• Higher yields. Markets continue to adjust interest rate expectations higher with inflation pressures showing limited signs of abating.

• USD rebound. The larger lift in US bond yields has boosted the USD. Equity markets are looking increasingly complacent to the macro landscape.

• AUD crosscurrents. Relative interest rate differentials are a AUD headwind. But the high level of commodity prices is an underlying support.

The upswing in bond yields has continued with markets coming around to the view that interest rates will need to keep moving higher and stay at very elevated levels for some time to slow growth and (hopefully) bring inflation down. The reacceleration in Eurozone core inflation, which at 5.6%pa is historically high, combined with another very low US initial jobless claims print (a sign the labour market is tight), and upward revision to US unit labour costs caught the markets attention. Unit labour costs aren’t normally market moving, but the large jump was too big to ignore. Unit labour costs are now running at 6.3%pa, near the highest in 4 decades, supporting the idea US inflation could be ‘sticky’ and that the Fed’s tightening cycle has further to go.

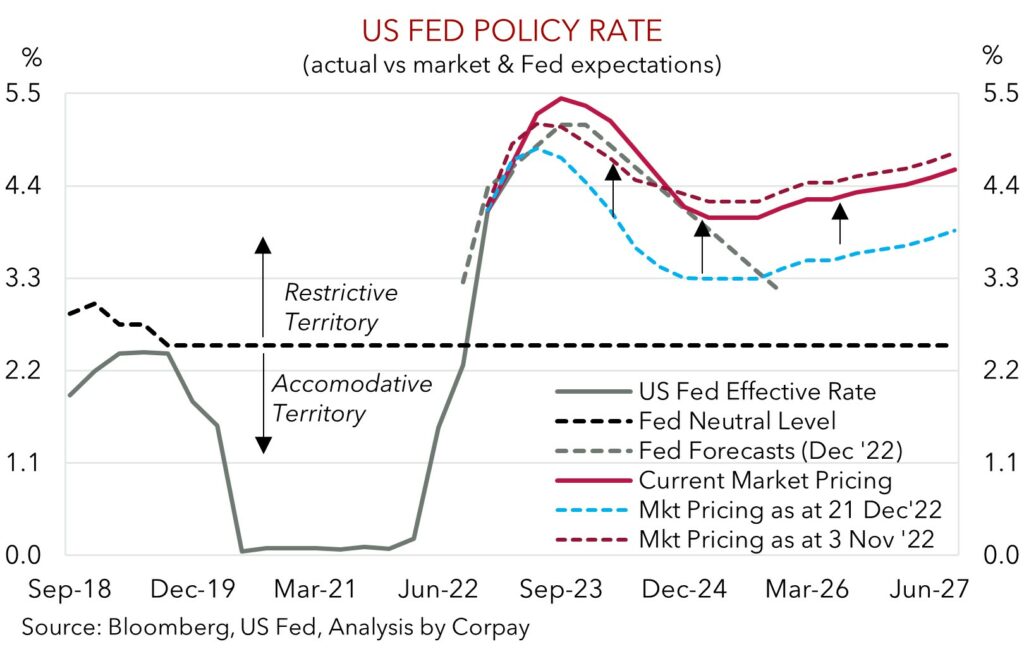

Long-end Eurozone bond yields rose another 4bps, pushing the German 10yr up to a new cyclical high (2.74%), with the inflation result reinforcing expectations the ECB will deliver a 50bp hike at its mid-March meeting. In the US, yields rose a further 2-8bps across the curve, with the 10yr pushing through the 4% barrier for the first time since early-November. As our chart shows, expectations for how high the US Fed may lift rates, and how long it could keep them well into ‘restrictive’ territory have risen substantially over the past few months. Markets are factoring in the Fed funds rate to peak ~5.45% in Q3, implying another ~70bps of tightening from here.

In FX, the relatively larger lift in US yields has boosted the USD. EUR has fallen below 1.06, the interest rate sensitive USD/JPY is tracking just under its 200-day moving average (137.27), GBP has more than unwound its recent UK/EU Northern Ireland agreement bounce, and the AUD has dipped below its 100-day moving average (0.6743). Our view remains that the higher US interest rate expectations should be USD supportive in the near-term.

Elsewhere, equity markets bucked the trend, with the US S&P500 rebounding to end the day in positive territory (+0.8%). Comments by non-voting US Fed member Bostic, who stated that policymakers “could be in a position to pause” by the mid to late US summer supported sentiment. However, we think this is a short-sighted reaction. It is inevitable the Fed will stop raising rates at some point, but there is still work to do in coming months, and importantly the negative economic effects have yet to be fully felt. In our opinion, equity markets remain at risk to a ‘growth shock’, and as such volatility could pick up over mid-year. This is a backdrop that also tends to be USD positive (see Market Musings: Reality check, phase two).

Global event radar: National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

AUD corner

AUD has drifted back below its 100-day moving average (0.6743) as the bounce back in the USD and adjustment in interest rates further in the US’ favour counteracted the lift in US equities and rise in energy and industrial metal prices.

We continue to have a positive USD bias, and think relative interest rate differentials are likely to remain a headwind for the AUD. Inflation dynamics in the US remain stubbornly strong, supporting expectations the US Fed will need to keep raising rates over coming meetings and leave them at high/restrictive levels for some time. At the same time, market pricing looking for the RBA to push the cash rate up to ~4.2% later this year, still looks too aggressive in our view. We see the cash rate peaking at ~3.85-4.1%, with another 25bp hike coming next week.

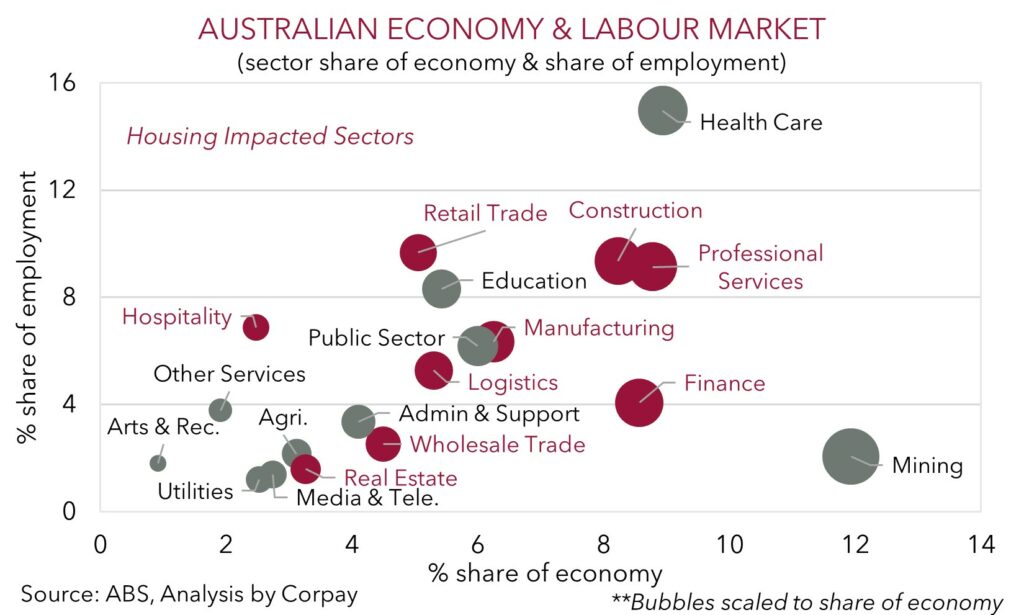

Signs that the sharp rise in rates is having an impact across the Australian economy continue to show up. Housing trends are a key cog in the machine. Building approvals fell sharply in January, and while there can be a lot of month-to-month volatility, the underlying trend is pointing to less residential construction activity down the track as higher mortgage rates reduce borrowing capacity and as people tighten their belts. As our chart shows, given its deep and wide supply-chain, and other interconnected forces, housing (which is very rate sensitive) is an important growth and employment driver. Our Private Demand Tracker is pointing to a deceleration in growth over H1, which should see unemployment lift (see Market Wire: Growth Momentum Slowing).

At the same time the higher level of commodity prices and optimism around regional growth generated by China’s reopening is likely to be an offsetting factor which we think should help the AUD find solid support around ~$0.66-0.67. China’s annual National People’s Congress kicks off on Sunday with the government set to unveil its growth and policy targets. Firm signs China is looking to inject additional stimulus to bolster the post-COVID recovery may give the AUD some support early next week.

AUD event radar: National People’s Congress (5th Mar), China Trade Data (7th Mar), RBA Meeting (7th Mar), RBA Governor Lowe Speaks (8th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), AU Jobs Data (16th Mar), US FOMC Meeting (23rd Mar).

AUD levels to watch (support / resistance): 0.6610, 0.6690 / 0.6794, 0.6897

SGD corner

USD/SGD has recovered lost ground with the pair unwinding yesterday’s modest fall to be back up near ~1.3475. The rebound in the USD, generated by the ongoing lift in US bond yields (see above), has driven the move. We expect USD/SGD to remain supported, with any near-term pullbacks limited in both scale and duration. This stems from our thinking that the upswing in US interest rate expectations should remain firmly in place given the strong US inflation pulse and resilience across the activity data. This in turn should, in our opinion, remain an underlying source of support for the USD. Underpinned by this tailwind we believe that USD/SGD can move up towards its 100-day moving average (1.3573) over the period ahead.

SGD event radar: National People’s Congress (5th Mar), RBA Meeting (7th Mar), BoJ Meeting (10th Mar), US Employment (11th Mar), US CPI Inflation (14th Mar), US Retail Sales (15th Mar), China Activity Data (15th Mar), ECB Meeting (17th Mar), Singapore CPI (23rd Mar), BoE Meeting (23rd Mar), US FOMC Meeting (23rd Mar), Eurozone CPI Inflation (31st Mar).

SGD levels to watch (support / resistance): 1.3314, 1.3377 / 1.3573, 1.3660