• Oil & bonds. Oil prices have continued to rise. Inflation risks are underpinning bond yields. Relatively higher US yields have supported the USD.

• AUD struggles. The stronger USD has washed through FX markets. EUR touched its lowest level since early-January. AUD hit a fresh 2023 low.

• Local data. Headline inflation re-accelerated. Improvement in core inflation is slow going. Pressure on the RBA to tighten further remains. Retail sales due today.

Another night of bearish sentiment with a further jump in oil prices fanning inflation fears which in turn feed through to bond yields and a stronger USD. WTI crude oil rose 3.6%. At ~US$93.70/brl WTI is near its highest since last August and ~40% above where it was tracking in mid-June. Inventories at Cushing Oklahoma (the US’ biggest crude hub) fell to just under 22mn barrels. This is close to operational minimums. Low inventories at a time oil demand are elevated and world supply is constrained by Saudi Arabia’s production cuts is rattling nerves and pushing up prices. As pointed out before this can impact the economy on multiple fronts. On the one hand, the jump in oil will mechanically boost headline inflation over coming months. On the other, higher oil prices act like a tax on households/businesses by reducing disposable income, potentially adding to the unfolding slowdown in activity.

Bond yields continue to advance with 10yr rates in the UK and Germany up another 3bps while in the US the 10yr yield rose ~7bps. At 4.61% the US 10yr is at levels last seen in Q4 2007. The upswing in bond yields is dampening risk appetite. Also not helping the mood is the potential for another US Government shutdown from 1 October. The Senate released a stopgap funding bill that was due to be voted on on Friday, but some hardline Republicans are demanding changes to ease its path in the House. The political divide means a shutdown still appears more likely than not.

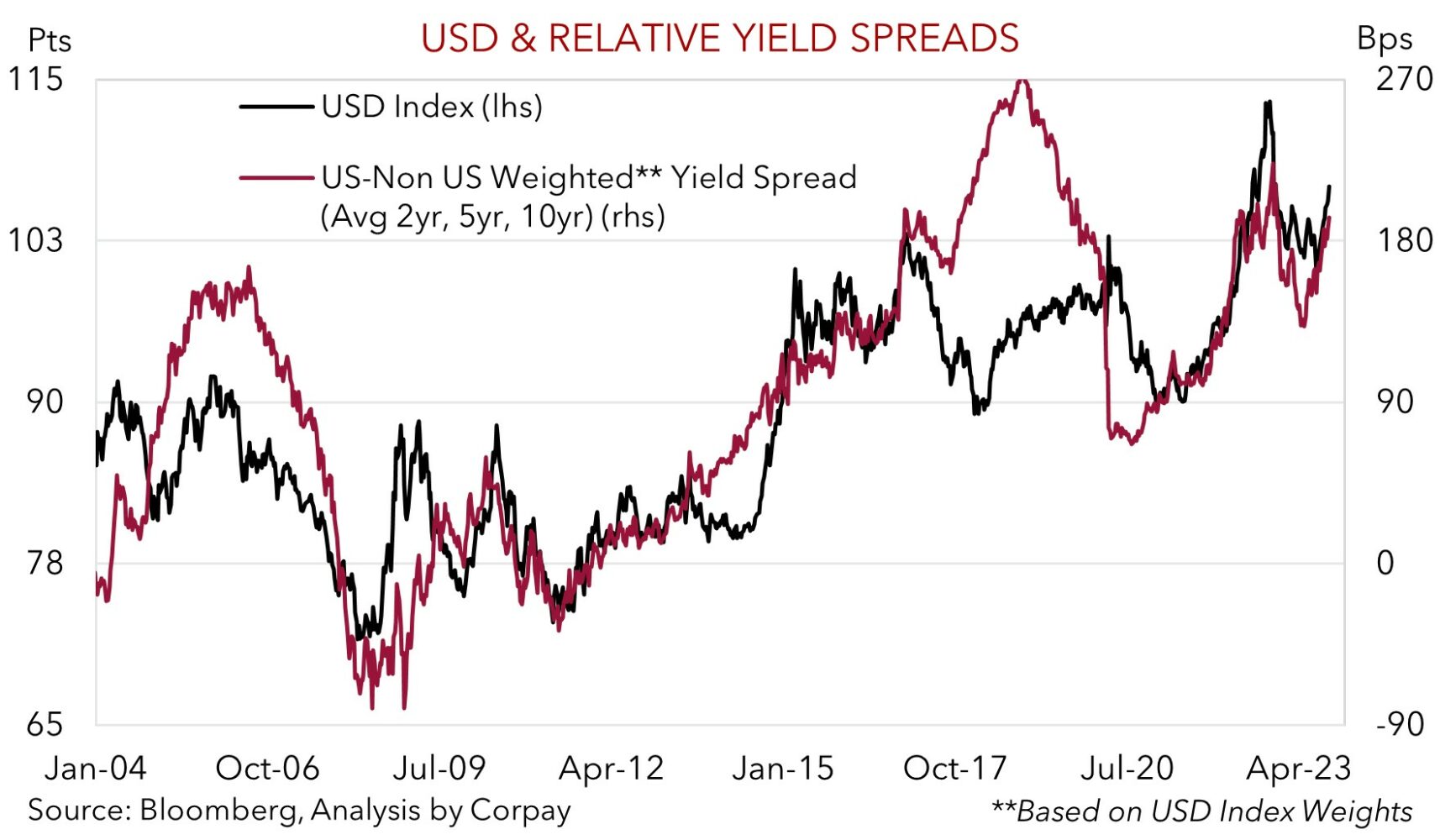

European equities were generally a bit lower (EuroStoxx600 -0.2%), although the US S&P500 managed to end the day flat after spending most of the session in the red. In FX, the shift in relative yield differentials in favour of the US has supported the USD. As our chart shows the correlation between the USD and US-non US yields spreads has tightened over the past year, though current levels suggest the USD Index (which is at its highest since last November) may have run too far. EUR (now ~$1.0506) touched its lowest point since early-January, GBP (now ~$1.1238) is at a ~6-month low, USD/JPY has moved back above ~149.50, and USD/SGD (now ~$1.3717) is around a ~10-month peak. The AUD hit a fresh 2023 low (now ~$0.6354).

In the near-term, as negative risk sentiment prevails, the USD is likely to remain supported. However, with a lot of positives now factored into the USD, the odds of a pullback are rising, in our view. The extent of the US’ relative economic outperformance is unlikely to last based on our reading of various leading indicators, a ‘higher for longer’ US Fed outlook looks well priced, and more negative seasonal forces typically kick in in Q4 (see Market Musings: History doesn’t repeat, but…). US initial jobless claims are released tonight, as are revisions to US GDP (10:30pm AEST), while a few Fed members including Chair Powell (6am AEST) will speak.

AUD corner

The AUD has remained under downward pressure with negative risk sentiment and a stronger USD stemming from higher oil prices and rising bond yields flowing through. The AUD touched a fresh 2023 low overnight before stabilising (now ~$0.6354). The AUD also lost some ground on the crosses, but in a reflection of how USD-centric things have been the moves have generally been smaller. Compared to this time yesterday the AUD has weakened by ~0.3% against the JPY and NZD, 0.5% versus GBP and CNH, and is less than 0.1% lower against the EUR.

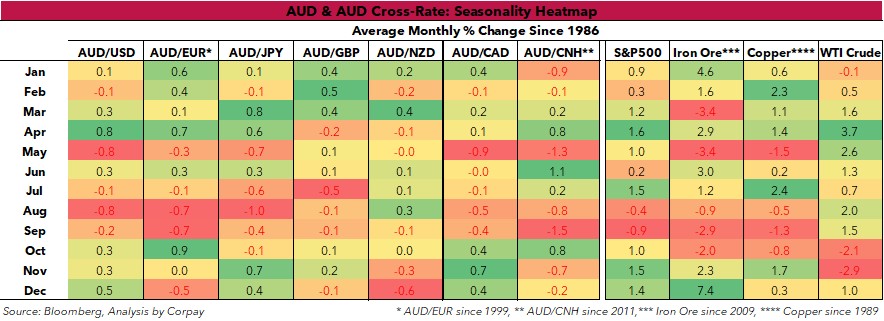

The weakness in the AUD over August and September is not unusual. We flagged this repeatedly over the past ~2-months following our deep dive into seasonal patterns (see Market Musings: History doesn’t repeat, but…). As the heatmap shows, the AUD tends to be weaker over this time of the year, as are US equities, iron ore, and copper, while oil prices typically rise. The magnitudes are different but the direction of travel in 2023 hasn’t been. While the AUD could remain heavy over the very near-term given the risk backdrop, we continue to believe that down around current low levels a lot of ‘bad news’ is priced into the AUD. A lot of positives appear factored into the USD, AUD positioning and technical momentum indicators are starting to look stretched, there are signs China’s economy is starting to turn the corner, the RBA may still need to do more (see below), and fundamentals such as Australia’s high terms of trade and flow support from the current account surplus (now ~1.2% of GDP) remain in place (see Market Musings: AUD: Always darkest before the dawn). Since 2015, the AUD has traded sub ~$0.6350 less than ~2% of the time.

Locally, the monthly CPI indicator matched expectations with annual inflation re-accelerating back up to 5.2%pa. The jump in petrol prices was a positive contributor. But a closer look at the detail suggests that the broader improvement in inflation is still slow growing. Risk of further RBA tightening (e.g. in November after the quarterly CPI report released in late-October) remains, in our opinion. Core inflation (i.e. trimmed mean) held steady at 5.6%pa with services prices sticky. Rents have quickened, and categories with labour cost inputs such as ‘restaurant meals’ had a solid price rises. Given the tightness in the labour market and lags in Australia’s wage dynamics these pressures could persist.

Today, August retail sales are due, as are quarterly job vacancies (11:30am AEST). We believe retail sales may post another positive result (mkt +0.3%) with spending on services related to the Women’s Football World Cup and the burgeoning population supportive factors. A solid report may give the beleaguered AUD support, particularly on some of the crosses. In our view, AUD/EUR and AUD/GBP appear too low compared to our gauge of relative terminal interest rate expectations.

AUD levels to watch (support / resistance): 0.6250, 0.6320 / 0.6499, 0.6593