum. We expect US rate expectations to remain elevated, which in our view should continue to support the USD.

Global event radar: China PMIs (Wed), Eurozone CPI Inflation (Thurs), National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

AUD corner

AUD remains on the backfoot, falling towards its 100-day moving average (0.6730). Yet another upward repricing in US Fed interest rate expectations, stemming from better than anticipated US economic data and high inflation has concurrently supported the USD and dampened risk sentiment (see above).

On the back of the resurgent USD and shift in relative interest rate differentials the AUD is now ~6% below its early-February highs. As we have had for several weeks, we continue to have an underlying positive USD bias. In our view, this week’s US economic data releases and speakers from the US Fed should reinforce the uptrend in US interest rate expectations, with a higher-for-longer message and a hawkish tone anticipated. We think this should continue to be USD supportive, and may weigh on risk appetite further given the negative flow through to growth created by restrictive policy settings.

That said, while we believe these factors can continue to act as AUD headwinds, given how far and fast the AUD has declined recently, we think further moves lower could be a slower grind with more intermittent bounces starting to come through. Over the past few years the AUD has tended to find solid support ~0.67, having only fallen convincingly below during the early-COVID USD liquidity squeeze, and last years slump in the EUR as Eurozone recession fears took hold. This week Australian retail sales (Tue), Q4 GDP (Wed) and the China PMIs (Wed) are the regional economic highlights. These data releases are expected to show relative improvement. If realised, a positive run of Australia/China data may help counteract the firmer USD, and generate some AUD support during the week.

AUD event radar: AU Retail Sales (Tue), AU GDP (Wed), China PMIs (Wed), National People’s Congress (5th Mar), China Trade Data (7th Mar), RBA Meeting (7th Mar), RBA Governor Lowe Speaks (8th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar).

AUD levels to watch (support / resistance): 0.6690, 0.6730 / 0.6893, 0.6916

SGD corner

The upswing in US interest rate expectations and bond yields on the back of stronger than forecast US activity and inflation data (see above) continues to support the USD. In the wake of the latest repricing of the US Fed policy outlook following the higher than forecast PCE inflation print, USD/SGD touch its highest level of the year. USD/SGD is now ~3.5% above its early-February cyclical low.

In our opinion, USD/SGD can continue to edge higher over the coming weeks, with retracements likely to be limited. This is based on our thinking that US bond yields and the USD should remain elevated. This week’s US data is generally expected to show the economy remains on a positive footing. This in turn should reinforce thoughts that the US Fed will need to tighten policy settings further in order to get inflation on a sustainable track back down to its target. We think this is also likely to be the message from the various Fed members throughout the week.

SGD event radar: China PMIs (Tue), Eurozone CPI Inflation (Wed), National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

SGD levels to watch (support / resistance): 1.3318, 1.3377 / 1.3590, 1.3660