• Bond yields. Long-end yields jumped up overnight. US 10yr around its highest since Q4 ’07. This & soft Eurozone growth supported the USD. EUR sub 1.06.

• Mixed messages. AUD/USD lost a little ground yesterday, but AUD outperformed its European peers. Positioning metrics appear quite ‘net short’ AUD.

• AUD events. Monthly AU CPI indicator due tomorrow & retail sales released on Thursday. Various factors point to a re-acceleration in inflation.

After easing slightly at the end of last week bond yields jumped back up overnight, led by moves at the long-end of the curve. German and UK 10yr yields rose 6-7bps, while the US 10yr rate increased ~10bps. At 4.53% the US 10yr yield is around its highest since Q4 2007. Given shorter tenor rates consolidated yield curves steepened. At -60bps the US 2s10s yield curve is at its steepest in ~4 months. There was limited new newsflow to drive the moves, though familiar underlying themes of lingering inflation and outlook of ‘higher for longer’ rates are still in place. Overnight, US Fed member Goolsbee noted that the risk inflation stays higher is still the larger challenge and that the debate is soon likely to shift to how long to hold rates at elevated levels.

European equities weakened (EuroStoxx50 -1%), inline with the negative session in China following news troubled property developer Evergrande had ditched a debt restructuring plan because property sales were weaker than anticipated and given an investigation into a subsidiary prohibited it from issuing new bonds. Data out of German also continues to point to weak growth momentum. As per the PMIs, the forward-looking IFO business confidence gauge remained well below average in August, consistent with mild recessionary conditions. In the US, after starting the day on the backfoot the S&P500 clawed its way back to end the day in positive territory (+0.4%) despite the headwinds mentioned, and with the threat of another US Government shutdown kicking off on 1st October.

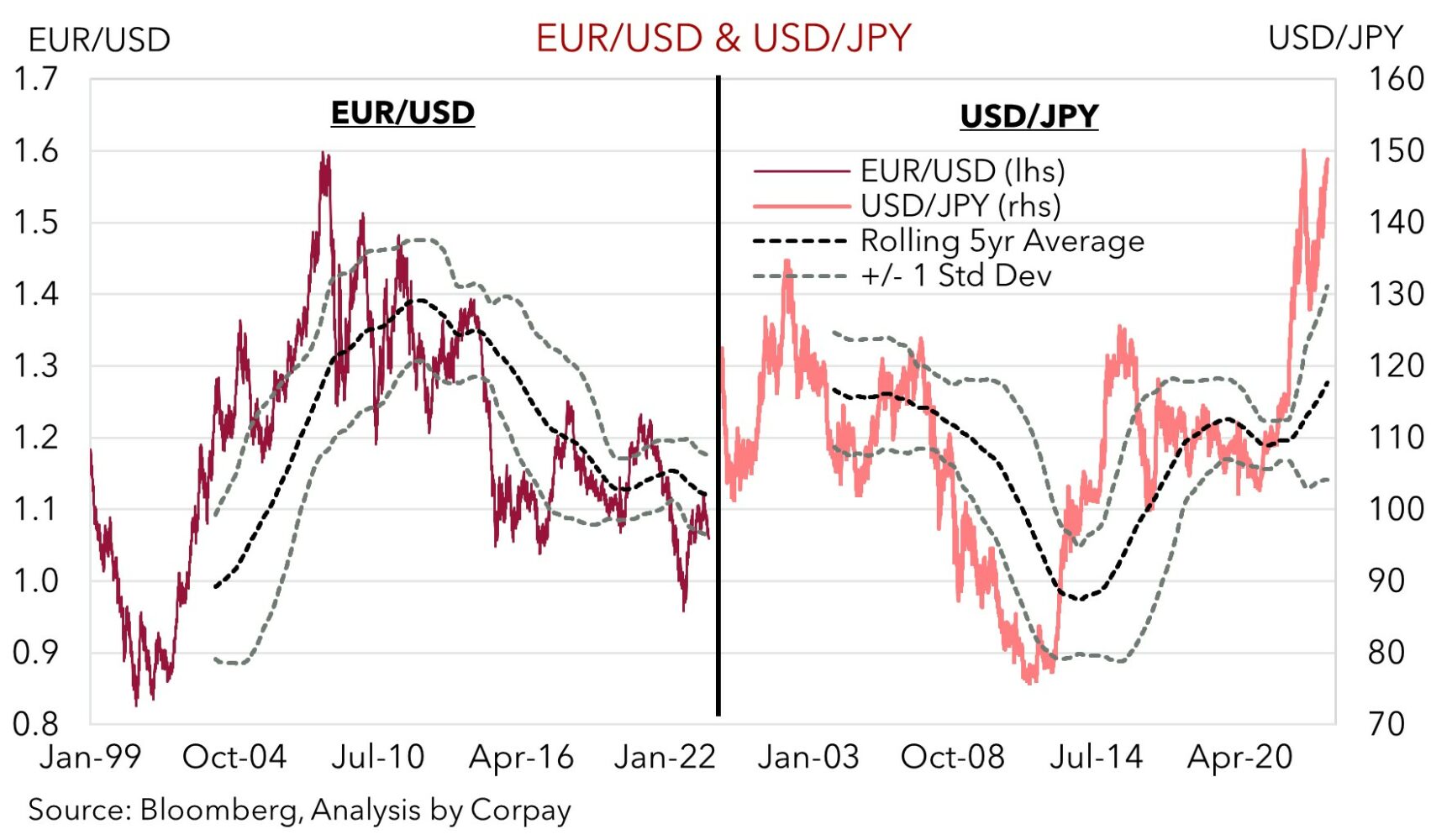

In FX, the USD index edged up touching its highest level since late-November 2022. The sluggish European macro environment continues to weigh on EUR and GBP. EUR slipped back under ~$1.06, with both currencies now near respective ~6-month lows against the USD. USD/JPY has pushed up towards ~149, and a softer CNH and China property developer jitters has exerted a bit of pressure on the AUD (now ~$0.6422). We continue to think that at current levels there is a lot of ‘good news’ discounted in the USD. As our chart shows, EUR and JPY appear quite stretched, especially the JPY which is now trading more than 2 standard deviations away from its ~5-year average. As mentioned yesterday, we believe another US government shutdown combined with the ongoing auto workers strike poses a near-term growth risk for the US economy. Moreover, a lengthy shutdown could affect federally-produced data releases. This could hamper Fed decision making, potentially lower the odds of another near-term Fed rate hike. In our judgement, when combined with a projected slowdown in the US core PCE deflator (released Friday), these hurdles could see markets reduce their lofty longer-term US interest rate expectations. If realised, this could take some of the heat out of the USD.

AUD corner

The AUD has given back a little ground at the start of the new week, with the stronger USD (stemming from the sluggish European growth conditions and relatively higher US bond yields), China property developer concerns, and softer CNH factors (see above). That said, at ~$0.6422 the AUD/USD is only back down where it was tracking on Friday, and it is inline with its ~30-day average. On the crosses, the AUD has inched up against the EUR (+0.3%) with AUD/EUR just below its 100-day moving average. AUD/GBP remains near its ~2-month highs, while AUD/JPY is around the top of its September range. By contrast, the firmer NZD has pushed AUD/NZD back under 1.08.

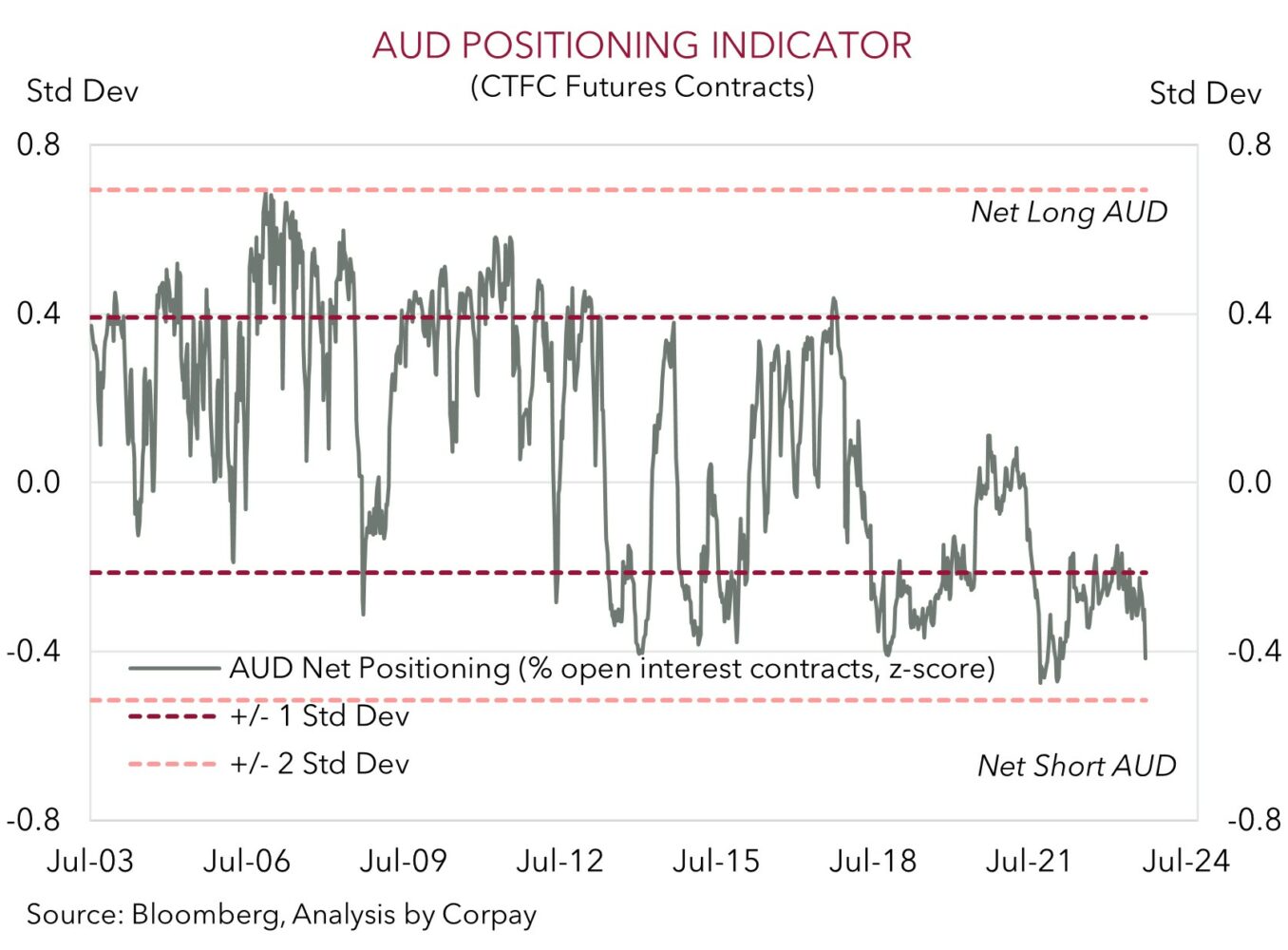

As discussed yesterday and over the past few weeks, down near current levels we think a lot of negatives are factored into the AUD. And that it may not take much of a shift in the data flow and/or sentiment to see the currency bounce back, particularly with indicators such as futures contracts showing indicative AUD positioning is now quite ‘net short’ (see chart and Market Musings: AUD: Always darkest before the dawn).

In our view, the incoming Australian economic data could generate some AUD support, especially on the crosses. The monthly CPI indicator for August is released on Wednesday and retail sales are due on Thursday. The substantial rise in petrol prices over recent months, the weaker AUD and its flow-through to imported prices, and stickiness across services inflation (which will be better captured in this month’s CPI data) points to a meaningful re-acceleration in inflation. We see upside risks to the market’s forecasts (mkt 5.2%pa from 4.9%pa in July). On top of that we believe retail sales may post another solid result (mkt +0.3%) with spending on services related to the Women’s Football World Cup and the burgeoning population tailwinds. Over the past year the Australian population has, on average, grown by ~47,000 per month. This is more than double the pre-COVID run-rate. In our view retail sales and/or inflation surprises could see markets bolster their near-term RBA rate hike expectations, which in turn could be an AUD positive.

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6515, 0.6601

SGD corner

Despite the firmer USD index (see above), USD/SGD has remained range bound with the pair hovering near ~1.3660 over the past 24hrs. On the crosses, EUR/SGD (now ~1.4472) has moved below its 200-day moving average with the weaker EUR on the back of Eurozone growth concerns the driver. SGD/JPY (now ~108.97) has risen to historic highs, with the softer JPY following last weeks BoJ ‘no change’ decision still washing through markets.

Locally, the latest read on Singapore inflation was released yesterday. Headline inflation ticked down to 4%pa while core inflation slowed to 3.4%pa. Both are running at rates last seen in early-2022. While the slowdown in inflation is unlikely to spur the Monetary Authority of Singapore to ease policy in mid-October meeting, the inflation trend shows measures are working and that there is scope for authorities to begin to hint at a more dovish tilt down the track.

As discussed yesterday, focus for markets this week will be on the Eurozone CPI and US PCE deflator data (Friday), comments by Fed Chair Powell (Friday), and the risk of another US government shutdown (from 1st Oct). In our view, another US shutdown combined with the auto workers strike poses a near-term growth risk for the US economy. These headwinds in conjunction with a slowdown in the US core PCE deflator could see markets temper their longer-term US interest rate expectations. This in turn may generate some downward pressure on the USD (and USD/SGD) over the period ahead.

SGD levels to watch (support / resistance): 1.3471, 1.3504 / 1.3690, 1.3711