• Negative sentiment. Elevated bond yields, sluggish US data, & US government shutdown jitters dampened risk sentiment. Equities lower. USD firm.

• AUD sluggish. The backdrop has weighed on the EUR & GBP. AUD also a bit lower. Since 2015 AUD has only traded sub ~$0.64 ~2% of the time.

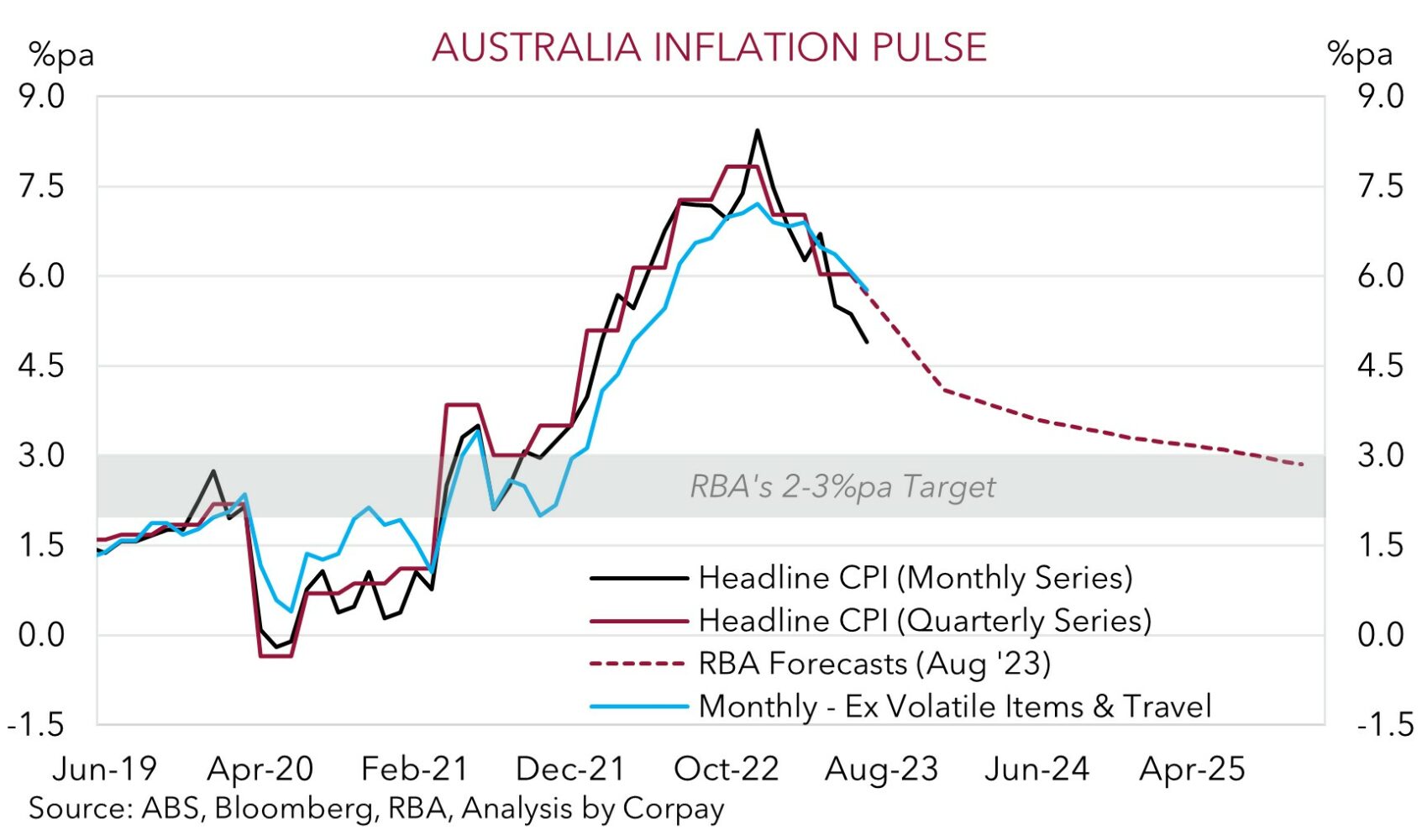

• AU CPI. Monthly CPI indicator released today. The large jump in petrol & stickiness across services prices points to a re-acceleration in inflation.

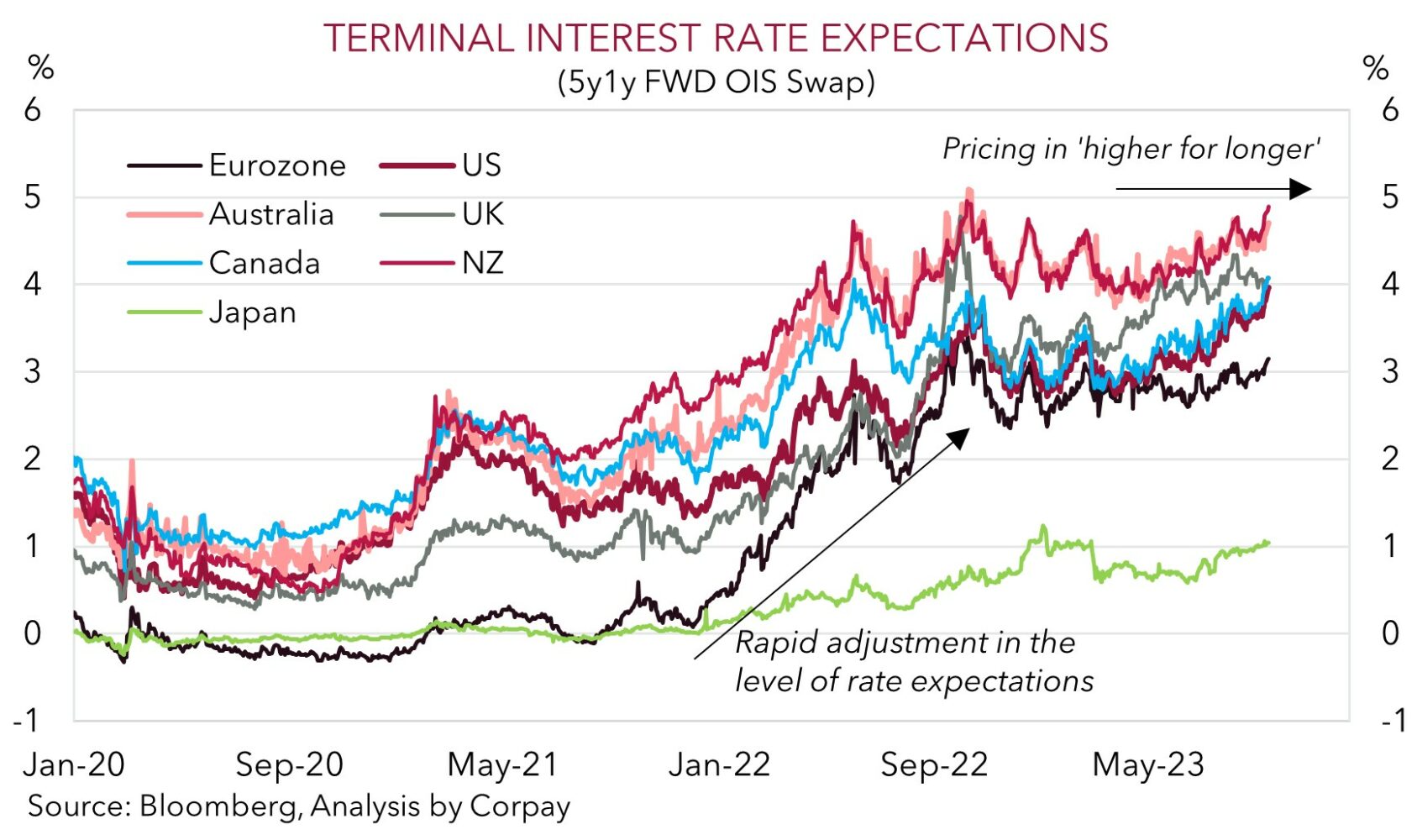

A negative night for risk sentiment. News flow has remained light but the outlook for ‘higher for longer’ interest rates on the back of still elevated inflation and ‘hawkish’ central bank rhetoric, sluggish US data, and jitters about another US government shutdown (from 1st October) combined to dampen the mood. Though comments from Senate Majority Leader Schumer have raised some hopes of a bipartisan stopgap funding bill being approved. If passed in the Senate and House, it would kick the can down the road and temporarily fund federal agencies for another 45 days.

Across markets, the US 10yr yield (now 4.54%) remains near its highest level since Q4 2007, while the US 2yr rate (now 5.12%) is tracking around the top of its cyclical range. Equities declined and the VIX volatility index pushed up to its highest level since late-May. The US S&P500 fell ~1.5%, taking the index to its lowest point since early-June. The S&P500 is now over 7% below its 2023 highs reached ~2-months ago. Commodities were mixed with oil higher (WTI crude +0.8% to ~US$90.40/brl) and growth-linked base metals lower (copper -0.7%, the 7th fall in the past 8 days).

In FX, the USD remains firm with the USD index trading at its highest level since last November. Regional growth concerns and relatively higher US yields continue to exert downward pressure on EUR and GBP. EUR (now ~$1.0570) is near the bottom of its 6-month range and GBP (now ~$1.2161) is now ~7.5% below its mid-July peak. USD/JPY has inched up above ~149, with the bout of risk aversion partially offsetting the USD strength. AUD has slipped back under ~$0.64 for the first time in ~1 week.

Data wise, US new home sales declined by a larger than anticipated 8.7%, as did consumer confidence which touched a ~4-month low. A drop in forward-looking expectations was a factor with US consumers (the engine room of the US economy) feeling more pessimistic about income, business conditions, and employment six months from now. As we have pointed out before, the US’ relative economic outperformance has been a USD tailwind over the past few months, but a pivot point may have been reached. With US ‘excess savings’ now largely depleted, student loan repayments re-starting, cost of living pressures still in place, credit conditions tightening, and confidence below average, risks of a slowdown in the consumer-driven US economy over coming months are on the rise. We think a step down in US growth momentum, coupled with an improvement in China as stimulus measures gain traction, could take some of the heat out of longer-dated US interest rate expectations and the USD down the track. But in the very near-term, as negative risk sentiment prevails, the USD is likely to remain supported.

AUD corner

The AUD lost some ground over the past 24hrs, with the firmer USD and negative risk sentiment, as illustrated by the falls in equities, lower base metal prices, and higher VIX index, washing through. The AUD (-0.4%) has dipped back under ~$0.64 for the first time since last Thursday. The AUD is also a touch softer against the EUR (-0.2%), JPY (-0.3%), and CNH (-0.4%), but flat against GBP, CAD, and NZD. That said, in level terms, at ~0.6052 AUD/EUR remains near its highest since early-August, and AUD/GBP (now ~0.5260) is around a ~2-month peak.

We continue to believe that down near current low levels a lot of ‘bad news’ is priced into the AUD (and a lot of positives are factored into the USD), and that fundamentals such as Australia’s high terms of trade and flow support stemming from the current account surplus (now ~1.2% of GDP) should limit further downside. Since 2015, when these forces kicked into gear, the AUD has only traded sub ~$0.64 ~2% of the time (see Market Musings: AUD: Always darkest before the dawn).

As discussed over recent days, we think the incoming Australian economic data could generate some AUD support, especially on the crosses. The monthly CPI indicator for August is due today (11:30am AEST) and retail sales are released tomorrow. In terms of the CPI, the large jump up in petrol over recent months, the weaker AUD and its flow-through to imported prices, and stickiness across services inflation (which will be better captured in the August CPI data) points to a meaningful re-acceleration in inflation, in our view. We see upside risks to the market’s forecasts (mkt 5.2%pa from 4.9%pa in July), with the underlying detail also potentially indicating that the RBA’s Q3 core inflation projection is too low.

Added to that, we believe retail sales may post another positive result (mkt +0.3%) with spending on services related to the Women’s Football World Cup and the burgeoning population supportive factors. Over the past year the Australian population has, on average, grown by ~47,000 per month. In our judgement, inflation and/or retail sales surprises may see markets add to their near-term RBA rate hike expectations, generating a bit of a boost for the beleaguered AUD. Though the negative risk backdrop is likely to work in the other direction over the near-term.

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6507, 0.6598